James Brown 1976 Funk

Get up offa the shutdown.

Get up offa the dance floor.

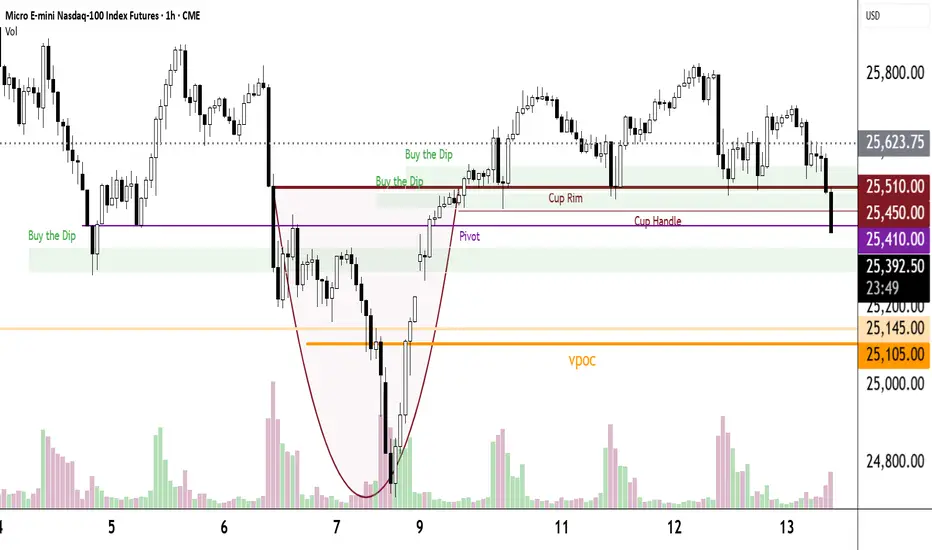

Today's Dance Floor is 25510.

Hmmm...What's happening? He thought we would have seen a much bigger bounce last night when the shutdown ended.

Today's key landmarks are clearly seen.

Buy the Dips

***Wait for a bounce

***He simply waits for a Bullish white candle.

***Then he looks for a bit of support, your choice, whatever you are comfortable with.

***In 5-point increments from there to the low of the bounce he buys 1 MNQ

***Each entry has a 21-point target.

If you are more conservative, tailor it to your trading style. He especially likes a White Bull preceded by an Exhaustion Candle @ a Prior Day Close.

No stops allowed.

Sometimes the Px falls through the floor. Keep some dry powder for that event.

Repeat the process for the next BTD area.

This plan is a $$$ maker.

Don't forget Breakouts, A Pawn for a King, Pivots & Jokers.

Get up offa the shutdown.

Get up offa the dance floor.

Today's Dance Floor is 25510.

Hmmm...What's happening? He thought we would have seen a much bigger bounce last night when the shutdown ended.

Today's key landmarks are clearly seen.

Buy the Dips

***Wait for a bounce

***He simply waits for a Bullish white candle.

***Then he looks for a bit of support, your choice, whatever you are comfortable with.

***In 5-point increments from there to the low of the bounce he buys 1 MNQ

***Each entry has a 21-point target.

If you are more conservative, tailor it to your trading style. He especially likes a White Bull preceded by an Exhaustion Candle @ a Prior Day Close.

No stops allowed.

Sometimes the Px falls through the floor. Keep some dry powder for that event.

Repeat the process for the next BTD area.

This plan is a $$$ maker.

Don't forget Breakouts, A Pawn for a King, Pivots & Jokers.

Note

He uses a 5m chart for BTDsNote

09:51; His 1st BTD 330. Lowest BTD 280.Note

09;53; Patience...Wait for a pullback.This is a good bounce.

If you want to start some Breakout Trades 390.00 is a good start.

