Wyckoff Accumulation & Distribution is a trading strategy that was developed by Richard Wyckoff in the early 1900s. It is based on the premise that markets move in cycles and that traders may recognize and use these cycles.

In accumulation phase Wyckoff strategy involves identifying a Trading Range where buyers are accumulating shares of a stock before it moves higher. This allows traders to enter into positions at lower prices and benefit from the eventual price increase. Wyckoff Accumulation is an effective way for traders and investors to gain on market movements and make profits from their trades.

The Wyckoff Trading Ranges feature a chart pattern called Descending Wedge. This pattern involves two trendlines, one falling and one rising, which converge to form a wedge shape.

This pattern indicates that the price of an asset is likely to break out in the direction of the falling trendline.

In my understanding, "Continuous Weakness" means a shift away from selling towards buying. Sellers fail to hold the pressure, so buyers take the lead leading in D,E: MARKUP phases.

Kind regards

Artem Shevelev

Please check out my older Education Ideas

Consider put like and follow my page for more updates)

In accumulation phase Wyckoff strategy involves identifying a Trading Range where buyers are accumulating shares of a stock before it moves higher. This allows traders to enter into positions at lower prices and benefit from the eventual price increase. Wyckoff Accumulation is an effective way for traders and investors to gain on market movements and make profits from their trades.

The Wyckoff Trading Ranges feature a chart pattern called Descending Wedge. This pattern involves two trendlines, one falling and one rising, which converge to form a wedge shape.

This pattern indicates that the price of an asset is likely to break out in the direction of the falling trendline.

In my understanding, "Continuous Weakness" means a shift away from selling towards buying. Sellers fail to hold the pressure, so buyers take the lead leading in D,E: MARKUP phases.

Kind regards

Artem Shevelev

Please check out my older Education Ideas

Consider put like and follow my page for more updates)

Trade active:

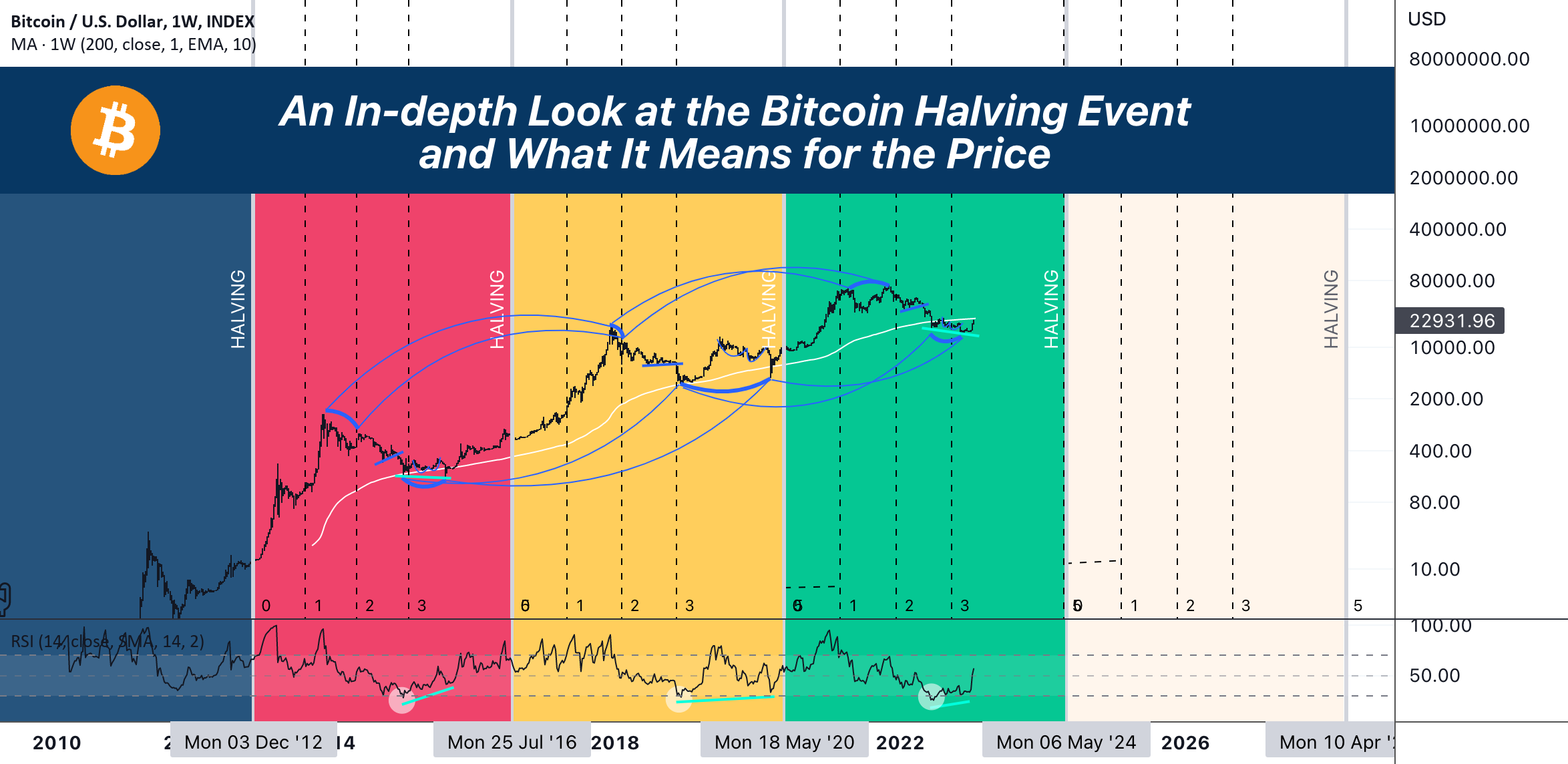

🚨 This Bitcoin education idea contains price prediction as well :)

🔵 🟡 𝗙𝗥𝗘𝗘 & 𝗣𝗥𝗘𝗠𝗜𝗨𝗠 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀: t.me/+5hlxWmhHaKplN2Rk

Enjoying the content? Here's a free way to show your support!

Sign Up and get Special Bonuses:

🔵 toobit.com/t/ArShevelev 🔵

🟡 bybit.com/b/ArShevelev 🟡

Enjoying the content? Here's a free way to show your support!

Sign Up and get Special Bonuses:

🔵 toobit.com/t/ArShevelev 🔵

🟡 bybit.com/b/ArShevelev 🟡

![TOP 20 TRADING PATTERNS [cheat sheet]](https://s3.tradingview.com/s/SGUilTg3_big.png)