Macro Overview

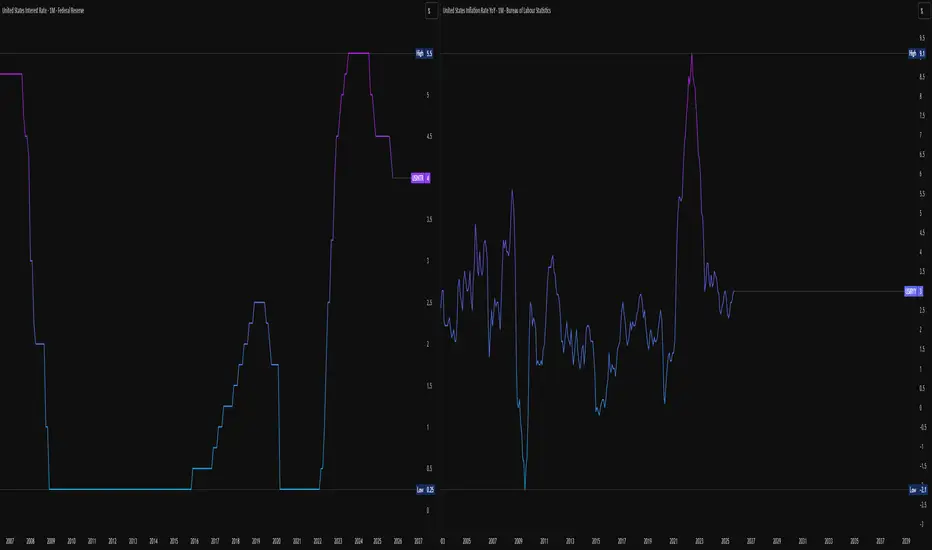

Global monetary policy remains in a transitional phase, not yet a true easing cycle.

The Federal Reserve executed a hawkish 25 bps cut (4.25% → 4.00%), maintaining its QT program and signaling that further reductions are not guaranteed.

The ECB held rates steady amid slightly higher inflation, while the BoE remains restrictive.

Liquidity conditions, according to the latest H.4.1, confirm a net weekly drain, not an injection — contradicting market narratives of a “pivot.”

🏛️ Global Monetary Conditions (latest data)

United States 🇺🇸

Inflation (YoY): 3.0% (Sep 2025)

Policy Rate: 4.00% (after 25 bps cut)

Real Rate: ≈ +1.0%

Comment: The Fed delivered a hawkish cut; QT remains active. H.4.1 shows liquidity withdrawal (RRP and TGA up, reserves down).

Stance: Restrictive bias maintained.

Euro Area 🇪🇺

Inflation (YoY, flash): 2.1% (Oct 2025)

ECB Deposit Rate: 2.00% (unchanged)

Real Rate: ≈ –0.1%

Stance: Neutral; ECB focuses on currency and fiscal stability.

United Kingdom 🇬🇧

Inflation (YoY): 3.8% (Sep 2025)

Bank Rate: 4.00%

Real Rate: ≈ +0.2%

Stance: Restrictive; inflation remains well above target, limiting policy flexibility.

Brazil 🇧🇷

Inflation (YoY): 5.17% (Sep 2025)

Selic Rate: 15.00%

Real Rate: ≈ +9.8%

Stance: Active easing cycle under high nominal yields; strong carry-trade appeal.

Japan 🇯🇵

Inflation (YoY): 2.9% (Sep 2025)

Policy Rate: 0.50%

Real Rate: ≈ –2.4%

Stance: Ultra-loose, but with tightening bias emerging.

Data Note:

CFTC COT reports remain unavailable during the U.S. government shutdown.

Liquidity assessment must rely on the H.4.1 report, yield curves, and repo dynamics instead of position data.

💧 Liquidity Context (Federal Reserve)

Despite the rate cut, the Fed’s balance sheet continues to contract:

• Securities holdings: –7.1B

• Reverse Repo (RRP): +10.2B

• Treasury General Account (TGA): +50B

• Reserve balances: –85B

→ Net Liquidity: –59B (weekly)

Liquidity conditions are tighter, not looser.

Interpretation:

The Fed’s “insurance cut” contrasts with actual quantitative tightening and a measurable liquidity drain.

💡 Macro Bias Summary

Equities (NASDAQ / S&P500) – Neutral to slightly bullish tactically. The rate cut provides short-term relief, but QT and liquidity contraction limit upside potential.

