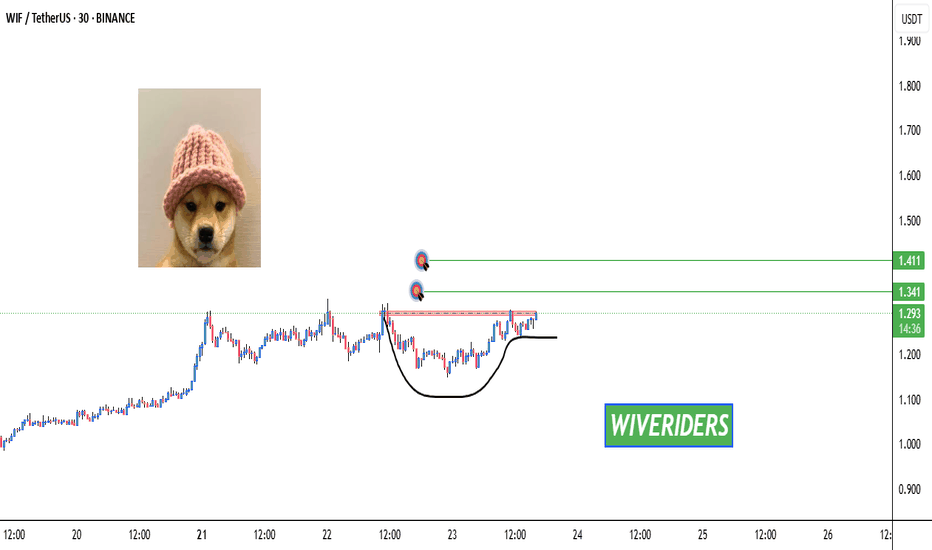

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸

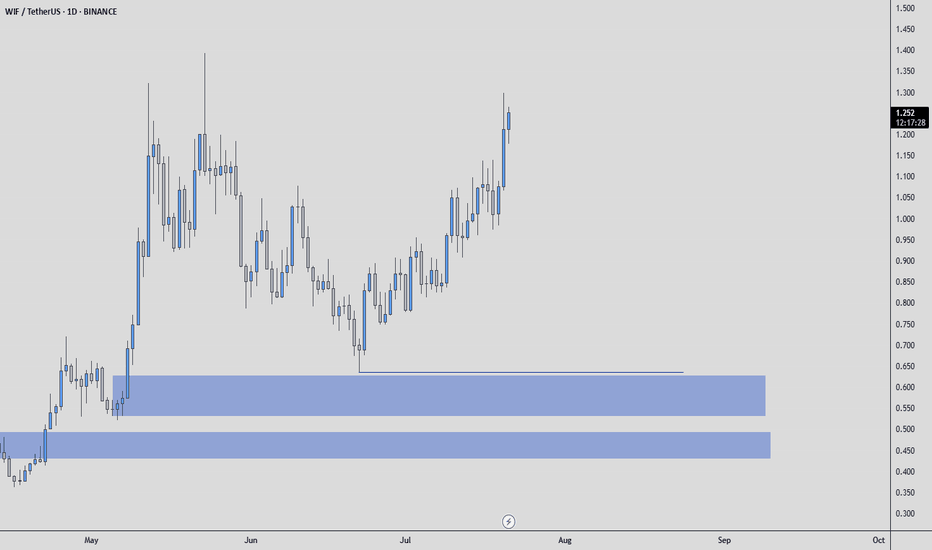

WIFUSDT

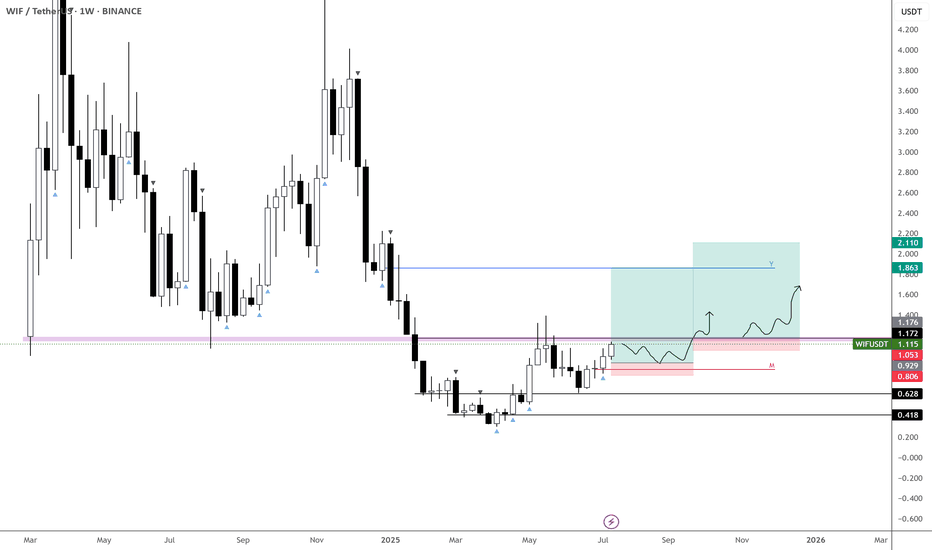

WIFUSDT: Mid-Term AnalysisI know the prices I want are very cheap.

But I believe this market can give me those prices if I’m patient.

Until then, I’m watching calmly. If price comes to my levels, I will look for:

✅ Footprint absorption

✅ CDV support

✅ Structure reclaim for confirmation

