Strategies

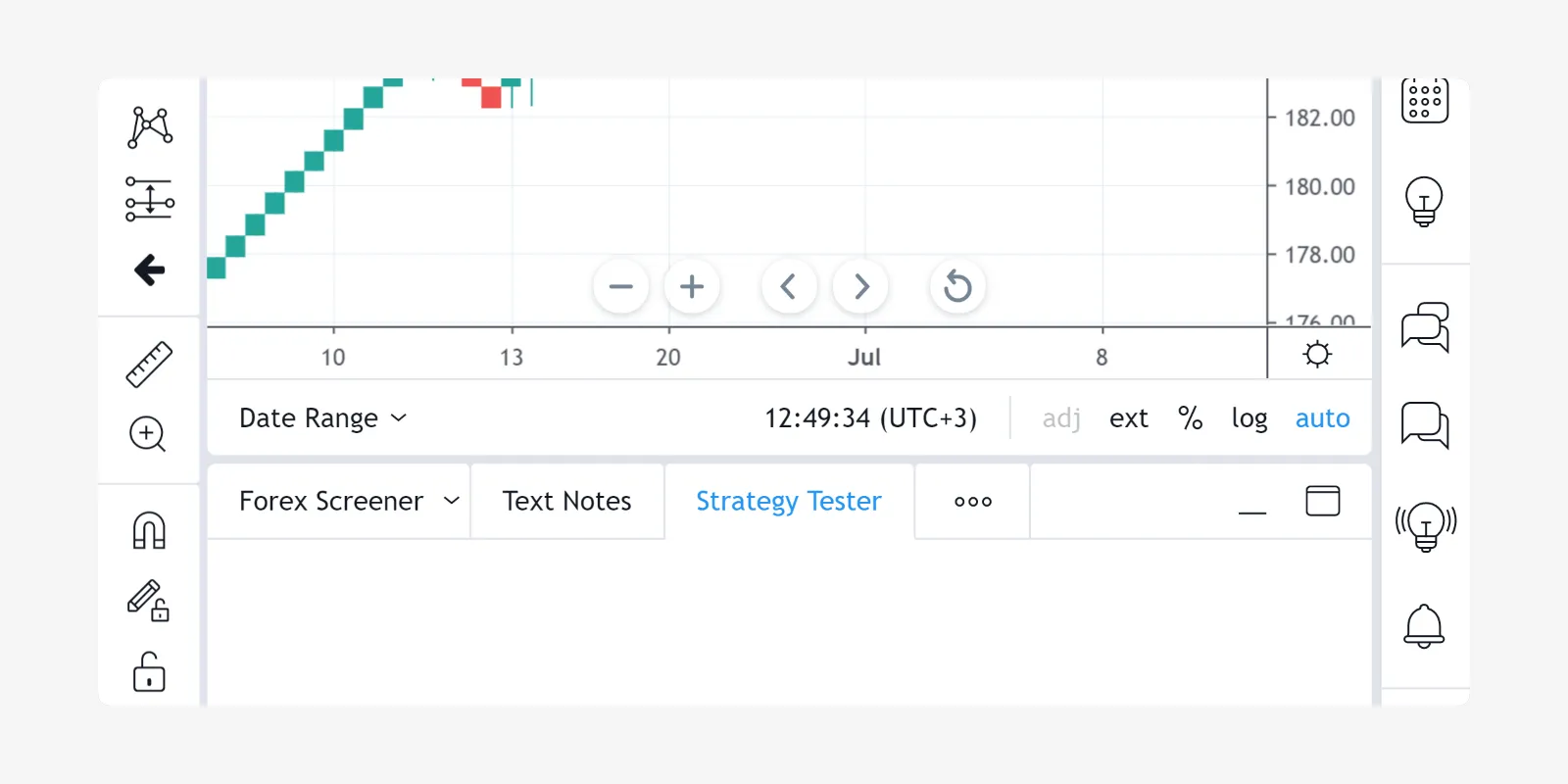

A strategy is a Pine script that can send, modify and cancel buy/sell orders. Strategies allow you to perform backtesting (emulation of a strategy trading on historical data) and forwardtesting (emulation of a strategy trading on real-time data) according to your algorithms.

