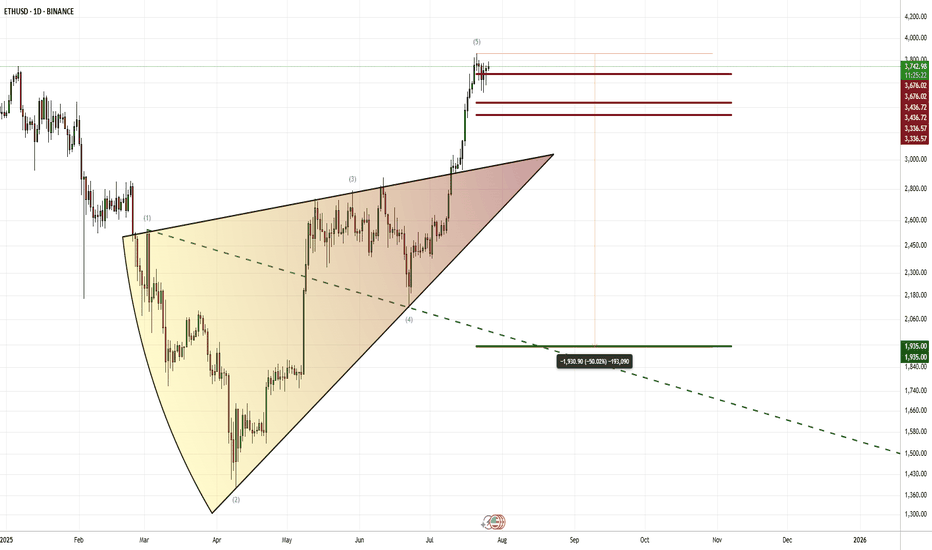

ETH | USDHello! This is my bearish scenario for ETH. If we get a weekly or monthly candle close below the red lines above, I’ll be expecting a downward phase toward the 1930 levels within 1–2 months. However, if we can close July above 3725, then my bullish outlook will remain intact.

CRYPTO:ETHUSD BINANCE:ETHUSDT BINANCE:ETHUSDT.P CRYPTOCAP:ETH.D BINANCE:ETHBTC CRYPTOCAP:ETH INDEX:ETHUSD BINANCE:ETHUSDT

Trade ideas

ETH Repeating Last Weekend's PA?This weekend's PA is very similar to last weekend, and I think we are roughly near the circled areas with respect to progression. BITSTAMP:ETHUSD is at high risk area to open new positions and it would be safer once the 3900 level is broken on volume. If we break 3900, then it should be fairly easy to reach 4000 but there is a confluence of resistance there, so I expect a pause/temporary reversal.

Current Trades

Spot

Entry: 3700

TP: ~4030 (.618 fib) unless it breaks on volume, then ~4130 (.768 fib)

SL: 3795

Perps (20x long)

Entry: 3842

TP: same as above

SL: 3830

the real question is what happens to $ETH at ATH?eth is currently holding above the quarter channel with resistance above between 3500-ATH

there is a potential moonshot to 7k and beyond (13k?), if the markets are indeed in the infant stage of a bull run.

for now eth is heading towards the golden pocket of the move down with support from ath avwap

as htf bullish market structure never broke this could mean that the highs are ran, rsi has bounced the mid point and could be cruising towards the cook zone again, its here i will watch to see a divergence form when the 3M OB and yearly level is approached.

upside 3500, 4500/ATH, 7000, 130000

downside 1900, 1200, 800

its quite possible that we put in a long term range drifting between 5k and 1k before we see expansion upwards

nfa, just food for thought on the htf but most of the volume is supporting price.

ETHEREUM: $4,250 Target in Sight Amid Wide Consolidation 📈ETHEREUM is currently undergoing a consolidation phase.

The price is stuck within a wide horizontal channel on the 4-hour timeframe.

We see a strong positive bullish reaction at its support level, leading to a bounce and the formation of a minor resistance.

The violation of this minor resistance indicates a change of character, suggesting a high probability of local buyer dominance.

Our target is at 4250 range resistance.

ETH/USD Short Setup: Bearish Reversal Toward $3,830 TargetA short (sell) trade setup for Ethereum (ETH/USD).

The entry zone is around $3,870–$3,880.

The stop loss is set at $3,909.71, protecting against upside breakouts.

The target is $3,830.85, suggesting a downside move of about $40.