If it aligns, I’ll take the trade with clear risk. If not, I’ll keep waiting.

No rush. The right price, or no trade.

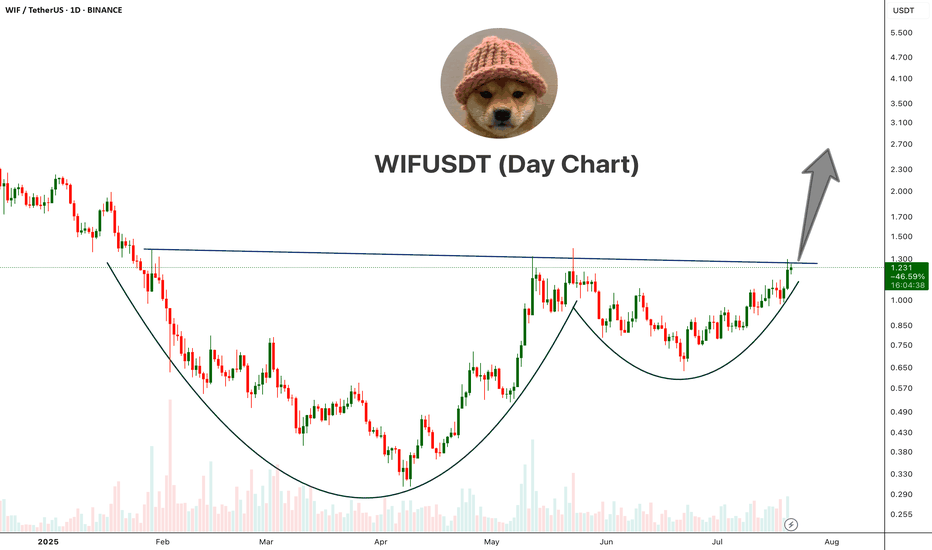

WIFUSDT Cup And Handle PatternWIF is showing a classic Cup and Handle pattern on the daily chart, a strong bullish reversal setup.

The price has broken above the neckline resistance around the $1.25–$1.30 area with bullish momentum. This breakout, if sustained with volume confirmation, could open the doors for a major upside move.