A strategy written in Pine has many of the same capabilities as a Pine

study, a.k.a. indicator. When you write a strategy, it must start

with the

strategy()

annotation call (instead of study). Strategies may plot data, but they

can also place, modify and cancel orders. They also have access to

essential strategy performance information through specific keywords.

The same information is available externally in the Strategy Tester

tab. Once a strategy is calculated on historical data, you can see

hypothetical order fills.

A simple strategy example

//@version=4

strategy("test")

if bar_index < 100

strategy.entry("buy", strategy.long, 10, when=strategy.position_size <= 0)

strategy.entry("sell", strategy.short, 10, when=strategy.position_size > 0)

plot(strategy.equity)

As soon as the script is compiled and applied to a chart, you can see filled order marks on it and how your balance was changing during backtesting (equity curve). This is a very basic strategy that buys and sells on every bar.

The strategy("test") line states that the script is a strategy named

“test”. strategy.entry() is a command that can be used to send both

“buy” and “sell” orders. plot(strategy.equity) plots the equity

curve.

Applying a strategy to a chart

To test your strategy, apply it to the chart. Use the symbol and time intervals that you want to test. You can use a built-in strategy from the Indicators & Strategies dialog box, or write your own.

Backtesting and forwardtesting

On TradingView, strategies are calculated on all the chart’s available historical data (backtesting), and then automatically continue calculations when real-time data comes in (forwardtesting).

By default, during both historical and real-time calculation, code is calculated on the bar’s close.

When forwardtesting, you have the option of configuring script

calculation to occur on every real-time tick. To enable this, check the

Recalculate On Every Tick option in the strategy’s

Settings/Properties, or specify it in the script’s code using:

strategy(..., calc_on_every_tick=true).

You can set the strategy to perform one additional calculation after an

order is filled. For this you need to check Recalculate After Order

filled in the strategy’s Settings/Properties, or do it in the

script’s code using: strategy(..., calc_on_order_fills=true).

Broker emulator

TradingView uses a broker emulator when running strategies. Unlike in real trading, the emulator only fills orders at chart prices, which is why an order can only be filled on the next tick in forwardtesting and on the next bar or later in backtesting, i.e., after the strategy calculates.

The following logic is used to emulate order fills:

- If the bar’s high is closer to bar’s open than the bar’s low, the broker emulator assumes that intrabar price was moving this way: open → high → low → close.

- If the bar’s low is closer to bar’s open than the bar’s high, the broker emulator assumes that intrabar price was moving this way: open → low → high → close.

- The broker emulator assumes that there are no gaps inside bars, meaning the full range of intrabar prices is available for order execution.

- Even if the Recalculate On Every Tick option is enabled in

strategy properties (or the script’s

strategycall usescalc_on_every_tick=true), the broker emulator’s behavior still uses the above logic.

Here is a strategy demonstrating how orders are filled by the broker emulator:

//@version=4

strategy("History SAW demo", overlay=true, pyramiding=100, calc_on_order_fills=true)

strategy.entry("LE", strategy.long)

This code is calculated once per bar on the close, but an additional calculation occurs as soon as an order is filled. That is why you can see 4 filled orders on every bar: 2 orders on open, 1 order on high and 1 order on low. This is for backtesting. In real-time, orders would be executed on every new tick.

It is also possible to emulate an order queue. The setting is called

Verify Price For Limit Orders and can be found in strategy properties,

or set in the script’s code with

strategy(..., backtest_fill_limits_assumption=X). The specified value

is a minimum price movements in number of points/pips (default value is

0). A limit order is filled if the current price is better (higher for

sell orders, lower for buy orders) by the specified number of

points/pips. The execution price still matches the limit order price.

