04 DEC 2014 - Update:

Friends,

Important NFP data coming out tomorrow. Expectation favors softer employment data.

In the long-term, USDollar index remains bullish. However, the interim calls for unwinding.

Looking at the $USDJPY, model defines a high-target at 120.996 - This nominal target represents a low-probability reach, but high-probability reversal (i.e.: not likely attained, but if so, a significant decline should ensue).

The following chart is looking at a dual view:

1 - Top is $USDJPY

and

2 - Bottom is $USDJPY tempered by $ES.

The filtered charted below reveals tendencies, such as sustained, but weakened rally within a bullish channel. The second point is a double-top formation, suggesting that $USDJPY's rally weakened against its SP500 futures. The two would tend to maintain a positive correlation. However, if the USDollar bearish force strengthened against the implied market strength, I would expect that this weakness would pervade across other USD crosses.

For instance, we have recently looked at:

1 - The possible topping in $USDRUB:

(Source: )

2 - The potential near-reversal in $XAUUSD:

(Source: )

3 - A technical recovery in $GBPUSD:

(Source: )

4 - A long-awaited Elliott Wave Flat completion in $USDCAD:

(Source: )

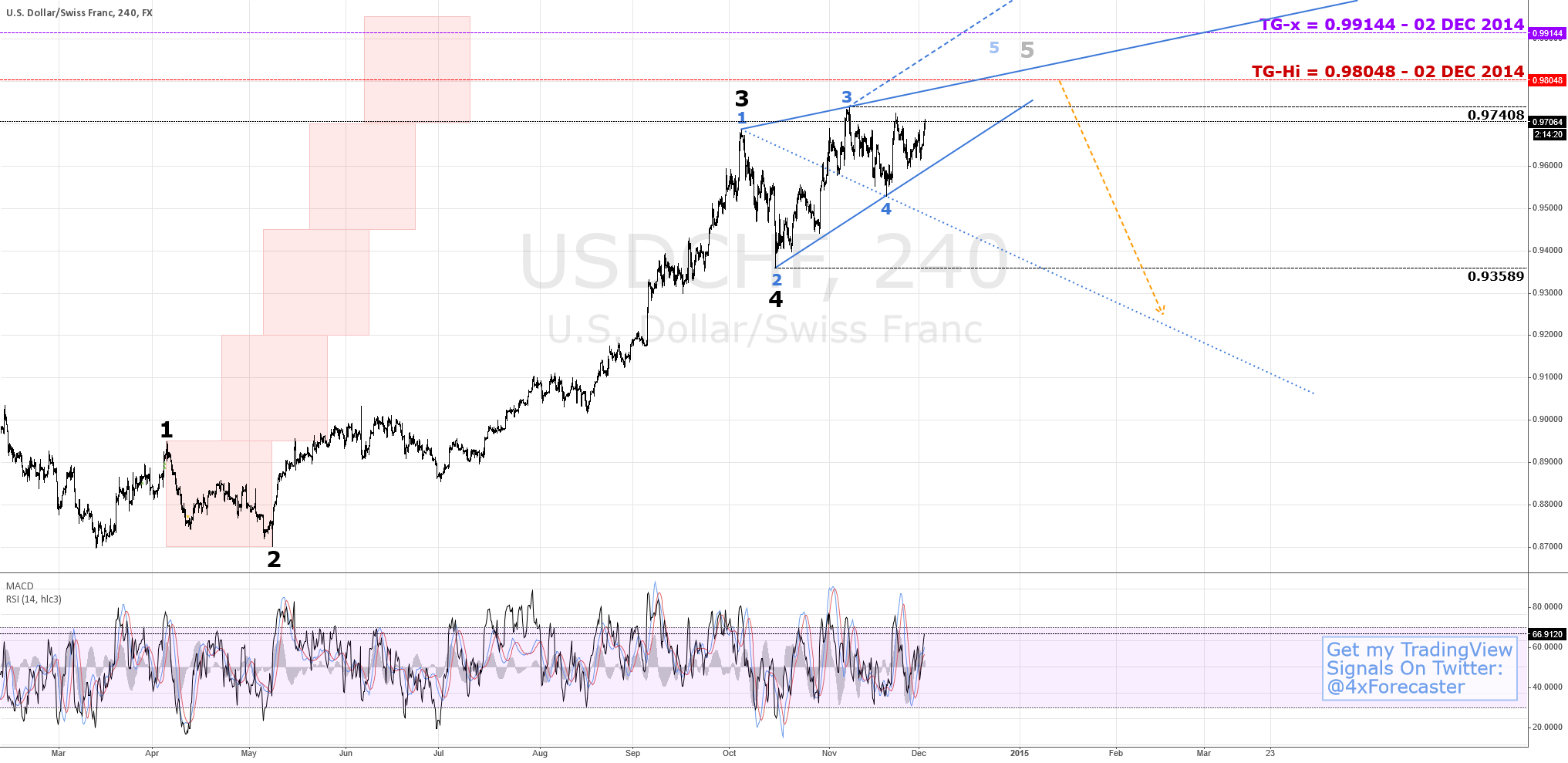

5 - A near-complete target-hit in $USDCHF at TG-Hi:

Source: )

6 - A pending 5th wave completion in $EURUSD:

(Source: )

7 - And a similar $AUDUSD geometric completion in $AUDUSD:

(Source: )

OVERALL:

In other words, all of these charts are implying a pending reversal on the back of a weakening $USD, at least in the most immediate, smaller timeframes.

Most recently, the $ES analysis also pointed to a potential top, stomped at a 1.618-Fibonacci following a quasi-mechanical ascent, possibly connected to a multi-central bank purchase coordination, according to ZeroHedge.com.

Directional bias rests on Neutral until clear sign of reversal emerge.

Cheers,

David Alcindor

Predictive Analysis & forecasting

Denver, Colorado - USA

-----