Cheers

Hexa

BINANCE:WIFUSDT

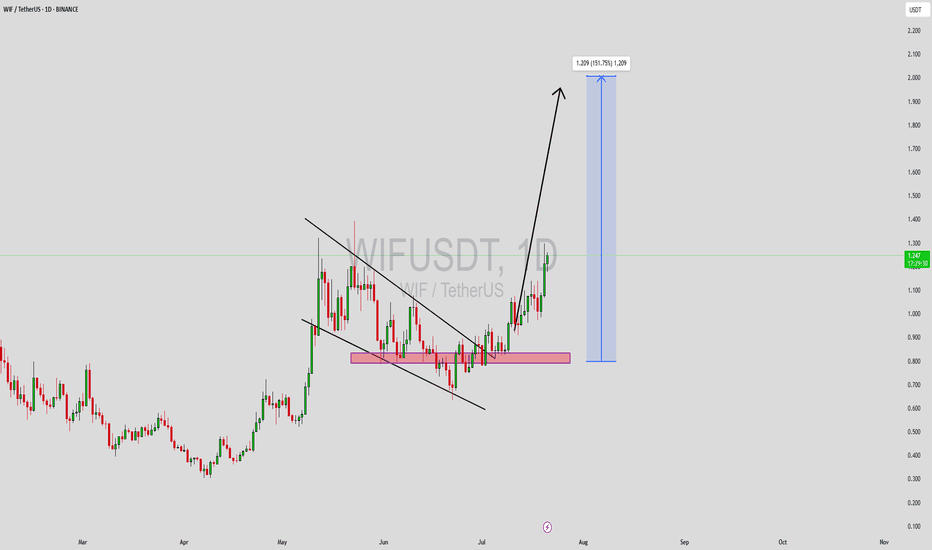

WIFUSDT Forming Descending ChannelWIFUSDT is currently trading within a descending channel pattern, a structure often considered bullish when found in a broader uptrend. This pattern indicates a period of healthy correction and consolidation, which often precedes a breakout move to the upside. With good trading volume and growing interest from the crypto community, WIF may be preparing for a strong reversal. The technical setup suggests a potential gain of 140% to 150%+ upon a confirmed breakout above the upper boundary of the channel.

Dogwifhat (WIF) has garnered significant attention due to its strong meme coin narrative within the Solana ecosystem. As meme tokens continue to attract retail attention, WIF has remained one of the more resilient and talked-about assets in its category. This strong community support, combined with current technical indicators, adds confidence to the bullish case.

The descending channel has allowed price to compress and reset RSI levels, setting the stage for a possible explosive move. If price breaks out with volume, this could mark the beginning of a new bullish wave. Traders should watch for a breakout candle with strong follow-through above recent resistance zones as a key confirmation point.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$WIF just gearing for a new ATH! Not expecting much of a retrace on BINANCE:WIFUSDT — more likely we get consolidation against resistance.

This current level is crucial, and likely to form the base for either:

• A new ATH, or

• At minimum, a third retest of the $4.5–5 zone.

The broader market continues to push higher, and with Bitcoin Dominance breaking down, things could get very interesting in the coming months.

📌 Plan:

• Waiting on a clean retrace (as per second entry... previous post)

• Or a reclaim of the purple block to add to the position

Time to Accumulate $WIF - $1.2 is NextWIF finally showing signs of life.

Starting to build a position below 60c—this looks like an optimal entry given how well it's behaving.

Accumulation zone remains between 40–50c, as long as price holds there.

Targeting the 1.2 area on a break and hold above 65c.

BINANCE:WIFUSDT SEED_WANDERIN_JIMZIP900:WIF

WIF: The Perfect Storm Setup - Ascending Triangle Breakout

📐 Perfect geometric pattern formation

📊 Volume profile supporting the setup

🎯 Clear target zones with minimal resistance

⚡ Compression leading to expansion

🎯 THE SETUP: Triple Confluence Strategy 🔥

📍 ENTRY ZONE: $1.00 - $1.06

🎯 TARGET 1: $2.000 (+85%)

🎯 TARGET 2: $2.400 (+120%)

🔴 STOP LOSS: $0.95 (-3%)

___________ NOTE ____________

🚨 RISK MANAGEMENT 🚨 DYOR

$WIF | Inverted head and shoulders $Wif/Usdt

BINANCE:WIFUSDT.P

The price is formed the Inverted head and shoulders pattern and did a breakout of the neckline, expecting the price to retest green lines (neckline).

If 1H CC hit and bounce above the green lines, it'll be a long opportunity.

Entering at current price will increase the SL, it's suggested to wait for a retest, to have better entry and a good risk management.

Use only 1-2% of your portfolio.

NFA, DYOR

TP:

Price explosion is coming?Read carefullyhello friends👋

We have come to analyze a popular Kuwaiti meme that you have asked to analyze a lot.

🌟Well, according to the drop we had, it can be seen that the buyers came in and formed a good upward wave, and after that, Femt entered a channel, which can be said to be a flag pattern...🧐

Now, according to the formed channel, we can enter into a purchase transaction with capital and risk management in case of a valid failure of the channel.