Example:

backtest_fill_limits_assumption = 1. Minimum price movement is0.25.- A buy limit order is placed at price

12.50. - Current price is

12.50. - The order cannot be filled at the current price because

backtest_fill_limits_assumption = 1. To fill the order the price must be0.25*1lower. The order is put in the queue. - Assume that the next tick comes at price

12.00. This price is 2 points lower, meaning the conditionbacktest_fill_limits_assumption = 1is satisfied, so the order should be filled. The order is filled at12.50(original order price), even if the price is not available anymore.

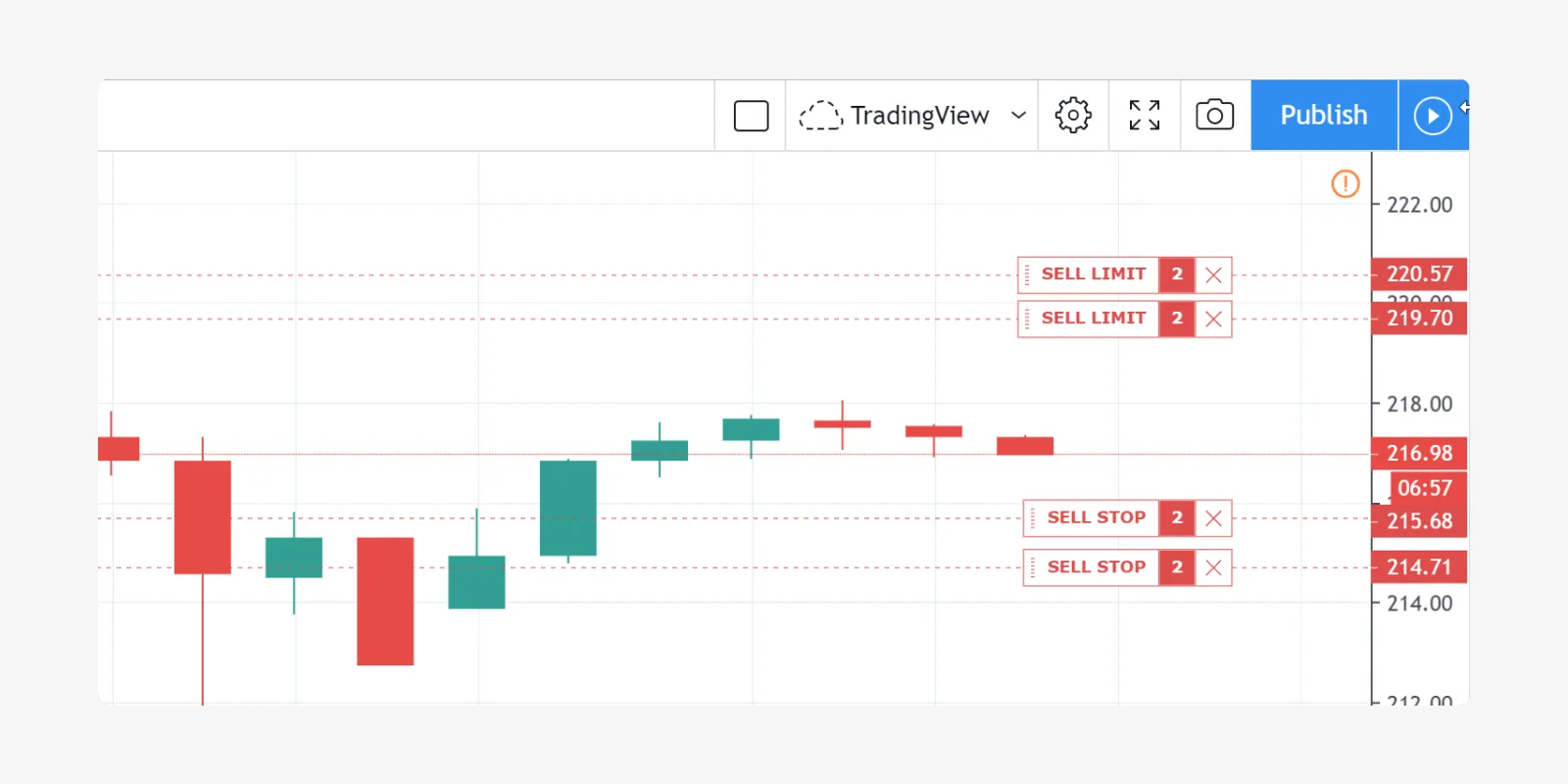

Order placement commands

All keywords related to strategies start with a strategy. prefix. The

following commands are used for placing orders: strategy.entry,

strategy.order and strategy.exit.

pyramiding setting in the strategy’s properties and by the

strategy.risk.allow_entry_in function. If there is an open market

position when an opposite direction order is generated, the number

of contracts/shares/lots/units will be increased by the number of

currently open contracts (script equivalent:

strategy.position_size + quantity). As a result, the size of the

opened market position will be equal to the order size specified in

the strategy.entry command.

strategy.risk.allow_entry_in

function. It allows you to create complex entry and exit order

constructions when the functionality of strategy.entry and

strategy.exit will not do.

strategy.oca.reduce

group. An exit order cannot be placed if there is no open market

position or there is no active entry order (an exit order is bound

to the ID of an entry order). It is not possible to exit a position

with a market order using the command strategy.exit. For this, the

strategy.close

or

strategy.close_all

commands should be used. If the number of

contracts/shares/lots/units specified for the strategy.exit is

less than the size of current open positions, the exit will be

partial. It is possible to exit from the same entry order more than

once using the same exit order ID, which allows you to create exit

strategies with multiple levels. In cases where a market position is

