Ford Motor Company (NYSE:$F) is accelerating its European EV strategy through a newly announced partnership with Renault aimed at producing smaller, more affordable electric vehicles and jointly developing commercial vans. The companies are responding to intensifying pressure from Chinese automakers such as BYD, Changan, and Xpeng, which continue to gain ground in Europe with aggressively priced EVs.

Ford CEO Jim Farley described the move as essential to survival in a market undergoing rapid disruption. The first jointly developed small EV will roll out of a Renault facility in northern France in 2028—designed specifically for Europe and filling a key gap in Ford’s global EV lineup. Alongside passenger EVs, the partnership aims to create a “powerhouse of LCVs” (light commercial vehicles) by combining Renault and Ford technologies to fend off future Chinese competition.

The partnership also brings manufacturing scale to Renault, Europe’s smallest major automaker, which is actively building alliances to reduce EV development costs. Ford, meanwhile, benefits from access to Renault’s EV platforms at a time when U.S. regulatory uncertainty—under the Trump administration’s EV policy rollback—forces the automaker to invest in both ICE and electric technologies. The arrangement complements Ford’s existing collaborations with Volkswagen and strengthens its competitive footing in Europe’s evolving EV landscape.

Technical Analysis

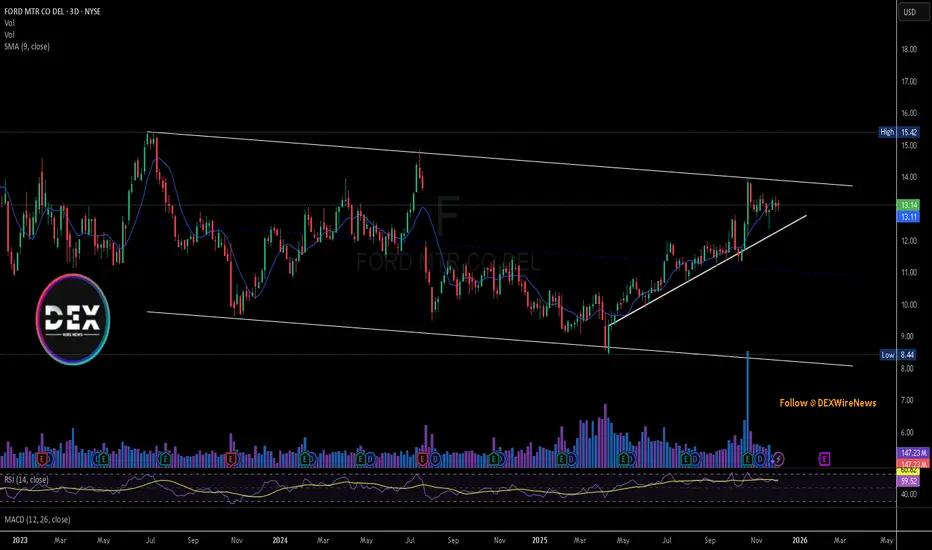

Ford stock has been trading within a broad descending channel since early 2023, with clear resistance near $15.40 and support around $8.40. Recently, price has pushed into a short-term uptrend, riding an ascending trendline from the $10 region and approaching channel resistance.

The stock is currently trading around $13.14, consolidating just below the upper boundary of the long-term channel. Volume saw a major spike in late 2025, signaling renewed institutional interest, followed by steady participation as price climbs.

RSI sits near 60, showing bullish momentum without being overbought. MACD remains positive, reflecting continuation strength. A breakout above $14–$15.40 would confirm a major trend reversal, opening room toward $17. Failure to break could send price back to the rising trendline near $12.

Ford CEO Jim Farley described the move as essential to survival in a market undergoing rapid disruption. The first jointly developed small EV will roll out of a Renault facility in northern France in 2028—designed specifically for Europe and filling a key gap in Ford’s global EV lineup. Alongside passenger EVs, the partnership aims to create a “powerhouse of LCVs” (light commercial vehicles) by combining Renault and Ford technologies to fend off future Chinese competition.

The partnership also brings manufacturing scale to Renault, Europe’s smallest major automaker, which is actively building alliances to reduce EV development costs. Ford, meanwhile, benefits from access to Renault’s EV platforms at a time when U.S. regulatory uncertainty—under the Trump administration’s EV policy rollback—forces the automaker to invest in both ICE and electric technologies. The arrangement complements Ford’s existing collaborations with Volkswagen and strengthens its competitive footing in Europe’s evolving EV landscape.

Technical Analysis

Ford stock has been trading within a broad descending channel since early 2023, with clear resistance near $15.40 and support around $8.40. Recently, price has pushed into a short-term uptrend, riding an ascending trendline from the $10 region and approaching channel resistance.

The stock is currently trading around $13.14, consolidating just below the upper boundary of the long-term channel. Volume saw a major spike in late 2025, signaling renewed institutional interest, followed by steady participation as price climbs.

RSI sits near 60, showing bullish momentum without being overbought. MACD remains positive, reflecting continuation strength. A breakout above $14–$15.40 would confirm a major trend reversal, opening room toward $17. Failure to break could send price back to the rising trendline near $12.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.