The price action and drawn arrow indicate expectations of a bearish move after a small consolidation

ETH Ethereum Analysis: Waiting for Confirmation at a Key Level📊 Currently analyzing Ethereum (ETH) — on the 4H timeframe, price action has broken structure and tapped into a major external range high, aligning perfectly with a significant resistance zone. ⚡

When we zoom into the 30-minute chart, applying tools like the Anchored VWAP and Volume Profile, we can clearly observe a deep retracement beneath both the VWAP and a key value area. This suggests a period of indecision where price could break in either direction — 🚀 a clean breakout above may trigger a long opportunity, while a rejection and move lower could present a short setup.

At this stage, patience is key — we’re simply waiting for the market to reveal its hand before committing to a bias. 🎯

📉 Disclaimer: This analysis is for educational purposes only and not financial advice. Always conduct your own research before trading.

ETH/USD (Ethereum vs. U.S. Dollar) 1-hour chart....ETH/USD (Ethereum vs. U.S. Dollar) 1-hour chart on TradingView, using the Ichimoku Cloud indicator.

Here’s what can be observed:

The current price is around $3,857.

There’s a descending trendline that has been broken to the upside — a potential bullish signal.

The price is inside the Ichimoku cloud, suggesting consolidation or a possible trend reversal.

Two target levels are marked on my chart:

First Target Point around $3,960 – $3,980

Second Target Point around $4,200 – $4,220

✅ Summary of Target Levels:

Target 1: ≈ $3,960

Target 2: ≈ $4,200

These appear to be my measured move or resistance targets based on the breakout projection from the cloud or prior swing levels.

Ethereum Wave Analysis – 31 October 2025- Ethereum reversed from support level 3800.00

- Likely to rise to resistance level 4200.00

Ethereum cryptocurrency recently reversed from the key support level 3800.00 (which has been reversing the price from the start of October) intersecting with the support trendline of the daily down channel from August and the support trendline from June.

The upward reversal from the support level 3800.00 stopped the previous short term correction ii – which is a part of the impulse waves 3 and (3).

Given the clear daily uptrend, Ethereum cryptocurrency can be expected to rise toward the next resistance level 4200.00, which stopped the previous waves 1 and i.

40% November Candle coming!!!Welcome to the second part of my thesis. This section takes a short-term view of price action. Several key factors support a +40% ETH rally in November, let's break them down:

LIQUIDITY: The past two months have delivered choppy price action. ETH repeatedly swept prior lows while failing to print higher highs. This reinforces short-term bearish sentiment, yet the long-term uptrend remains intact. Such consolidation is classic liquidity engineering in a bull market, its sole purpose is to harvest stops and shake out weak hands.

Key KPI: Record Liquidations – Over $2.1B in total crypto liquidations since September (per Coinglass), with $1.4B longs wiped in October alone—the highest two-month cascade on record. This flushed leveraged bulls and primed sideline capital. Short-term sentiment is now deeply pessimistic (Fear & Greed Index at 25), positioning the market for a mean-reversion squeeze.

I don’t expect a vertical moonshot. A steady grind of fifteen +3% days (average daily gain needed: 1.8%) compounds to +40% by month-end—entirely achievable in a low volatility breakout.

INCREASING SHORT INTEREST: Crypto is a short-horizon arena dominated by retail and algo traders. Prolonged sideways action erodes conviction, pushing participants to flip bearish out of boredom. Rising short interest creates upside liquidity pools—the market always hunts the crowd.

Key KPI: Perpetual futures funding rates flipped negative (-0.05% 8h avg on Binance/Bybit) for the first time since July, while open interest rose 12% amid flat price. Uptober bulls are capitulating; short interest hit a 3-month high (45% of OI on major exchanges). Exhaustion of sell pressure is imminent.

HIGHER LOW: ETH defended the mid October low on multiple retests, forming a clear higher low on the daily timeframe. This signals bearish momentum exhaustion, dips are now absorption zones, not breakdowns.

In summary: Extreme liquidations have cleared the runway, negative funding rates stack shorts for a squeeze, and structural higher lows prove demand dominance. November’s catalyst stack (Pectra + post-election clarity) meets a technically washed-out market. The +40% move isn’t hope, it’s probability.

Technical analysis for ETH nov 2025There is a historic fair value gap between 3700 and 4300 which the recent drop from 4300 is moving inside. We see four well defined bases and rallies starting from the historically established 3700 level, Looking to the williams vix fix we see moderately strong buying at the 3700 level.

The expectation would be that we see an immediate rally back to the rally neckline at 3900 but it's also reasonable to see a lot of ranging between the current price (3800) and the 100hr moving average. This is because the market must establish more confidence in the rally neckline before moving higher. Once a base at 4000 is established we'll see a medium term-fair value gap fill back to 4300.