formed by multiple entry orders (pyramiding enabled), each exit

order must be linked to a matching entry order.

Example 1:

//@version=4

strategy("revers demo")

if bar_index < 100

strategy.entry("buy", strategy.long, 4, when=strategy.position_size <= 0)

strategy.entry("sell", strategy.short, 6, when=strategy.position_size > 0)

plot(strategy.equity)

The above strategy constantly reverses market position from +4 to -6, back and forth, which the plot shows.

Example 2:

//@version=4

strategy("exit once demo")

strategy.entry("buy", strategy.long, 4, when=strategy.position_size <= 0)

strategy.exit("bracket", "buy", 2, profit=10, stop=10)

This strategy demonstrates a case where a market position is never closed because it uses a partial exit order to close the market position and it cannot be executed more than once. If you double the line for exiting, the strategy will close the market position completely.

Example 3:

//@version=4

strategy("Partial exit demo")

if bar_index < 100

strategy.entry("buy", strategy.long, 4, when=strategy.position_size <= 0)

strategy.exit("bracket1", "buy", 2, profit=10, stop=10)

strategy.exit("bracket2", "buy", profit=20, stop=20)

This code generates 2 levels of brackets (2 take profit orders and 2 stop loss orders). Both levels are activated at the same time: first level to exit 2 contracts and the second one to exit all the rest.

The first take profit and stop loss orders (level 1) are in an OCA group. The other orders (level 2) are in another OCA group. This means that as the order from level 1 is filled, the orders from level 2 are not cancelled; they stay active.

Every command placing an order has an ID (string value) which is a

unique order identifier. If an order with the same ID is already placed

but not yet filled, the last command modifies the existing order. If

modification is not possible (conversion from buy to sell), the old

order is cancelled and the new order is placed. strategy.entry and

strategy.order work with the same IDs (they can modify the same entry

order). strategy.exit works with other order IDs (it is possible to

have an entry order and an exit order with the same ID).