🔥Follow us for more signals on Bolran.🔥

*Trade safely with us*

WIFUSDT Forming Breakout Descending ChannelWIFUSDT is showing an exciting technical setup as it breaks free from a prolonged downward channel and consolidates near a strong support zone. This breakout pattern signals that the coin could be on the verge of a significant trend reversal, supported by healthy trading volume and renewed investor confidence. With buyers defending key levels and pushing the price above resistance, WIF is capturing the attention of traders looking for high-momentum plays.

Looking at the chart, WIFUSDT’s recent price action suggests that the base has formed well within the highlighted demand zone, providing a solid foundation for a sharp upward move. The breakout from the descending channel is a classic sign of trend change, and this technical shift is further reinforced by steady volume and bullish sentiment across social platforms. Traders should keep an eye on retests of the breakout zone for potential entry opportunities, as these could offer excellent risk-to-reward setups.

The potential gain of 140% to 150%+ makes WIFUSDT a top pick for those scanning the market for trending coins with breakout potential. The meme coin community remains highly active around WIF, and this fresh surge in interest could propel the coin to test its next major resistance levels in the coming weeks. As always, risk management and closely monitoring price action will be key to riding this bullish wave successfully.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Skeptic | Dogwifhat (WIF): Precision Triggers for Spot & FuturesWelcome, traders, Its Skeptic! 😎 Is Dogwifhat (WIF) the next meme coin rocket or a risky gamble? I’m diving into a pro-level breakdown of WIF, the Solana-based meme coin with a $882.06M market cap, ranked #75 globally. This analysis covers recent performance, ecosystem strengths, and technical triggers for spot and futures trading, grounded in cycle-based strategies. Trade with no FOMO, no hype, just reason. Let’s dissect WIF! 🚖

📰 Recent Performance & Key Events

Dogwifhat (WIF) , a Solana-based meme coin launched in late 2023, trades at 0.886 with a $882.06M market cap, ranking #75 globally. Featuring a Shiba Inu in a pink beanie, it leverages Solana’s high-speed, low-fee blockchain and a deflationary burn mechanism with a 998.9 million token supply. Listed on major exchanges like Binance, KuCoin, and Gate.io, WIF enjoys strong liquidity. In July 2025, it’s up 5.26% in 24 hours and 24.57% over 7 days, with a 24-hour trading volume of $450M. However, it’s down 80.94% from its all-time high of $4.84 (March 31, 2024), reflecting meme coin volatility :)

Technical & Market Position

WIF benefits from Solana’s scalable ecosystem, a hub for DeFi and NFTs, with 160,000+ TPS and low fees, outpacing slower networks. Its community-driven appeal, active on X, Reddit, and Discord, fuels its momentum, with posts highlighting a cult-like following. Compared to Pepe ($4.08B market cap, 456,000+ holders, 37% holding over a year), WIF’s smaller but vocal community shows dedication. However, its lack of real-world utility and reliance on social media hype mirror Pepe’s 25.7% year-to-date drop, raising concerns about sustainability.

Risks : Speculative volatility, pump-and-dump schemes, and dependence on Solana’s performance and social media sentiment make WIF a high-risk bet. Use stop loss to manage swings.

📈 Technical Analysis

Daily Timeframe

The Weekly (HWC) is bearish, entering a major bearish trend after forming a double bottom and breaking support. However, the Daily (MWC) started an uptrend, achieving 350 % growth before correcting to the 0.5 Fibonacci retracement —a healthy correction without breaking the uptrend momentum. Key support zones are $0.635–$0.679 . A break below could resume the Weekly bearish trend, so stay alert.

Spot Trigger (Long): Break above resistance at $ 1.047 , confirmed by a volume surge (ideally 2x the average of the prior 5–7 candles). Volume is critical—technical analysis is an art, not a science, so don’t fixate on exact numbers.

Key Insight: The Daily uptrend holds, but a volume spike is essential to confirm bullish moves and avoid fakeouts.

4-Hour Timeframe (Futures Triggers)

On the 4-hour chart (LWC), for longs:

Trigger: Break of the downward trendline and resistance at $ 0.958 , with volume confirmation (strong volume seen in the prior uptrend leg). Additional confirmation: RSI re-entering overbought.

