Other timeframes and data

Introduction

Pine Script® allows users to request data from sources and contexts other than those their charts use. The functions we present on this page can fetch data from a variety of alternative sources:

- request.security() retrieves data from another symbol, timeframe, or other context.

- request.security_lower_tf() retrieves intrabar data, i.e., data from a timeframe lower than the chart timeframe.

- request.currency_rate() requests a daily rate to convert a value expressed in one currency to another.

- request.dividends(), request.splits(), and request.earnings() respectively retrieve information about an issuing company’s dividends, splits, and earnings.

- request.financial() retrieves financial data from FactSet.

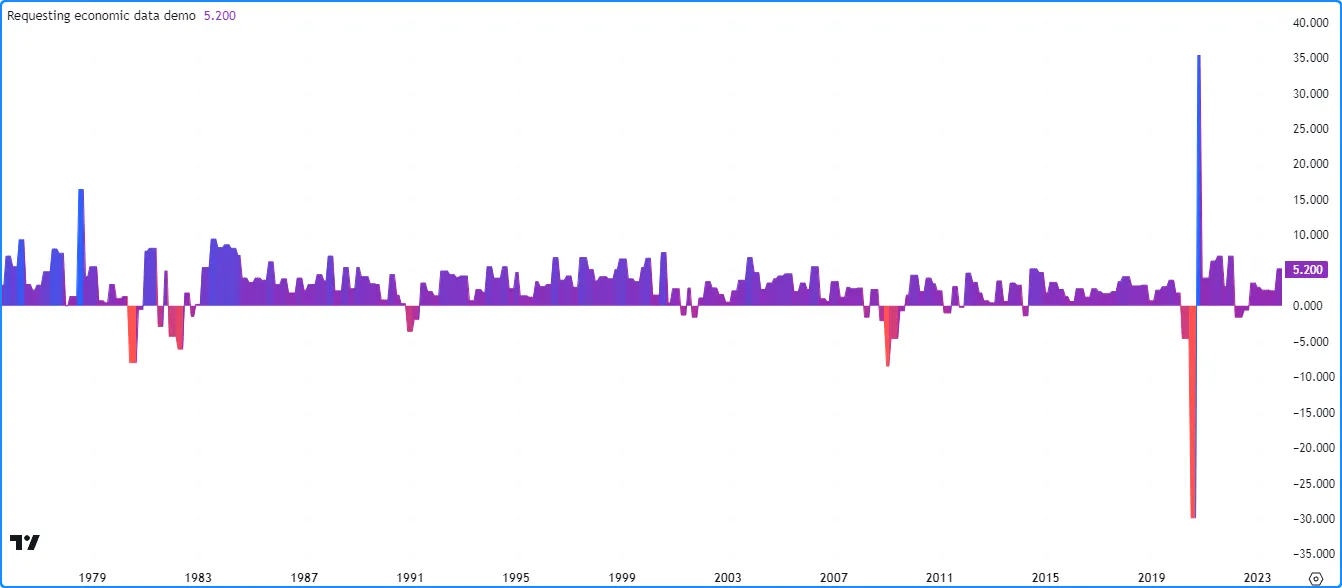

- request.economic() retrieves economic and industry data.

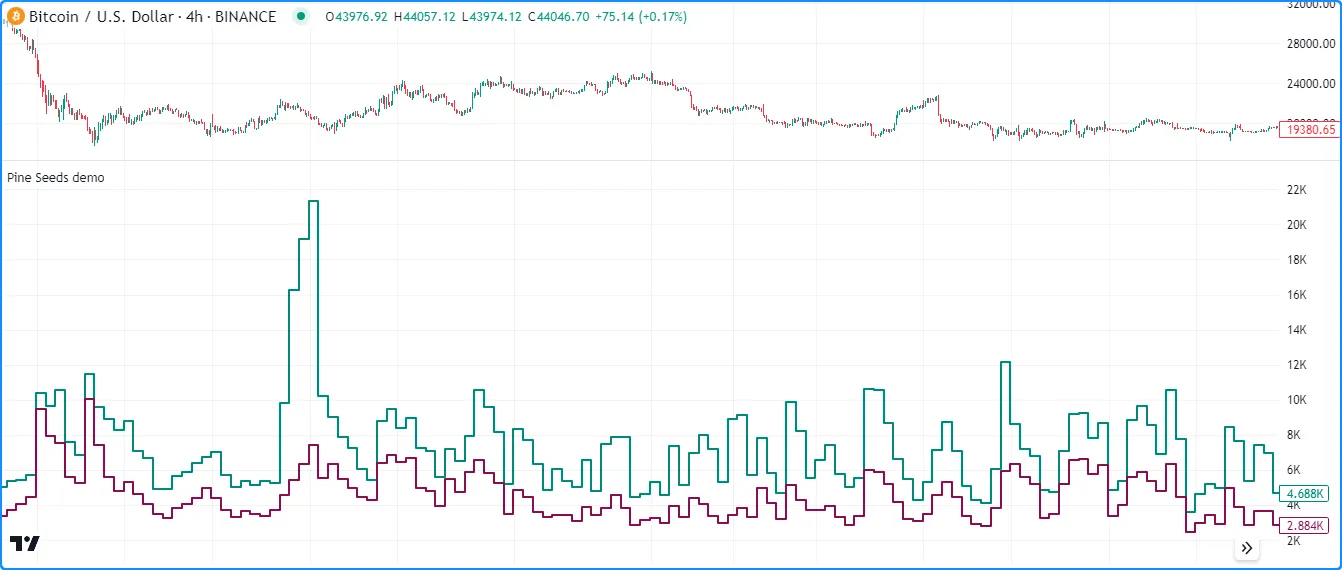

- request.seed() retrieves data from a user-maintained GitHub repository.

These are the signatures of the functions in the request.* namespace:

request.security(symbol, timeframe, expression, gaps, lookahead, ignore_invalid_symbol, currency, calc_bars_count) → series <type>

request.security_lower_tf(symbol, timeframe, expression, ignore_invalid_symbol, currency, ignore_invalid_timeframe, calc_bars_count) → array<type>

request.currency_rate(from, to, ignore_invalid_currency) → series float

request.dividends(ticker, field, gaps, lookahead, ignore_invalid_symbol, currency) → series float

request.splits(ticker, field, gaps, lookahead, ignore_invalid_symbol) → series float

request.earnings(ticker, field, gaps, lookahead, ignore_invalid_symbol, currency) → series float

request.financial(symbol, financial_id, period, gaps, ignore_invalid_symbol, currency) → series float

request.economic(country_code, field, gaps, ignore_invalid_symbol) → series float

request.seed(source, symbol, expression, ignore_invalid_symbol, calc_bars_count) → series <type>The request.*() family of functions has numerous potential applications. Throughout this page, we discuss in detail these functions and some of their typical use cases.

Common characteristics

Many functions in the request.*() namespace share some common properties and parameters. Before we explore each function in depth, let’s familiarize ourselves with these characteristics.

Behavior

All request.*() functions have similar internal behavior, even though they do not all share the same required parameters. Every unique request.*() call in a script requests a dataset from a defined context (i.e., ticker ID and timeframe) and evaluates an expression across the retrieved data.

The request.security() and request.security_lower_tf() functions allow programmers to specify the context of a request and the expression directly via the symbol, timeframe, and expression parameters, making them suitable for a wide range of data requests.

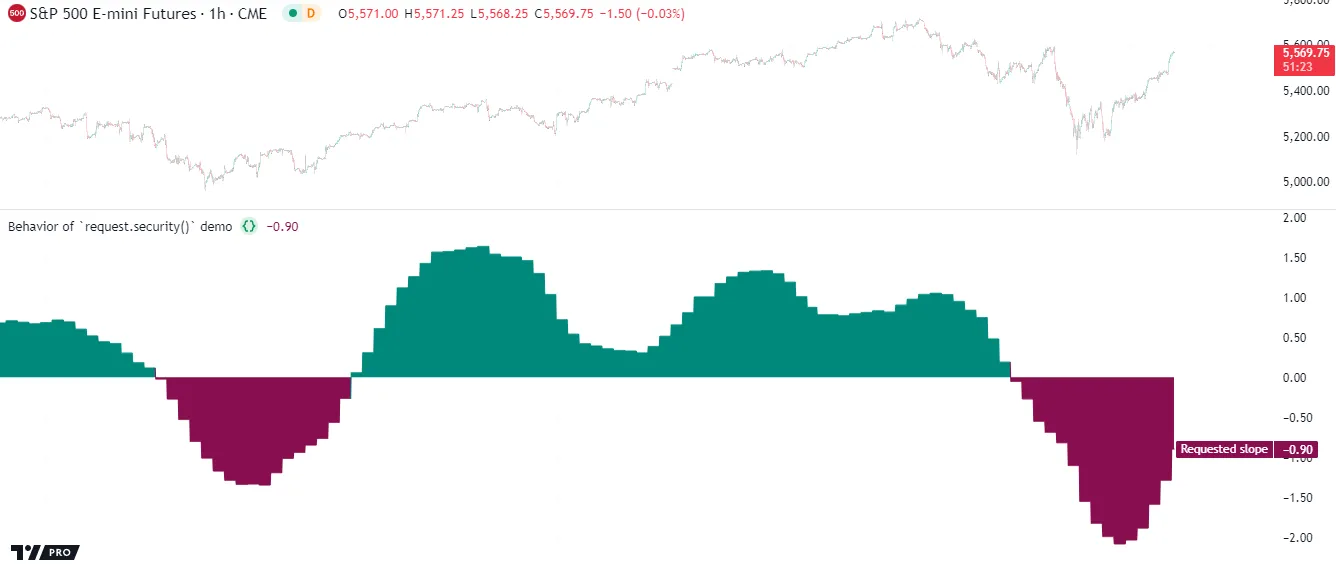

For example, the request.security() call in this simple script requests daily “AMEX:SPY” data, and it calculates the slope of a 20-bar linear regression line using the retrieved hl2 prices. The first two arguments specify the context of the request, and the third specifies the expression to evaluate across the requested data:

Other functions within the request.*() namespace do not allow programmers to directly define the full context of a request or the evaluated expression. Instead, these functions determine some of the necessary information internally because they perform only specific types of requests.

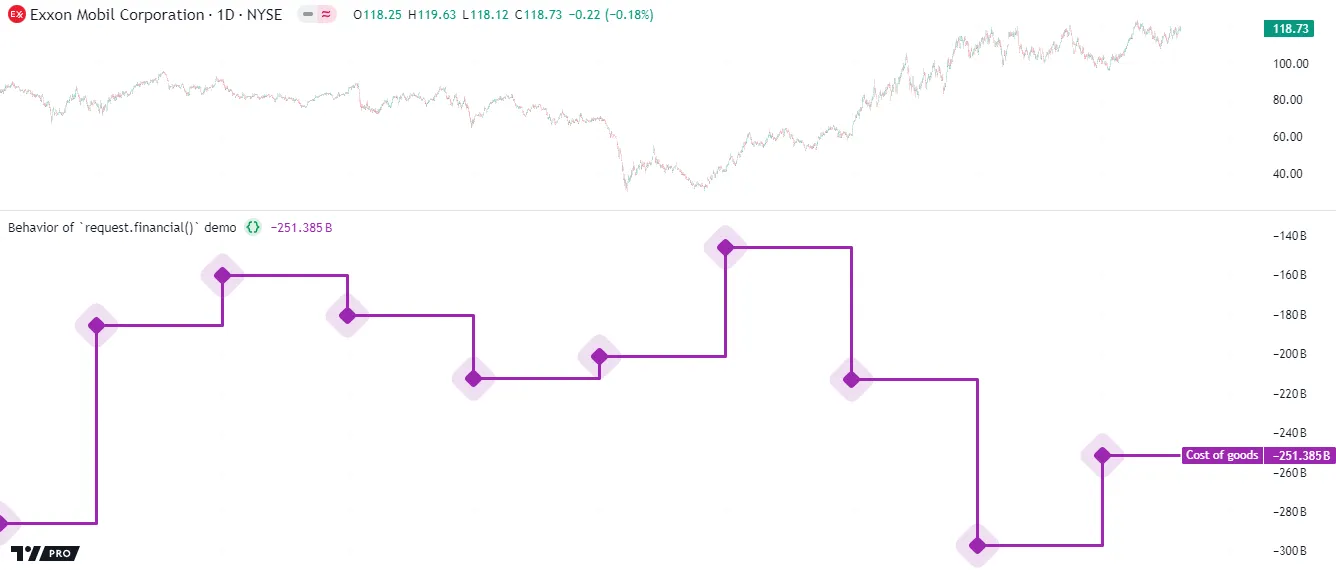

For instance, request.financial() exclusively retrieves periodic financial data. Its required parameters (symbol, financial_id, and period) all define parts of a specific financial ticker ID. The function does not allow specification of the timeframe or expression, as it determines these details internally. The script below demonstrates a simple call to this function that retrieves the annual cost of goods data for the chart symbol’s issuing company:

Scripts can perform up to 40 unique requests using any combination of request.*() function calls. Only unique request.*() calls count toward this limit because they are the only calls that fetch new data. Redundant calls to the same request.*() function with identical arguments do not retrieve new data. Instead, they reuse the data from the first executed call. See this section of the Limitations page for more information.

gaps

When using a request.*() function to retrieve data from another context, the data may not come in on each new bar as it would with the current chart. The gaps parameter of a request.*() function controls how the function responds to nonexistent values in the requested series.

Suppose we have a script executing on an 1-minute chart that requests hourly data for the chart’s symbol using request.security(). The function call returns new values only on the 1-minute bars that cover the opening and closing times of the symbol’s hourly bars. On other chart bars, we can decide whether the function returns na values or the last available values via the gaps parameter.

When the gaps parameter uses barmerge.gaps_on, the function returns na results on all chart bars where new data is not yet confirmed from the requested context. Otherwise, when the parameter uses barmerge.gaps_off, the function fills the gaps in the requested data with the last confirmed values on historical bars and the most recent developing values on realtime bars.

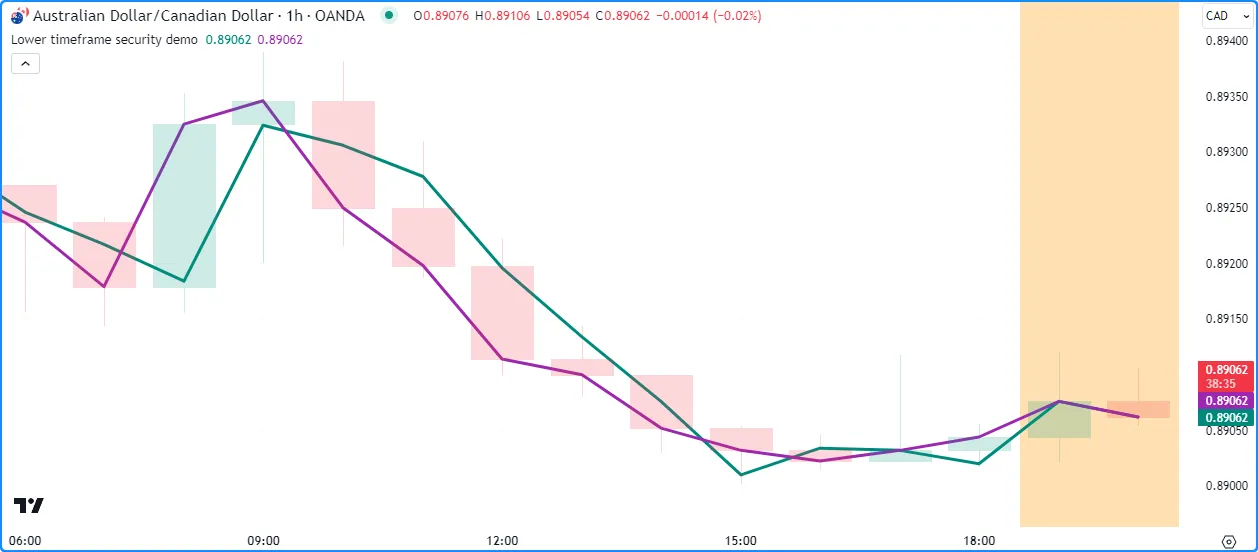

The script below demonstrates the difference in behavior by plotting the results from two request.security() calls that fetch the close price of the current symbol from the hourly timeframe on a 1-minute chart. The first call uses gaps = barmerge.gaps_off and the second uses gaps = barmerge.gaps_on:

Note that:

- barmerge.gaps_off is the default value for the

gapsparameter in all applicablerequest.*()functions. - The script plots the requested series as lines with breaks (plot.style_linebr), which do not bridge over na values as the default style (plot.style_line) does.

