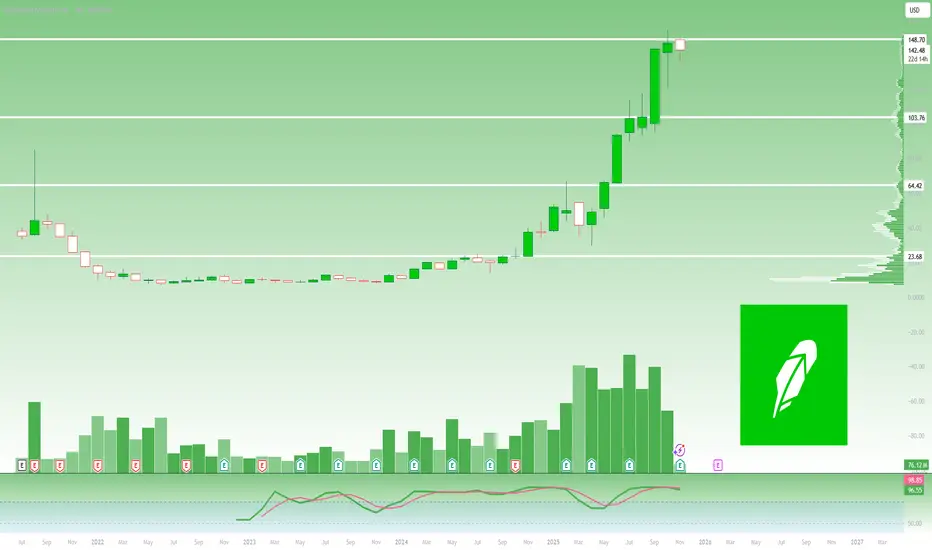

How Robinhood Doubled Revenue and Tripled Earnings in One Year

What’s up? Hope you didn’t lose too much sleep over that market massacre, I just dug into Robinhood's Q3 2025 earnings, and man o man, it's one of those reports that makes you sit up and pay attention.

The numbers are strong across the board, and it feels like the company is finally hitting its stride after years of building out the platform. Let me walk you through the highlights and what they actually mean

The Big Picture

Robinhood pulled in $1.27 billion in net revenue, beating estimates by about $60 million and doubling what they did this time last year. Even better, GAAP earnings per share came in at $0.61 way above the $0.54 analysts expected and more than triple the year-ago figure. That's not just growth; that's acceleration

Where the Money's Coming From?

Transaction revenue remains the engine, up 129% to $730 million. Options led the charge at $304 million (up 50%), equities surged 132% to $86 million, but crypto while still up over 300% year over year to $268 million actually missed estimates by about $19 million. That's the one soft spot in an otherwise green report.

Net interest revenue jumped 66% to $456 million, showing how much they're benefiting from higher rates and growing cash balances. "Other revenue" doubled to $88 million, likely tied to the rapid growth in Robinhood Gold subscribers, which I'll get to in a sec

Customer Growth and Engagement

They're now at 26.8 million funded customers (up 10%) and 27.9 million investment accounts (up 11%). Total assets on the platform hit $333 billion more than double last year. Net deposits were $20.4 billion in the quarter, putting them on pace for $68.3 billion over the trailing twelve months.

The real standout? Robinhood Gold subscribers grew 77% to 3.9 million. That's premium users paying for better rates, instant deposits, and pro tools. ARPU (revenue per user) climbed 82% to $191, which tells you they're not just adding bodies they're adding profitable ones

Costs & Capital

Operating expenses rose 31% to $639 million, but adjusted EBITDA still exploded 177% to $742 million. Net income? $556 million, up 271%. They've got $4.3 billion in cash and bought back $107 million in shares this quarter ($810 million over the past year). Solid capital return without looking desperate.

Early Look at October

Management teased some preliminary October numbers, and they're eye-popping: record monthly volumes across equities, options, and even prediction markets/futures. Margin balances topped $16 billion (up 150%+), equity notional volumes around $320 billion (also up 150%+), and options contracts over 260 million (up 60%+). Crypto volumes hit $32 billion, with Bitstamp contributing more than the app itself nice validation of that acquisition.

Leadership Note

CFO Jason Warnick is transitioning out, with Shiv Verma stepping in. Smooth handoffs matter, especially when the numbers are this good.

This wasn't just a beat and raise quarter, it was a statement. Robinhood's turning into a full stack financial platform, not just the "meme stock app" from 2021. Crypto dipped a bit relative to expectations, but everything else from options trading to Gold subscriptions to interest income is firing on all cylinders.

October's early read suggests the momentum hasn't slowed. If they keep shipping products at this pace (and Vlad says they won't slow down), the growth runway still looks long. Definitely one to watch..

What’s up? Hope you didn’t lose too much sleep over that market massacre, I just dug into Robinhood's Q3 2025 earnings, and man o man, it's one of those reports that makes you sit up and pay attention.

The numbers are strong across the board, and it feels like the company is finally hitting its stride after years of building out the platform. Let me walk you through the highlights and what they actually mean

The Big Picture

Robinhood pulled in $1.27 billion in net revenue, beating estimates by about $60 million and doubling what they did this time last year. Even better, GAAP earnings per share came in at $0.61 way above the $0.54 analysts expected and more than triple the year-ago figure. That's not just growth; that's acceleration

Where the Money's Coming From?

Transaction revenue remains the engine, up 129% to $730 million. Options led the charge at $304 million (up 50%), equities surged 132% to $86 million, but crypto while still up over 300% year over year to $268 million actually missed estimates by about $19 million. That's the one soft spot in an otherwise green report.

Net interest revenue jumped 66% to $456 million, showing how much they're benefiting from higher rates and growing cash balances. "Other revenue" doubled to $88 million, likely tied to the rapid growth in Robinhood Gold subscribers, which I'll get to in a sec

Customer Growth and Engagement

They're now at 26.8 million funded customers (up 10%) and 27.9 million investment accounts (up 11%). Total assets on the platform hit $333 billion more than double last year. Net deposits were $20.4 billion in the quarter, putting them on pace for $68.3 billion over the trailing twelve months.

The real standout? Robinhood Gold subscribers grew 77% to 3.9 million. That's premium users paying for better rates, instant deposits, and pro tools. ARPU (revenue per user) climbed 82% to $191, which tells you they're not just adding bodies they're adding profitable ones

Costs & Capital

Operating expenses rose 31% to $639 million, but adjusted EBITDA still exploded 177% to $742 million. Net income? $556 million, up 271%. They've got $4.3 billion in cash and bought back $107 million in shares this quarter ($810 million over the past year). Solid capital return without looking desperate.

Early Look at October

Management teased some preliminary October numbers, and they're eye-popping: record monthly volumes across equities, options, and even prediction markets/futures. Margin balances topped $16 billion (up 150%+), equity notional volumes around $320 billion (also up 150%+), and options contracts over 260 million (up 60%+). Crypto volumes hit $32 billion, with Bitstamp contributing more than the app itself nice validation of that acquisition.

Leadership Note

CFO Jason Warnick is transitioning out, with Shiv Verma stepping in. Smooth handoffs matter, especially when the numbers are this good.

This wasn't just a beat and raise quarter, it was a statement. Robinhood's turning into a full stack financial platform, not just the "meme stock app" from 2021. Crypto dipped a bit relative to expectations, but everything else from options trading to Gold subscriptions to interest income is firing on all cylinders.

October's early read suggests the momentum hasn't slowed. If they keep shipping products at this pace (and Vlad says they won't slow down), the growth runway still looks long. Definitely one to watch..

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.