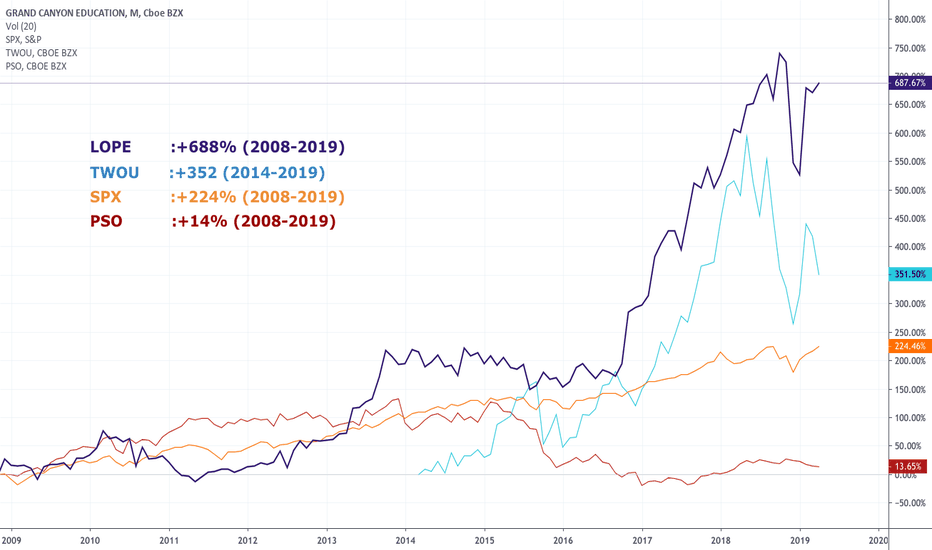

Grand Canyon Education I am impressed with this company, and I like it a lot - I have been researching it for some time now, and today I have finally decided to take a position in to it after this last big dip. The share price may still run lower in the short term, but long term I think it will continue to make new highs.

6.85USD

204.99 MUSD

960.90 MUSD

29.37 M

About Grand Canyon Education, Inc.

Sector

CEO

Brian E. Mueller

Website

Headquarters

Phoenix

Employees (FY)

5.8 K

Founded

2003

ISIN

US38526M1062

FIGI

BBG000FV28W9

Grand Canyon Education, Inc. engages in the provision of education services. It offers graduate and undergraduate degree programs and certificates across colleges. The company was founded by Christopher C. Richardson and Brent D. Richardson in November 2003 and is headquartered in Phoenix, AZ.

Grand Canyon Education $LOPE$LOPE is just below the 50SMA on weekly and RSI is above 50. It seems that it is forming Head and Shoulders,inverted. the right shoulder is missing though. To confirm the pattern needs to pull back and back above $98.93.

If you find my charts useful, please leaver me a "like"

thx

UpTrend Still valid, to be tested soon.#LOPE - We had a signal on Dec. 12. +9% so far.

There is a signal of recovery after the most recent performance.

There is a gap up still open. It must be closed in order to continue the up trend just started.

The upward trend may be tested soon, near the green trend-line.

Important news on Feb. 18.

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of LOPE is 127.63 USD — it has decreased by 2.63% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Grand Canyon Education, Inc. stocks are traded under the ticker LOPE.

Grand Canyon Education, Inc. is going to release the next earnings report on May 7, 2024. Keep track of upcoming events with our Earnings Calendar.

LOPE stock is 3.48% volatile and has beta coefficient of 1.00. Check out the list of the most volatile stocks — is Grand Canyon Education, Inc. there?

One year price forecast for Grand Canyon Education, Inc. has a max estimate of 165.00 USD and a min estimate of 150.00 USD.

LOPE earnings for the last quarter are 1.26 USD per share, whereas the estimation was 1.09 USD resulting in a 15.95% surprise. The estimated earnings for the next quarter are 2.72 USD per share. See more details about Grand Canyon Education, Inc. earnings.

Grand Canyon Education, Inc. revenue for the last quarter amounts to 221.91 M USD despite the estimated figure of 219.61 M USD. In the next quarter revenue is expected to reach 275.23 M USD.

Yes, you can track Grand Canyon Education, Inc. financials in yearly and quarterly reports right on TradingView.

LOPE stock has fallen by 3.30% compared to the previous week, the month change is a 3.87% fall, over the last year Grand Canyon Education, Inc. has showed a 9.40% increase.

LOPE net income for the last quarter is 80.71 M USD, while the quarter before that showed 35.74 M USD of net income which accounts for 125.83% change. Track more Grand Canyon Education, Inc. financial stats to get the full picture.

Today Grand Canyon Education, Inc. has the market capitalization of 3.93 B, it has decreased by 2.75% over the last week.

No, LOPE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, LOPE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Grand Canyon Education, Inc. stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 19, 2024, the company has 5.80 K employees. See our rating of the largest employees — is Grand Canyon Education, Inc. on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Grand Canyon Education, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Grand Canyon Education, Inc. stock shows the buy signal. See more of Grand Canyon Education, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on Grand Canyon Education, Inc. future price: according to them, LOPE price has a max estimate of 165.00 USD and a min estimate of 150.00 USD. Read a more detailed Grand Canyon Education, Inc. forecast: see what analysts think of Grand Canyon Education, Inc. and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Grand Canyon Education, Inc. EBITDA is 281.23 M USD, and current EBITDA margin is 29.27%. See more stats in Grand Canyon Education, Inc. financial statements.