- When using barmerge.gaps_off, the request.security() function returns the last confirmed close from the hourly timeframe on all historical bars. When running on realtime bars (the bars with the color.aqua background in this example), it returns the symbol’s current close value, regardless of confirmation. For more information, see the Historical and realtime behavior section of this page.

ignore_invalid_symbol

The ignore_invalid_symbol parameter of request.*() functions determines how a function handles invalid data requests, e.g.:

- Using a

request.*()function with a nonexistent ticker ID as thesymbol/tickerparameter. - Using request.financial() to retrieve information that does not exist for the specified

symbolorperiod. - Using request.economic() to request a

fieldthat does not exist for acountry_code.

A request.*() function call produces a runtime error and halts the execution of the script when making an erroneous request if its ignore_invalid_symbol parameter is false. When this parameter’s value is true, the function returns na values in such a case instead of raising an error.

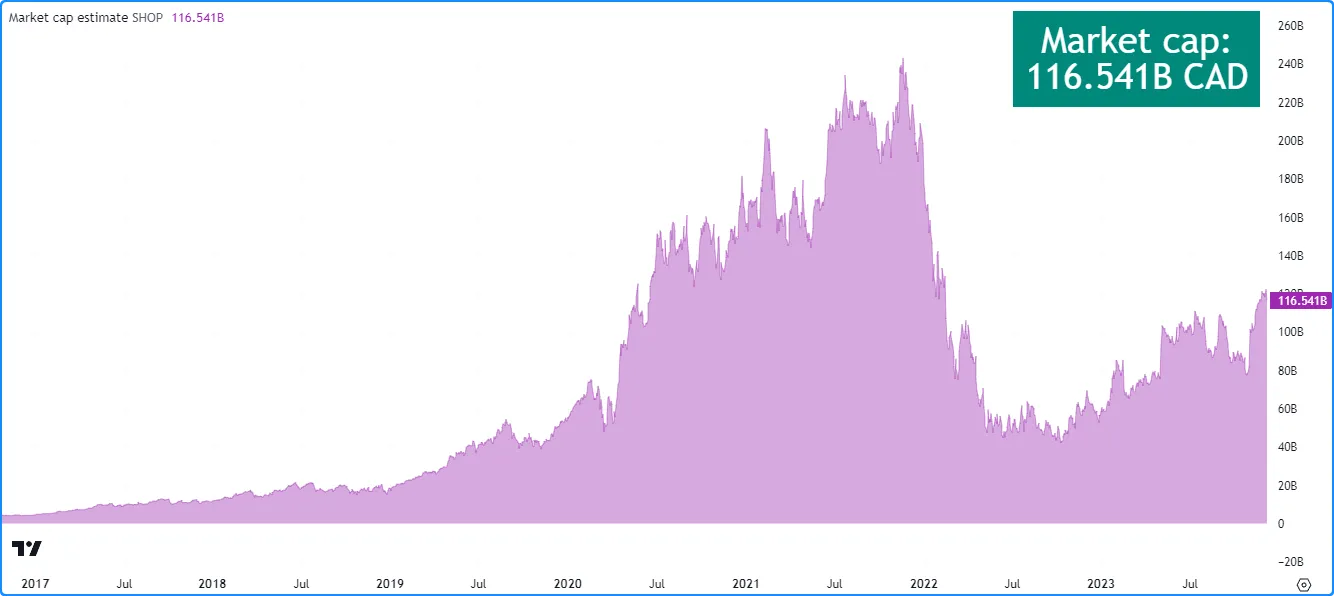

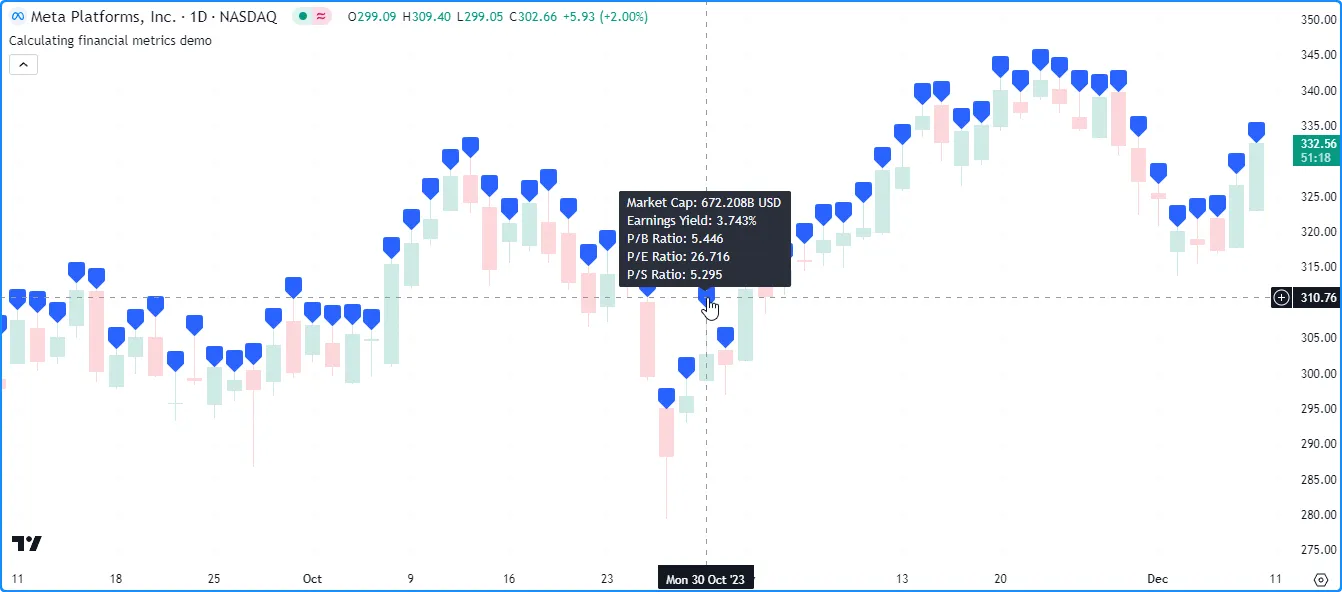

This example uses request.*() calls within a user-defined function to retrieve data for estimating an instrument’s market capitalization (market cap). The user-defined calcMarketCap() function calls request.financial() to retrieve the total shares outstanding for a symbol and request.security()

to retrieve a tuple containing the symbol’s close and syminfo.currency values. We’ve included ignore_invalid_symbol = true in both of these request.*() calls to prevent runtime errors for invalid requests.

The script displays a formatted string representing the symbol’s estimated market cap value and currency in a table on the chart and uses a plot() call to visualize the marketCap history:

Note that:

- The

calcMarketCap()function only returns non-na values on valid instruments with total shares outstanding data, such as the one we selected for this example. It returns na on others that do not have financial data, including forex, crypto, and derivatives. - Not all issuing companies publish quarterly financial reports. If the issuing company of the

symboldoes not report on a quarterly basis, change the “FQ” value in this script to the company’s minimum reporting period. See the request.financial() section for more information. - We included format.volume in the indicator() and str.tostring() calls to specify that the y-axis of the chart pane represents volume-formatted values and the “string” representation of the

marketCapvalue shows as volume-formatted text. - For efficiency, this script creates a table and initializes its cell on the first chart bar, then updates the cell’s text on the last bar. To learn more about working with tables, see the Tables page.

currency

The currency parameter of a request.*() function allows users to specify the currency of the requested data. When this parameter’s value differs from the syminfo.currency of the symbol, the function converts the requested values to express them in the specified currency. This parameter accepts a built-in variable from the currency.* namespace, such as currency.JPY, or a “string” representing a valid currency code (e.g., “JPY”). By default, this parameter accepts a “series” argument that can change across executions. If dynamic requests are disabled, it accepts a value with only a “simple” or weaker qualifier.

The conversion rate between the syminfo.currency of the requested data and the specified currency depends on the previous daily value of the corresponding currency pair from the most popular exchange. If no exchange provides the rate directly, the function derives the rate using a spread symbol.

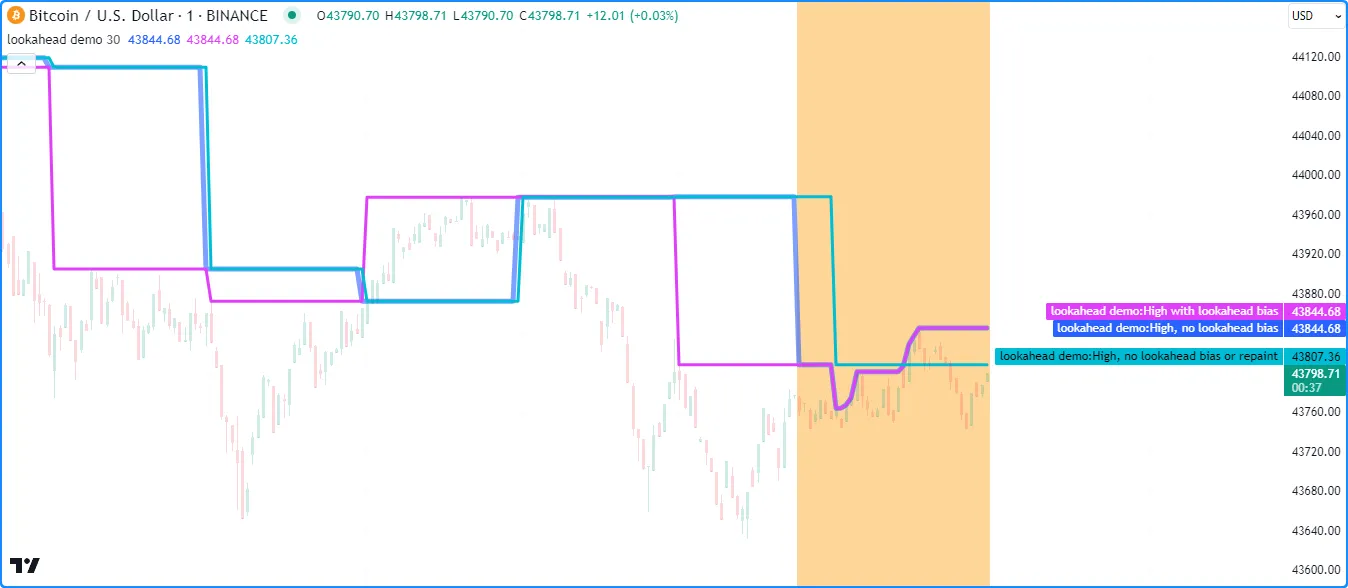

lookahead

The lookahead parameter in request.security(), request.dividends(), request.splits(), and request.earnings() specifies the lookahead behavior of the function call. Its default value is barmerge.lookahead_off.

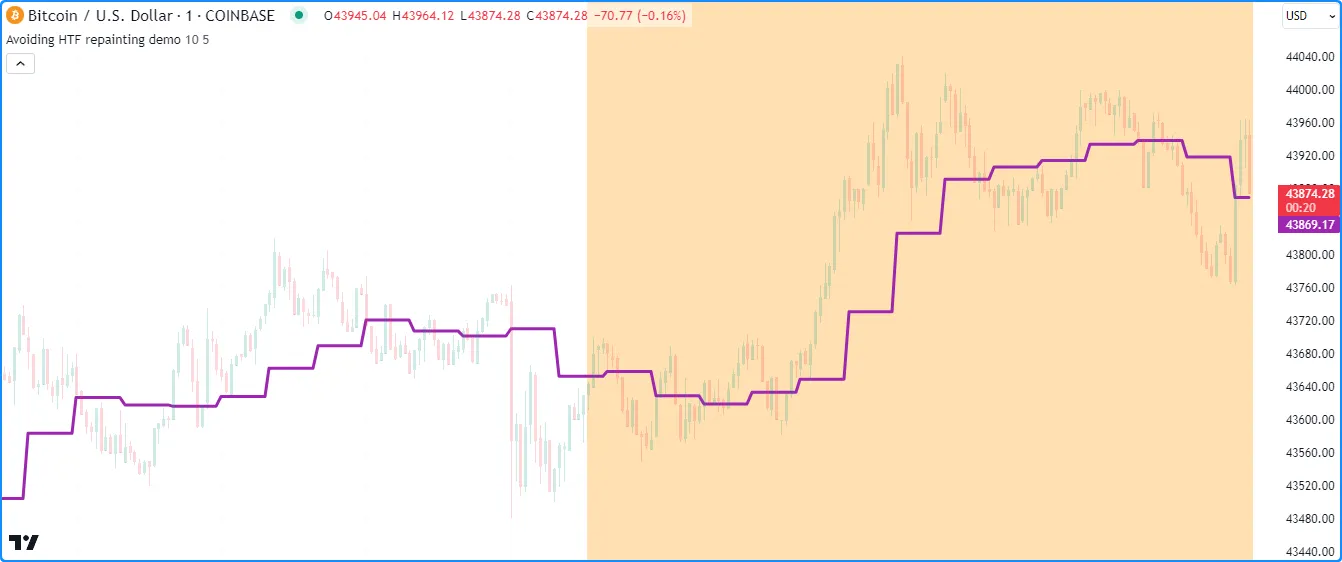

When requesting data from a higher-timeframe (HTF) context, the lookahead value determines whether the request.*() function can return values from times beyond those of the historical bars it executes on. In other words, the lookahead paremeter determines whether the requested data may contain lookahead bias on historical bars.

When requesting data from a lower-timeframe (LTF) context, the lookahead parameter determines whether the function requests values from the first or last intrabar (LTF bar) of each chart-timeframe bar.

Programmers should exercise extreme caution when using lookahead in their requests, namely when requesting data from higher timeframes.

When using barmerge.lookahead_on as the lookahead value, ensure that it does not compromise the integrity of the script’s logic by leaking future data into historical chart bars.

The following scenarios are cases where enabling lookahead is acceptable in a request.*() call:

- The

expressionin request.security() references a series with a historical offset (e.g.,close[1]), which prevents the function from requesting future values that it would not have access to on a realtime basis. - The specified

timeframein the call is the same as the chart the script executes on, i.e., timeframe.period. - The function call requests data from an intrabar timeframe, i.e., a timeframe smaller than the timeframe.period. See this section for more information.

