No prediction, just hope. GRCU pot stockAll I'm sayin is that it looks hopeful to have bottomed. One could plead the case of bullish divergence. With legalization in the cards this year, maybe this is a dark horse but it's too soon to tell. I love to draw predictions but I don't really have a lot to work with here. This is one of my long

0.0001USD

408.83 KUSD

2.25 MUSD

4.28 B

About Green Cures & Botanical Distribution Inc.

Sector

CEO

Robert Tanko

Headquarters

Denver

Website

Founded

1986

ISIN

US3930072083

FIGI

BBG000DN29L9

Global Roundtable Corp. engages in development, distribution and wholesale of hemp-infused nutritional, botanical, sports, and body care products. Its brands include Hollywood Green Vodka and Contagin Gin. The company was founded on September 22, 1986 and is headquartered in Denver, CO.

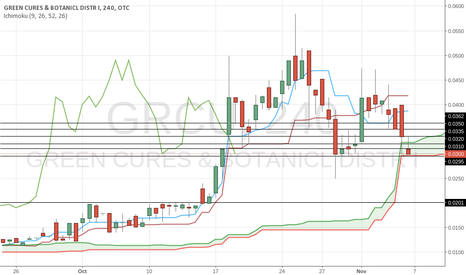

If price gets under 0.0295 then that'd be bearish confirmationScenario :

If price (and LS) in 4 hour timeframe gets under 0.0295 then that would be a confirmation of bearish trend.

If price (and LS) in 4 hour timeframe does not get under 0.0295 than further analysis to be done

If price gets under 0.0295 then next potential support would be 0.0201

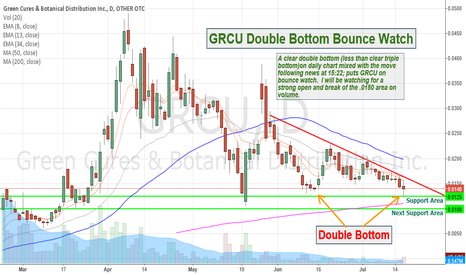

GRCU Double Bottom Bounce WatchClear Double Bottom; Less than clear triple bottom on daily chart. News released on 15:22 today caused a nice move into close. There was a low volume selloff to close at .0140 red on the day. I will be watching for a strong open and break of .0150 area on volume to break above down trend line.

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of GRCU is 0.0001 USD — it has increased by 50.00% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Green Cures & Botanical Distribution Inc. stocks are traded under the ticker GRCU.

Green Cures & Botanical Distribution Inc. is going to release the next earnings report on May 29, 2024. Keep track of upcoming events with our Earnings Calendar.

GRCU stock is 100.00% volatile and has beta coefficient of 1.62. Check out the list of the most volatile stocks — is Green Cures & Botanical Distribution Inc. there?

Yes, you can track Green Cures & Botanical Distribution Inc. financials in yearly and quarterly reports right on TradingView.

GRCU stock hasn't changed in a week, the month change is a 50.00% rise, over the last year Green Cures & Botanical Distribution Inc. has showed a 76.92% decrease.

GRCU net income for the last quarter is 288.37 K USD, while the quarter before that showed 336.73 K USD of net income which accounts for −14.36% change. Track more Green Cures & Botanical Distribution Inc. financial stats to get the full picture.

No, GRCU doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, GRCU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Green Cures & Botanical Distribution Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Green Cures & Botanical Distribution Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Green Cures & Botanical Distribution Inc. stock shows the sell signal. See more of Green Cures & Botanical Distribution Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Green Cures & Botanical Distribution Inc. EBITDA is 483.27 K USD, and current EBITDA margin is 21.47%. See more stats in Green Cures & Botanical Distribution Inc. financial statements.