To cancel a specific order using its ID, the strategy.cancel(string ID) command should be used. To cancel all pending orders the strategy.cancel_all() command should be used. Strategy orders are placed as soon as their conditions are satisfied and command is called in code. The broker emulator doesn’t execute orders before the next tick comes after the code was calculated, while in real trading an order can get filled sooner. When a market order is generated at the close of the current bar, the broker emulator only executes it at the open price of the next.

Example:

//@version=4

strategy("next bar open execution demo")

if bar_index < 100

strategy.order("buy", strategy.long, when=strategy.position_size == 0)

strategy.order("sell", strategy.short, when=strategy.position_size != 0)

If this code is applied to a chart, all orders are filled at the open of every bar.

Conditions for order placement (when, pyramiding, strategy.risk)

are checked when the script is calculated. If all conditions are

satisfied, the order is placed. If any condition is not satisfied, the

order is not placed. It is important to cancel price orders (limit, stop

and stop-limit orders).

Example (for MSFT, 1D):

//@version=4

strategy("Priced Entry demo")

var c = 0

if year > 2020

c := c + 1

if c == 1

strategy.entry("LE1", strategy.long, 2, stop = high + 35 * syminfo.mintick)

strategy.entry("LE2", strategy.long, 2, stop = high + 2 * syminfo.mintick)

Even though pyramiding is disabled, both these orders are filled in

backtesting because when they are generated there is no opened long

market position. Both orders are placed and when price satisfies order

execution conditions, they both get executed. It is recommended to put

the orders in an OCA group using strategy.oca.cancel. This way only

one order is filled and the other one is cancelled. Here is the modified

code:

//@version=4

strategy("Priced Entry demo")

var c = 0

if year > 2020

c := c + 1

if c == 1

strategy.entry("LE1", strategy.long, 2, stop = high + 35 * syminfo.mintick, oca_type = strategy.oca.cancel, oca_name = "LE")

strategy.entry("LE2", strategy.long, 2, stop = high + 2 * syminfo.mintick, oca_type = strategy.oca.cancel, oca_name = "LE")

If, for some reason, order placing conditions are not met when executing

the command, the entry order will not be placed. For example, if

pyramiding settings are set to 2, the existing position already contains

two entries and the strategy tries to place a third one, it will not be

placed. Entry conditions are evaluated at the order generation stage and

not at the execution stage. Therefore, if you submit two price type

entries with pyramiding disabled, once one of them is executed the other

will not be cancelled automatically. To avoid issues we recommend using

strategy.oca.cancel groups for entries so when one entry order is

filled the others are cancelled.

The same is true for price type exits. Orders will be placed once their conditions are met, i.e., an entry order with a matching ID is filled.

Closing market position

Despite the fact that it is possible to exit from a specific entry in code, when orders are shown in the List of Trades in the Strategy Tester tab, they all are linked according to FIFO (first in, first out) rules. If an entry order ID is not specified for an exit order in code, the exit order closes the first entry order that opened market position. Let’s study the following example:

//@version=4

strategy("exit Demo", pyramiding=2, overlay=true)

strategy.entry("Buy1", strategy.long, 5,

when = strategy.position_size == 0 and year > 2014)

strategy.entry("Buy2", strategy.long,

10, stop = strategy.position_avg_price +

strategy.position_avg_price*0.1,

when = strategy.position_size == 5)

strategy.exit("bracket", loss=10, profit=10, when=strategy.position_size == 15)

The code given above places 2 orders sequentially: “Buy1” at market

price and “Buy2” at a 10% higher price (stop order). The exit order is

placed only after entry orders have been filled. If you apply the code

to a chart, you will see that each entry order is closed by an exit

order, though we did not specify entry order ID to close in this line:

strategy.exit("bracket", loss=10, profit=10, when=strategy.position_size == 15)

Another example:

//@version=4

strategy("exit Demo", pyramiding=2, overlay=true)

strategy.entry("Buy1", strategy.long, 5, when = strategy.position_size == 0)

strategy.entry("Buy2", strategy.long,

10, stop = strategy.position_avg_price +

strategy.position_avg_price*0.1,

when = strategy.position_size == 5)

strategy.close("Buy2",when=strategy.position_size == 15)

strategy.exit("bracket", "Buy1", loss=10, profit=10, when=strategy.position_size == 15)

plot(strategy.position_avg_price)

- It opens a 5-contract long position with the order “Buy1”.