This example demonstrates how the lookahead parameter affects the behavior of higher-timeframe data requests and why enabling lookahead in request.security() without offsetting the expression is misleading. The script calls request.security() to get the HTF high price for the current chart’s symbol in three different ways and plots the resulting series on the chart for comparison.

The first call uses barmerge.lookahead_off (default), and the others use barmerge.lookahead_on. However, the third request.security() call also offsets its expression using the history-referencing operator [] to avoid leaking future data into the past.

As we see on the chart, the plot of the series requested using barmerge.lookahead_on without an offset (fuchsia line) shows final HTF high prices before they are actually available on historical bars, whereas the other two calls do not:

Note that:

- The series requested using barmerge.lookahead_off has a new historical value at the end of each HTF period, and both series requested using barmerge.lookahead_on have new historical data at the start of each period.

- On realtime bars, the plot of the series without lookahead (blue) and the series with lookahead and no historical offset (fuchsia) show the same value (i.e., the HTF period’s unconfirmed high price), as no data exists beyond those points to leak into the past. Both of these plots repaint their results after the user reloads the script, because the elapsed realtime bars from the previous run become historical bars in the new run.

- The series that uses lookahead and a historical offset (aqua) does not repaint its results, because it always uses the last confirmed value from the higher timeframe. See the Avoiding repainting section of this page for more information.

Dynamic requests

By default, unlike all previous Pine Script versions, all v6 script’s request.*() functions are dynamic.

In contrast to non-dynamic requests, dynamic requests can:

- Access data from different data feeds using a single

request.*()instance with “series” arguments. - Execute within the local scopes of conditional structures, loops, and exported functions.

- Execute nested requests.

Aside from the features listed above, there are insignificant differences in the behavior of dynamic and non-dynamic requests. However, for backward compatibility, programmers can deactivate dynamic requests by specifying dynamic_requests = false in the indicator(), strategy(), or library() declaration statement.

”series” arguments

Scripts without dynamic requests enabled cannot use “series” arguments for most request.*() function parameters, which means the argument values cannot change. The only exception is the expression parameter in request.security(), request.security_lower_tf(), and request.seed(), which always allows “series” values.

In contrast, when a script allows dynamic requests, all request.*() function parameters that define parts of the ticker ID or timeframe of a request accept “series” arguments that can change with each script execution. In other words, with dynamic requests, it’s possible for a single request.*() instance to fetch data from different contexts in different executions. Some other optional parameters, such as ignore_invalid_symbol, can also accept “series” arguments, allowing additional flexibility in request.*() call behaviors.

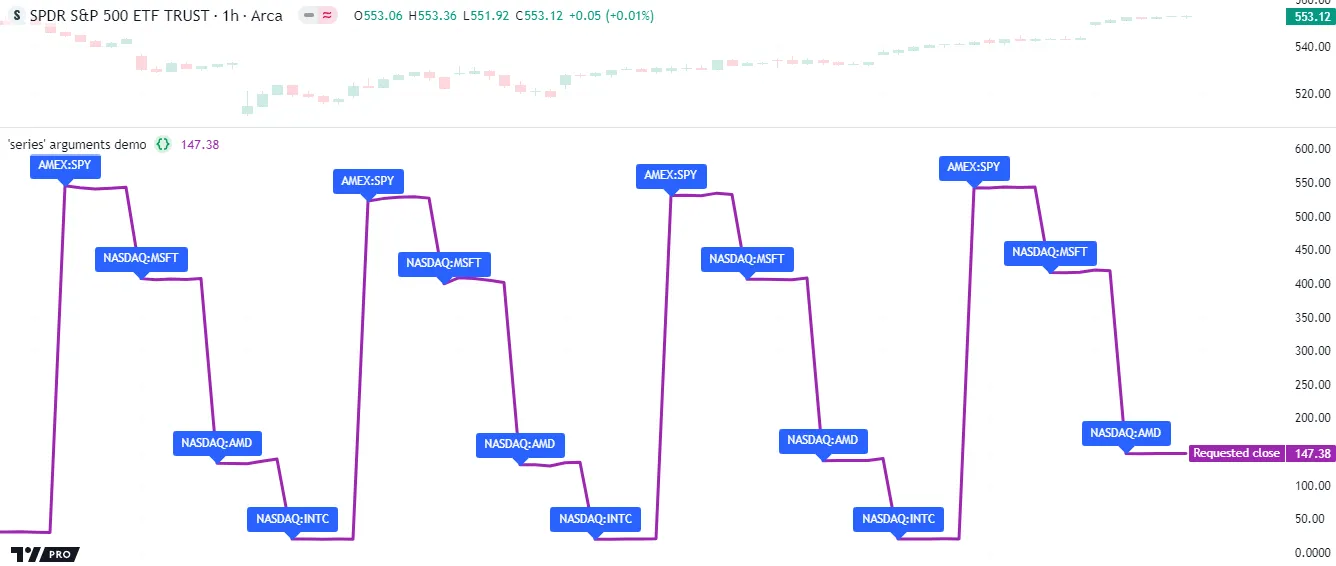

The following script declares a symbolSeries variable that is assigned four different symbol strings in 20-bar cycles, with its value changing after every five bars. The request.security() call uses this variable as the symbol argument. The script plots the requestedClose values, which therefore represent a different symbol’s close prices for each five-bar period.

Note that:

- The script draws a label every time the

symbolSerieschanges, to signify which symbol’s data therequestedClosecurrently represents. - Pine v6 scripts enable dynamic requests by default, allowing this script to use a “series string”

symbolargument in its request.security() call without error. If the dynamic behavior is disabled by includingdynamic_requests = falsein the indicator() declaration, then the “series” argument causes a compilation error.

An important limitation is that when using dynamic request.*() calls with “series” arguments or within local scopes, scripts must request all required datasets while executing on historical bars. All request.*() calls on realtime bars can retrieve data from the datasets that the script previously accessed on historical bars, but they cannot request a new context or evaluate a new expression.

To illustrate this limitation, let’s revisit the above script. Notice that it requests close data for all four symbols on the chart’s timeframe during its historical executions. The external datasets for those four contexts are the only ones that any request.*() call on realtime bars can access.

Below, we changed the timeframe argument in the script’s request.security() call to specify that it requests symbolSeries data from the chart’s timeframe on historical bars and the “240” (240 minutes = 4H) timeframe on realtime bars. This version raises a runtime error on the first realtime tick, if it is run on any timeframe other than the 4H timeframe, because it cannot access the 4H data feeds without requesting them on historical bars first:

In local scopes

When scripts do not allow dynamic requests, all request.*() calls execute once on every bar or realtime tick, which prevents their use within most local scopes. The only exception is for request.*() calls in the scopes of non-exported functions and methods, because the Pine Script compiler extracts such calls into the global scope during translation.

Scripts that allow dynamic requests do not restrict the execution of request.*() calls to the global scope. They can call request.*() functions directly within the scopes of conditional structures and loops, meaning that each request.*() instance in the code can activate zero, one, or several times on each script execution.

The following example uses a single request.security() instance within a loop to request data from multiple forex data feeds. The script declares an array of symbols on the first chart bar, which it iterates through on all bars using a for…in loop. Each loop iteration calls request.security() to retrieve the volume value for one of the symbols and pushes the result into the requestedData array. After the loop terminates, the script calculates the average, maximum, and minimum values from the requestedData array using built-in methods, then plots the results on the chart:

Notice that the expression argument in the above example (volume) is loop-invariant, i.e., it does not change on any loop iteration. When using request.*() calls within a loop, all parameters defining parts of the requested context can accept arguments that depend on variables from the loop’s header or mutable variables that change within the loop’s local scope. However, a request.*() call’s evaluated expression cannot depend on the values of those variables.

Here, we modified the above script to use the second form of the for…in loop statement, which creates a tuple containing the index and value of each element in the symbols array. The request.security() instance in this version uses the index (i) in its expression argument, resulting in a compilation error:

In libraries

Libraries with dynamic requests enabled can export functions and methods that utilize request.*() calls within their local scopes, provided that the evaluated expressions do not depend on any exported function parameters.

For example, this simple library exports an htfPrices() function that requests a tuple of confirmed open, high, low, and close prices using a specified tickerID and timeframe. If we publish this library, another script can import the function to request higher-timeframe prices without explicitly calling request.security().

Note that:

- The tuple that the request.security() call includes as the

expressionargument does not depend on thehtfPrices()parameters. - The

htfPrices()function includes a runtime.error() call that raises a custom runtime error when thetimeframeargument does not represent a higher timeframe than the chart’s timeframe. See the higher timeframes section for more information. - The request.security() call uses barmerge.lookahead_on and offsets each item in the tuple by one bar. This is the only recommended method to avoid repainting.

Nested requests

Scripts can use dynamic requests to execute nested requests, i.e., request.*() calls that dynamically evaluate other request.*() calls that their expression arguments depend on.

When a request.security() or request.security_lower_tf() call uses an empty string or syminfo.tickerid for its symbol argument, or if it uses an empty string or timeframe.period for the timeframe argument, the requested ticker ID or timeframe depends on the context where the call executes. This context is normally the ticker ID or timeframe of the chart that the script is running on. However, if such a request.security() or request.security_lower_tf() function call is evaluated by another request.*() call, the nested request inherits that request.*() call’s ticker ID or timeframe information.

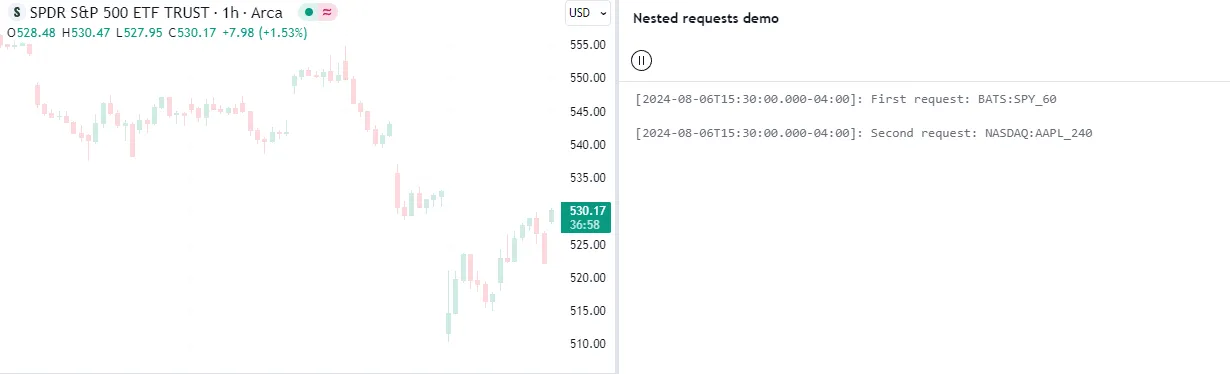

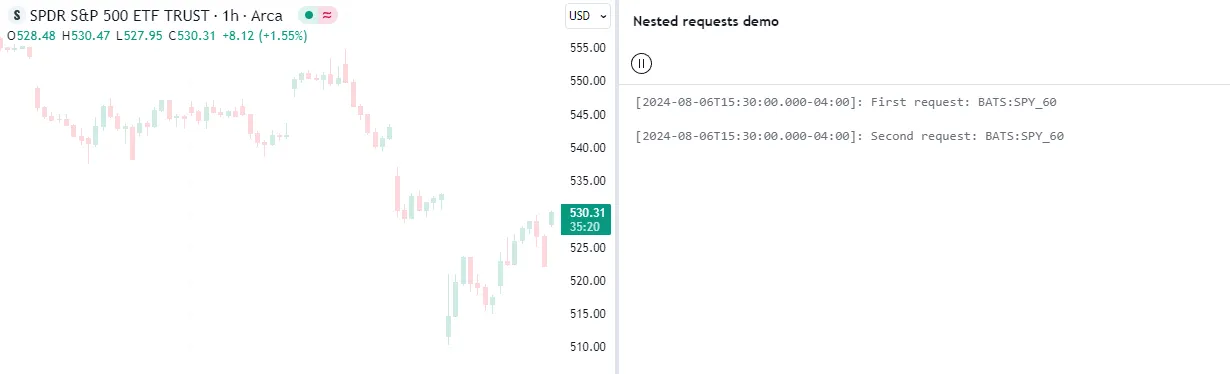

For example, the script below contains two request.security() calls and uses Pine Logs to display their results. The first call uses empty strings as its symbol and timeframe arguments, meaning that the requested context depends on where the call executes. It evaluates a concatenated string containing the call’s requested ticker ID and timeframe, and the script assigns its result to the info1 variable.

The second call requests data for a specific symbol and timeframe using the info1 variable as its expression argument. Since the info1 variable depends on the first request.security() call, the second call evaluates the first call within its own context. Therefore, the first call adopts the second call’s ticker ID and timeframe while executing within that context, resulting in a different returned value:

This script allows the execution of the first request.security() call within the context of the second call because Pine v6 scripts enable dynamic request.*() calls by default. We can disable this behavior by including dynamic_requests = false in the indicator() declaration statement. Without dynamic requests enabled, the script evaluates each call independently, passing the first call’s calculated value directly into the second call rather than executing the first call within the second context. Consequently, the second call’s returned value is the same as the first call’s value, as we see below:

Data feeds

TradingView’s data providers supply different data feeds that scripts can access to retrieve information about an instrument, including:

- Intraday historical data (for timeframes < 1D)

- End-of-day (EOD) historical data (for timeframes >= 1D)

- Realtime data (which may be delayed, depending on your account type and extra data services)

- Extended hours data

Not all of these data feed types exist for every instrument. For example, the symbol “BNC:BLX” only has EOD data available.

For some instruments with intraday and EOD historical feeds, volume data may not be the same since some trades (block trades, OTC trades, etc.) may only be available at the end of the trading day. Consequently, the EOD feed will include this volume data, but the intraday feed will not. Differences between EOD and intraday volume feeds are almost nonexistent for instruments such as cryptocurrencies, but they are commonplace in stocks.

Slight price discrepancies may also occur between EOD and intraday feeds. For example, the high value on one EOD bar may not match any intraday high values supplied by the data provider for that day.

Another distinction between EOD and intraday data feeds is that EOD feeds do not contain information from extended hours.

When retrieving information on realtime bars with request.*()

functions, it’s important to note that historical and realtime data

reported for an instrument often rely on different data feeds. A

broker/exchange may retroactively modify values reported on realtime

bars, which the data will only reflect after refreshing the chart or

restarting the script.

Another important consideration is that the chart’s data feeds and feeds requested from providers by the script are managed by independent, concurrent processes. Consequently, in some rare cases, it’s possible for races to occur where requested results temporarily fall out of synch with the chart on a realtime bar, which a script retroactively adjusts after restarting its executions.

These points may account for variations in the values retrieved by

request.*() functions when requesting data from other contexts. They

may also result in discrepancies between data received on realtime bars

and historical bars. There are no steadfast rules about the variations

one may encounter in their requested data feeds.

When using data feeds requested from other contexts, it’s also crucial

to consider the time axis differences between the chart the script

executes on and the requested feeds since request.*() functions adapt

the returned series to the chart’s time axis. For example, requesting

“BTCUSD” data on the “SPY” chart with

request.security()

will only show new values when the “SPY” chart has new data as well.

