Dear Friends in Trading,

How I see it for Monday & Tuesday: 8-9 Sept.

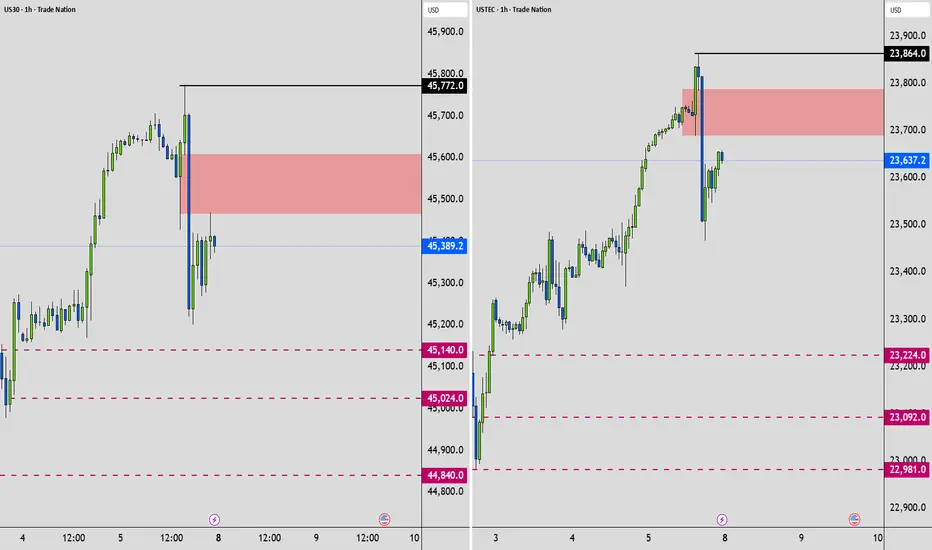

1) Potential Targets for US30

2) Potential Targets for NAS100

Keynote: BE SAFE!

Wednesday to Friday is stacked with High Impact Data.

I personally will be focusing on catching setups for this week before Wednesday.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.

How I see it for Monday & Tuesday: 8-9 Sept.

1) Potential Targets for US30

2) Potential Targets for NAS100

Keynote: BE SAFE!

Wednesday to Friday is stacked with High Impact Data.

I personally will be focusing on catching setups for this week before Wednesday.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.

Note

“I share only my perspective. In this industry, learning never ends, but progress comes when we learn from mistakes without repeating them.” - ANROCNote

Important Update for both instruments:Should a 1 HR candle close a body above the red SELL - OB (order blocks).

The potential for new LL's remains possible - But the probability will be diminished from Very High to Low.

PERSONALLY, I INVALIDATE THE SHORT THESIS IN SUCH A CASE.

Note

What I am looking for to SHORT (I'm not always right)US30 - I want a 30minute candle body to close below 45459 THEN retest and reject the level.

NAS100 - I want a 30minute candle body to close below 23720 THEN retest and reject the level.

All the best...!

Note

NAS100 - Running after the liquidity @ 23864 AGAIN. Scrapping SHORT idea 4 now.SELL Threshold remains valid only for today 23720...I'm not holding my breath.

I caught a quick short with US30.

Note

I could see on 30Minutes the "TIGHT STATE" of the European session - US30.It failed the first time at my threshold, but when it closed below right at NYSE open, I entered -

4 What it's worth. US30's probability was higher = TIGHT STATE / CONTRACTION is followed by EXPANSION

Note

Please know that I am only sharing what I do...I do not do signals.I only wish that you will find something of value through my process, that you can make your own and add to your own strategy.

No 2 persons will ever see charts in exactly the same way.

Isn't that AWESOME🙏

Note

US30 - 45383 to 45459 is your new OB.. It might still go down to 45200Note

Sorry not OB.FVG Resistance

Note

SCRAPPED ☝️☝️☝️Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.