Shorts: No short trigger currently. Despite the Weekly bearish HWC, the Daily MWC uptrend and strong support at $0.635–$0.679 make shorting illogical. Wait for a support break and MWC turning bearish for a safer short with better R/R.

Pro Tip: Longs are viable with volume and RSI confirmation. Avoid shorts until the MWC aligns bearish to minimize fakeout risk. Always use MAX 1%–2% risk per trade.

Final Vibe Check

This WIF breakdown delivers precise triggers for spot ($1.047) and futures ($0.958 long, no short yet), leveraging cycle-based strategies. With a bearish Weekly but bullish Daily, prioritize volume confirmation to navigate meme coin volatility. Solana’s ecosystem and exchange listings give WIF an edge, but its hype-driven nature demands caution. Want more cycle setups or another pair? Drop it in the comments! If this analysis sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which WIF trigger are you watching? Share your thoughts in the comments, and let’s crush it together!

WIF ANALYSIS🔮 #WIF Analysis - Update 🚀🚀

💲 We can see that there is a formation of Falling Wedge Wedge Pattern in #WIF and we can see a bullish movement after a good breakout. Before that we would see a little retest and and then a bullish movement.

💸Current Price -- $0.848

📈Target Price -- $1.049

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#WIF #Cryptocurrency #Breakout #DYOR

WIF/USDT – Major Breakout Incoming! Potential Upside Over +400%!Technical Analysis:

The WIF/USDT (dogwifhat / Tether) pair on the 1D timeframe is currently showing signs of a bullish breakout from a well-defined descending channel that has formed over the past few months.

📌 Key Highlights:

Price has been consolidating within a descending channel since March 2025.

It is now attempting to break out above the upper boundary of the channel – a strong bullish signal.

The breakout is forming after a strong bounce from the $0.70–$0.75 support zone, indicating accumulation and potential trend reversal.

📈 Resistance Levels (Target Zones):

1. $1.0251 – first key resistance to watch.

2. $1.2008 – minor resistance, ideal short-term target post-breakout.

3. $1.8468 – major historical resistance level.

4. $2.1772 – key psychological and technical level.

5. $2.9503 – extended bullish target.

6. $4.1525 – maximum bullish projection in case of parabolic move.

📉 Support Levels:

$0.8627 – current price level.

$0.70–$0.75 – previous strong support zone and lower channel base.

📊 Strategy Insight:

A potential entry could be considered on a confirmed breakout and retest around $1.02.

Targets can be scaled based on resistance levels mentioned above.

Use proper risk management and stop-loss below the channel to avoid fakeouts.

Conclusion:

WIF/USDT is showing a strong bullish reversal structure, breaking out from a mid-term descending pattern. This could be the beginning of a massive upward impulse, with over +400% potential gain if key targets are reached. A critical moment for traders and investors to pay attention!

#WIFUSDT #WIFBreakout #CryptoAnalysis #AltcoinSeason #Dogwifhat #BullishSetup #BreakoutAlert #CryptoTrading #CryptoSignals #WIFArmy

dogwifhat WIF price analysis🤪 "They" are trying to breathe "new life" into #WIF . And if they manage to keep the price of OKX:WIFUSDT above $0.55, this plan will have a chance of success.

So what do we have:

◆ #WIF holders need to keep their fingers crossed that everything will work out and there will soon be growth, and with it a chance to get out of a prolonged "draw fall"

◆ Traders need to wait for confirmation that the price of #WIFUSD is holding steady above $0,55.

And no large trading leverage, because this is a fairly volatile meme coin, even x5 leverage, which allows for a -19% error, or x3, which forgives a “miss” of -32% from the entry point, can liquidate your deposit when trading volatile assets.

⁉️ Do you believe that the price of #dogwifhat can still return to the $4 range with a corresponding project capitalization of $4 billion?

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

WIFUSDT Forming Classic Wedge WIFUSDT has recently formed a classic wedge pattern, a powerful technical indicator often associated with upcoming breakouts. Wedge patterns, especially those with tightening price action and consistent volume, suggest a coiled market preparing for a strong directional move. In the case of WIFUSDT, this wedge structure is showing all the right characteristics for a bullish breakout, supported by growing trading volume and increasing investor interest.

