JosephGikuni

Possible M pattern and Reversal in New York Session Confirmatons. 1. Break of key level 1.3900 2. London session created a high 3. Retest of the daily high in NY session price is trapping sellers, therefore price will stophunt key level 1.39250

Possible EUR bearish momentum continuation. Thursday NY reversal happened, there was London session pullback which got me thinking market maker wanted retail traders to get in for buys(buyers trap), price retraced at 70.5 fib, target is the low of the day because today is friday. The 4hr candle is bearish.

confirmations 1. ema cross in 5min tf 2. accumulation after the cross

I think the 2 days bearish move is a sellers induction or trap. Confirmations: 1. 5 min ema cross 2. small accumulation after the cross 3. possible w patter on tuesday

1. Possible correction of the bullish trend 2. Low of asian and the day, has been broken and is being retested

Ema cross in 5 min Accumulation after cross Possible Reversal in Thursday

Ema cross in 5min TF Asian high has been tested and broken Possible break of the resistance Quick scalp Target is 20 pips

In higher timeframes EJ has been accumulating at the highs created in dec 2021, there is little to no liquidity for a reversal. Market maker is grabbing sell orders at 127, which is an institutional level. I will be looking for buys in either NY session or on Tuesday 2nd Feb. This is a trap for sellers

Possible break of the fake resistance Bull momentum>>Pullback>>accumulation(execution)

Break and retest of the high of asian session Bullish momentum

Confirmation: 1. Ema cross in 5 min 2.Accumulation after the cross

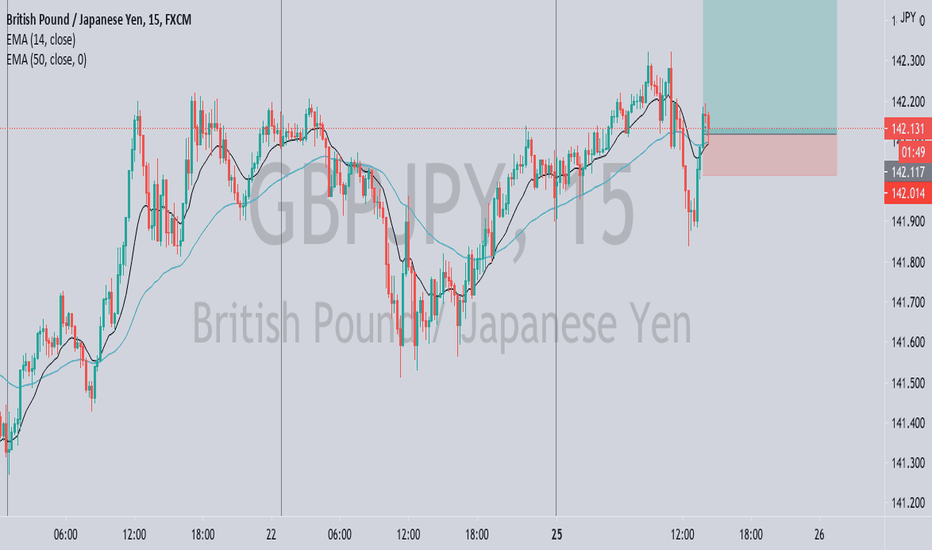

Possible GJ Buys. Sellers trap at the resistance, market maker accumulating sell orders. confirmations 1. ECR in 5min TF 2

Possible gap fill before NY session Entry confirmation 1. ema cross 2. accumulation after cross