Since childhood we were told if you want to sleep peacefully at night never take a loan and always stay debt free but the wealthy seem to follow a completely different rulebook.

How is it that debt creates stress for some people but becomes a growth engine for others.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

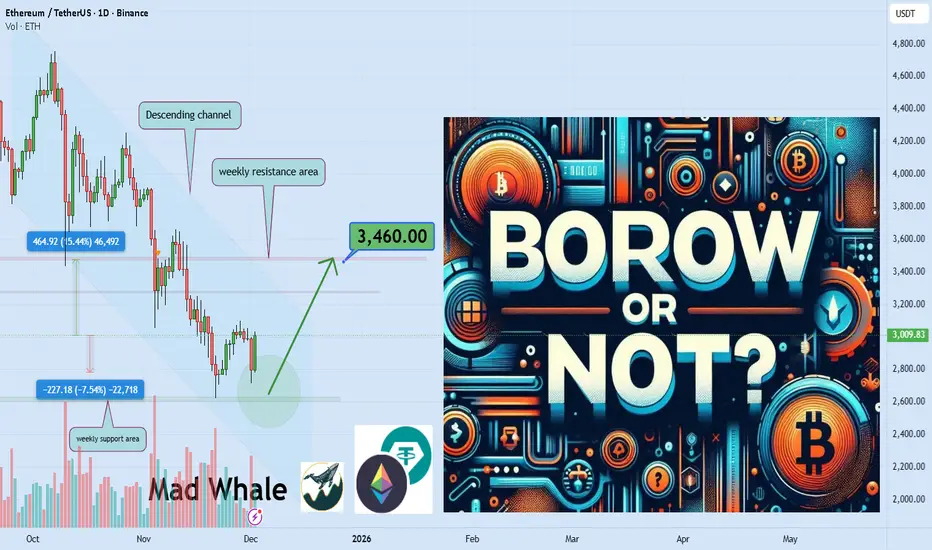

🎯 Analytical Insight on

ETHUSDT:

ETHUSDT:

I expect a much bigger rise for ethusdt than what I have shown on the chart. But we should remember that every year when the New Year approaches the market usually goes bearish. We need to wait and pass through that period to see what the final result will be.

Now, let's dive into the educational section,

The Basic View of Debt 🧠

Borrowing becomes scary only when it is used for spending not for building value and this is exactly what separates people into two groups.

Why Debt Works for Successful People 💡

Successful individuals turn debt into leverage rather than a burden because compound growth quietly pays the installments while the asset grows larger.

Bad Debt and Short Term Pleasure 🔥

But if you use borrowed money to buy the latest phone take a luxury trip or upgrade your car you only enjoy a short moment before the real pressure begins.

Leverage Behavior in the Market 🧩

The market follows the same rule anyone who enters a position for excitement eventually pays the price but those who seek value creation don’t fear volatility.

The Wealthy Mindset 💬

For the wealthy debt is a mental framework they spread risk instead of running from it which makes their decisions calmer and more precise.

Psychological Pressure on Traders 📉

Traders who always trade only with personal capital often face heavy mental pressure because every price movement equals worry and worry creates mistakes.

The Difference Between Good and Bad Debt 🚀

Once you understand the difference between good debt and bad debt your market view changes good debt builds the future bad debt sells it.

Following the Money and Big Player Logic 🌫

This difference helps you read large investors because they also pull liquidity from places with the lowest psychological and financial cost.

Emotions and Debt in Crypto 🌋

The crypto market reacts deeply to emotions and a trader under stress enters the wrong game but one with the mindset of the wealthy stays steady.

Value Creation Over Time 🌱

Value creation means moving toward things that grow over time and the market reflects this through the behavior of big capital you only need to follow the money trail.

Good Debt and Analytical Structure 🌀

Bad debt makes a trader nervous and impulsive while good debt works like a quiet engine building long term vision and charts teach the same lesson.

