TILT's New Partnership: This Time With the Shinnecock Indian NaTILT Holdings Inc. (NEO: TILT) (OTCQX:TLLTF), a global provider of cannabis business solutions including inhalation technologies, cultivation, manufacturing, processing, brand development and retail, has formed a new partnership with Little Beach Harvest, a brand-new cannabis business entirely owned

−0.1674USD

−63.53 MUSD

169.00 MUSD

314.62 M

About Tilt Holdings Inc.

Sector

Industry

CEO

Timothy Conder

Website

Headquarters

Phoenix

Employees (FY)

358

Founded

2017

FIGI

BBG00MQLR694

TILT Holdings, Inc. engages in the provision of software solutions for the cannabis industry in USA and Canada. It operates through the following segments: Technology/Distribution, Cannabis, Accessories, and Corporate. The Technology/Distribution segment includes Baker, Blackbird, and Briteside. The Cannabis segment is comprised of SVH, Sea Hunter and Standard Farms. The Accessories segment covers Jupiter. The Corporate segment is comprised of White Haven. The company was founded on September 20, 2017 and is headquartered in Phoenix, AZ.

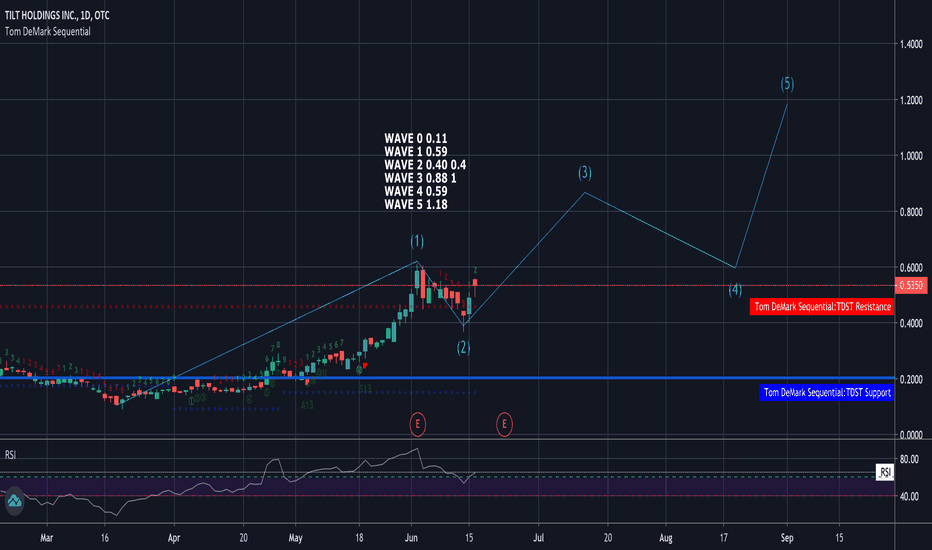

Trade $TLLTF like an option, but it's a stockTilt Holdings ( TLLTF : www.tradingview.com ) is a marijuana stock that currently trades at a price similar to an option. I like to trade TD D-Waves 3 and 5 and it appears to me this stock is just now entering Wave 3 and with a bang. Retracement levels from the Wave 0 to the peak of Wave 1 sugges

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Curated watchlists where TLLTF is featured.

Frequently Asked Questions

The current price of TLLTF is 0.0290 USD — it has decreased by 4.29% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Tilt Holdings Inc. stocks are traded under the ticker TLLTF.

Tilt Holdings Inc. is going to release the next earnings report on May 13, 2024. Keep track of upcoming events with our Earnings Calendar.

TLLTF earnings for the last quarter are −0.02 USD per share, whereas the estimation was −0.02 USD resulting in a −42.67% surprise. The estimated earnings for the next quarter are −0.01 USD per share. See more details about Tilt Holdings Inc. earnings.

Tilt Holdings Inc. revenue for the last quarter amounts to 44.60 M USD despite the estimated figure of 42.68 M USD. In the next quarter revenue is expected to reach 43.00 M USD.

Yes, you can track Tilt Holdings Inc. financials in yearly and quarterly reports right on TradingView.

TLLTF stock has fallen by 6.45% compared to the previous week, the month change is a 12.84% rise, over the last year Tilt Holdings Inc. has showed a 53.00% decrease.

TLLTF net income for the last quarter is −22.56 M USD, while the quarter before that showed −8.55 M USD of net income which accounts for −163.74% change. Track more Tilt Holdings Inc. financial stats to get the full picture.

No, TLLTF doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, TLLTF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tilt Holdings Inc. stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 23, 2024, the company has 358.00 employees. See our rating of the largest employees — is Tilt Holdings Inc. on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tilt Holdings Inc. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tilt Holdings Inc. stock shows the sell signal. See more of Tilt Holdings Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tilt Holdings Inc. EBITDA is −9.20 M USD, and current EBITDA margin is −8.80%. See more stats in Tilt Holdings Inc. financial statements.