- It extends the long position by purchasing 10 more contracts at 10% higher price with the order “Buy2”.

- The exit order (strategy.close) to sell 10 contracts (exit from “Buy2”) is filled.

If you take a look at the plot, you can see that average entry price = “Buy2” execution price and our strategy closed exactly this entry order, while on the Trade List tab we can see that it closed the first “Buy1” order and half of the second “Buy2”. It means that no matter which entry order you specify for your strategy to close, the broker emulator will still close the first one, according to FIFO rules. It works the same way as when trading with a real broker.

OCA groups

It is possible to put orders in 2 different One-Cancells-All (OCA) groups in Pine Script.

strategy.oca.reduce.

Example:

//@version=4

strategy("oca_cancel demo")

if year > 2014 and year < 2016

strategy.entry("LE", strategy.long)

strategy.entry("SE", strategy.short)

You may think that this is a reverse strategy since pyramiding is not allowed, but in fact both orders will get filled because they are market orders, which means they are to be executed immediately at the current price. The second order doesn’t get cancelled because both are filled almost at the same moment and the system doesn’t have time to process the first order fill and cancel the second one before it gets executed. The same would happen if these were price orders with same or similar prices. The strategy places all orders allowed according to market position, etc.

The strategy places all orders that do not contradict the rules (in our case market position is flat, therefore any entry order can be filled). At each tick calculation, firstly all orders with the satisfied conditions are executed and only then the orders from the group where an order was executed are cancelled.

To turn the above strategy into a reverse strategy you need to place orders in the OCA group:

//@version=4

strategy("oca_cancel demo")

if year > 2014 and year < 2016

strategy.entry("LE", strategy.long, oca_type = strategy.oca.cancel, oca_name="Entry")

strategy.entry("SE", strategy.short, oca_type = strategy.oca.cancel, oca_name="Entry")

strategy.order and strategy.entry functions).

Every group has its own unique id, like orders. If two groups have the same id, but different type, they will be considered a different groups. Example:

//@version=4

strategy("My Script")

if year > 2014 and year < 2016

strategy.entry("Buy", strategy.long, oca_name="My oca", oca_type=strategy.oca.reduce)

strategy.exit("FromBy", "Buy", profit=100, loss=200, oca_name="My oca")

strategy.entry("Sell", strategy.short, oca_name="My oca", oca_type=strategy.oca.cancel)

strategy.order("Order", strategy.short, oca_name="My oca", oca_type=strategy.oca.none)

“Buy” and “Sell” will be placed in different groups as their type is

different. “Order” will be outside of any group as its type is set to

strategy.oca.none. Moreover, “Buy” will be placed in the exit group

as exits are always placed in the strategy.oca.reduce_size type group.

Risk management

It is not easy to create a universally profitable strategy. Usually,

strategies are created for certain market patterns and can produce

uncontrollable losses when applied to other data. Therefore, stopping

auto trading when too many losses occur is important. A special group of

strategy commands help you manage risk. They all start with the

strategy.risk. prefix.

In any given strategy you can combine any number of risk management

criteria in any combination. Every risk category command is calculated

at every tick as well as at every order execution event, regardless of

the calc_on_order_fills strategy setting. There is no way to disable

any risk rule at runtime from a script. Regardless of where in the

script the risk rule is located it will always be applied unless the

line with the rule is deleted and the script is recompiled.