Since “SPY” is not a 24-hour symbol, the “BTCUSD” data returned will

contain gaps that are otherwise not present when viewing its chart

directly.

request.security()

The request.security() function allows scripts to request data from other contexts than the chart the script executes on, such as:

- Other symbols, including spread symbols

- Other timeframes (see our User Manual’s page on Timeframes to learn about timeframe specifications in Pine Script)

- Custom contexts, including alternative sessions, price adjustments,

chart types, etc. using

ticker.*()functions

This is the function’s signature:

request.security(symbol, timeframe, expression, gaps, lookahead, ignore_invalid_symbol, currency, calc_bars_count) → series <type>The symbol value is the ticker identifier representing the symbol to

fetch data from. This parameter accepts values in any of the following

formats:

- A “string” representing a symbol (e.g., “IBM” or “EURUSD”) or an “Exchange:Symbol” pair (e.g., “NYSE:IBM” or “OANDA:EURUSD”). When the value does not contain an exchange prefix, the function selects the exchange automatically. We recommend specifying the exchange prefix when possible for consistent results. Users can also pass an empty string to this parameter, which prompts the function to use the current chart’s symbol.

- A “string” representing a spread symbol (e.g., “AMD/INTC”). Note that “Bar Replay” mode does not work with these symbols.

- The

syminfo.ticker

or

syminfo.tickerid

built-in variables, which return the symbol or the

“Exchange:Symbol” pair that the current chart references. We

recommend using

syminfo.tickerid

to avoid ambiguity unless the exchange information does not matter

in the data request. For more information on

syminfo.*variables, see this section of our Chart information page. - A custom ticker identifier created using

ticker.*()functions. Ticker IDs constructed from these functions may contain additional settings for requesting data using non-standard chart calculations, alternative sessions, and other contexts. See the Custom contexts section for more information.

The timeframe value specifies the timeframe of the requested data.

This parameter accepts “string” values in our

timeframe specification format (e.g., a value of “1D” represents the daily

timeframe). To request data from the same timeframe as the chart the

script executes on, use the

timeframe.period

variable or an empty string.

The expression parameter of the

request.security()

function determines the data it retrieves from the specified context.

This versatile parameter accepts “series” values of

int,

float,

bool,

color,

string,

and chart.point types. It can also accept

tuples,

collections,

user-defined types, and the outputs of function and

method calls. For more

details on the data one can retrieve, see the

Requestable data section below.

Timeframes

The

request.security()

function can request data from any available timeframe, regardless of

the chart the script executes on. The timeframe of the data retrieved

depends on the timeframe argument in the function call, which may

represent a higher timeframe (e.g., using “1D” as the timeframe

value while running the script on an intraday chart) or the chart’s

timeframe (i.e., using

timeframe.period

or an empty string as the timeframe argument).

Scripts can also request limited data from lower timeframes with

request.security()

(e.g., using “1” as the timeframe argument while running the script

on a 60-minute chart). However, we don’t typically recommend using this

function for LTF data requests. The

request.security_lower_tf()

function is more optimal for such cases.

Higher timeframes

Most use cases of

request.security()

involve requesting data from a timeframe higher than or the same as the

chart timeframe. For example, this script retrieves the

hl2

price from a requested higherTimeframe. It

plots the resulting series

on the chart alongside the current chart’s

hl2 for

comparison:

Note that:

- We’ve included an offset to the

expressionargument and used barmerge.lookahead_on in request.security() to ensure the series returned behaves the same on historical and realtime bars. See the Avoiding repainting section for more information.

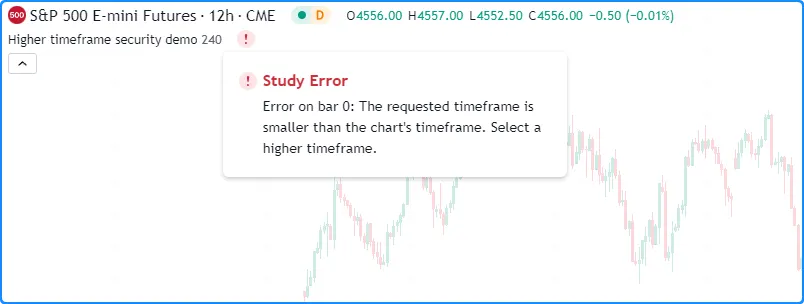

Notice that in the above example, it is possible to select a

higherTimeframe value that actually represents a lower timeframe

than the one the chart uses, as the code does not prevent it. When

designing a script to work specifically with higher timeframes, we

recommend including conditions to prevent it from accessing lower

timeframes, especially if you intend to

publish it.

Below, we’ve added an if structure to our previous example. If the higherTimeframe value represents a timeframe that is smaller than the chart’s timeframe, the script calls runtime.error() within the structure’s local block to raise a custom runtime error, effectively preventing the script from requesting LTF data:

Lower timeframes

Although the

request.security()

function is intended to operate on timeframes greater than or equal to

the chart timeframe, it can request data from lower timeframes as

well, with limitations. When calling this function to access a lower

timeframe, it will evaluate the expression from the LTF context.

However, it can only return the results from a single intrabar (LTF

bar) on each chart bar.

The intrabar that the function returns data from on each historical

chart bar depends on the lookahead value in the function call. When

using

barmerge.lookahead_on,

it will return the first available intrabar from the chart period.

When using

barmerge.lookahead_off,

it will return the last intrabar from the chart period. On realtime

bars, it returns the last available value of the expression from the

timeframe, regardless of the lookahead value, as the realtime intrabar

information retrieved by the function is not yet sorted.

This script retrieves

close

data from the valid timeframe closest to a fourth of the size of the

chart timeframe. It makes two calls to

request.security()

with different lookahead values. The first call uses

barmerge.lookahead_on

to access the first intrabar value in each chart bar. The second uses

the default lookahead value

(barmerge.lookahead_off),

which requests the last intrabar value assigned to each chart bar. The

script plots the outputs of

both calls on the chart to compare the difference:

Note that:

- The script determines the value of the

lowerTimeframeby calculating the number of seconds in the chart timeframe with timeframe.in_seconds(), then dividing by four and converting the result to a valid timeframe string via timeframe.from_seconds(). - The plot of the series without lookahead (purple) aligns with the close value on the chart timeframe, as this is the last intrabar value in the chart bar.

- Both request.security() calls return the same value (the current close) on each realtime bar, as shown on the bars with the orange background.

- Scripts can retrieve up to 200,000 intrabars from a lower-timeframe context. The number of chart bars with available intrabar data varies with the requested lower timeframe, the

calc_bars_countvalue, and the user’s plan. For more information, see this section of the Limitations page.

Requestable data

The

request.security()

function is quite versatile, as it can retrieve values of any

fundamental type (int, float, bool, color, or string). It can also request the IDs of data structures and

built-in or

user-defined types that reference fundamental types. The data this function

requests depends on its expression parameter, which accepts any of the

following arguments:

- Built-in variables and function calls

- Variables declared by the script

- Tuples

- Calls to user-defined functions

- Chart points

- Collections

- User-defined types

Built-in variables and functions

A frequent use case of request.security() is requesting the output of a built-in variable or function/method call from another symbol or timeframe.

For example, suppose we want to calculate the 20-bar SMA of a symbol’s ohlc4 prices from the daily timeframe while on an intraday chart. We can accomplish this task with a single line of code:

The above line calculates the value of ta.sma(ohlc4, 20) on the current symbol’s data from the daily timeframe.

It’s important to note that newcomers to Pine might sometimes confuse the above line of code as being equivalent to the following:

However, this line returns an entirely different result. Rather than requesting a 20-bar SMA from the daily timeframe, it requests the ohlc4 price from the daily timeframe and calclates the ta.sma() of the results over 20 chart bars.

In essence, when the intention is to request the results of an

expression from other contexts, pass the expression directly to the

expression parameter in the

request.security()

call, as demonstrated in the initial example.

Let’s expand on this concept. The script below calculates a multi-timeframe (MTF) ribbon of moving averages, where each moving average in the ribbon calculates over the same number of bars on its respective timeframe. Each request.security() call uses a ta.sma() call as its expression argument to return a length-bar SMA from the specified timeframe:

Note that:

- The script calculates the ribbon’s higher timeframes by multiplying the chart’s timeframe.in_seconds() value by 2, 3, and 4, then converting each result into a valid timeframe string using timeframe.from_seconds().

- Instead of calling

ta.sma()

within each

request.security()

call, one could use the

chartAvgvariable as theexpressionin each call to achieve the same result. See the next section for more information. - On realtime bars, this script also tracks unconfirmed SMA values from each higher timeframe. See the Historical and realtime behavior section to learn more.

Declared variables

The request.security() function’s expression parameter can accept declared variables that are accessible to the scope from which the function call executes. When using a declared variable as the expression argument, the function call duplicates all preceding code that determines the assigned value or reference. This duplication allows the function to evaluate necessary calculations and logic in the requested context without affecting the original variable.

For instance, this line of code declares a priceReturn variable that holds the current bar’s arithmetic price return:

We can evaluate the priceReturn variable’s calculations in another context by using it as the expression in a request.security() call. The call below duplicates the variable’s calculation and evaluates it across the data from another symbol, returning a separate series adapted to the chart’s time axis:

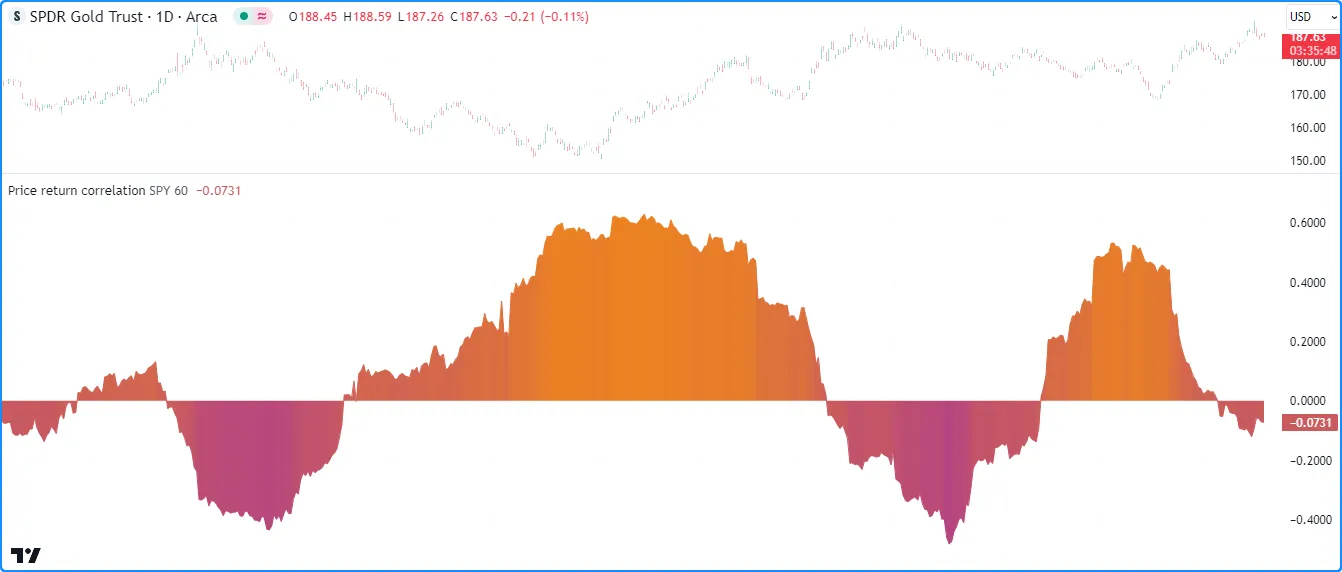

This example script compares the price returns of the current chart’s symbol and a user-specified symbol. It calculates the value of the priceReturn variable, then uses that variable as the expression in a request.security() call to evaluate the calculation on the input symbol’s data. After the request, the script calculates the correlation between the priceReturn and requestedReturn series using ta.correlation() and plots the result on the chart:

Note that:

- The request.security() call executes the same calculation used in the

priceReturndeclaration, but the request’s calculation operates on the close values from the specified symbol’s data. - The script uses the color.from_gradient() function to calculate the color for the plot of the

correlationseries on each bar. See this section of the Colors page to learn more about color gradients.

When using a variable as the expression argument of a request.*() call, it’s important to note that the function only duplicates code that affects the variable before the call. It cannot copy any subsequent code following the call. Consequently, if the script reassigns the variable or modifies its referenced data after calling request.security(), the code evaluated on the requested data does not include those additional operations.

For example, the following script declares a counter variable and calls request.security() to evaluate the variable from the same context as the chart. After the call, the script increments the counter value by one with the addition assignment operator (+=), then uses plots and Pine Logs to display the counter and requestedCounter values for comparison.

As shown below, the plots and logs of the two variables display different values. The requestedCounter variable has a consistent value of 0 because the request.security() call evaluates only the initial variable declaration. The request cannot evaluate the addition assignment operation because the script includes that code after the function call:

Tuples

Tuples in Pine Script are comma-separated sets of expressions enclosed in brackets that can hold multiple values of any available type. We use tuples when creating functions or other local blocks that return more than one value.

The

request.security()

function can accept a tuple as its expression argument, allowing

scripts to request multiple series of different types using a single

function call. The expressions within requested tuples can be of any

type outlined throughout the

Requestable data section of this page, excluding other tuples.

Tuples are particularly handy when a script needs to retrieve more than one value from a specific context.

