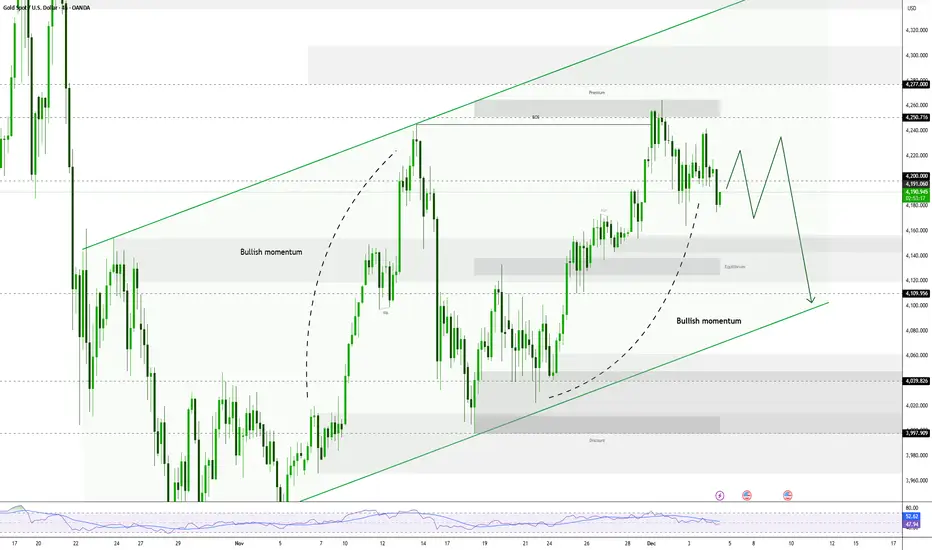

Gold (XAU/USD) is under pressure as it has repeatedly failed to break through the $4,245-$4,250 barrier. This failure, followed by a decline, supports the bearish view.

✅ Bearish Scenario

- ⚡Initial Critical Point: Diverse technical oscillators indicate that further declines are likely to find decent support near the weekly low, which is the $4,164-$4,163 area.

- ⚡Downside Target: Continued selling below this level could drag Gold towards the $4,100 round figure.

- ⚡Strong Support Base: The next decline will test the confluence support at $4,085.

Note: $4,085 is composed of the 200-period EMA on the 4-hour chart and an ascending trendline. This level should act as a strong short-term base.

✅ Bullish Scenario

- ⚡Strong Hurdle: The $4,245 – $4,250 zone will continue to act as an immediate strong barrier.

- ⚡Next Target: Above $4,250, the price could head towards the $4,277 – $4,278 region.

- ⚡Strong Upside Trigger: Sustained strength beyond the $4,300 round figure will be seen as a key trigger for bulls and pave the way for additional short-term gains.

✅ Bearish Scenario

- ⚡Initial Critical Point: Diverse technical oscillators indicate that further declines are likely to find decent support near the weekly low, which is the $4,164-$4,163 area.

- ⚡Downside Target: Continued selling below this level could drag Gold towards the $4,100 round figure.

- ⚡Strong Support Base: The next decline will test the confluence support at $4,085.

Note: $4,085 is composed of the 200-period EMA on the 4-hour chart and an ascending trendline. This level should act as a strong short-term base.

✅ Bullish Scenario

- ⚡Strong Hurdle: The $4,245 – $4,250 zone will continue to act as an immediate strong barrier.

- ⚡Next Target: Above $4,250, the price could head towards the $4,277 – $4,278 region.

- ⚡Strong Upside Trigger: Sustained strength beyond the $4,300 round figure will be seen as a key trigger for bulls and pave the way for additional short-term gains.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.