The price structure within the wedge is narrowing, indicating a possible compression before expansion. This typically precedes a sharp breakout, and current market behavior around WIFUSDT suggests bulls are positioning themselves for a significant upside move. Technical projections show a strong potential for gains ranging between 140% to 150%+, especially if the breakout is accompanied by momentum confirmation on higher timeframes.

What adds to the bullish thesis is the noticeable uptick in trading volume, which confirms that accumulation might already be underway. When volume supports a pattern breakout, it often adds strength and sustainability to the move. With market sentiment slowly shifting and capital rotating into altcoins, WIFUSDT stands out as a high-potential candidate in the current environment.

WIFUSDT is quickly becoming a favorite among breakout traders and short-term investors looking to ride explosive setups. If the wedge breaks to the upside as expected, it could mark the beginning of a strong rally phase. Traders may want to monitor closely for entry signals as the breakout unfolds.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$SOLANA $180 PUMP INCOMINSOL/USDT – 4H Chart Summary

Market Structure:

HTF: Bullish trend remains intact.

LTF: Previously bearish, now showing early signs of a bullish reversal.

Pattern Formation:

Potential Inverse Head & Shoulders forming.

Neckline at $157 — must hold for pattern to complete.

Break above previous high will invalidate Inverse Head & Shoulders.

Trendline & Breakout:

Price has broken above the descending bearish trendline.

Indicates a momentum shift from bearish to bullish.

Fair Value Gaps (FVG):

1D FVG below current price – potential retest & long entry zone.

2x 1D FVG above price – act as targets or supply areas.

Psychological Levels & Volume:

Key levels at $165, $170, $175.

Volume profile shows high liquidity at each of these levels – strong TP zones.

OBV Indicator:

OBV has broken above resistance – supports bullish continuation.

Trade Scenarios:

Bullish Setup:

Long on retest of lower FVG zone ($142–$145).

Target TPs: $165 → $170 → $175 (align with psychological & high-volume areas).

Invalidation:

Break below FVG support or failure to hold above $142.

WIFUSDT Long Setup – Falling Wedge Breakout Incoming?Hey Traders — if you're into high-conviction setups with real momentum, this one’s for you.

WIF has been consolidating inside a falling wedge structure and is now showing signs of strength from the major horizontal support zone around $0.77. The structure is tightening, and the recent bounce from support could be the early signal of a breakout.

Here’s the trade idea:

Entry Zone: $0.77 – $0.81

Breakout Confirmation: 4H close above the wedge trendline (~$0.87)

Targets:

Target 1: $0.95

Target 2: $1.10

Target 3: $1.35

Invalidation / SL: Below $0.74

Risk-Reward: High (3R+ depending on entry)

Strategy:

Wait for a confirmed breakout with volume. Early entries around current support with tight SLs offer favorable setups if you’re comfortable with added risk.

Keep an eye on Bitcoin’s volatility and global macros, as they may influence alt momentum.

You saw a meme. I saw imbalanceWIF doesn’t need to be serious — because I am. This move isn’t about hype. It’s about inefficiency, reclaimed structure, and a clear delivery path.

The logic:

Price swept the lows and gave a clean reaction off the OB. From there, it filled the local FVG but didn’t expand — it paused. That tells me it’s not finished building. The first push wasn’t the move. It was the positioning.

The real draw is layered above:

TP1: 0.9591 — inefficiency midpoint

TP2: 1.0469 — external liquidity and high-volume cluster

The FVG-OB combo below (0.8736–0.8565) is the reload zone. That’s where Smart Money buys. Not above. Not late.

Execution:

Entry: 0.857–0.875 zone

SL: Below 0.825

TP1: 0.959

TP2: 1.046

Let retail react to candles. I’m reacting to context.

Final thought:

“You can laugh at the ticker. Just don’t laugh at the R/R.”

Price collapsed. I didn’t flinch. Here’s whyThat wick didn’t scare me — it confirmed the setup. Volume spiked, price swept an equal low, and printed the reaction I was waiting for.

The logic:

Clean FVG formed on the drop

Price returned to rebalance

Reaction from that FVG confirms Smart Money intent

It’s not about chasing the reversal — it’s about understanding the anatomy of one. And that’s exactly what just unfolded here.

