⚙️  CRWV | Institutional Buy Signal Confirmed — DSS Sees a 61% Upside Runway 🚀

CRWV | Institutional Buy Signal Confirmed — DSS Sees a 61% Upside Runway 🚀

While the market debates direction, CoreWeave’s structure, volume, and model consensus are quietly aligning for a potential multi-week rally.

📊 VolanX DSS + Institutional Forecast Fusion:

Current Price: $134.63 – $139.93 range

Institutional 30-Day Target: $149.53 (+11.1%)

VolanX DSS 15-Day Prediction: $173.73 (+24.2%)

VolanX DSS 30-Day Projection: $225.67 (+61.3%)

Model Agreement: 9/9 bullish alignment

Confidence Level: 100 %

Sharpe Ratio: 2.20 (strong risk-adjusted return)

Prediction Volatility: 12.6 % → stable yet explosive potential

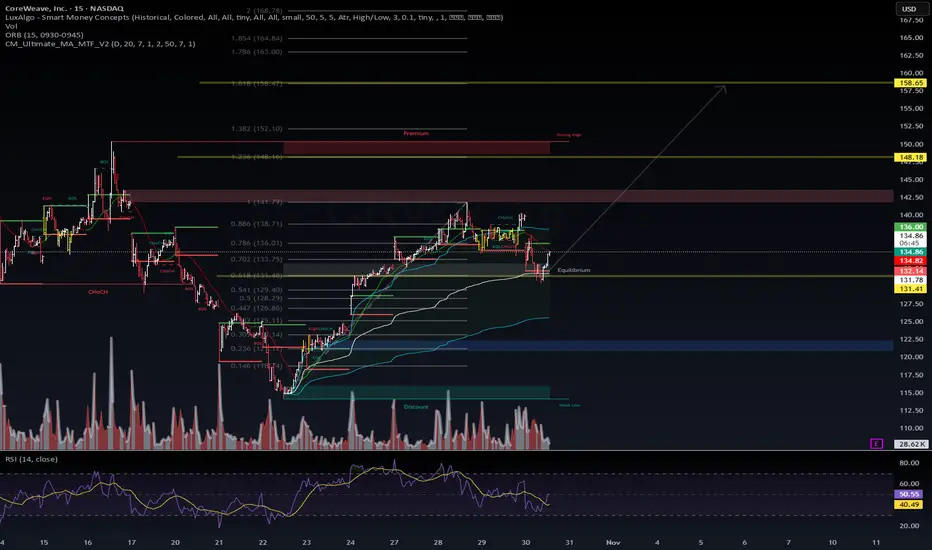

🧠 VolanX Technical Context (15m–1H Confluence):

Current equilibrium zone: $131.8 – $134.8

Key premium breakout level: $138.7 → above triggers next leg to $149 → $158 → $225

Fibonacci 0.786 (136.0) = current accumulation zone

RSI 40–50 → neutral but forming hidden bullish divergence

Volume contracting → compression coil phase before breakout

🎯 VolanX DSS Playbook:

Position in the equilibrium zone ($132–135).

Hold through November — AI forecast expects parabolic expansion through early December.

Profit targets:

• $149 (institutional target)

• $173 (VolanX 15-day)

• $225 (VolanX 30-day)

Macro Correlation:

CoreWeave rides the AI + Data Center Infrastructure theme.

With yields stabilizing (~4.1 %), liquidity rotation into next-gen compute infrastructure stocks continues — NVDA,

NVDA,  SMCI,

SMCI,  CRWV leading the pack.

CRWV leading the pack.

VolanX DSS Probability Matrix:

🟩 Bull 70 % 🟨 Neutral 20 % 🟥 Bear 10 %

“When AI, institutions, and price all agree — volatility becomes opportunity. The setup is loaded.”

#CRWV #WaverVanir #VolanX #AITrading #SmartMoney #InstitutionalFlow #Liquidity #TechStocks #AIInfrastructure #NVDA #SMCI #Bullish

While the market debates direction, CoreWeave’s structure, volume, and model consensus are quietly aligning for a potential multi-week rally.

📊 VolanX DSS + Institutional Forecast Fusion:

Current Price: $134.63 – $139.93 range

Institutional 30-Day Target: $149.53 (+11.1%)

VolanX DSS 15-Day Prediction: $173.73 (+24.2%)

VolanX DSS 30-Day Projection: $225.67 (+61.3%)

Model Agreement: 9/9 bullish alignment

Confidence Level: 100 %

Sharpe Ratio: 2.20 (strong risk-adjusted return)

Prediction Volatility: 12.6 % → stable yet explosive potential

🧠 VolanX Technical Context (15m–1H Confluence):

Current equilibrium zone: $131.8 – $134.8

Key premium breakout level: $138.7 → above triggers next leg to $149 → $158 → $225

Fibonacci 0.786 (136.0) = current accumulation zone

RSI 40–50 → neutral but forming hidden bullish divergence

Volume contracting → compression coil phase before breakout

🎯 VolanX DSS Playbook:

Position in the equilibrium zone ($132–135).

Hold through November — AI forecast expects parabolic expansion through early December.

Profit targets:

• $149 (institutional target)

• $173 (VolanX 15-day)

• $225 (VolanX 30-day)

Macro Correlation:

CoreWeave rides the AI + Data Center Infrastructure theme.

With yields stabilizing (~4.1 %), liquidity rotation into next-gen compute infrastructure stocks continues —

VolanX DSS Probability Matrix:

🟩 Bull 70 % 🟨 Neutral 20 % 🟥 Bear 10 %

“When AI, institutions, and price all agree — volatility becomes opportunity. The setup is loaded.”

#CRWV #WaverVanir #VolanX #AITrading #SmartMoney #InstitutionalFlow #Liquidity #TechStocks #AIInfrastructure #NVDA #SMCI #Bullish

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.