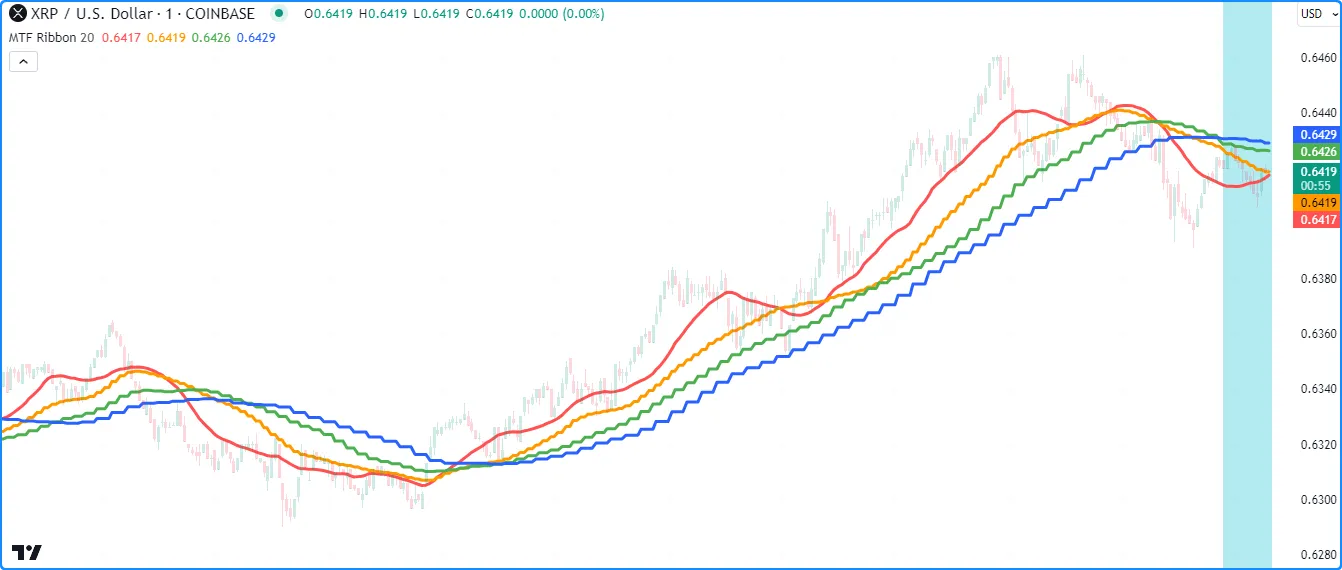

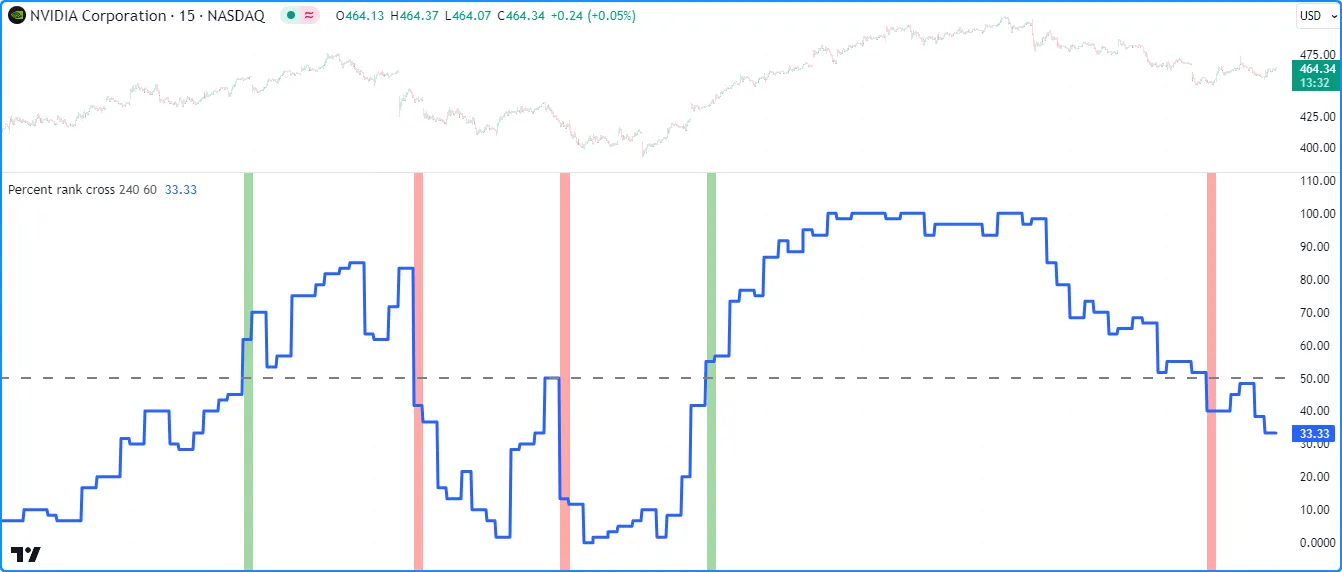

For example, the following script calculates the percent rank of the close series over length bars and assigns the result to the rank variable. It then calls request.security() to request a tuple containing the values of rank, ta.crossover(rank, 50), and ta.crossunder(rank, 50) from the specified timeframe. The script plots the requestedRank series in a separate pane, then uses the result of a ternary expression based on the crossOver and crossUnder values within a bgcolor() call to conditionally highlight the pane’s background:

Note that:

- We’ve offset the

rankvariable’s expression by one bar using the history-referencing operator [] and included barmerge.lookahead_on in the request.security() call to ensure the values on realtime bars do not repaint after becoming historical bars. See the Avoiding repainting section for more information. - The

request.security()

call returns a tuple, so we use a tuple declaration to declare

the

requestedRank,crossOver, andcrossUndervariables. To learn more about using tuples, see this section of our User Manual’s Type system page.

User-defined functions

User-defined functions and

methods

are custom functions written by users. They allow users to define

sequences of operations associated with an identifier that scripts can

conveniently call throughout their executions (e.g., myUDF()).

The request.security() function can request the results of user-defined functions and methods whose scopes consist of any types outlined throughout this page’s Requestable data section.

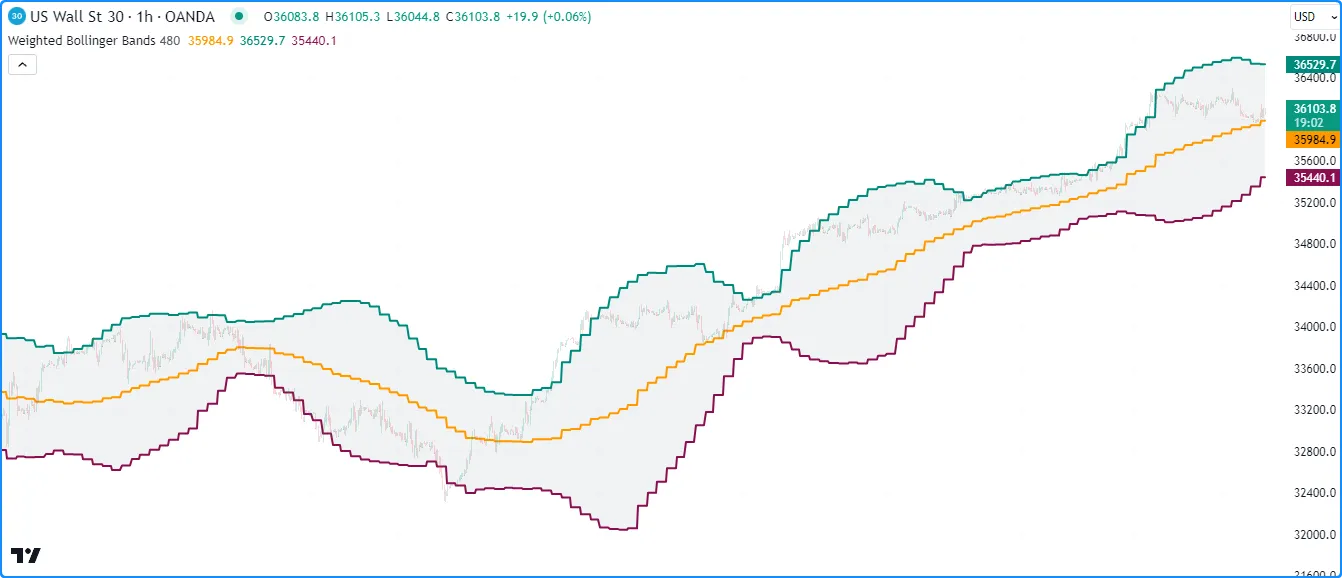

For example, this script contains a user-defined weightedBB() function

that calculates Bollinger Bands with the basis average weighted by a

specified weight series. The function returns a

tuple of custom

band values. The script calls the weightedBB() as the expression

argument in

request.security()

to retrieve a

tuple of band values calculated on the specified timeframe and

plots the results on the

chart:

Note that:

- We offset the

sourceandweightarguments in theweightedBB()call used as theexpressionin request.security() and used barmerge.lookahead_on to ensure the requested results reflect the last confirmed values from thetimeframeon realtime bars. See this section to learn more.

Chart points

Chart points are reference types that represent coordinates on the chart. Lines, boxes, polylines, and labels use chart.point objects to set their display locations.

The

request.security()

function can use the ID of a

chart.point

instance in its expression argument, allowing scripts to retrieve

chart coordinates from other contexts.

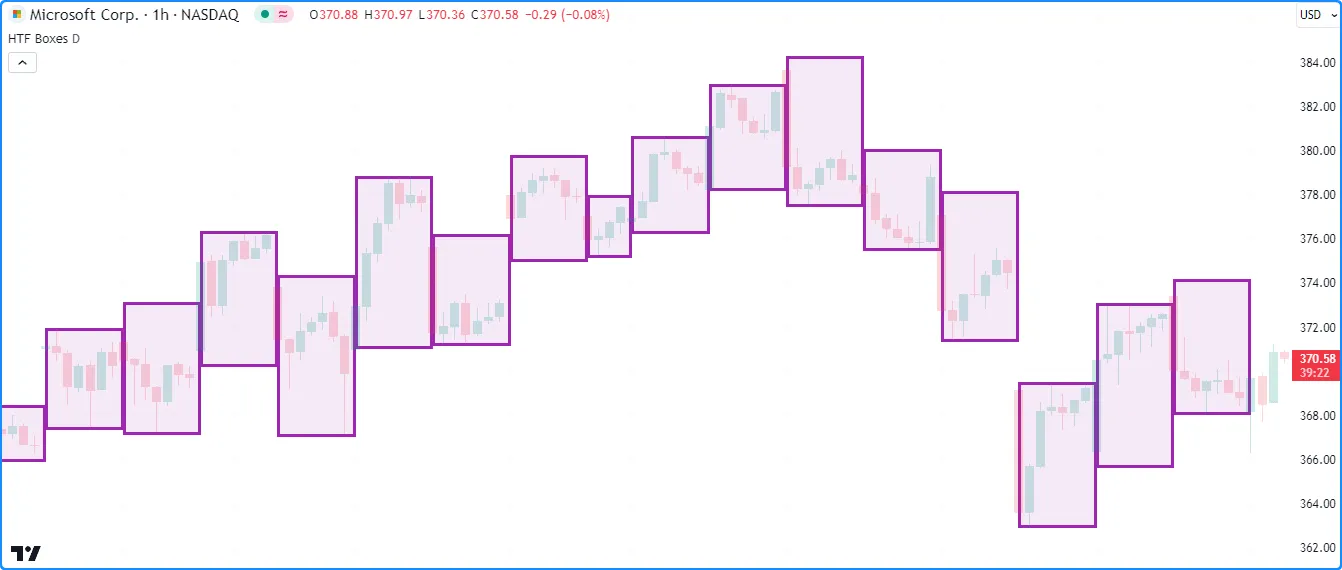

The example below requests a tuple of historical

chart points from a higher timeframe and uses them to draw

boxes on the

chart. The script declares the topLeft and bottomRight variables

that reference

chart.point

IDs from the last confirmed bar. It then uses

request.security()

to request a

tuple containing the IDs of

chart points representing the topLeft and bottomRight from a

higherTimeframe.

When a new bar starts on the higherTimeframe, the script draws a new box using the time and price coordinates from the requestedTopLeft and requestedBottomRight chart points:

Note that:

- Because we designed this example to request data from higher timeframes, we’ve included a runtime.error() call that the script executes if the

higherTimeframevalue represents a lower timeframe than timeframe.period.

Collections

Pine Script collections (arrays, matrices, and maps) are data structures that contain an arbitrary number of elements with specified types. The request.security() function can retrieve the IDs of collections whose elements consist of:

- Fundamental types

- Chart points

- User-defined types that satisfy the criteria listed in the section below

This example below calculates the ratio of a confirmed bar’s high-low range to the range between the highest and lowest prices over 10 bars from a from a specified symbol and timeframe. It uses maps to hold the values used in the calculations.

The script uses a data map with “string” keys and “float” values to store the current bar’s high, low, ta.highest(), and ta.lowest() results. It passes the map as the expression argument in a request.security() call on each bar to retrieve another map containing the values calculated from the specified context, then assigns that map’s reference to the otherData variable. The script uses the “float” values associated with the “High”, “Low”, “Highest”, and “Lowest” keys of the otherData map to calculate the ratio series that it plots in the chart pane:

Note that:

- The

request.security()

call in this script can return

na

if no data is available from the specified context. Since one

cannot call methods on a

map

variable when its value is

na,

we’ve added an

if

structure to only calculate a new

ratiovalue whenotherDatareferences a valid map instance.

User-defined types

User-defined types (UDTs) are composite types containing an arbitrary number of fields, which can be of any available type, including other user-defined types.

The request.security() function can retrieve the IDs of objects produced by UDTs from other contexts if their fields consist of:

- Fundamental types

- Chart points

- Collections that satisfy the criteria listed in the section above

- Other UDTs whose fields consist of any of these types

The following example requests an

object ID using a

specified symbol and displays its field values on a chart pane.

The script contains a TickerInfo UDT with “string” fields for

syminfo.* values, an

array

field to store recent “float” price data, and an “int” field to hold

the requested ticker’s

bar_index

value. It assigns a new TickerInfo ID to an info variable on every

bar and uses the variable as the expression in

request.security()

to retrieve the ID of an object representing the calculated info from the specified

symbol.

The script displays the requestedInfo object’s description,

tickerType, currency, and barIndex values in a

label

and uses

plotcandle()

to display the values from its prices array:

Note that:

- The

syminfo.*variables used in this script all return “simple string” qualified types. However, objects in Pine are always qualified as “series”. Consequently, all values assigned to theinfoobject’s fields automatically adopt the “series” qualifier. - It is possible for the

request.security()

call to return

na

due to differences between the data requested from the

symboland the main chart. This script assigns a newTickerInfoobject to therequestedInfoin that case to prevent runtime errors.

request.security_lower_tf()

The request.security_lower_tf() function is an alternative to request.security() designed for reliably requesting information from lower-timeframe (LTF) contexts.

While request.security() can retrieve data from a single intrabar (LTF bar) in each chart bar, request.security_lower_tf() retrieves data from all available intrabars in each chart bar, which the script can access and use in additional calculations. Each request.security_lower_tf() call can retrieve up to 200,000 intrabars from a lower timeframe, depending on the user’s plan. See this section of our Limitations page for more information.

Below is the function’s signature, which is similar to the signature of request.security():

request.security_lower_tf(symbol, timeframe, expression, ignore_invalid_symbol, currency, ignore_invalid_timeframe, calc_bars_count) → array<type>This function requests data only from timeframes that are lower than or equal to the chart’s timeframe (timeframe.period). If the timeframe argument of the request.security_lower_tf() call represents a higher timeframe, the function raises a runtime error or returns na results, depending on the ignore_invalid_timeframe parameter. The parameter’s default value is false, meaning the function raises an error and halts the script’s executions if the timeframe argument is invalid.

Requesting intrabar data

Intrabar data can provide a script with additional information that may not be obvious or accessible from solely analyzing data sampled on the chart’s timerframe. The request.security_lower_tf() function can retrieve many data types from an intrabar context.

Before you venture further in this section, we recommend exploring the

Requestable data portion of the

request.security() section above, which provides foundational information about

the types of data one can request. The expression parameter in

request.security_lower_tf()

accepts most of the same arguments discussed in that section, excluding

direct references to

collections and mutable variables.

Although it accepts many of the same types of arguments, this function

returns

array

results, which comes with some differences in interpretation and

handling, as explained below.

Intrabar data arrays

Lower timeframes contain more data points than higher timeframes, as new values come in at a higher frequency. For example, when comparing a 1-minute chart to an hourly chart, the 1-minute chart will have up to 60 times the number of bars per hour, depending on the available data.

To address the fact that multiple intrabars exist within a chart bar,

request.security_lower_tf()

always returns its results as arrays. The elements in the returned

arrays represent the

expression values retrieved from the lower timeframe sorted in

ascending order based on each intrabar’s timestamp.

The type template assigned to the returned

arrays corresponds to the

data types passed in the

request.security_lower_tf()

call. For example, using an “int” as the expression will produce an

array<int> instance, a “bool” as the expression will produce an

array<bool> instance, etc.

