Trade Plan:

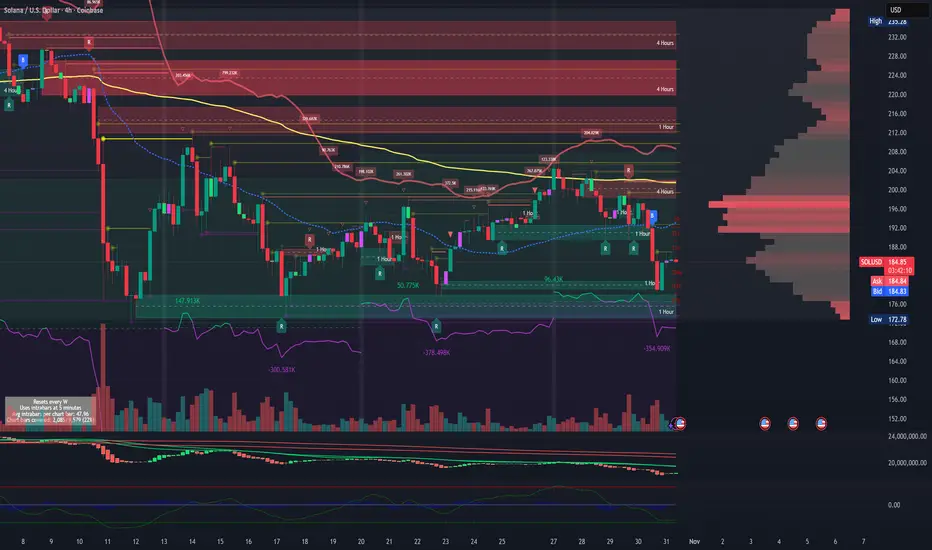

Buy dips into $185 → $181 → $178 with a protective tail at $168, target $194 → $203 → $212+, and invalidate if $168 HTF breaks.

Price Movement + Liquidation + Whale Map

Solana has successfully rebounded from the key demand pocket at $178–$181, where aggressive buyers defended the prior 4H swing low and swept liquidity below the rising trendline. This bounce confirms continued smart-money defense of structure, following a multi-day corrective pullback after distributing into the $203–$208 supply band. Price is now stabilizing above the micro accumulation shelf at $183–$186, with intraday candles showing higher-lows and early bullish momentum returning, supported by volume absorption on each dip into the mid-$180s. As long as SOL holds the $181 reclaim, this remains a continuation accumulation phase, not a trend breakdown.

The next short-term move favors a grind-up retracement toward trapped shorts around $191–$194, followed by a sweep of the liquidity band at $197–$200 — the first key liquidation magnet above. A clean break and hold above $200 opens the door to speed-move expansion into $207–$212, where heavy resting sell walls and prior profit-taking nodes reside. Above this, breakout momentum could accelerate into $223–$231 on momentum ignition, but that remains a secondary stage target and depends on reclaim strength above the $210 shelf.

On the downside, major liquidation pools remain stacked beneath $182, then $178, and a deeper wash at $172–$168 (high-value tail liquidity + psychological flush zone). If price wicks into those levels, it would likely be a liquidity hunt rather than structural failure, provided bulls recapture the zone quickly. Whales have been accumulating consistently in the $168–$181 band for weeks, with on-chain order-flow showing absorption during each correction phase, confirming institutional accumulation rather than distribution. Sell walls reappear in layers above $203, $208, and $215, suggesting short-term volatility expected upon breakout but not necessarily cycle-top behavior — more likely controlled profit-taking.

Execution Plan: Bias remains buying retracements, not chasing. Primary dip accumulation zone remains $183–$185, ideal add layer at $181–$178 on wick flush, and tail-hedge allocation stands at $172–$168. Risk defined below $168. First take-profit ladder rests at $194 → $200 → $212, with secondary hold targets into $223+ if strength persists. Maintain core long ride if momentum and on-chain flows stay supportive.

Invalidation: The setup remains fully valid as long as SOL does not close a 4H candle below $178 and does not lose $168 on HTF closing basis. A persistent breakdown below $168 would shift structure into a larger ABC corrective phase, delaying continuation rather than ending the macro bull drive. Until then, liquidity behavior, trend structure, whale positioning, and momentum context remain biased to the upside with accumulation-driven volatility.

Buy dips into $185 → $181 → $178 with a protective tail at $168, target $194 → $203 → $212+, and invalidate if $168 HTF breaks.

Price Movement + Liquidation + Whale Map

Solana has successfully rebounded from the key demand pocket at $178–$181, where aggressive buyers defended the prior 4H swing low and swept liquidity below the rising trendline. This bounce confirms continued smart-money defense of structure, following a multi-day corrective pullback after distributing into the $203–$208 supply band. Price is now stabilizing above the micro accumulation shelf at $183–$186, with intraday candles showing higher-lows and early bullish momentum returning, supported by volume absorption on each dip into the mid-$180s. As long as SOL holds the $181 reclaim, this remains a continuation accumulation phase, not a trend breakdown.

The next short-term move favors a grind-up retracement toward trapped shorts around $191–$194, followed by a sweep of the liquidity band at $197–$200 — the first key liquidation magnet above. A clean break and hold above $200 opens the door to speed-move expansion into $207–$212, where heavy resting sell walls and prior profit-taking nodes reside. Above this, breakout momentum could accelerate into $223–$231 on momentum ignition, but that remains a secondary stage target and depends on reclaim strength above the $210 shelf.

On the downside, major liquidation pools remain stacked beneath $182, then $178, and a deeper wash at $172–$168 (high-value tail liquidity + psychological flush zone). If price wicks into those levels, it would likely be a liquidity hunt rather than structural failure, provided bulls recapture the zone quickly. Whales have been accumulating consistently in the $168–$181 band for weeks, with on-chain order-flow showing absorption during each correction phase, confirming institutional accumulation rather than distribution. Sell walls reappear in layers above $203, $208, and $215, suggesting short-term volatility expected upon breakout but not necessarily cycle-top behavior — more likely controlled profit-taking.

Execution Plan: Bias remains buying retracements, not chasing. Primary dip accumulation zone remains $183–$185, ideal add layer at $181–$178 on wick flush, and tail-hedge allocation stands at $172–$168. Risk defined below $168. First take-profit ladder rests at $194 → $200 → $212, with secondary hold targets into $223+ if strength persists. Maintain core long ride if momentum and on-chain flows stay supportive.

Invalidation: The setup remains fully valid as long as SOL does not close a 4H candle below $178 and does not lose $168 on HTF closing basis. A persistent breakdown below $168 would shift structure into a larger ABC corrective phase, delaying continuation rather than ending the macro bull drive. Until then, liquidity behavior, trend structure, whale positioning, and momentum context remain biased to the upside with accumulation-driven volatility.

Keyvan Khodakhah

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Keyvan Khodakhah

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.