Predictions and analysis

One of the Uk's 'big four' banks, Barclays bank is looking to make a comeback after being in a corrective phase(or downtrend) for more than a year and a half. The stock made an impulsive up move from the march 2020 bottom and the same went on till Jan 2022.Since then however the stock entered the 'wave 2' correction and has remained in it for more a year and a...

Falling Wedge Pattern for PSNY chart, Polestar In this chart analysis, it's evident that there's a potential buying opportunity if we manage to reclaim the indicated level (previous gap after Earnings). This could take 30 to 45 days, as institutional investors are not very interested in buying this stock. However, it's crucial to exercise caution and patience,...

Barclays is currently trading within a Descending triangle that is visible on the Multi-Month Timeframes. It has had some wicks below the Demand Line already, but has yet to truly break down. Whenever it decides to truly break down, there are really no supports below it, so I think it will go and make new all time lows and reach one of the Fibonacci Extensions...

Barclays - 30d expiry - We look to Sell at 172.38 (stop at 178.52) 175 continues to hold back the bulls. Broken out of the Head and Shoulders formation to the upside. The primary trend remains bearish. Bespoke resistance is located at 173. Early optimism is likely to lead to gains although extended attempts higher are expected to fail. Resistance could...

Barclays - 30d expiry - We look to Buy a break of 152.62 (stop at 145.44) We are trading at oversold extremes. A bullish reverse Head and Shoulders has formed. Short term bias has turned positive. Prices have reacted from 132.06. A break of the recent high at 152.22 should result in a further move higher. Our outlook is bullish. Our profit targets will be...

Barclays - 30d expiry - We look to Buy at 140.42 (stop at 134.98) Price action continued to range between key support & resistance (140.00 - 175.00) and we expect this to continue. We are trading at oversold extremes. Short term momentum is bearish. Early pessimism is likely to lead to losses although extended attempts lower are expected to fail. Support is...

Barclays Short Term We look to Sell at 171.28 (stop at 176.42) Previous resistance located at 170.00. Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. We look for a temporary move lower. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower. Our profit...

Barclays PLC, through its subsidiaries, provides various financial products and services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International divisions. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth...

The pricing of the VIX futures tracking ETN VXX no longer reflects reality. Barclays has halted new issuance of both the VXX and OIL ETNs. Existing shares of VXX are being bid up far beyond the movement in the underlying futures market. As I mentioned in a previous post, (linked below), I believe the VIX is setting up for a breakout to the upside. I...

Barclays - Short Term - We look to Buy at 187.74 (stop at 177.66) Preferred trade is to buy on dips. Previous support located at 190.00. Prices expected to stall near trend line support. Levels close to the 50% pullback level of 187.16 found buyers. The primary trend remains bullish. Our profit targets will be 219.38 and 227.80 Resistance: 200.00 / 210.00...

en.wikipedia.org Could push up in the coming weeks one to watch - nothing is guaranteed however. AMEX:VXX LSE:BARC NYSE:BCS

DNN had an sucessful breakout after an triangle pattern and the trend will continue. Also check latest news from Barclays: Barclays believes investors are overlooking a key source in the push to decarbonization: nuclear energy. Barclays notes that nuclear output is not influenced by weather conditions and seasonality; nuclear waste is less than the waste from...

Barclays is forming the low right now. With good fundamentals i for see the price doubling very soon.

#BARC is likely to correct from current levels to continue it's wave (iii) within higher Wave 3. Would go Long @ 133, TP 188, SL 118.

USDCHF D1 - Bit late to the part posting this, apologies. Very similar structure and paced moving pair here, DXY is at a key level to monitor, retesting after breaking upside of a trading zone, we covered all of this in the rundown, but take a look here too if you haven't got a chance to watch the video.

JUMP IN THEM SELLS TEAM! BARCALYS NOW VALID TO ENTER FOR A SELL! Stocks strategy file now released! below youll see our list of stocks we have found optimal settings for! Amazon Apple Tesla Cineworld Facebook Netflix BABA US30 DAX - DE30EUR US500 NAS100 SPX500USD Google ROKU UK100 BA - Boeing Zoom ZM Barclays What is our strategy? Our strategy is a trend...

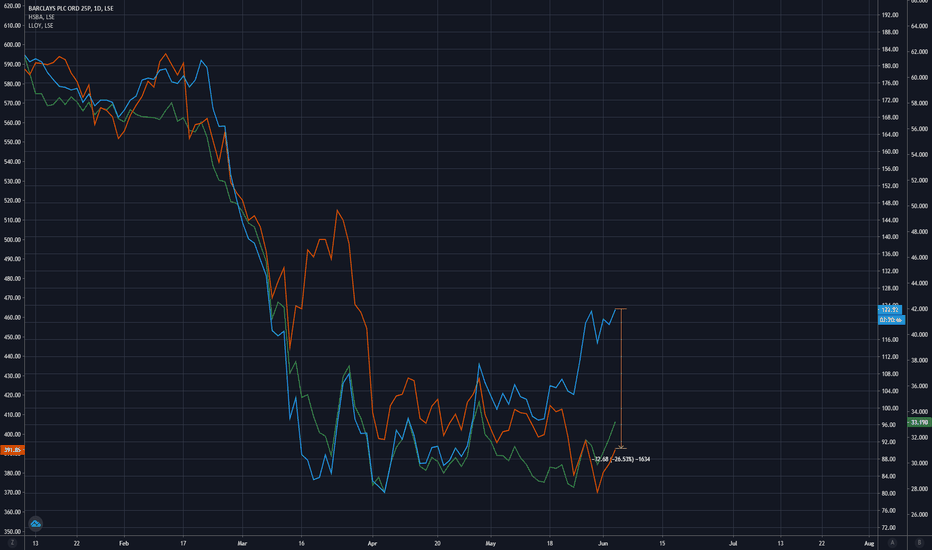

Recent bank divergence, Barclays storming ahead. Lloyds and HSBC left behind.