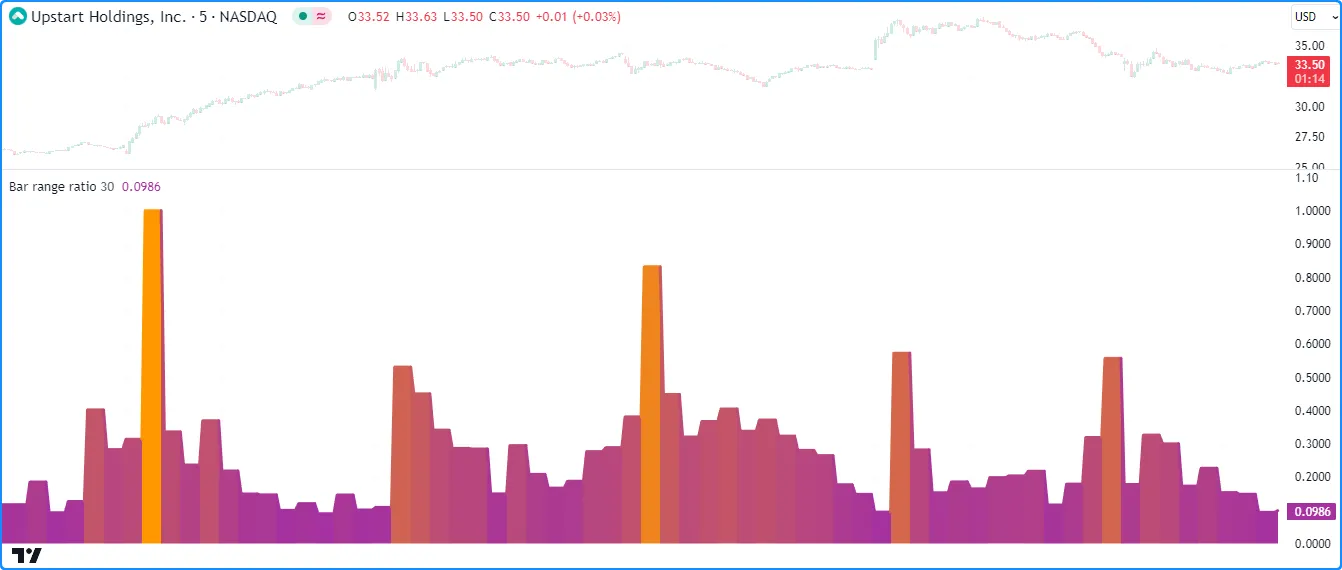

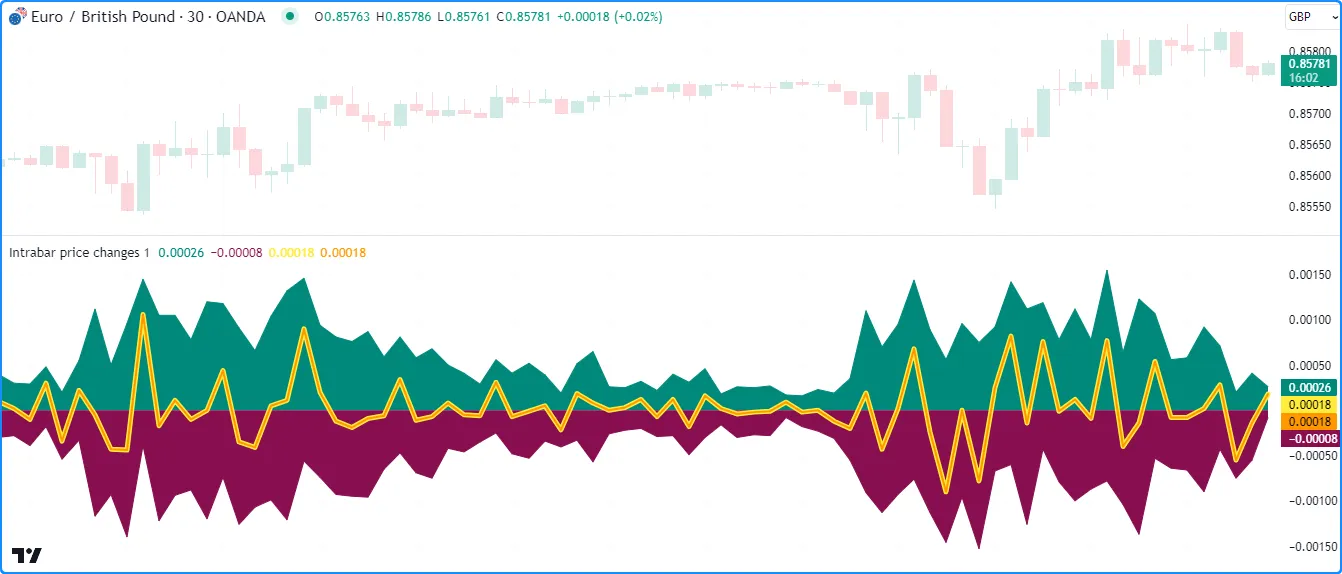

The following script uses intrabar information to decompose the chart’s close-to-close price changes into positive and negative parts. It calls request.security_lower_tf() to fetch a “float” array containing ta.change(close) values from a specified lower timeframe on each chart bar, then accesses all the array’s elements using a for…in loop to accumulate positiveChange and negativeChange sums. The script adds the accumulated values to calculate the netChange value, then plots the results on the chart alongside the priceChange value for comparison:

Note that:

- The plots based on intrabar data may not appear on all available chart bars, as request.security_lower_tf() can only access up to the most recent 200,000 intrabars available from the requested context. When executing this function on a chart bar that doesn’t have accessible intrabar data, it will return an empty array.

- The number of intrabars per chart bar may vary depending on the data available from the context and the chart the script executes on. For example, a provider’s 1-minute data feed may not include data for every minute within the 60-minute timeframe due to a lack of trading activity over some 1-minute intervals. To check the number of intrabars retrieved for a chart bar, one can use array.size() on the resulting array.

- If the

lowerTimeframevalue is greater than the chart’s timeframe, the script will raise a runtime error, as we have not supplied anignore_invalid_timeframeargument in the request.security_lower_tf() call.

Tuples of intrabar data

When passing a tuple or a function call that returns a tuple as the

expression argument in

request.security_lower_tf(),

the result is a tuple of arrays with

type templates corresponding to the types within the argument. For example,

using a [float, string, color] tuple as the expression will result

in [array<float>, array<string>, array<color>] data returned by the

function. Using a tuple expression allows a script to fetch several

arrays of intrabar data

with a single

request.security_lower_tf()

function call.

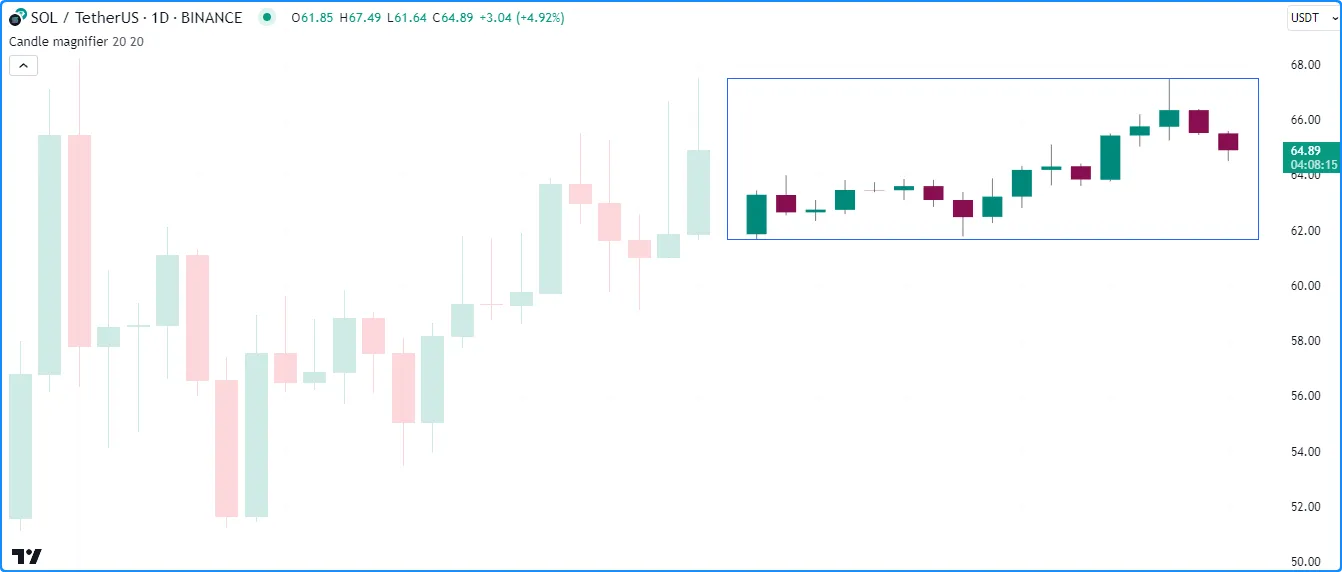

The following example requests OHLC data from a lower timeframe and

visualizes the current bar’s intrabars on the chart using

lines and boxes. The

script calls

request.security_lower_tf()

with the [open, high, low, close] tuple as its expression to

retrieve a tuple of arrays

representing OHLC information from a calculated lowerTimeframe. It

then uses a

for loop

to set line coordinates with the retrieved data and current bar indices

to display the results next to the current chart bar, providing a

“magnified view” of the price movement within the latest candle. It

also draws a

box

around the lines to indicate the chart region occupied by intrabar drawings:

Note that:

- The script draws each candle using two

lines:

one to represent wicks and the other to represent the body.

Since the script can display up to 500 lines on the chart,

we’ve limited the

maxIntrabarsinput to 250. - The

lowerTimeframevalue is the result of calculating the math.ceil() of the timeframe.in_seconds() divided by themaxIntrabarsand converting to a valid timeframe string with timeframe.from_seconds(). - The script sets the top of the box drawing using the

array.max()

of the requested

hDataarray, and it sets the box’s bottom using the array.min() of the requestedlDataarray. As we see on the chart, these values correspond to the high and low of the chart bar.

Requesting collections

In some cases, a script might need to request

collections from an intrabar context. However, in contrast to

request.security(),

scripts cannot use collection references or calls to functions that return them as the expression

argument in a

request.security_lower_tf()

call, because arrays cannot

directly store references to other

collections.

Despite these limitations, it is possible to request collections from lower timeframes, if needed, with the help of wrapper types.

To make collections requestable with request.security_lower_tf(), we must create a UDT with a field to reference a collection ID. This step is necessary since arrays cannot reference other collections directly but can reference UDTs with collection fields:

With our Wrapper UDT defined, we can now pass the IDs of

objects of the UDT to the

expression parameter in

request.security_lower_tf().

A straightforward approach is to use a call to the type’s built-in *.new() function as

the expression argument. For example, this line of code uses a call to Wrapper.new() with array.from(close) as the collection argument directly within the request.security_lower_tf() call:

Alternatively, we can create a

user-defined function or

method

that returns an object of

the UDT and call that function within

request.security_lower_tf().

For instance, this code calls a custom newWrapper() function that

returns a Wrapper ID as the expression argument:

The result with either of the above is an

array

containing Wrapper IDs from all available intrabars in the chart bar,

which the script can use to reference Wrapper instances from specific

intrabars and use their collection fields in additional operations.

The script below utilizes this approach to collect

arrays of intrabar data

from a lowerTimeframe and uses them to display data from a specific

intrabar. Its custom Prices type contains a single data field to

reference array<float> instances that hold price data, and the

user-defined newPrices() function returns the ID of a Prices object.

The script calls

request.security_lower_tf()

with a newPrices() call as its expression argument to retrieve an

array

of Prices IDs from each intrabar in the chart bar, then uses

array.get()

to get the ID from a specified available intrabar, if it exists. Lastly,

it uses

array.get()

on the data array assigned to that instance and calls

plotcandle()

to display its values on the chart:

Note that:

- The

intrabarPricesvariable references aPricesobject only if the size of therequestedPricesarray is greater than theintrabarIndex, because attempting to use array.get() to retrieve an element that doesn’t exist causes an out of bounds error. - The

intrabarDatavariable references an array from theintrabarPrices.datafield only if theintrabarPricesvariable references aPricesobject. IfintrabarPricesholds na because intrabar data is not available for a bar, theintrabarDatavariable references an array of na values. - The process used in this example is not necessary to achieve the intended result. Instead of using UDTs, we can use the tuple

[open, high, low, close]as theexpressionargument in the request to retrieve a tuple of arrays for further operations. See the Tuples of intrabar data section above for more information.

Custom contexts

Pine Script includes multiple ticker.*() functions that allow scripts

to construct custom ticker IDs that specify additional settings for

data requests when used as a symbol argument in

request.security()

and

request.security_lower_tf():

- ticker.new()

constructs a custom ticker ID from a specified

prefixandtickerwith additionalsessionandadjustmentsettings. - ticker.modify()

constructs a modified form of a specified

tickeridwith additionalsessionandadjustmentsettings. - ticker.heikinashi(),

ticker.renko(),

ticker.pointfigure(),

ticker.kagi(),

and

ticker.linebreak()

construct a modified form a

symbolwith non-standard chart settings. - ticker.inherit()

constructs a new ticker ID for a

symbolwith additional parameters inherited from thefrom_tickeridspecified in the function call, allowing scripts to request thesymboldata with the same modifiers as thefrom_tickerid, including session, dividend adjustment, currency conversion, non-standard chart type, back-adjustment, settlement-as-close, etc. - ticker.standard()

constructs a standard ticker ID representing the

symbolwithout additional modifiers.

Let’s explore some practical examples of applying ticker.*()

functions to request data from custom contexts.

Suppose we want to include dividend adjustment in a stock symbol’s

prices without enabling the “Adjust data for dividends” option in the

“Symbol” section of the chart’s settings. We can achieve this in a

script by constructing a custom ticker ID for the instrument using

ticker.new()

or

ticker.modify()

with an adjustment value of

adjustment.dividends.

This script creates an adjustedTickerID using

ticker.modify(),

uses that ticker ID as the symbol in

request.security()

to retrieve a

tuple of adjusted price values, then uses plotcandle() to plot the result as candles on the chart. It also highlights the background of bars where the requested prices differ from the prices without dividend adjustment.

As we see on the “NYSE:XOM” chart below, enabling dividend adjustment results in different historical values before the date of the latest dividend:

Note that:

- If a modifier included in a constructed ticker ID does not apply to the symbol, the script will ignore that modifier when requesting data. For instance, this script will display the same values as the main chart on forex symbols such as “EURUSD”.

While the example above demonstrates a simple way to modify the chart’s

symbol, a more frequent use case for ticker.*() functions is applying

custom modifiers to another symbol while requesting data. If a ticker ID

referenced in a script already has the modifiers one would like to apply

(e.g., adjustment settings, session type, etc.), they can use

ticker.inherit()

to quickly and efficiently add those modifiers to another symbol.

In the example below, we’ve edited the previous script to request data

for a symbolInput using modifiers inherited from the

adjustedTickerID. This script calls

ticker.inherit()

to construct an inheritedTickerID and uses that ticker ID in a

request.security()

call. It also requests data for the symbolInput without additional

modifiers and plots candles

for both ticker IDs in a separate chart pane to compare the difference.

As shown on the chart, the data requested using the inheritedTickerID

includes dividend adjustment, whereas the data requested using the

symbolInput directly does not:

Note that:

- Since the

adjustedTickerIDrepresents a modified form of the syminfo.tickerid, if we modify the chart’s context in other ways, such as changing the chart type or enabling extended trading hours in the chart’s settings, those modifiers will also apply to theadjustedTickerIDandinheritedTickerID. However, they will not apply to thesymbolInputsince it represents a standard ticker ID.