Twitter: @4xForecaster

00000

Friends,

Important NFP data coming out tomorrow. Expectation favors softer employment data.

In the long-term, USDollar index remains bullish. However, the interim calls for unwinding.

Looking at the $USDJPY, model defines a high-target at 120.996 - This nominal target represents a low-probability reach, but high-probability reversal (i.e.: not likely attained, but if so, a significant decline should ensue).

The following chart is looking at a dual view:

1 - Top is $USDJPY

and

2 - Bottom is $USDJPY tempered by $ES.

The filtered charted below reveals tendencies, such as sustained, but weakened rally within a bullish channel. The second point is a double-top formation, suggesting that $USDJPY's rally weakened against its SP500 futures. The two would tend to maintain a positive correlation. However, if the USDollar bearish force strengthened against the implied market strength, I would expect that this weakness would pervade across other USD crosses.

For instance, we have recently looked at:

1 - The possible topping in $USDRUB:

(Source: )

2 - The potential near-reversal in $XAUUSD:

(Source: )

3 - A technical recovery in $GBPUSD:

(Source: )

4 - A long-awaited Elliott Wave Flat completion in $USDCAD:

(Source: )

5 - A near-complete target-hit in $USDCHF at TG-Hi:

Source: )

6 - A pending 5th wave completion in $EURUSD:

(Source: )

7 - And a similar $AUDUSD geometric completion in $AUDUSD:

(Source: )

OVERALL:

In other words, all of these charts are implying a pending reversal on the back of a weakening $USD, at least in the most immediate, smaller timeframes.

Most recently, the $ES analysis also pointed to a potential top, stomped at a 1.618-Fibonacci following a quasi-mechanical ascent, possibly connected to a multi-central bank purchase coordination, according to ZeroHedge.com.

Directional bias rests on Neutral until clear sign of reversal emerge.

Cheers,

David Alcindor

Predictive Analysis & forecasting

Denver, Colorado - USA

-----

Twitter: @4xForecaster

00000