📊 TradingView Tools

In this journey there are tools that sharpen your perspective such as the money flow indicator which helps you see when major liquidity enters or exits the market.

Another feature is volume ranges which reveal where decision density is highest crucial for understanding leveraged behavior in price action.

A third useful tool is momentum indicators showing whether a trend moves with real strength or just a short emotional spike.

Combining these tools resembles the wealthy approach to debt using multiple signals to build a logical decision so risk is managed not removed.

Summary 🎯

If you start viewing debt as a tool rather than a fear your market decisions will become clearer and more rational.

Golden Recommendations ⭐

Learn to distinguish spending from investing because the market also recognizes this difference with sharp precision.

Question any move that does not create long term peace because psychological pressure is the biggest hidden debt.

Before making any decision ask whether it builds value or just offers a momentary thrill because the future grows from value not excitement.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks, Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

How is it that debt creates stress for some people but becomes a growth engine for others.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on

I expect a much bigger rise for ethusdt than what I have shown on the chart. But we should remember that every year when the New Year approaches the market usually goes bearish. We need to wait and pass through that period to see what the final result will be.

Now, let's dive into the educational section,

The Basic View of Debt 🧠

Borrowing becomes scary only when it is used for spending not for building value and this is exactly what separates people into two groups.

Why Debt Works for Successful People 💡

Successful individuals turn debt into leverage rather than a burden because compound growth quietly pays the installments while the asset grows larger.

Bad Debt and Short Term Pleasure 🔥

But if you use borrowed money to buy the latest phone take a luxury trip or upgrade your car you only enjoy a short moment before the real pressure begins.

Leverage Behavior in the Market 🧩

The market follows the same rule anyone who enters a position for excitement eventually pays the price but those who seek value creation don’t fear volatility.

The Wealthy Mindset 💬

For the wealthy debt is a mental framework they spread risk instead of running from it which makes their decisions calmer and more precise.

Psychological Pressure on Traders 📉

Traders who always trade only with personal capital often face heavy mental pressure because every price movement equals worry and worry creates mistakes.

The Difference Between Good and Bad Debt 🚀

Once you understand the difference between good debt and bad debt your market view changes good debt builds the future bad debt sells it.

Following the Money and Big Player Logic 🌫

This difference helps you read large investors because they also pull liquidity from places with the lowest psychological and financial cost.

Emotions and Debt in Crypto 🌋

The crypto market reacts deeply to emotions and a trader under stress enters the wrong game but one with the mindset of the wealthy stays steady.

Value Creation Over Time 🌱

Value creation means moving toward things that grow over time and the market reflects this through the behavior of big capital you only need to follow the money trail.

Good Debt and Analytical Structure 🌀

Bad debt makes a trader nervous and impulsive while good debt works like a quiet engine building long term vision and charts teach the same lesson.

📊 TradingView Tools

In this journey there are tools that sharpen your perspective such as the money flow indicator which helps you see when major liquidity enters or exits the market.

Another feature is volume ranges which reveal where decision density is highest crucial for understanding leveraged behavior in price action.

A third useful tool is momentum indicators showing whether a trend moves with real strength or just a short emotional spike.

Combining these tools resembles the wealthy approach to debt using multiple signals to build a logical decision so risk is managed not removed.

Summary 🎯

If you start viewing debt as a tool rather than a fear your market decisions will become clearer and more rational.

Golden Recommendations ⭐

Learn to distinguish spending from investing because the market also recognizes this difference with sharp precision.

Question any move that does not create long term peace because psychological pressure is the biggest hidden debt.

Before making any decision ask whether it builds value or just offers a momentary thrill because the future grows from value not excitement.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks, Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

Educational plans & Free signals, all in telegram:

👉t.me/madwhalechannel

👉t.me/madwhalechannel

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Educational plans & Free signals, all in telegram:

👉t.me/madwhalechannel

👉t.me/madwhalechannel

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.