Context switching, the security function

The function security lets the user to request data from additional

symbols and resolutions, other than the ones to which the indicator is

applied.

Detailed description

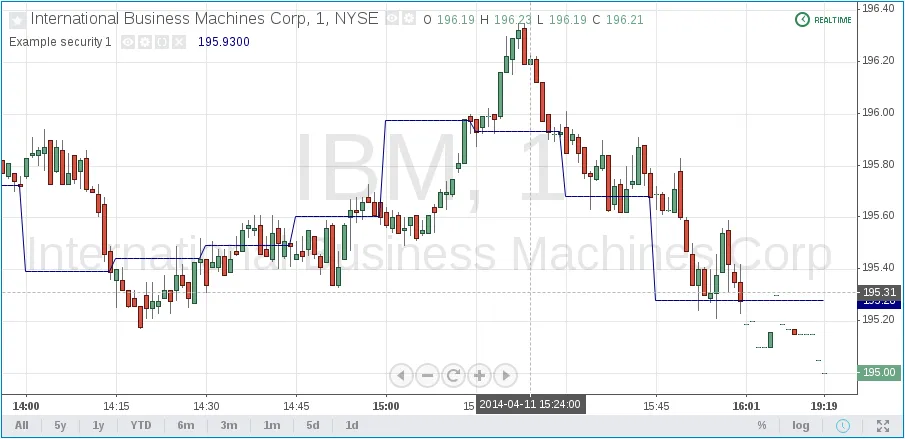

We will assume that we are applying a script to the chart IBM,1. The following script will display the close price of the IBM symbol but on a 15 resolution.

As seen from the security arguments

description,

the first argument is the name of the requested symbol. The second

argument is the required resolution, and the third one is an expression

which needs to be computed on the requested series.

The name of the symbol can be set using two variants: with a prefix that

shows the exchange (or data provider) or without it. For example:

"NYSE:IBM", "BATS:IBM" or "IBM". In the case of using the name of

a symbol without an exchange prefix, the exchange selected by default is

BATS. Current symbol name is assigned to ticker and tickerid

built-in variables. The variable ticker contains the value of the

symbol name without an exchange prefix, for example "MSFT". The

variable tickerid is a symbol name with an exchange prefix, for

example, "BATS:MSFT", "NASDAQ:MSFT". It’s recommended to use

tickerid to avoid possible ambiguity in the indicator’s displayed

values of data taken from different exchanges.

The resolution (or timeframe, the second argument of the security

function) is also set as a string. Any intraday resolution is set by

specifying a number of minutes. The lowest resolution is minute which

is set by the literal "1". It’s possible to request any1 number of

minutes: "5", "10", "21", etc. Hourly resolution is also set by

minutes2. For example, the following lines signify an hour, two hours

and four hours respectively: "60", "120", "240". A resolution with

a value of 1 day is set by the symbols "D" or "1D". It’s possible

to request any number of days: "2D", "3D", etc. Weekly and

monthly resolutions are set in a similar way: "W", "1W", "2W",

…, "M", "1M", "2M". "M" and "1M" are sorts of one month

resolution value. "W" and "1W" are the same weekly resolution value.

The third parameter of the security function can be any arithmetic

expression or a function call, which will be calculated in chosen series

context.

For example, with the security the user can view a minute chart and

display an SMA (or any other indicator) based on any other resolution

(i.e., daily, weekly, monthly):

Or one can declare the variable

and calculate it in 1, 15 and 60 minutes:

The function security, as should be understood from the examples,

returns a series which is adopted correspondingly to the time scale of

the current chart’s symbol. This result can be either shown directly on

the chart (i.e., with plot), or be used in further calculations of the

indicator’s code. The indicator ‘Advance Decline Line’ of the

function security is a more difficult example:

The script requests three securities at the same time. Results of the requests are then added to an arithmetic formula. As a result, we have a stock market indicator used by investors to measure the number of individual stocks participating in an upward or downward trend (read more).

Pay attention to the fact that, out of convenience, the call security

is ‘wrapped up’ in the user function sym. (just to write a bit less

of code).

security function was designed to request data of a timeframe higher

than the current chart timeframe. For example, if you have a 60 minute

chart, you can request 240, D, W (or any higher timeframe) and plot the

results.

Barmerge gaps and lookahead

There are two switches that define how requested data will be mapped to the current timeframe.

First one — gaps — controls gaps in data. Default value is

barmerge.gaps_off,

data is merged continiously (without na-gaps). All the gaps (if any)

are filled with the previous nearest non-na value. If

barmerge.gaps_on

then data will be merged possibly with gaps (na values).

