📢 News 📢

President Trump is set to announce new tariffs today, April 2, 2025, at 4 p.m. Eastern Time. This initiative, dubbed "Liberation Day," aims to boost U.S. manufacturing by targeting imports like autos, steel, and pharmaceuticals. 📦💊 However, economists warn that these measures could lead to higher consumer costs and disrupt trade relations. 📉💹

This news might influence market sentiment and could have implications for gold trading. Keep an eye on how the market reacts! 📈💰

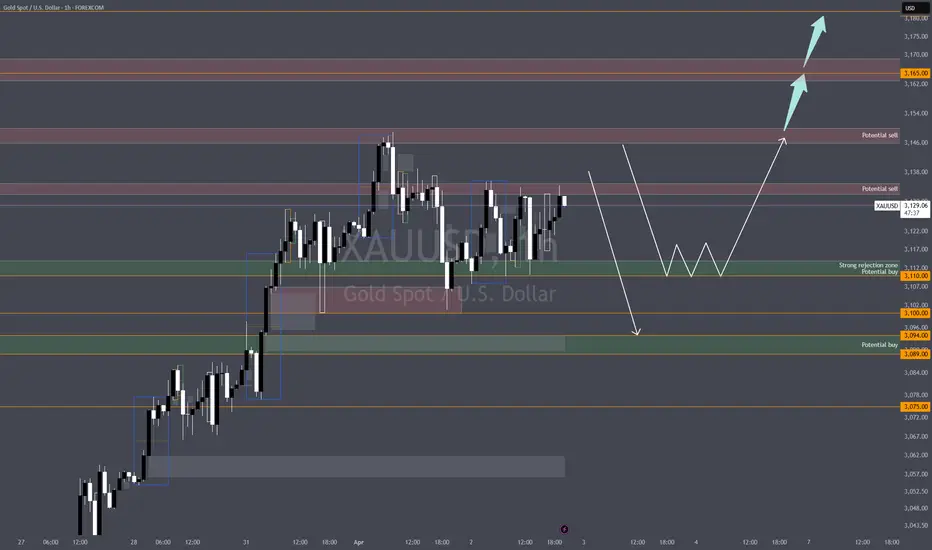

📊XAUUSD 1H Analysis (Current Situation)

Market Structure:

The market is in a clear bullish trend with strong momentum from the previous sessions.

Recent price action shows consolidation near 3,132, suggesting a potential liquidity build-up.

There is a higher high formation, but rejection from the supply zone around 3,139 - 3,150.

Key Technical Zones & Confluences:

Supply Zone / Potential Sell Area:

3,139 - 3,150: If price reacts with strong rejections here, a potential short opportunity may emerge.

3,165 - 3,182: If price breaks above 3,150, this is the next key resistance area.

Demand Zone / Potential Buy Areas:

3,110 - Strong Rejection Zone: If price pulls back here and finds bullish confirmations (e.g., bullish engulfing, liquidity grab), a long entry could be valid.

3,092 - 3,075 Potential Buy Zone: A deeper retracement into this level could provide a sniper entry opportunity.

🔴 Sell Setup

Entry Zone: $3,133 - $3,135

SL: Above $3,138 (tight protection)

TP1: $3,128 (first reaction)

TP2: $3,117 (liquidity zone)

TP3: $3,103 (full move)

📌 Reasoning:

Mid-range premium pricing (not at extreme highs but still valid)

Multiple rejections in this zone (potential shift in order flow)

Possible short-term retrace before continuation

🔴 Sell Idea

Entry Zone: $3,145 - $3,150

SL: Above $3,153 (small wick safety)

TP1: $3,132 (reaction level)

TP2: $3,128 (stronger demand)

TP3: $3,117 (full imbalance fill)

📌 Reasoning:

Liquidity grab potential above $3,145

Imbalance & order block confluence

Possible rejection from premium supply

🟢 Buy idea

Entry Zone: $3,094 - $3,089

Stop Loss (SL): Below $3,085

Take Profit (TP) Levels:

TP1: $3,117

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Unmitigated demand zone

Imbalance around $3,094 suggests a reaction

Strong liquidity pockets nearby

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

President Trump is set to announce new tariffs today, April 2, 2025, at 4 p.m. Eastern Time. This initiative, dubbed "Liberation Day," aims to boost U.S. manufacturing by targeting imports like autos, steel, and pharmaceuticals. 📦💊 However, economists warn that these measures could lead to higher consumer costs and disrupt trade relations. 📉💹

This news might influence market sentiment and could have implications for gold trading. Keep an eye on how the market reacts! 📈💰

📊XAUUSD 1H Analysis (Current Situation)

Market Structure:

The market is in a clear bullish trend with strong momentum from the previous sessions.

Recent price action shows consolidation near 3,132, suggesting a potential liquidity build-up.

There is a higher high formation, but rejection from the supply zone around 3,139 - 3,150.

Key Technical Zones & Confluences:

Supply Zone / Potential Sell Area:

3,139 - 3,150: If price reacts with strong rejections here, a potential short opportunity may emerge.

3,165 - 3,182: If price breaks above 3,150, this is the next key resistance area.

Demand Zone / Potential Buy Areas:

3,110 - Strong Rejection Zone: If price pulls back here and finds bullish confirmations (e.g., bullish engulfing, liquidity grab), a long entry could be valid.

3,092 - 3,075 Potential Buy Zone: A deeper retracement into this level could provide a sniper entry opportunity.

🔴 Sell Setup

Entry Zone: $3,133 - $3,135

SL: Above $3,138 (tight protection)

TP1: $3,128 (first reaction)

TP2: $3,117 (liquidity zone)

TP3: $3,103 (full move)

📌 Reasoning:

Mid-range premium pricing (not at extreme highs but still valid)

Multiple rejections in this zone (potential shift in order flow)

Possible short-term retrace before continuation

🔴 Sell Idea

Entry Zone: $3,145 - $3,150

SL: Above $3,153 (small wick safety)

TP1: $3,132 (reaction level)

TP2: $3,128 (stronger demand)

TP3: $3,117 (full imbalance fill)

📌 Reasoning:

Liquidity grab potential above $3,145

Imbalance & order block confluence

Possible rejection from premium supply

🟢 Buy idea

Entry Zone: $3,094 - $3,089

Stop Loss (SL): Below $3,085

Take Profit (TP) Levels:

TP1: $3,117

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Unmitigated demand zone

Imbalance around $3,094 suggests a reaction

Strong liquidity pockets nearby

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

⚡Join our Free Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / SMC educational content & Trading Psychology to elevate your mind.

⭐ VIP ACCESS & Coaching 1-on-1⭐ t.me/GoldMindsFX_A

Daily Sniper Plans / SMC educational content & Trading Psychology to elevate your mind.

⭐ VIP ACCESS & Coaching 1-on-1⭐ t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚡Join our Free Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / SMC educational content & Trading Psychology to elevate your mind.

⭐ VIP ACCESS & Coaching 1-on-1⭐ t.me/GoldMindsFX_A

Daily Sniper Plans / SMC educational content & Trading Psychology to elevate your mind.

⭐ VIP ACCESS & Coaching 1-on-1⭐ t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.