📊 Fundamentals first:

- Short-term: The copper market is turbulent—marked by sharp price spikes, crashes, and global shifts in stock levels.

- Medium-term: Despite forecasted surpluses from ICSG, technology innovations and steady demand (especially from China and green sectors) may underpin prices.

- U.S. risk factor: The tariffs remain a major wildcard, likely restructuring trade flows, increasing domestic input costs, and distorting global price differentials.

📈 Now the Chart:

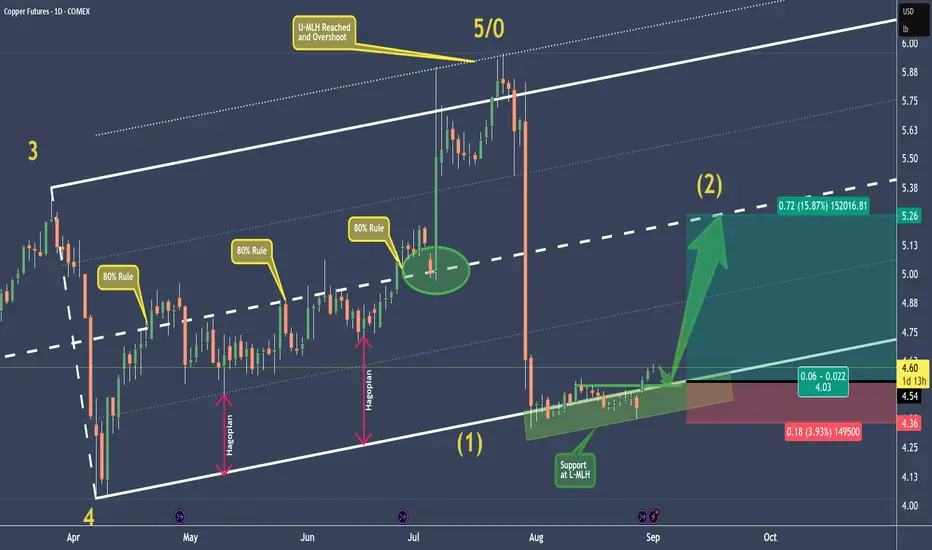

P5/0 at the U-MLH marked the end, and price dropped into the void.

Now, at the L-MLH we see support has built up.

The momentum we see now will probably lead in a pullback before the potential massive run-up to the Centerline.

💡 If the trading God gives me a pullback, I am willingly risk my 0.5% in this trade to make at least 4x more. 🦊

Happy new week to all §8-)

- Short-term: The copper market is turbulent—marked by sharp price spikes, crashes, and global shifts in stock levels.

- Medium-term: Despite forecasted surpluses from ICSG, technology innovations and steady demand (especially from China and green sectors) may underpin prices.

- U.S. risk factor: The tariffs remain a major wildcard, likely restructuring trade flows, increasing domestic input costs, and distorting global price differentials.

📈 Now the Chart:

P5/0 at the U-MLH marked the end, and price dropped into the void.

Now, at the L-MLH we see support has built up.

The momentum we see now will probably lead in a pullback before the potential massive run-up to the Centerline.

💡 If the trading God gives me a pullback, I am willingly risk my 0.5% in this trade to make at least 4x more. 🦊

Happy new week to all §8-)

Note

Here comes the pullback.If it holds, we are in good shape §8-)

Trade active

Looks good. Fingers crossed.🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.