+40% CANDLE IN NOVEMBER FOR ETH!!!This is going to be the first of my two-part thesis on why I believe ETH is set up for a +40% rally in November. First, the fundamentals:

**FED RATE CUT TRAP:** It might be hard to notice we are in a rate cut cycle, as crypto prices seem to have ignored the core thesis that money is getting cheaper and assets should be worth more. Well, this isn’t the first time we’ve gone in the opposite direction in the middle of a rate cut cycle. Back in September 2024, the Fed cut rates by 50 bps, and the crypto market had a meh reaction to it. Another 25 bps cut was expected in early November and wasn’t priced in during October. ETH gained and lost roughly 3% in both months. Basically, my point is that the correlation between rates and crypto isn’t uncommon, but it’s usually an anomaly that never lasts. Some call it manipulation; I call it MARKET FORCES.

**WALL STREET IS BUILDING ON THE ETHEREUM NETWORK:** Ethereum has the largest share of tokenized assets. This only means there is strong demand for ETH beyond speculation. I believe dips should have been more painful if Wall Street wasn’t scooping up excess supply.

**ETH Pectra UPGRADE (formerly "Fukasa"):** Scheduled for early November 2025, Pectra combines Prague (execution) and Electra (consensus) upgrades which results in lower issuance, higher staking, and stronger institutional tooling.

Why +40% in November?

Timing Catalyst: The upgrade activates right after the U.S. election dust settles (Nov 5), giving the market a clean macro window to front-run the narrative.

Supply Shock: Pectra’s staking reforms are expected to push staking participation from ~28% to 35%+ within 60 days (per Lido/Figment forecasts), pulling ~2.5M ETH off exchanges. Combined with blob fee burns, issuance drops to its lowest post-Merge level.

The rate-cut “trap” was just the market mispricing cheaper capital; Pectra is the technical trigger that turns latent institutional balance sheets into aggressive ETH bids. November is when the flywheel spins.

BULLISH MOMENTUM AIMING FOR KEY RESISTANCR BREAKOUTTechnical Analysis:

Market Structure:

Ethereum has shown a clear change of character (CHoCH) around the $4,080 level, confirming a bullish shift in structure after consolidating for several sessions between $3,900 and $4,100.

Trend:

The pair is now in a strong ascending channel, with a clear parabolic curve supporting the recent rally. Price action has been consistently forming higher lows, indicating healthy momentum from buyers.

Support Zone:

Primary Support: $3,700 – $3,750

Intermediate Support: $4,050 – $4,080

These areas are key for potential pullbacks before further continuation upward.

Resistance Zone:

The main resistance lies at $4,280 – $4,330, marked by previous structural highs and supply zone rejection.

A clean break and retest above $4,330 could open the path toward $4,450 – $4,500.

Momentum & Volume:

The bullish impulse leg highlighted in blue shows strong momentum with minimal retracement, suggesting institutional participation or aggressive buying pressure.

Projection:

Short-term expectation is a minor pullback around $4,200 – $4,150, followed by another push upward toward the resistance zone ($4,300 – $4,350).

ETHUSD Neutral bias remains intact above 3,723The ETHUSD remains in a neutral trend, with recent price action indicating a corrective pullback within the broader trading range.

Support Zone: 3,723 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3,723 would confirm ongoing upside momentum, with potential targets at:

4,020 – initial resistance

4,118 – psychological and structural level

4,210 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3,723 would weaken the bullish outlook and suggest deeper downside risk toward:

3,620 – minor support

3,520 – stronger support and potential demand zone

Outlook:

Neutral bias remains intact while the ETHUSD holds above 3,723. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETH >>>>>>> ShortIn the 12-month cyclical pattern of Ethereum, I foresee a downward trend developing during 2026 and 2027.

Based on the recurring structure of Ethereum’s price movements and its historical cycle behavior, I’ve identified three potential levels (or “steps”) of decline that could act as key support zones during this corrective phase.

These three steps represent possible stages where:

The first pullback may begin .. a short-term correction or initial cooldown.

The second step could serve as a consolidation or mid-cycle stabilization area.

The third step may form the major cycle bottom, where market accumulation begins and prepares for the next upward phase.

Overall, this outlook is derived from Ethereum’s repeating annual patterns, historical cycle analysis, and its correlation with broader crypto-market dynamics.

Therefore, I expect a corrective and accumulation phase throughout 2026–2027, potentially setting the stage for Ethereum’s next major rally once the cycle resets.

ETH Outlook after the Dip. What to expect NOW?Finally, the price broke the wedge, and the price experienced a significant drop. I think now is the time for ETH to rise again to 1900 . STRONG SUPPORT 1400 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!