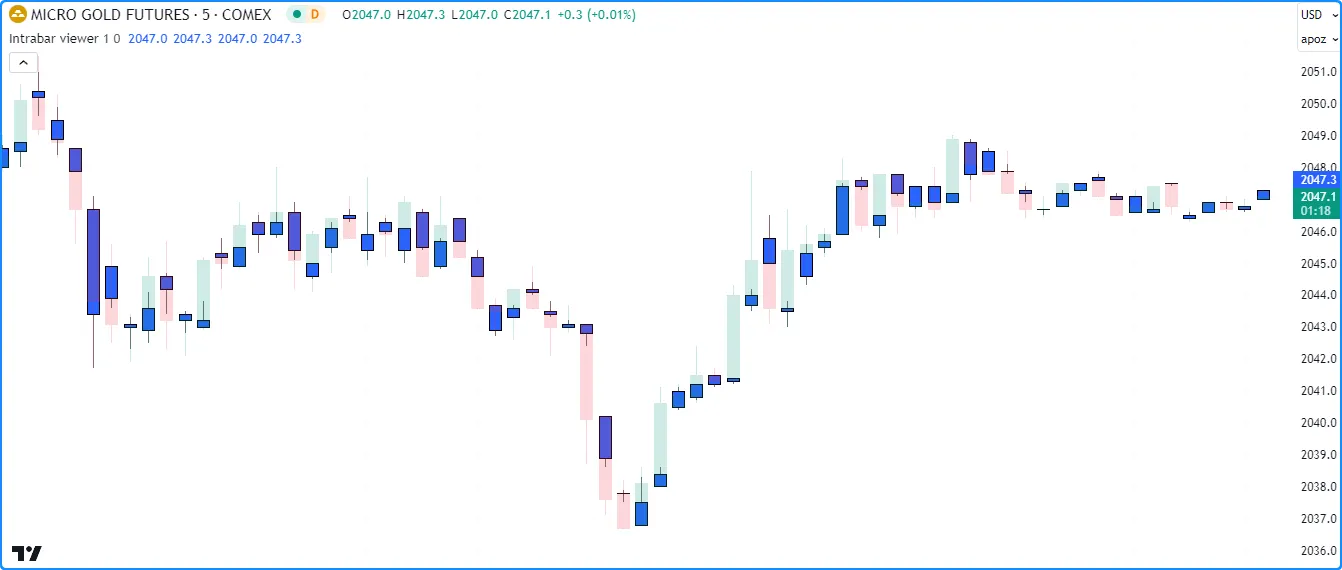

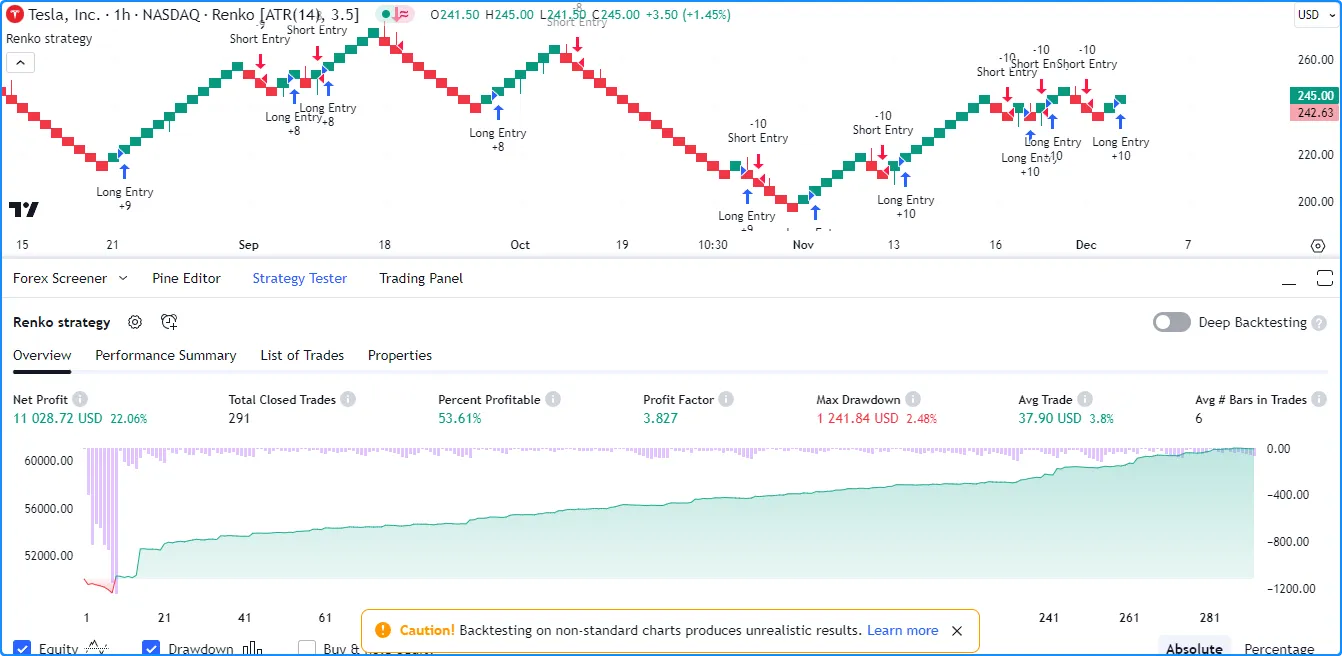

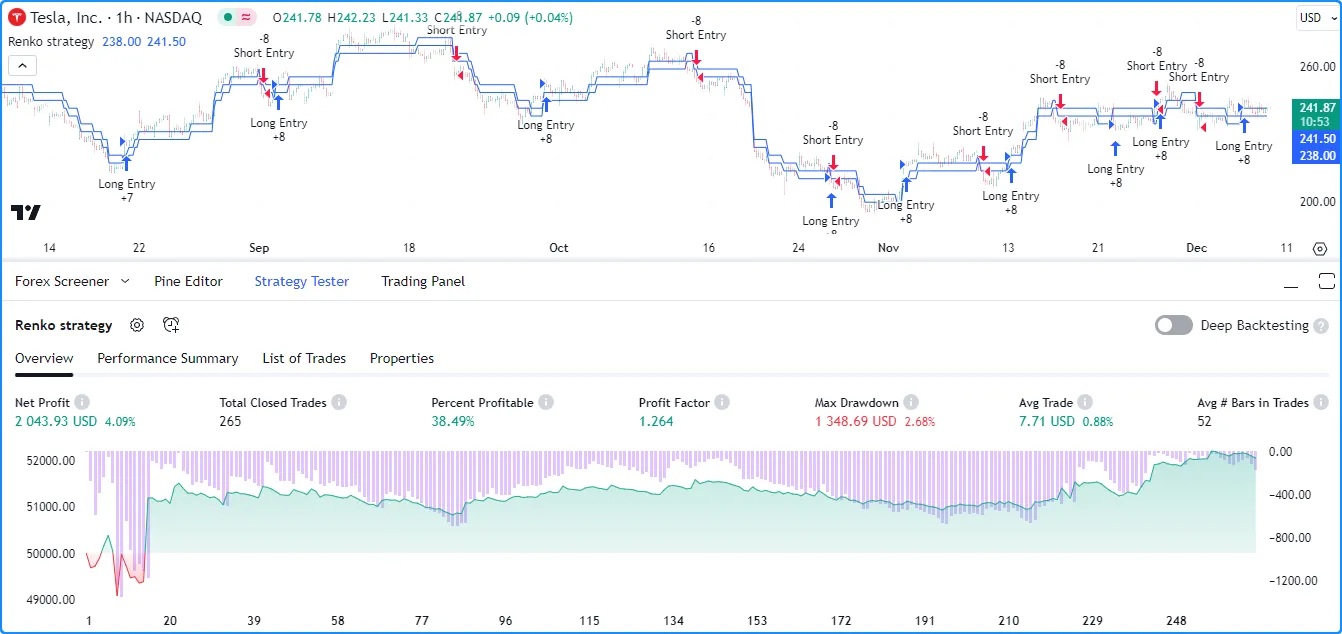

Another frequent use case for requesting custom contexts is retrieving data that uses non-standard chart calculations. For example, suppose we want to use Renko price values to calculate trade signals in a strategy() script. If we simply change the chart type to “Renko” to get the prices, the strategy will also simulate its trades based on those synthetic prices, producing misleading results:

To ensure our strategy shows results based on actual prices, we can create a Renko ticker ID using ticker.renko() while keeping the chart on a standard type, allowing the script to request and use Renko prices to calculate its signals without calculating the strategy results on them:

Historical and realtime behavior

Functions in the request.*() namespace can behave differently on

historical and realtime bars. This behavior is closely related to

Pine’s Execution model.

Consider how a script behaves within the main context. Throughout the chart’s history, the script calculates its required values once and commits them to that bar so their states are accessible on subsequent executions. On an unconfirmed bar, however, the script recalculates its values on each update to the bar’s data to align with realtime changes. Before recalculating the values on that bar, it reverts calculated values to their last committed states, otherwise known as rollback, and it only commits values to that bar once the bar closes.

Now consider the behavior of data requests from other contexts with request.security(). As when evaluating historical bars in the main context, request.security() only returns new historical values when it confirms a bar in its specified context. When executing on realtime bars, it returns recalculated values on each chart bar, similar to how a script recalculates values in the main context on the open chart bar.

However, the function only confirms the requested values when a bar from its context closes. When the script restarts, what were previously realtime bars become historical bars. Therefore, request.security() only returns the values it confirmed on those bars. In essence, this behavior means that requested data may repaint when its values fluctuate on realtime bars without confirmation from the context.

In most circumstances where a script requests data from a broader context, one will typically require confirmed, stable values that do not fluctuate on realtime bars. The section below explains how to achieve such a result and avoid repainting data requests.

Avoiding Repainting

Higher-timeframe data

When requesting values from a higher timeframe, they are subject to repainting since realtime bars can contain unconfirmed information from developing HTF bars, and the script may adjust the times that new values come in on historical bars. To avoid repainting HTF data, one must ensure that the function only returns confirmed values with consistent timing on all bars, regardless of bar state.

The most reliable approach to achieve non-repainting results is to use

an expression argument that only references past bars (e.g.,

close[1]) while using

barmerge.lookahead_on

as the lookahead value.

Using

barmerge.lookahead_on

with non-offset HTF data requests is discouraged since it prompts

request.security()

to “look ahead” to the final values of an HTF bar, retrieving

confirmed values before they’re actually available in the script’s

history. However, if the values used in the expression are offset by

at least one bar, the “future” data the function retrieves is no

longer from the future. Instead, the data represents confirmed values

from established, available HTF bars. In other words, applying an

offset to the expression effectively prevents the requested data from

repainting when the script restarts its executions and eliminates

lookahead bias in the historical series.

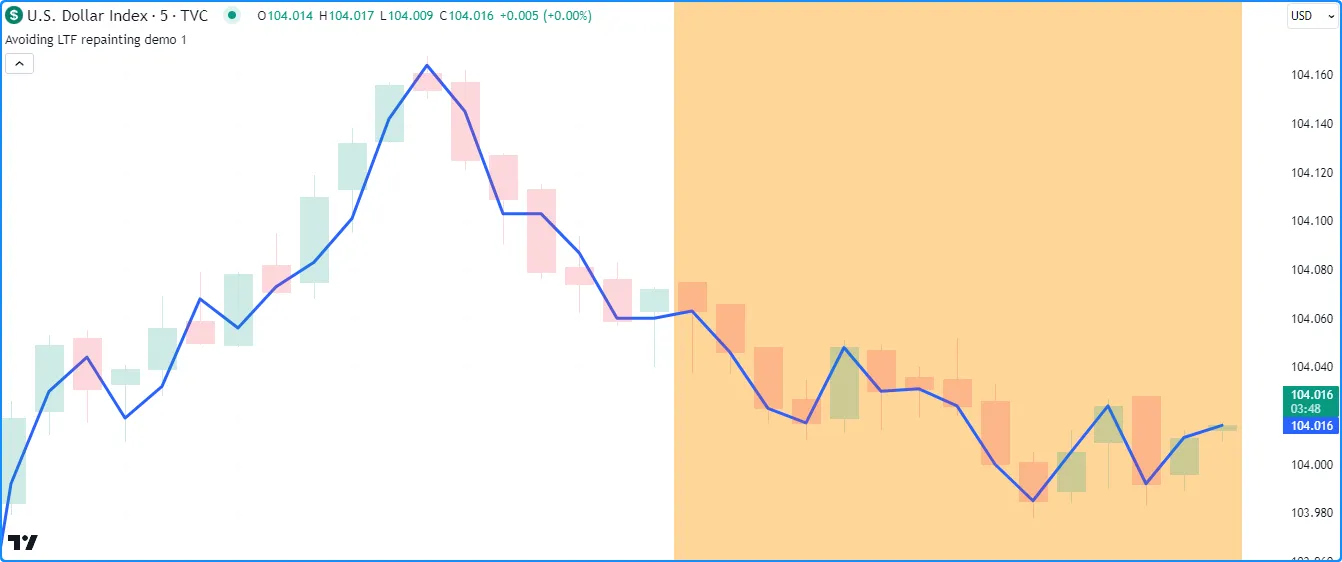

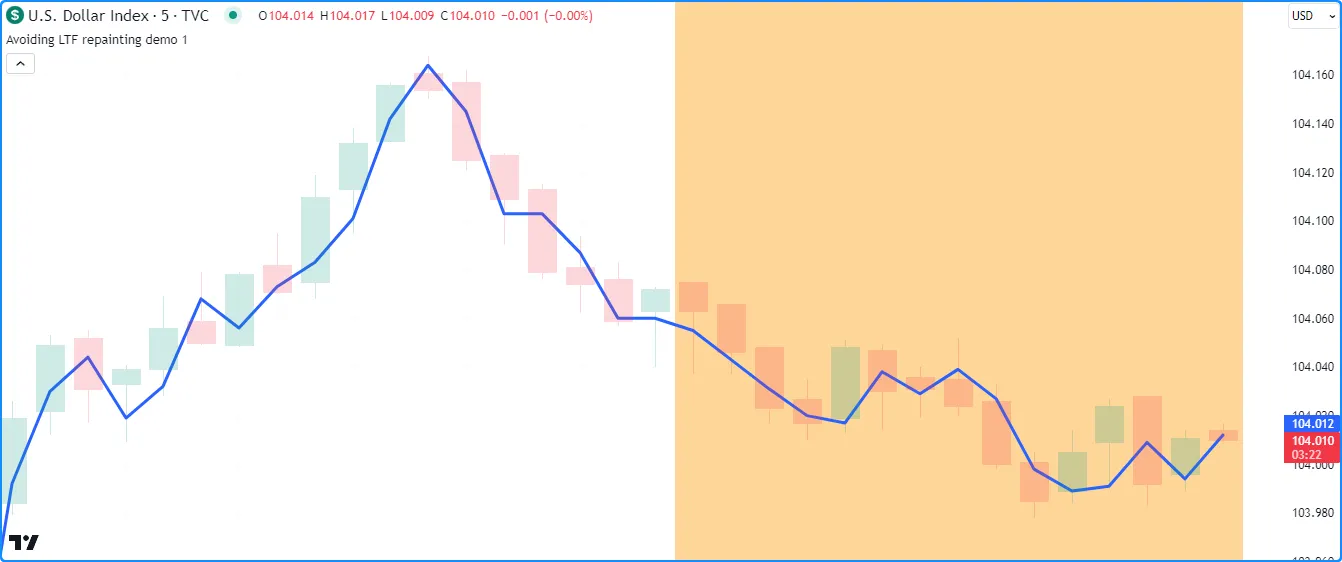

The following example demonstrates a repainting HTF data request. The script uses request.security() without offset modifications or additional arguments to retrieve the results of a ta.wma() call from a higher timeframe. It also highlights the background to indicate which bars were in a realtime state during its calculations.

