🟡 XAUUSD Weekly Update | 23 October 2025

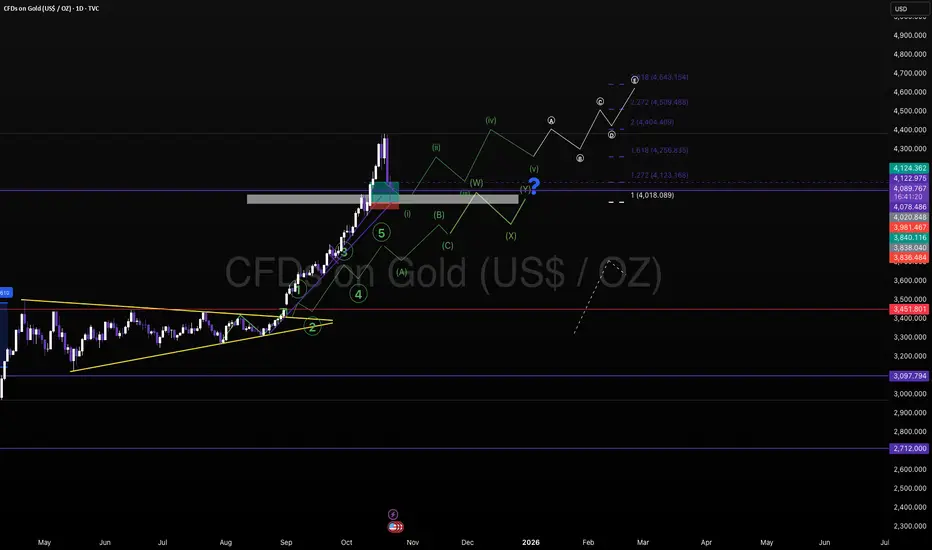

Gold reached a new all-time high at 4381, marking the potential completion of wave (5) within the broader impulsive cycle.

Following this strong rally, price action is now entering a corrective phase, suggesting a temporary pullback before the next major directional move.

🔹 Main Scenario – Corrective Wave Developing

After reaching 4381, gold started to form a potential A–B–C correction from the top of wave (5).

The first leg of the correction (wave A) appears to be developing, signaling profit-taking and short-term exhaustion among buyers.

A short-term retracement toward structural support areas could provide a new accumulation zone before the next bullish impulse.

🔸 Alternative Scenario – Extended Consolidation

If selling pressure persists, the correction may extend into a broader range structure before resuming the uptrend.

Only a confirmed daily close below key support (former breakout base) would suggest a deeper retracement phase.

📊 Overall Outlook

Gold remains technically bullish in the medium term despite the current pullback.

This retracement from 4381 is viewed as a healthy correction within the dominant uptrend.

Traders should watch for stabilization signals near support as potential re-entry zones for the next upward wave.

Gold reached a new ATH at 4381 before entering a corrective phase ⚠️

Short-term pullback expected — but the medium-term structure remains bullish.

#XAUUSD #GOLD #WaveAnalysis #ElliottWave #GoldForecast #TradingView #PriceAction

Gold reached a new all-time high at 4381, marking the potential completion of wave (5) within the broader impulsive cycle.

Following this strong rally, price action is now entering a corrective phase, suggesting a temporary pullback before the next major directional move.

🔹 Main Scenario – Corrective Wave Developing

After reaching 4381, gold started to form a potential A–B–C correction from the top of wave (5).

The first leg of the correction (wave A) appears to be developing, signaling profit-taking and short-term exhaustion among buyers.

A short-term retracement toward structural support areas could provide a new accumulation zone before the next bullish impulse.

🔸 Alternative Scenario – Extended Consolidation

If selling pressure persists, the correction may extend into a broader range structure before resuming the uptrend.

Only a confirmed daily close below key support (former breakout base) would suggest a deeper retracement phase.

📊 Overall Outlook

Gold remains technically bullish in the medium term despite the current pullback.

This retracement from 4381 is viewed as a healthy correction within the dominant uptrend.

Traders should watch for stabilization signals near support as potential re-entry zones for the next upward wave.

Gold reached a new ATH at 4381 before entering a corrective phase ⚠️

Short-term pullback expected — but the medium-term structure remains bullish.

#XAUUSD #GOLD #WaveAnalysis #ElliottWave #GoldForecast #TradingView #PriceAction

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.