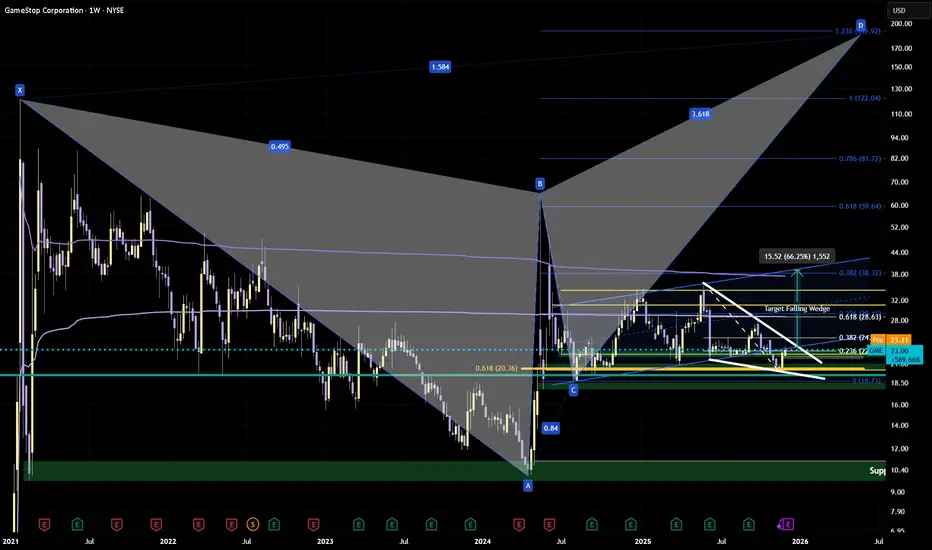

We're sitting at a juicy confluence right now — the 0.618 fib from the 2024 low-to-high AND the 0.236 from the 2025 high-to-low. When fibs stack, they have my attention.

The Falling Wedge

Classic bullish pattern forming since the end of May: price coiling tighter between converging trendlines.

• First target zone: $28–29 (lines up with the VWAP from the 2020 low)

• Next target: $38 (lines up with the 0.382 Fib and the VWAP from the 2021 high)

Now, will we smash through the 0.236 on the first try? Probably not. GME loves its signature rounding loop before committing to a move, so I wouldn’t be surprised to see some chop here first.

The $20–22 zone has been re-accumulation territory again and again: same support, better structure, and improving fundamentals.

The Bigger Picture: Bearish Crab Harmonic

On the harmonic side, the ABC leg of the big Crab is doing its job as a roadmap. When I flip that same ABC into Fib extensions, the 1.236–1.382 FE band drops right into the larger 1.618 XA D-zone of the Bearish Crab. That whole cluster sits roughly in the $200 area, which is where the full pattern would be expected to exhaust if the Crab completes.

The Roadmap:

Current: $22-23

Wedge breakout: $29-30

Next leg: $38

Extended: $59 → $81 → $122

Harmonic D zone: ~$200

The wedge gives us the catalyst. The harmonic gives us the destination. Let's see how it plays out. NFA. DYOR.

The Falling Wedge

Classic bullish pattern forming since the end of May: price coiling tighter between converging trendlines.

• First target zone: $28–29 (lines up with the VWAP from the 2020 low)

• Next target: $38 (lines up with the 0.382 Fib and the VWAP from the 2021 high)

Now, will we smash through the 0.236 on the first try? Probably not. GME loves its signature rounding loop before committing to a move, so I wouldn’t be surprised to see some chop here first.

The $20–22 zone has been re-accumulation territory again and again: same support, better structure, and improving fundamentals.

The Bigger Picture: Bearish Crab Harmonic

On the harmonic side, the ABC leg of the big Crab is doing its job as a roadmap. When I flip that same ABC into Fib extensions, the 1.236–1.382 FE band drops right into the larger 1.618 XA D-zone of the Bearish Crab. That whole cluster sits roughly in the $200 area, which is where the full pattern would be expected to exhaust if the Crab completes.

The Roadmap:

Current: $22-23

Wedge breakout: $29-30

Next leg: $38

Extended: $59 → $81 → $122

Harmonic D zone: ~$200

The wedge gives us the catalyst. The harmonic gives us the destination. Let's see how it plays out. NFA. DYOR.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.