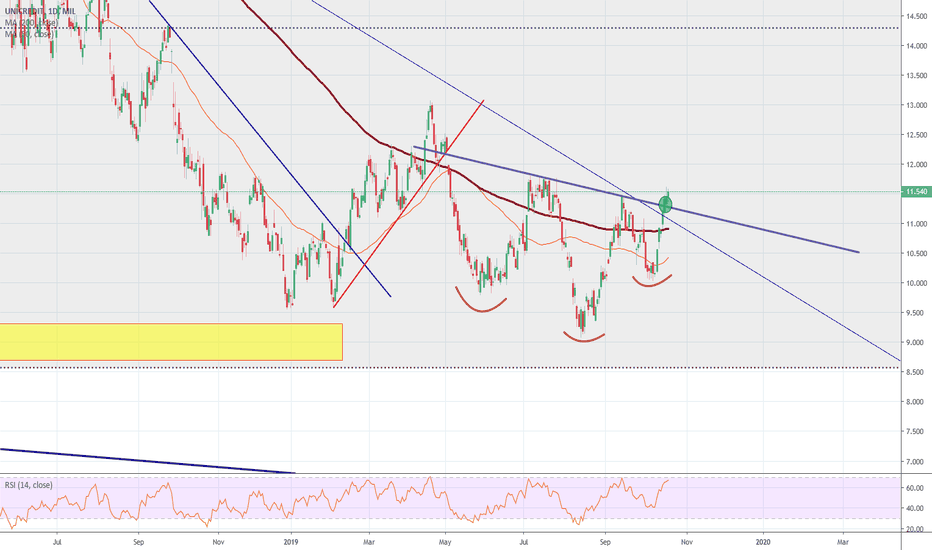

UCG Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

T

5.80USD

10.50 BUSD

51.62 BUSD

1.48 B

About UniCredito Spa

Sector

Industry

CEO

Andrea Orcel

Website

Headquarters

Milan

Employees (FY)

72.08 K

Founded

1870

ISIN

IT0005239360

FIGI

BBG000BSZNS6

UniCredit SpA engages in the provision of banking and financial solutions. It operates through the following geographical segments: Italy, Germany, Central Europe, Eastern Europe, Russia, and Group Corporate Centre. The company was founded in 1870 and is headquartered in Milan, Italy.

6000 employees cut from UnicreditAnother bank, the same story "The Italian bank may lose as many as 10,000 staff in a new strategic plan." It just proves that the banking sector continues to suffer... only a few will survive. For that, they need to restructure and optimize the service.

UniCredit joins other large European banks s

Sell: it's retesting the 12.800 resistanceThe 12.800 has being retested and with very little volumes going to that direction.

There's the potential for a sell-off. The ratio reward/risk it's pretty high since we are close to 12.800 and a good stop loss would be 12.900 - 13.000, while it could go down for much more.

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of UNCFF is 37.55 USD — it has increased by 1.95% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange UniCredito Spa stocks are traded under the ticker UNCFF.

UniCredito Spa is going to release the next earnings report on May 7, 2024. Keep track of upcoming events with our Earnings Calendar.

UNCFF stock is 2.38% volatile and has beta coefficient of 0.88. Check out the list of the most volatile stocks — is UniCredito Spa there?

UNCFF earnings for the last quarter are 1.31 USD per share, whereas the estimation was 1.11 USD resulting in a 17.81% surprise. The estimated earnings for the next quarter are 0.84 USD per share. See more details about UniCredito Spa earnings.

UniCredito Spa revenue for the last quarter amounts to 6.31 B USD despite the estimated figure of 6.13 B USD. In the next quarter revenue is expected to reach 6.16 B USD.

Yes, you can track UniCredito Spa financials in yearly and quarterly reports right on TradingView.

UNCFF stock has risen by 4.01% compared to the previous week, the month change is a 2.52% rise, over the last year UniCredito Spa has showed a 81.48% increase.

UNCFF net income for the last quarter is 3.10 B USD, while the quarter before that showed 2.45 B USD of net income which accounts for 26.40% change. Track more UniCredito Spa financial stats to get the full picture.

Today UniCredito Spa has the market capitalization of 61.13 B, it has decreased by 2.26% over the last week.

Yes, UNCFF dividends are paid annually. The last dividend per share was 1.92 USD. As of today, Dividend Yield (TTM)% is 2.89%. Tracking UniCredito Spa dividends might help you take more informed decisions.

UniCredito Spa dividend yield was 7.34% in 2023, and payout ratio reached 34.65%. The year before the numbers were 7.44% and 32.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, UNCFF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UniCredito Spa stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 23, 2024, the company has 72.08 K employees. See our rating of the largest employees — is UniCredito Spa on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UniCredito Spa technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UniCredito Spa stock shows the buy signal. See more of UniCredito Spa technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on UniCredito Spa future price: according to them, UNCFF price has a max estimate of 50.46 USD and a min estimate of 35.14 USD. Read a more detailed UniCredito Spa forecast: see what analysts think of UniCredito Spa and suggest that you do with its stocks.