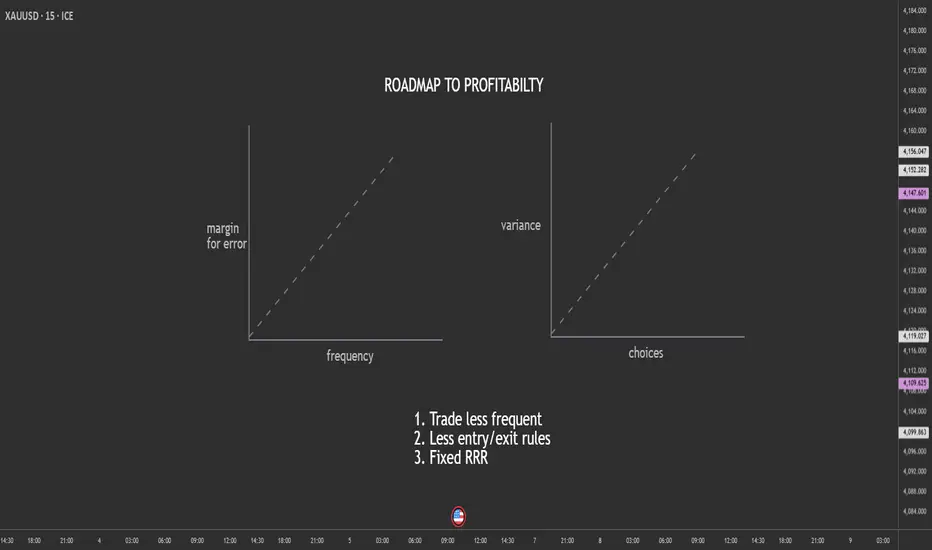

Most retail traders believe they need more—more trades, more setups, more indicators, more signals. But in reality, the traders who survive (and thrive) do the opposite. They trade less frequently, reduce the number of decisions, and lock in a fixed risk-to-reward ratio that keeps their edge stable.

Here’s why simplifying your trading increases your chances of long-term profitability.

1. Trading Less Reduces Mistakes

Every trade is a decision.

Every decision carries emotional and cognitive load.

The more trades you take:

By reducing trading frequency, you automatically reduce the number of opportunities for mistakes.

Fewer trades → Higher quality → More consistency.

Elite traders don’t take every “okay” trade.

They wait for the A+ setups that align perfectly with their plan.

2. Fewer Choices = Lower Variance in Outcomes

When you have too many signals, too many strategies, or too many timeframes, your decision-making becomes inconsistent. Choice overload raises the variance in outcomes—you might catch a big win today and then give it all back tomorrow on impulsive trades.

Reducing choices tightens your performance curve.

When you:

…your results stabilize. The randomness disappears, and your edge becomes measurable.

A stable edge is a profitable edge.

3. A Fixed RRR Protects You From Yourself

Most traders blow accounts not because of strategy, but because of inconsistent risk-to-reward ratios.

Sometimes they take 1:3, sometimes they settle for 1:1, sometimes they hold for 1:6 and give it back. This inconsistency destroys expectancy.

A fixed RRR:

Your job is NOT to predict the market.

Your job is to control the asymmetry between risk and reward.

A consistent 1:2 or 1:3 turns even a 40% win rate into profitability.

Final Thought

If you feel stuck, overwhelmed, or inconsistent, don’t add more tools.

Remove them.

The fewer decisions you have to make, the fewer mistakes you make.

The fewer trades you take, the higher your quality becomes.

And the more consistent your RRR, the more likely you are to stay profitable.

In trading, less really is more.

Here’s why simplifying your trading increases your chances of long-term profitability.

1. Trading Less Reduces Mistakes

Every trade is a decision.

Every decision carries emotional and cognitive load.

The more trades you take:

- the more tired your brain becomes

- the more emotional impulses creep in

- the more likely you are to overreact to noise

- the more commissions/spreads you pay

- the more small errors compound into big losses

By reducing trading frequency, you automatically reduce the number of opportunities for mistakes.

Fewer trades → Higher quality → More consistency.

Elite traders don’t take every “okay” trade.

They wait for the A+ setups that align perfectly with their plan.

2. Fewer Choices = Lower Variance in Outcomes

When you have too many signals, too many strategies, or too many timeframes, your decision-making becomes inconsistent. Choice overload raises the variance in outcomes—you might catch a big win today and then give it all back tomorrow on impulsive trades.

Reducing choices tightens your performance curve.

When you:

- trade one setup type

- focus on one pair or market

- use one timeframe

- follow one clear trigger

…your results stabilize. The randomness disappears, and your edge becomes measurable.

A stable edge is a profitable edge.

3. A Fixed RRR Protects You From Yourself

Most traders blow accounts not because of strategy, but because of inconsistent risk-to-reward ratios.

Sometimes they take 1:3, sometimes they settle for 1:1, sometimes they hold for 1:6 and give it back. This inconsistency destroys expectancy.

A fixed RRR:

- forces discipline

- keeps losses small

- standardizes wins

- makes your edge mathematically trackable

- creates predictable long-term performance

Your job is NOT to predict the market.

Your job is to control the asymmetry between risk and reward.

A consistent 1:2 or 1:3 turns even a 40% win rate into profitability.

Final Thought

If you feel stuck, overwhelmed, or inconsistent, don’t add more tools.

Remove them.

The fewer decisions you have to make, the fewer mistakes you make.

The fewer trades you take, the higher your quality becomes.

And the more consistent your RRR, the more likely you are to stay profitable.

In trading, less really is more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.