Current Price Action

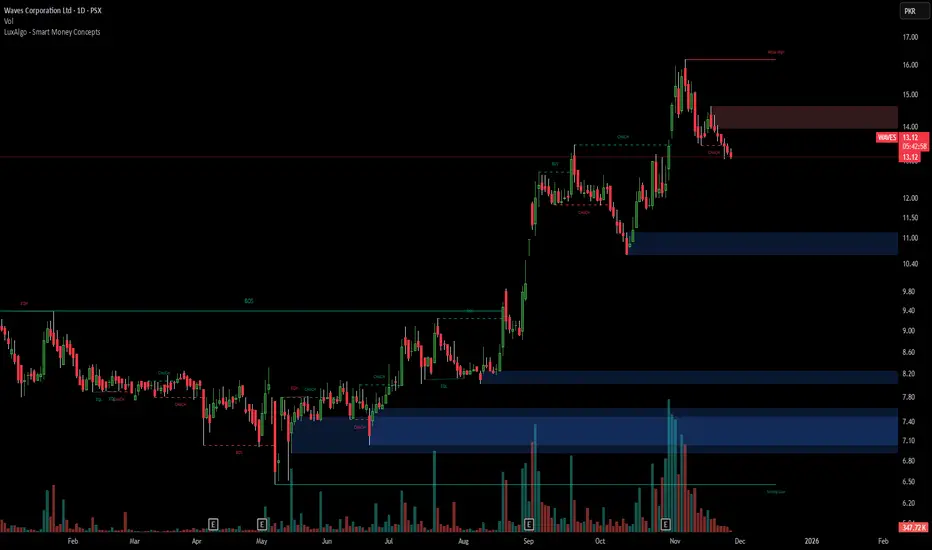

Current Price: PKR 13.13 (down 0.91%)

The stock is trading near concerning technical levels after a significant decline from recent highs.

Key Technical Observations

Trend Structure

The stock experienced a strong uptrend from August through early November, rallying from around PKR 10.50 to a peak near PKR 16.00 (approximately 50% gain). However, the recent price action shows a sharp rejection from the resistance zone and a breakdown in trend.

Critical Support & Resistance Zones

Resistance Zone (Red): PKR 14.00-14.40

This area previously acted as consolidation support but has now flipped to resistance. The stock is struggling below this level, which is a bearish signal.

Current Support Zone (Blue): PKR 11.00-11.40

This represents the former breakout level from October. If this zone fails, the stock could see accelerated selling pressure.

Major Support Zone (Blue): PKR 8.00-8.20

A critical demand zone that provided strong support during the summer consolidation period.

Volume Analysis

Notice the volume spikes marked with "E" (likely earnings releases):

High volume accompanies both rallies and declines

Recent selling volume appears elevated, suggesting distribution

The latest decline shows sustained selling pressure

Technical Pattern

The chart displays a classic "parabolic rise and rejection" pattern. The sharp spike to PKR 16.00 followed by immediate reversal is concerning and often indicates exhaustion of buying momentum.

Trading Outlook

Bearish Scenario (Higher Probability):

Break below PKR 13.00 could trigger a move toward the PKR 11.00-11.40 support zone

Failure of that level opens the door to PKR 8.00-8.20

Bullish Scenario (Requires Confirmation):

A reclaim above PKR 14.00 with strong volume would invalidate the bearish structure

Would need to see consolidation and base-building rather than immediate recovery attempts

Risk/Reward Assessment

Current positioning suggests unfavorable risk/reward for long entries. The stock needs to establish a new base before attempting sustainable upside moves.

Strategy Considerations:

For traders: Wait for clear support hold at PKR 11.00-11.40 or reclaim of PKR 14.00

Momentum has shifted bearish in the short term

Any bounce attempts into the PKR 14.00 resistance zone could provide shorting opportunities

The technical picture suggests caution here, with downside risks outweighing immediate upside potential until the stock can stabilize and form a new accumulation pattern.

Current Price: PKR 13.13 (down 0.91%)

The stock is trading near concerning technical levels after a significant decline from recent highs.

Key Technical Observations

Trend Structure

The stock experienced a strong uptrend from August through early November, rallying from around PKR 10.50 to a peak near PKR 16.00 (approximately 50% gain). However, the recent price action shows a sharp rejection from the resistance zone and a breakdown in trend.

Critical Support & Resistance Zones

Resistance Zone (Red): PKR 14.00-14.40

This area previously acted as consolidation support but has now flipped to resistance. The stock is struggling below this level, which is a bearish signal.

Current Support Zone (Blue): PKR 11.00-11.40

This represents the former breakout level from October. If this zone fails, the stock could see accelerated selling pressure.

Major Support Zone (Blue): PKR 8.00-8.20

A critical demand zone that provided strong support during the summer consolidation period.

Volume Analysis

Notice the volume spikes marked with "E" (likely earnings releases):

High volume accompanies both rallies and declines

Recent selling volume appears elevated, suggesting distribution

The latest decline shows sustained selling pressure

Technical Pattern

The chart displays a classic "parabolic rise and rejection" pattern. The sharp spike to PKR 16.00 followed by immediate reversal is concerning and often indicates exhaustion of buying momentum.

Trading Outlook

Bearish Scenario (Higher Probability):

Break below PKR 13.00 could trigger a move toward the PKR 11.00-11.40 support zone

Failure of that level opens the door to PKR 8.00-8.20

Bullish Scenario (Requires Confirmation):

A reclaim above PKR 14.00 with strong volume would invalidate the bearish structure

Would need to see consolidation and base-building rather than immediate recovery attempts

Risk/Reward Assessment

Current positioning suggests unfavorable risk/reward for long entries. The stock needs to establish a new base before attempting sustainable upside moves.

Strategy Considerations:

For traders: Wait for clear support hold at PKR 11.00-11.40 or reclaim of PKR 14.00

Momentum has shifted bearish in the short term

Any bounce attempts into the PKR 14.00 resistance zone could provide shorting opportunities

The technical picture suggests caution here, with downside risks outweighing immediate upside potential until the stock can stabilize and form a new accumulation pattern.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.