As shown on the chart below, the plot of the requested WMA only changes on historical bars when HTF bars close, whereas it fluctuates on all realtime bars since the data includes unconfirmed values from the higher timeframe:

To avoid repainting in this script, we can add

lookahead = barmerge.lookahead_on to the

request.security()

call and offset the call history of

ta.wma()

by one bar with the history-referencing operator

[],

ensuring the request always retrieves the last confirmed HTF bar’s WMA

at the start of each new timeframe. Unlike the previous script, this

version has consistent behavior on historical and realtime bar states,

as we see below:

Lower-timeframe data

The request.security() and request.security_lower_tf() functions can retrieve data from lower-timeframe contexts. The request.security() function can only retrieve data from a single intrabar in each chart bar, and request.security_lower_tf() retrieves data from all available intrabars.

When using these functions to retrieve intrabar data, it’s important to note that such requests are not immune to repainting behavior. Historical and realtime series often rely on separate data feeds. Data providers may retroactively modify realtime data, and it’s possible for races to occur in realtime data feeds, as explained in the Data feeds section of this page. Either case may result in intrabar data retrieved on realtime bars repainting after the script restarts its executions.

Additionally, a particular case that will cause repainting LTF requests is using request.security() with barmerge.lookahead_on to retrieve data from the first intrabar in each chart bar. While it will generally work as expected on historical bars, it will track only the most recent intrabar on realtime bars, as request.security() does not retain all intrabar information, and the intrabars the function retrieves on realtime bars are unsorted until restarting the script:

One can mitigate this behavior and track the values from the first intrabar, or any available intrabar in the chart bar, by using request.security_lower_tf() since it maintains an array of intrabar values ordered by the times they come in. Here, we call array.first() on a requested array of intrabar data to retrieve the close price from the first available intrabar in each chart bar:

Note that:

- While request.security_lower_tf() is more optimized for handling historical and realtime intrabars, it’s still possible in some cases for minor repainting to occur due to data differences from the provider, as outlined above.

- This code may not show intrabar data on all available chart

bars, depending on how many intrabars each chart bar contains,

as

request.*()functions can retrieve up to 200,000 intrabars from an LTF context. The maximum number of requestable intrabars depends on the user’s plan. See this section of the Limitations page for more information.

request.currency_rate()

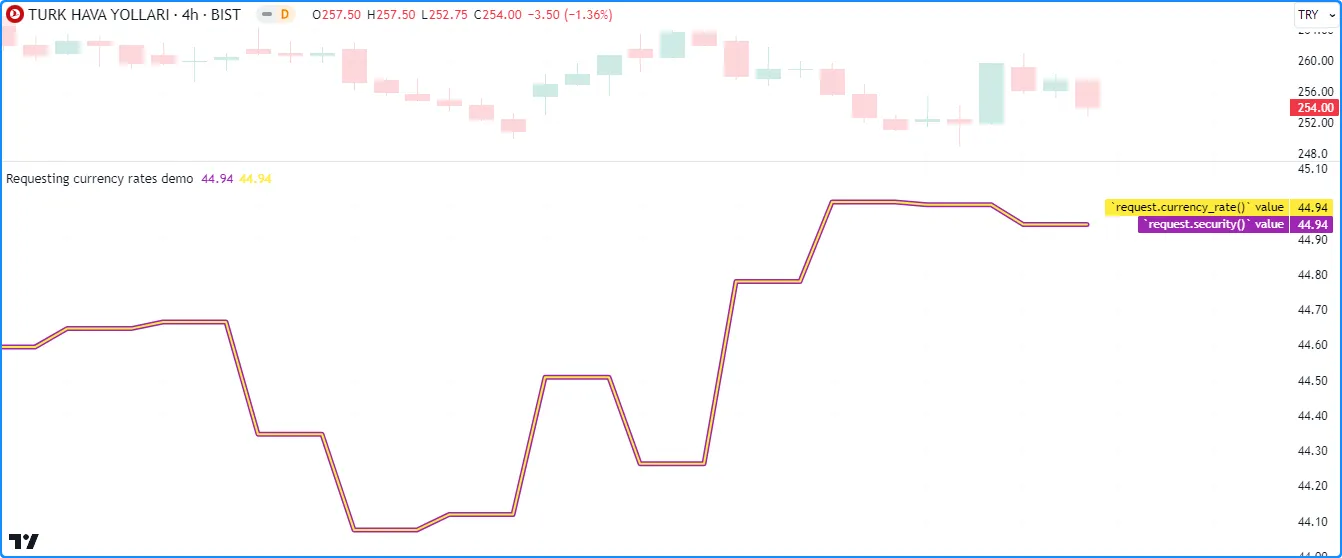

When a script needs to convert values expressed in one currency to another, one can use request.currency_rate(). This function requests a daily rate for currency conversion calculations based on currency pair or spread data from the most popular exchanges, providing a simpler alternative to fetching specific pairs or spreads with request.security().

While one can use request.security() to retrieve daily currency rates, its use case is more involved than request.currency_rate(), as one needs to supply a valid ticker ID for a currency pair or spread to request the rate. Additionally, a historical offset and barmerge.lookahead_on are necessary to prevent the results from repainting, as explained in this section.

The request.currency_rate() function, on the other hand, only requires currency codes. No ticker ID is needed when requesting rates with this function, and it ensures non-repainting results without requiring additional specification.

The function’s signature is as follows:

request.currency_rate(from, to, ignore_invalid_currency) → series floatThe from parameter specifies the currency to convert, and the to

parameter specifies the target currency. Both parameters accept

“string” values representing valid currency codes (e.g.,

“USD”) or any built-in currency.* variable (e.g.,

currency.USD).

When the function cannot calculate a valid conversion rate between the specified

from and to currencies, programmers can decide whether

it raises a runtime error or returns

na via

the ignore_invalid_currency parameter. The default value is false,

meaning the function raises a runtime error and halts the script’s

executions.

The following example demonstrates a simple use case for request.currency_rate(). Suppose we want to convert values expressed in Turkish lira (currency.TRY) to South Korean won (currency.KRW) using a daily conversion rate. If we use request.security() to retrieve the rate, we must supply a valid ticker ID and request the last confirmed close from the previous day.

In this case, no valid symbol exists that would allow us to

retrieve a conversion rate directly with

request.security().

Therefore, we first need a ticker ID for a

spread

that converts TRY to an intermediate currency, such as USD, then

converts the intermediate currency to KRW. We can then use that ticker

ID within

request.security()

with close[1] as the expression and

barmerge.lookahead_on

as the lookahead value to request a non-repainting daily rate.

Alternatively, we can achieve the same result more simply by calling

request.currency_rate().

This function does all the heavy lifting for us, only requiring from

and to currency arguments to perform its calculation.

As we see below, both approaches return the same daily rate:

request.dividends(), request.splits(), and request.earnings()

Analyzing a stock’s earnings data and corporate actions provides helpful insights into its underlying financial strength. Pine Script provides the ability to retrieve essential information about applicable stocks via request.dividends(), request.splits(), and request.earnings().

These are the functions’ signatures:

request.dividends(ticker, field, gaps, lookahead, ignore_invalid_symbol, currency) → series float

request.splits(ticker, field, gaps, lookahead, ignore_invalid_symbol) → series float

request.earnings(ticker, field, gaps, lookahead, ignore_invalid_symbol, currency) → series floatEach function has the same parameters in its signature, with the

exception of

request.splits(),

which doesn’t have a currency parameter.

Note that unlike the symbol parameter in other request.*()

functions, the ticker parameter in these functions only accepts an

“Exchange:Symbol” pair, such as “NASDAQ:AAPL”. The built-in

syminfo.ticker

variable does not work with these functions since it does not contain

exchange information. Instead, one must use

syminfo.tickerid

for such cases.

The field parameter determines the data the function will retrieve.

Each of these functions accepts different built-in variables as the

field argument since each requests different information about a

stock:

- The

request.dividends()

function retrieves current dividend information for a stock, i.e.,

the amount per share the issuing company paid out to investors who

purchased shares before the ex-dividend date. Passing the built-in

dividends.gross

or

dividends.net

variables to the

fieldparameter specifies whether the returned value represents dividends before or after factoring in expenses the company deducts from its payouts. - The

request.splits()

function retrieves current split and reverse split information for a

stock. A split occurs when a company increases its outstanding

shares to promote liquidity. A reverse split occurs when a company

consolidates its shares and offers them at a higher price to attract

specific investors or maintain their listing on a market that has a

minimum per-share price. Companies express their split information

as ratios. For example, a 5:1 split means the company issued

additional shares to its shareholders so that they have five times

the number of shares they had before the split, and the raw price of

each share becomes one-fifth of the previous price. Passing

splits.numerator

or

splits.denominator

to the

fieldparameter of request.splits() determines whether it returns the numerator or denominator of the split ratio. - The

request.earnings()

function retrieves the earnings per share (EPS) information for a

stock

ticker’s issuing company. The EPS value is the ratio of a company’s net income to the number of outstanding stock shares, which investors consider an indicator of the company’s profitability. Passing earnings.actual, earnings.estimate, or earnings.standardized as thefieldargument in request.earnings() respectively determines whether the function requests the actual, estimated, or standardized EPS value.

For a detailed explanation of the gaps, lookahead, and

ignore_invalid_symbol parameters of these functions, see the

Common characteristics section at the top of this page.

It’s important to note that the values returned by these functions reflect the data available as it comes in. This behavior differs from financial data originating from a request.financial() call in that the underlying data from such calls becomes available according to a company’s fiscal reporting period.

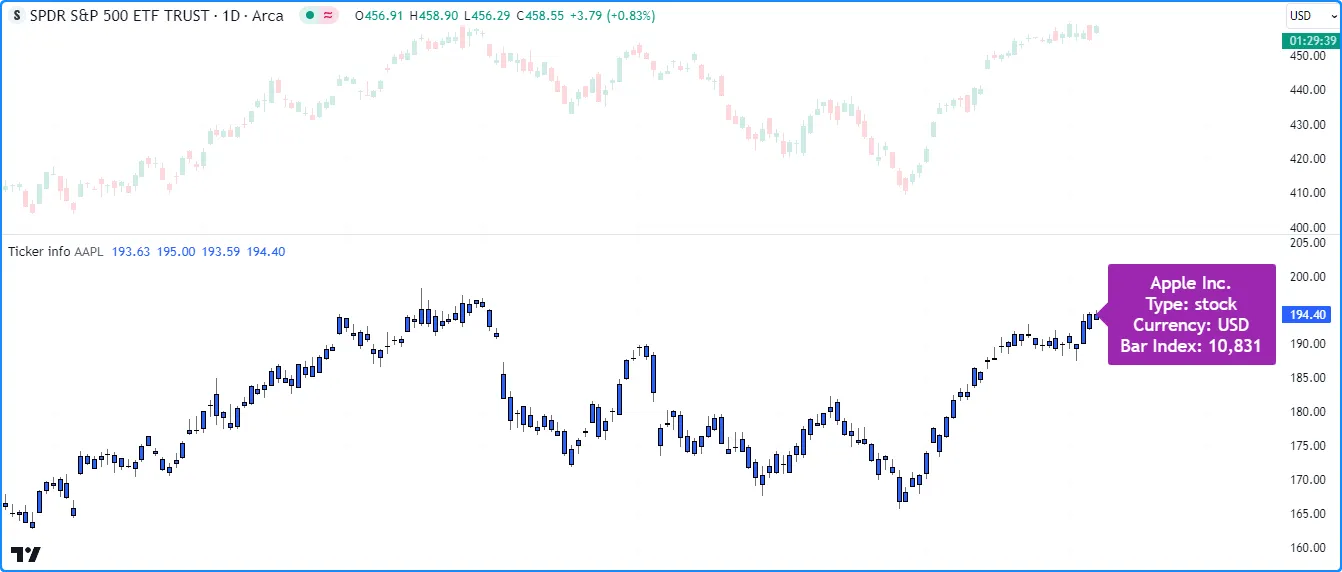

Here, we’ve included an example that displays a handy

table

containing the most recent dividend, split, and EPS data. The script

calls the request.*() functions discussed in this section to retrieve

the data, then converts the values to “strings” with str.*()

functions and displays the results in the infoTable with

table.cell():

Note that:

- We’ve included

barmerge.gaps_on

in the

request.*()calls, so they only return values when new data is available. Otherwise, they return na. - The script assigns a

table

ID to the

infoTablevariable on the first chart bar. On subsequent bars, it updates necessary cells with new information whenever data is available. - If no information is available from any of the

request.*()calls throughout the chart’s history (e.g., if thetickerhas no dividend information), the script does not initialize the corresponding cells since it’s unnecessary.

request.financial()

Financial metrics provide investors with insights about a company’s economic and financial health that are not tangible from solely analyzing its stock prices. TradingView offers a wide variety of financial metrics from FactSet that traders can access via the “Financials” tab in the “Indicators” menu of the chart. Scripts can access available metrics for an instrument directly via the request.financial() function.

This is the function’s signature:

request.financial(symbol, financial_id, period, gaps, ignore_invalid_symbol, currency) → series floatAs with the first parameter in

request.dividends(),

request.splits(),

and

request.earnings(),

the symbol parameter in

request.financial()

requires an “Exchange:Symbol” pair. To request financial information

for the chart’s ticker ID, use

syminfo.tickerid,

as

syminfo.ticker

will not work.

The financial_id parameter accepts a “string” value representing

the ID of the requested financial metric. TradingView has numerous

financial metrics to choose from. See the

Financial IDs section below for an overview of all accessible metrics and

their “string” identifiers.

The period parameter specifies the fiscal period for which new

requested data comes in. It accepts one of the following “string” arguments:

“FQ” (quarterly), “FH” (semiannual), “FY” (annual), or “TTM”

(trailing twelve months). Not all fiscal periods are available for all

metrics or instruments. To confirm which periods are available for

specific metrics, see the second column of the tables in the

Financial IDs section.

See this page’s

Common characteristics section for a detailed explanation of this function’s

gaps, ignore_invalid_symbol, and currency parameters.

It’s important to note that the data retrieved from this function comes in at a fixed frequency, independent of the precise date on which the data is made available within a fiscal period. For a company’s dividends, splits, and earnings per share (EPS) information, one can request data reported on exact dates via request.dividends(), request.splits(), and request.earnings().

This script uses

request.financial()

to retrieve information about the income and expenses of a stock’s

issuing company and visualize the profitability of its typical business

operations. It requests the “OPER_INCOME”, “TOTAL_REVENUE”, and

“TOTAL_OPER_EXPENSE”

financial IDs for the

syminfo.tickerid

over the latest fiscalPeriod, then

plots the results on the

chart:

Note that:

- Not all