Below price? An untouched EQ level. Above? A full inefficiency gap into 0.99. That’s the delivery map.

Trade framework:

Re-entry: Into the FVG zone (~0.825–0.807)

SL: Below EQ (~0.79)

TP1: 0.91 POC sweep

Final objective: Full push into 0.99

This isn't hype. This is precision. You don't need magic indicators when price gives you the story in volume and imbalance.

Final words:

“I don’t chase the move. I identify where it started — and wait for it to return.”

They brought it down for the fill — now it's time to see who’s rBINANCE:WIFUSDT just reacted perfectly off the 0.618 golden zone at 0.827 with bullish intent. The STB 1D and FVG 1D combo formed a high-probability demand zone that Smart Money won't ignore lightly.

Here’s the bullish roadmap:

Entry: 0.788 (bottom wick through 0.618 fib)

Structure: Clear higher low with mitigation of FVG 1D

Volume: Climax candle into key levels — classic absorption

Targets:

TP1: 0.921 (mid-level fib and consolidation ceiling)

TP2: 1.015 - 1.132 (FVG to OB 1D imbalance fill)

TP3: 1.321 (full expansion target — optimal trade entry delivery)

Moonshot: 1.393 if bulls dominate past OB retest

Invalidation: Daily close below 0.692 (STB 1D)

Price doesn’t just reverse — it transfers power. This is that shift.

For more plays just like this — all based in structure and timing — check the profile for setups that speak precision, not prediction.

I didn’t chase the high. I waited for the reclaim.WIF ran the 1.048 liquidity, reversed, and now it's offering the kind of structure I don’t second-guess. This isn’t about trend — this is about reclaiming control.

Here’s the map:

Price retraced cleanly into the BPR zone between 0.944 and 0.920 — right in the middle of the fib rebalancing zone

0.618 fib sits at 0.920, which makes this entire region a Smart Money entry block

Below that is the 1H OB at 0.840 — a worst-case sweep zone if liquidity gets run

Current structure suggests a tight range building beneath the previous high — a classic setup before a displacement move into 0.999 → 1.048

Hold above BPR and reclaim 0.969? That’s your greenlight.

Execution plan:

Entry: 0.944–0.920

TP1: 0.969

TP2: 1.048

Invalid below: 0.885 — or full re-entry from the 1H OB near 0.840

The move already happened. This is the retest. You either planned for it — or you're reacting late.

Precision like this lives in the profile. Setup-first. Noise-free.

This wasn’t a bounce. It was a reclaim.BINANCE:WIFUSDT.P hit the daily OB at 0.8330 and snapped back — not with hope, but with intent.

Smart Money didn’t panic on the drop. It positioned.

Here’s the structure:

Price tapped a clean D OB, aligned perfectly with 0.618 fib — the algorithm’s comfort zone

The bounce reclaimed 1.00 fast, and the market is now flirting with internal liquidity near 1.0178 and 1.1339

Above, the real draw sits at 1.3965 — a void yet to be filled

Below, we still have W OB liquidity near 0.7260 if this rotation fails

This move doesn’t need hype. It needs follow-through. If we consolidate above 0.9299 and break into 1.0178 clean, the next phase unlocks — straight into the 1.13–1.32 range.

Execution plan:

Bias remains bullish above 0.92

Pullbacks into 0.89–0.83 are still valid long zones as long as 0.7260 doesn’t get breached

Target 1.1339 first — then 1.3965 as the higher timeframe liquidity magnet

This setup isn’t emotional. It’s engineered. You don’t need to guess when price is built to deliver.

More trades like this — real levels, real invalidations — are in the profile description.

A 35% fall in WIF from its current price levels is possibleWIF has just broken below the 200 EMA on the H4 timeframe and reacted to an imbalance area.

From here, it’s possible for a pullback to form in an ABC pattern with low volume on the upward move, potentially testing the resistance zone where the 200 EMA may also act as resistance.

Looking at the BTC chart, there’s still room for further downside, which supports our thesis.

Using the RSI across the M15 and H1 timeframes to identify overbought areas with divergence could serve as the entry trigger.

Let’s see what this week brings!