Commodities (Gold / Oil / Copper) – Mixed bias. Gold capped by higher real yields; oil and copper remain driven by global demand expectations.

USD (DXY) – Bullish bias. Rate differentials and liquidity drain favor the dollar in the short term.

EUR/USD – Bearish bias. Euro policy stable, but U.S. remains tighter in real terms; spread still favors USD.

Crypto (BTC / ETH) – Range-bound and liquidity sensitive. Speculative flows remain correlated to net liquidity trends.

🧭 Cycle Interpretation

We remain in a prolonged transition, not a clean easing phase.

Real rates are positive, balance-sheet runoff continues, and central banks remain cautious after two years of inflation pressure.

The macro liquidity cycle is not yet expansionary, and risk assets should be traded selectively, not directionally.

Quote

“Fade the rhetoric, trade the flows — until net liquidity turns up decisively, ‘easing’ is a headline, not a condition.”

Global monetary policy remains in a transitional phase, not yet a true easing cycle.

The Federal Reserve executed a hawkish 25 bps cut (4.25% → 4.00%), maintaining its QT program and signaling that further reductions are not guaranteed.

The ECB held rates steady amid slightly higher inflation, while the BoE remains restrictive.

Liquidity conditions, according to the latest H.4.1, confirm a net weekly drain, not an injection — contradicting market narratives of a “pivot.”

🏛️ Global Monetary Conditions (latest data)

United States 🇺🇸

Inflation (YoY): 3.0% (Sep 2025)

Policy Rate: 4.00% (after 25 bps cut)

Real Rate: ≈ +1.0%

Comment: The Fed delivered a hawkish cut; QT remains active. H.4.1 shows liquidity withdrawal (RRP and TGA up, reserves down).

Stance: Restrictive bias maintained.

Euro Area 🇪🇺

Inflation (YoY, flash): 2.1% (Oct 2025)

ECB Deposit Rate: 2.00% (unchanged)

Real Rate: ≈ –0.1%

Stance: Neutral; ECB focuses on currency and fiscal stability.

United Kingdom 🇬🇧

Inflation (YoY): 3.8% (Sep 2025)

Bank Rate: 4.00%

Real Rate: ≈ +0.2%

Stance: Restrictive; inflation remains well above target, limiting policy flexibility.

Brazil 🇧🇷

Inflation (YoY): 5.17% (Sep 2025)

Selic Rate: 15.00%

Real Rate: ≈ +9.8%

Stance: Active easing cycle under high nominal yields; strong carry-trade appeal.

Japan 🇯🇵

Inflation (YoY): 2.9% (Sep 2025)

Policy Rate: 0.50%

Real Rate: ≈ –2.4%

Stance: Ultra-loose, but with tightening bias emerging.

Data Note:

CFTC COT reports remain unavailable during the U.S. government shutdown.

Liquidity assessment must rely on the H.4.1 report, yield curves, and repo dynamics instead of position data.

💧 Liquidity Context (Federal Reserve)

Despite the rate cut, the Fed’s balance sheet continues to contract:

• Securities holdings: –7.1B

• Reverse Repo (RRP): +10.2B

• Treasury General Account (TGA): +50B

• Reserve balances: –85B

→ Net Liquidity: –59B (weekly)

Liquidity conditions are tighter, not looser.

Interpretation:

The Fed’s “insurance cut” contrasts with actual quantitative tightening and a measurable liquidity drain.

💡 Macro Bias Summary

Equities (NASDAQ / S&P500) – Neutral to slightly bullish tactically. The rate cut provides short-term relief, but QT and liquidity contraction limit upside potential.

Commodities (Gold / Oil / Copper) – Mixed bias. Gold capped by higher real yields; oil and copper remain driven by global demand expectations.

USD (DXY) – Bullish bias. Rate differentials and liquidity drain favor the dollar in the short term.

EUR/USD – Bearish bias. Euro policy stable, but U.S. remains tighter in real terms; spread still favors USD.

Crypto (BTC / ETH) – Range-bound and liquidity sensitive. Speculative flows remain correlated to net liquidity trends.

🧭 Cycle Interpretation

We remain in a prolonged transition, not a clean easing phase.

Real rates are positive, balance-sheet runoff continues, and central banks remain cautious after two years of inflation pressure.

The macro liquidity cycle is not yet expansionary, and risk assets should be traded selectively, not directionally.

Quote

“Fade the rhetoric, trade the flows — until net liquidity turns up decisively, ‘easing’ is a headline, not a condition.”

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.