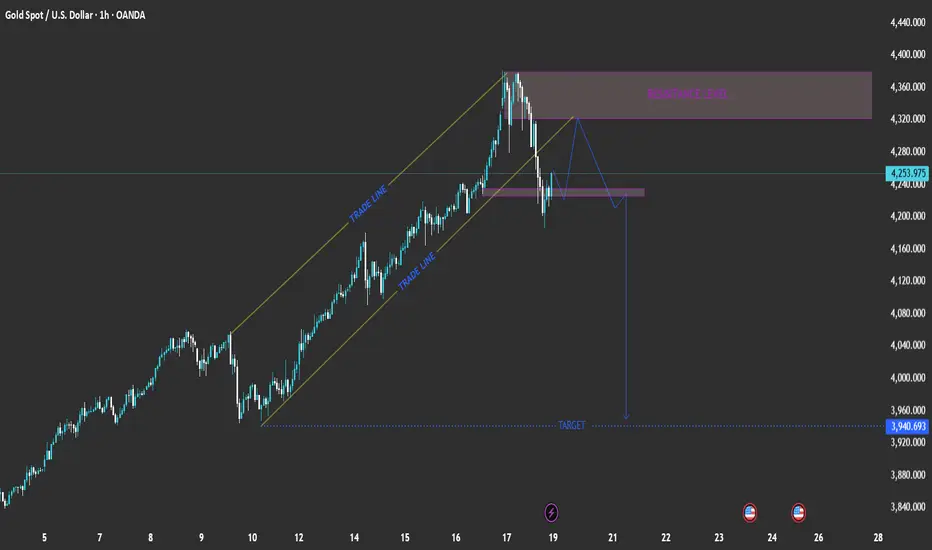

Timeframe: 1-hour

Current Price: 4,253.975

Trend: Recently broke out of an ascending channel (bearish signal)

📉 Chart Breakdown

1. Ascending Channel (Trade Lines)

Price was moving steadily inside a rising channel, indicated by the two parallel yellow “TRADE LINE” levels.

The break below the lower trade line suggests weakening bullish momentum and potential trend reversal.

2. Resistance Level (4,320 – 4,360 zone)

Marked in purple, this zone served as a key resistance.

Price rejected strongly from this area, confirming seller presence.

3. Structure Retest and Potential Move

After the channel break, price retraced back to retest the broken channel support (now resistance).

The projected blue path shows a lower-high formation followed by a new drop, completing a bearish continuation pattern.

4. Target Zone

The projected target is near 3,940.693, aligning with previous structure support.

This level could serve as a profit-taking area for short positions.

📊 Summary of Key Levels

Zone Type Range / Level

4,320 – 4,360 Resistance Strong supply zone

4,220 – 4,240 Retest zone Potential short entry area

3,940 Target Bearish target / demand zone

⚙️ Trading Plan Concept (Hypothetical)

Bias: Bearish

Entry Idea: Wait for rejection from 4,220–4,240 zone.

Stop Loss: Above 4,280 (resistance)

Take Profit: Around 3,940 (target)

Risk/Reward: Approximately 1:3 or better

🧭 Conclusion

The chart suggests that Gold (XAU/USD) might be entering a corrective bearish phase after failing to sustain its bullish channel. A retest of broken structure before another drop aligns with typical market structure behavior.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.