Note

305.25 was the 10/20 close.Note

09:59; He is starting BTDs @ 355.Note

10:03; If you haven't started Breakout trades yet, 420 is a good place to start. The lower the better.Note

MNQ Ladder of Success1.+1 MNQ every 5 points. Stop Market entry order

2.19-point target per entry. Stop Limit exit

Tailor it to your account size and trading style.

Buy 2 every 5 points.

Buy 1 every 10 points.

Whatever works for you.

The only wrong thing is doing nothing.

No stops allowed. This is, after all, a raging bull market.

Note

10:27; He's ready to double dip his BTDs. 355 - 280 in 5-point increments. You do what suits you. Note

10:38; Next BTD area: 280 - 210. Put it on your chart & watch it.If we get there, wait for the bounce.

Note

10:50: Quite puzzled why it is going lower but delighted. It gives him a chance to trade this area again. Also, he always has Pawns to redeem. Be sure to view prior posts about A Pawn for a KIng.Note

10:55; Next BTD area - 25135 -25065prior vpoc:25145

vpoc:25105

Very fertile soil and very good hunting.

Note

11:00; BTDs 25235 - 25195Note

11:02; Breakouts starting @ 25280Note

11:04; Breakouts starting @ 240.Aggressive. You do what you are comfortable with.

Note

11:22; Cup Rim @ 25115, Handle @ 25050. Pivot @ 25020.Cup & Handles are powerful patterns. They appear often. Their rims and handles are very good support and resistance levels. I think I have heard Charles Payne say it is his favorite pattern on a daily chart.

Note

12:04; Bouncing on 10/06 close 25184.75Breakouts start @ 25230

Note

12:11; MNQ Ladder of Success is a specific type of Breakout Trade. 25230 excellent starting point.Note

13:15; Bouncing on a VPOC one of the best supports.He is starting a new Breakout Ladder @ 25170.00

Note

25110 is also a cup rim,25060 its handle.BTD area 25135 - 25065

Note

14:40; BTD area 24945 - 24880prior Vpoc 24885

As usual, wait for the bounce before BTD entries.

As usual, start a new MNQ Ladder above the bounce.

This is an ideal place to buy a Joker or two. He buys Jokers at an easily recognized Px. In this case he bot 1 MNQ @ 25117, 1 MNQ 25067, & 1 MNQ @ 25017. Each one has a 101-point target.

Note

14:31; He very seldom BTD this late in the day, BUT today he BTD from 25050 - 25020 in 5-point increments. If the Px dips again he will BTD from 25090 - 25000Three reasons why

1. Big sell off = time for a bounce

2. Bouncing at a vpoc

3.Double Bottom

4. His margin allows it.

And he will start a new Breakout Ladder.

Note

14:50; We are also bouncing atop the head of Monster Head & Shoulders which dominated our charts for a long time and is yet influencing it.Note

15:14; His favorite Buy the Dip setup is an Exhaustion Candle that bounces on the prior day close and is immediately followed by a bullish white candle. That hasn't happened today. In fact, he doesn't see even one exhaustion candle immediately followed by a bullish white candle. Yet he had several dozen BTD roundtrip trades. Sure, some are hanging. They have yet to hit their targets. This was a very profitable BTD day even in the face of a selloff. Tailor this plan to fit your singular self. If you want higher probability BTD wins, only trade when you see an Exhaustion Candle immediately followed by a bullish white candle. If it's at a support - all the better. An Exhaustion Candle for a Buy the Dip Trade will be a black 5m candle with a lot of volume and a long lower wick. The sellers are exhausted and the buyers are buying.

It's all about your singular self. How big is your account? How much Initial Margin can you carry? A good rule of thumb is $3400.00 Initial Margin for 1 contract of MNQ. Brokers can and do change Initial Margin requirements during times of volatility. Stay on top of it. Allow some cushion. Always protect King Account.

Note

16:12; Ed Lawrence just stated that today's selloff was caused by the govt. shutdown and consequently delayed economic reports and growth. These factors led to a drop in the chances of a December interest rate cut by the Fed.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.