📊 Technical Analysis

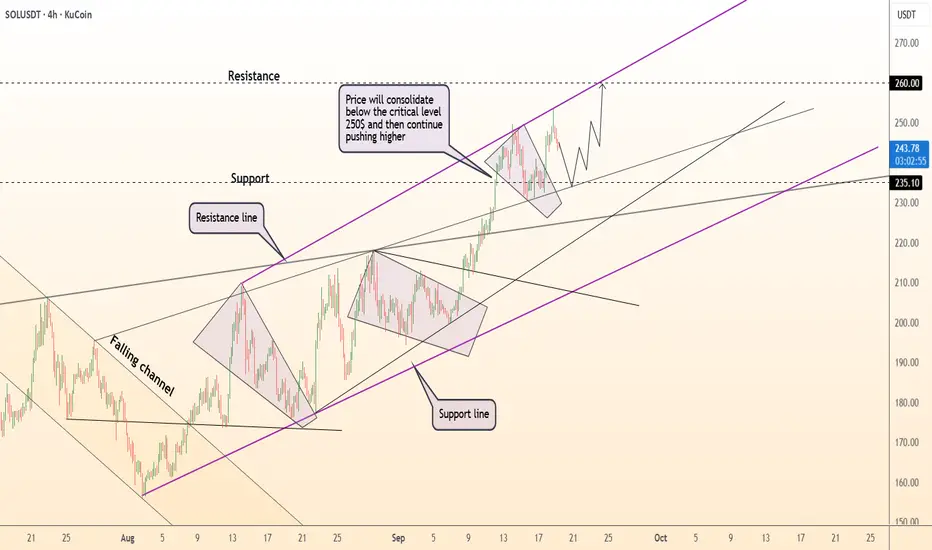

● SOL/USD maintains a rising channel, consolidating just below the $250 resistance after strong rallies from $200 support.

● Structure suggests a bullish continuation, with a breakout targeting $260 if buyers defend $235–$240 as short-term support.

💡 Fundamental Analysis

● Solana gains momentum as institutional flows and DeFi growth increase, while broader crypto sentiment improves with easing risk aversion.

✨ Summary

SOL/USD is consolidating below $250, with $235–$240 as support and upside potential toward $260 if momentum holds.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

● SOL/USD maintains a rising channel, consolidating just below the $250 resistance after strong rallies from $200 support.

● Structure suggests a bullish continuation, with a breakout targeting $260 if buyers defend $235–$240 as short-term support.

💡 Fundamental Analysis

● Solana gains momentum as institutional flows and DeFi growth increase, while broader crypto sentiment improves with easing risk aversion.

✨ Summary

SOL/USD is consolidating below $250, with $235–$240 as support and upside potential toward $260 if momentum holds.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Trade active

Good Point to Buy Signal!90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.