Second one — lookahead — was added in Pine Script version 3 <release_notes_v3>. The parameter has

two possible values:

barmerge.lookahead_off

and

barmerge.lookahead_on

to switch between the new (version 3) and old behavior (version 2 and 1)

of the

security

function.

Here is an example that shows the behavioral difference of the security function on a 5 minute chart:

The green line on the chart is the low price of an hourly bar that is

requested with lookahead on. It’s the old behavior of the security

function, implemented in Pine Script v2. The green line based on

historical data is displayed at the price level of an hourly low right

after a new hourly bar is created (dotted blue vertical lines). The red

line is a low price of an hourly bar that is requested with lookahead

off. In this case the requested low price of an hourly historical bar

will be given only on the last minute bar of the requested hour, when an

hourly bar’s low won’t return future data. The fuchsia dotted line

represents the beginning of real-time data. You can see that

barmerge.lookahead_on and barmerge.lookahead_off based on real-time

data behaves the same way according to barmerge.lookahead_off.

Understanding lookahead

There are many published scripts with the following lines:

The expression in security (close[1]) is a value of close of the

previous day, which is why the construction doesn’t use future

data.

In Pine Script version 3 we can rewrite this in two different ways,

using barmerge.lookahead_on or barmerge.lookahead_off. If you use

barmerge.lookahead_on, then it’s quite simple:

Because original construction doesn’t use data from future it is

possible to rewrite it using barmerge.lookahead_off. If you use

barmerge.lookahead_off, the script becomes more complex, but gives you

an understanding of how the lookahead parameter works:

When an indicator is based on historical data (i.e.,

barstate.isrealtime equals false), we take the current close of

the daily resolution and shift the result of security function call

one bar to the right in the current resolution. When an indicator is

calculated on real-time data, we take the close of the previous day

without shifting the security data.

Requesting data of a lower timeframe

It’s not recommended to request data of a timeframe lower that the

current chart timeframe (for example 1 minute data from 5 minute chart).

The main problem with such a case is that some part of a 1 minute data

will be inevitably lost, as it’s impossible to display it on a 5 minute

chart and not to break the time axis. So the security behaviour could

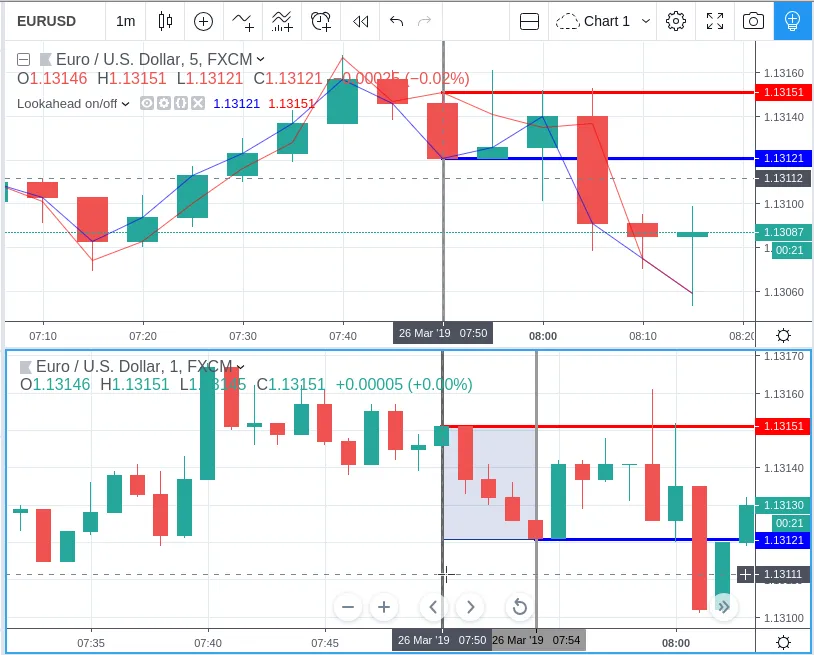

be rather weird. The next example illustrates this:

This study plots two lines which correspond to different values of

lookahead parameter. Red line shows data returned by security with

lookahead=true, blue line — with lookahead=false. Let us look at

the 5 minute bar that starts at 07:50. The red line at this bar has

value of 1.13151 which corresponds to a value of the first of the five

1 minute bars that fall into the time range 07:50—07:54. On the other

hand, the blue line at the same bar has value of 1.13121 which

corresponds to the last of the five 1 minute bars of the same time

range.