When a risk management rule is triggered, no orders will be generated starting from the next calculation of the script. Therefore, if a strategy has several rules of the same type with different parameters, it will stop calculating when the rule with the most strict parameters is triggered. When a strategy is stopped, all unexecuted orders are cancelled and then a market order is sent to close the position if it is not flat.

Furthermore, it is worth remembering that when using resolutions higher

than 1 day, the whole bar is considered to be 1 day for the rules

starting with prefix strategy.risk.max_intraday_.

Example (MSFT, 1):

//@version=4

strategy("multi risk demo", overlay=true, pyramiding=10, calc_on_order_fills = true)

if year > 2014

strategy.entry("LE", strategy.long)

strategy.risk.max_intraday_filled_orders(5)

strategy.risk.max_intraday_filled_orders(2)

The position will be closed and trading will be stopped until the end of every trading session after two orders are executed within this session, as the second rule is triggered earlier and is valid until the end of the trading session.

One should remember that the strategy.risk.allow_entry_in rule is

applied to entries only so it will be possible to enter in a trade using

the strategy.order command, as this command is not an entry command

per se. Moreover, when the strategy.risk.allow_entry_in rule is

active, entries in a “prohibited trade” become exits instead of

reverse trades.

Example (MSFT, 1D):

//@version=4

strategy("allow_entry_in demo", overlay=true)

if year > 2014

strategy.entry("LE", strategy.long, when=strategy.position_size <= 0)

strategy.entry("SE", strategy.short, when=strategy.position_size > 0)

strategy.risk.allow_entry_in(strategy.direction.long)

As short entries are prohibited by the risk rules, long exit trades will be made instead of reverse trades.

Currency

TradingView strategies can operate in a currency that is different from

the instrument’s currency. Net Profit and Open Profit are

recalculated in the account currency. Account currency is set in the

strategy properties’ Base Currency drop-down list or in the script

via the strategy(..., currency=currency.*) parameter. Performance

report values are calculated in the selected currency.

Trade profit (open or closed) is calculated based on the profit in the instrument currency multiplied by the cross-rate on the close of the trading day previous to the bar where the strategy is calculated.

Example: we trade EURUSD, D and have selected currency.EUR as the

strategy currency. Our strategy buys and exits the position using 1

point profit target or stop loss.

//@version=4

strategy("Currency test", currency=currency.EUR)

if year > 2020

strategy.entry("LE", true, 1000)

strategy.exit("LX", "LE", profit=1, loss=1)

profit = strategy.netprofit

plot(abs((profit - profit[1])*100), "1 point profit", color=color.blue, linewidth=2)

plot(1 / close[1], "prev usdeur", color=color.red)

After adding this strategy to the chart we can see that the plot lines are matching. This demonstrates that the rate to calculate the profit for every trade was based on the close of the previous day.

When trading on intra-day resolutions, the cross-rate on the close of the trading day previous to the bar where the strategy is calculated will be used and it will not change during the trading session.

When trading on resolutions higher than 1 day, the cross-rate on the close of the trading day previous to the close of the bar where the strategy is calculated will be used. Let’s say we trade on a weekly chart, then the cross rate on Thursday’s session close will always be used to calculate the profits.

In real-time, yesterday’s session close rate is used.

Leverage

When you open any position, the margin required to maintain the position will be calculated. If there are not enough funds, then a margin call occurs - the forced closure of part or all of the positions by a market order so that there is again enough funds to maintain the positions.

It is calculated by the formula:

margin = MVS * margin_percent, where margin is cash collateral for opening a position, in %, and MVS is the current market value of the security.

MVS is calculated according to the following formula: MVS = last_price * point_value * contracts.

margin_percent is a parameter that can be set in the strategy settings.

If margin == strategy.equity, then we can no longer open new positions. If margin > strategy.equity, then the margin call occurs, forcibly closing part or all of the positions until the margin < strategy.equity condition is met.