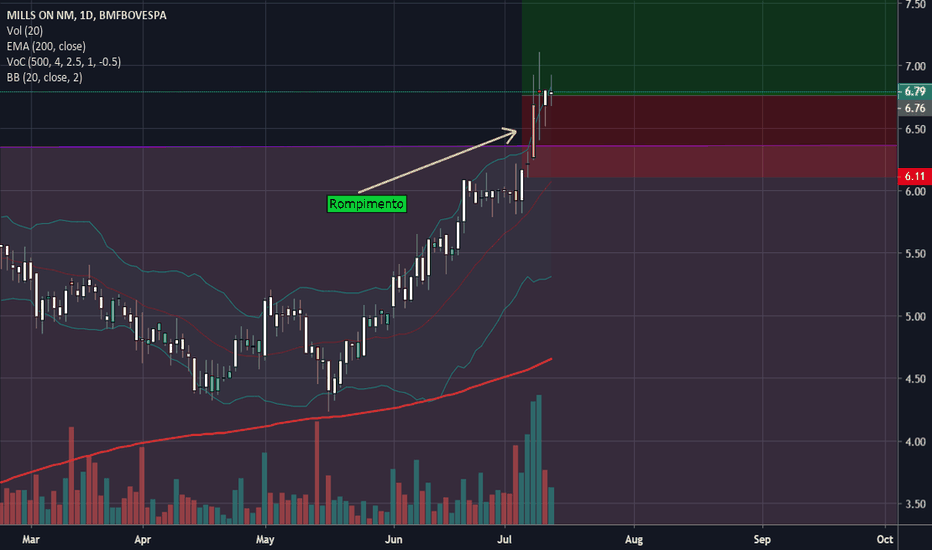

MILS3 - Saindo da zona de consolidação.Como podemos ver no gráfico, o ativo estava em uma zona de consolidação desde 2016 quando teve sua máxima nos R$ 6,40. Agora com a animação da bolsa o ativo conseguiu finalmente romper acima dessa barreira.

O volume de negociação também aumentou um pouco o que é um bom sinal. É um momento bom para

1.28BRL

277.93 MBRL

1.38 BBRL

99.43 M

About MILLS ON NM

Sector

Industry

CEO

Sérgio Kariya

Website

Headquarters

Rio de Janeiro

Employees (FY)

2.1 K

Founded

1952

ISIN

BRMILSACNOR2

FIGI

BBG000QBGBM0

Mills Locação, Serviços e Logística SA engages in the provision of infrastructure and construction solutions. Its product portfolio comprises solutions for access, scaffold, form, and shoring. It operates through the Construction and Rental segments. The company was founded by Jose Nacht in 1952 and is headquartered in Rio de Janeiro, Brazil.

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of MILS3 is 13.08 BRL — it has increased by 0.31% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on BMFBOVESPA exchange MILLS ON NM stocks are traded under the ticker MILS3.

MILLS ON NM is going to release the next earnings report on May 8, 2024. Keep track of upcoming events with our Earnings Calendar.

MILS3 stock is 0.54% volatile and has beta coefficient of 1.20. Check out the list of the most volatile stocks — is MILLS ON NM there?

One year price forecast for MILLS ON NM has a max estimate of 19.50 BRL and a min estimate of 17.00 BRL.

MILS3 earnings for the last quarter are 0.32 BRL per share, whereas the estimation was 0.26 BRL resulting in a 21.56% surprise. The estimated earnings for the next quarter are 0.37 BRL per share. See more details about MILLS ON NM earnings.

MILLS ON NM revenue for the last quarter amounts to 345.31 M BRL despite the estimated figure of 342.69 M BRL. In the next quarter revenue is expected to reach 390.00 M BRL.

Yes, you can track MILLS ON NM financials in yearly and quarterly reports right on TradingView.

MILS3 stock has fallen by 1.28% compared to the previous week, the month change is a 1.36% fall, over the last year MILLS ON NM has showed a 52.78% increase.

MILS3 net income for the last quarter is 80.86 M BRL, while the quarter before that showed 66.55 M BRL of net income which accounts for 21.50% change. Track more MILLS ON NM financial stats to get the full picture.

Today MILLS ON NM has the market capitalization of 3.15 B, it has decreased by 0.30% over the last week.

Yes, MILS3 dividends are paid annually. The last dividend per share was 0.08 BRL. As of today, Dividend Yield (TTM)% is 2.87%. Tracking MILLS ON NM dividends might help you take more informed decisions.

MILLS ON NM dividend yield was 2.75% in 2023, and payout ratio reached 27.91%. The year before the numbers were 1.87% and 20.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, MILS3 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MILLS ON NM stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 19, 2024, the company has 2.10 K employees. See our rating of the largest employees — is MILLS ON NM on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MILLS ON NM technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MILLS ON NM stock shows the buy signal. See more of MILLS ON NM technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on MILLS ON NM future price: according to them, MILS3 price has a max estimate of 19.50 BRL and a min estimate of 17.00 BRL. Read a more detailed MILLS ON NM forecast: see what analysts think of MILLS ON NM and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MILLS ON NM EBITDA is 646.60 M BRL, and current EBITDA margin is 46.93%. See more stats in MILLS ON NM financial statements.