ALPN and VRTX may merge surge of bullish momentum LONGAlpine is a biotech stock that had an earnings report beating estimates two weeks ago. It

is now reaching for all-time highs. That said, it is burning cash just slowing down the burn.

Both revenue and earnings showed remarkable improvement as compared with the previous

quarter. The bullish moment

−0.69USD

−32.18 MUSD

58.88 MUSD

47.05 M

About Alpine Immune Sciences, Inc.

Sector

Industry

CEO

Mitchell H. Gold

Website

Headquarters

Seattle

Employees (FY)

142

Founded

2007

ISIN

US02083G1004

FIGI

BBG001J2LL66

Alpine Immune Sciences, Inc. is a clinical-stage biopharmaceutical company, which focusses on discovering and developing innovative, protein-based immunotherapies to treat autoimmune and inflammatory diseases. Its product pipeline includes inflammatory diseases, immuno-oncology, and engineered cellular therapies. The company was founded in March 2007 and is headquartered in Seattle, WA.

Vertex Pharmaceuticals Set to Buy Alpine Sciences For $4.9 BlnIn a strategic move set to shake up the biotech landscape, Vertex Pharmaceuticals ( NASDAQ:VRTX ) has announced its acquisition of Alpine Immune Sciences ( NASDAQ:ALPN ) in a blockbuster $4.9 billion deal. The news, which sent shockwaves through the market, made Alpine Immune Sciences ( NASDAQ:ALPN

$ALPN confluence of supportSimilar to my recent SGMO idea, my view is that aVWAP support, 50% retracement and 50 day EMA support make a strong case that a relative low is in and higher prices are soon to come. For ALPN, the aVWAP cluster from recent significant lows/highs all cluster in a tight range in the mid 11s, which is

Option and License AgreementAlpine Immune Sciences and AbbVie Announce Option and License Agreement for the Development and Commercialization of ALPN-101

Alpine Immune Sciences grants AbbVie option to license worldwide rights to ALPN-101, a phase 2-ready, first-in-class dual CD28/ICOS costimulation antagonist, building on Abb

Watching $ALPN --> $4.20 TargetFirst off, please don't take anything I say seriously or as financial advice. As always, this is on opinion based basis. That being said, given the current Alpine price, analyst have been giving it a strong buy rating and it looks like it is having a retracement of around early 2020 price. I think a

$ALPN Upside Targets Alpine Immune Sciences, Inc. is a development-stage pharmaceutical company. The firm engages in the discovering of protein-based immunotherapies therapies targeting the immune synapse to treat cancer, autoimmune, and inflammatory disorders. It offers Immunotherapy, Immune Synapse, vIgD Platform Tech

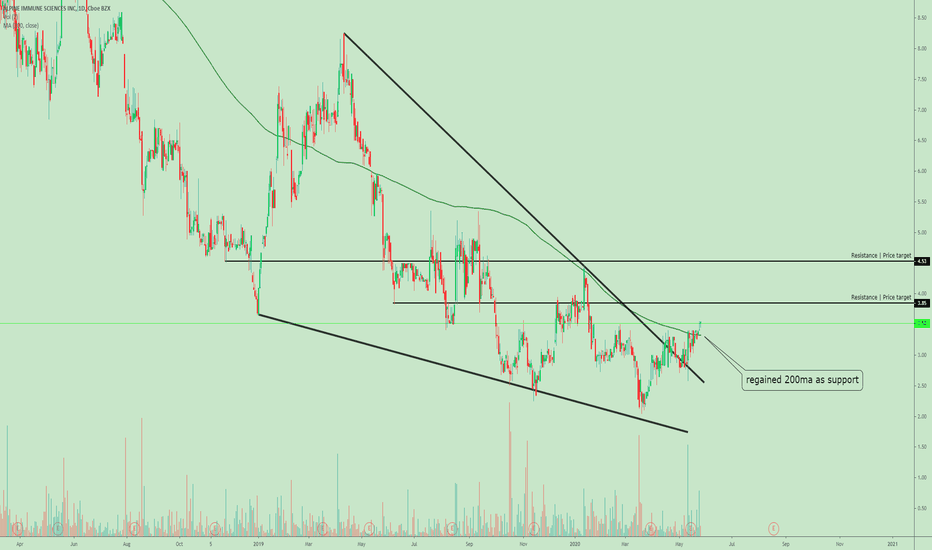

Alpine Immune Science Inc on Breakout watch $alpnTechnically setting up for breakout.

200ma may be break.

Downtrend approaching.

RSI just crossed mid point.

MACD reversing off Zero line as Histogram ticks higher

Average analysts price target $11 ! Buy

Company profile

Alpine Immune Sciences, Inc. is a development-stage pharmaceutical company. The

ALPN - One Target Hit. Going Again.Alpine Immune Sciences, Inc. is a development-stage pharmaceutical company, which engages in the discovering of protein-based immunotherapies therapies targeting the immune synapse to treat cancer, autoimmune, and inflammatory disorders. It offers Immunotherapy, Immune Synapse, vIgD Platform Technol

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of ALPN is 64.43 USD — it has decreased by 0.05% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Alpine Immune Sciences, Inc. stocks are traded under the ticker ALPN.

Alpine Immune Sciences, Inc. is going to release the next earnings report on May 9, 2024. Keep track of upcoming events with our Earnings Calendar.

ALPN stock is 0.09% volatile and has beta coefficient of 3.33. Check out the list of the most volatile stocks — is Alpine Immune Sciences, Inc. there?

One year price forecast for Alpine Immune Sciences, Inc. has a max estimate of 65.00 USD and a min estimate of 65.00 USD.

ALPN earnings for the last quarter are −0.24 USD whereas the estimation was −0.33 USD which accounts for 28.21% surprise. Estimated earnings for the next quarter are −0.33 USD. See more details about Alpine Immune Sciences, Inc. earnings.

Alpine Immune Sciences, Inc. revenue for the last quarter amounts to 10.04 M USD despite the estimated figure of 7.25 M USD. In the next quarter revenue is expected to reach 9.10 M USD.

Yes, you can track Alpine Immune Sciences, Inc. financials in yearly and quarterly reports right on TradingView.

ALPN stock has risen by 0.39% compared to the previous week, the month change is a 72.27% rise, over the last year Alpine Immune Sciences, Inc. has showed a 762.52% increase.

ALPN net income for the last quarter is 5.96 M USD, while the quarter before that showed −11.72 M USD of net income which accounts for 150.84% change. Track more Alpine Immune Sciences, Inc. financial stats to get the full picture.

Today Alpine Immune Sciences, Inc. has the market capitalization of 4.23 B, it has decreased by 1.73% over the last week.

No, ALPN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, ALPN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alpine Immune Sciences, Inc. stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 19, 2024, the company has 142.00 employees. See our rating of the largest employees — is Alpine Immune Sciences, Inc. on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alpine Immune Sciences, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alpine Immune Sciences, Inc. stock shows the strong buy signal. See more of Alpine Immune Sciences, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on Alpine Immune Sciences, Inc. future price: according to them, ALPN price has a max estimate of 65.00 USD and a min estimate of 65.00 USD. Read a more detailed Alpine Immune Sciences, Inc. forecast: see what analysts think of Alpine Immune Sciences, Inc. and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alpine Immune Sciences, Inc. EBITDA is −43.67 M USD, and current EBITDA margin is −74.18%. See more stats in Alpine Immune Sciences, Inc. financial statements.