Equity Put Call ratio - thoughtsEquity Put Call Ratio spiked 5 times and remained above average for 28 trading days (or 38 calendar days) during the initial q1 2020 Covid sell off, Feb 24 to April 2nd.

Let the selling play out. Looks too early to turn bullish, but everyone appears to be rushing to the same side of the boat (and

12/23 WATCHLIST + MARKET OUTLOOK (Warning!)** THIS IS PURELY MY OPINION AND I AM NOT LIABLE FOR YOUR TRADING DECISIONS **

Very interesting day today where even though we GOT the stimulus bill, the market did not seem satisfied. We remained under the major support (now resistance) trendline in red, which has served as support since the coron

PCCE; Risk Assets "crash conditions" are met. Dump it all! SHORTHere it is, up cluse and personal.

This is the Put/Call Ratio 14 day RSI. - A highly reliable indicator of 93.8% accuracy.

Dump ALL risk assets - including the highly correlated Precious Metals!! - here!

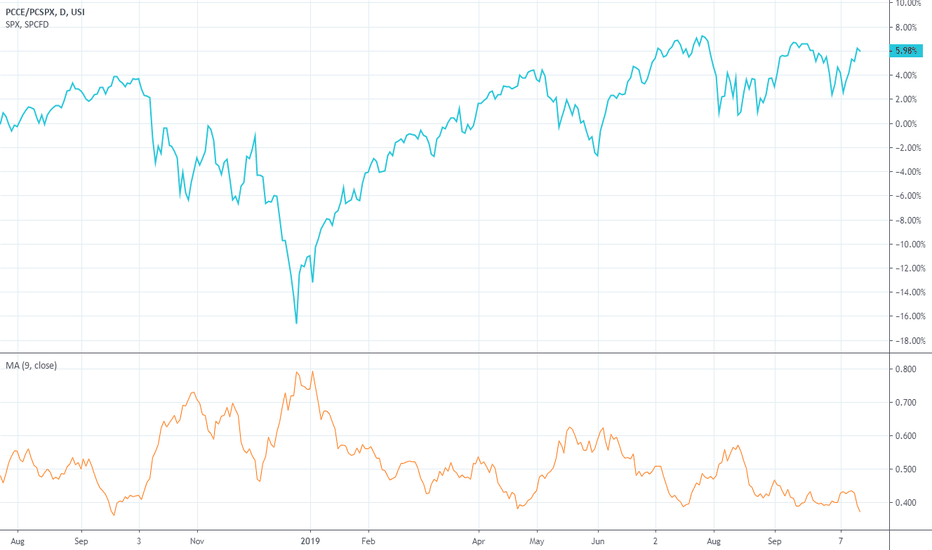

The raw PCCE

Here is the VIX

... and the FAANGs

... and the AUDUSD

... and the USD (D

PUT/CALL RATIO EQUITY MARKET WARNING SIGNALHello,

Here I've analyzed the PCCE (Put/Call Ratio Equities) in the monthly time frame.

Something extremely concerning is taking place for the coming months. We are close to hitting .45 on the put/call ratio which is in extremely overbought territory. What this means is when we are in this level,

Equity Put/Call ratio Decade lowThe Equity Put/Call ratio has reached a low not seen in the last decade. The last 2 times it got close to this low the market corrected significantly beteween 25-30%.

This may be a strong indicator of a market top - valuations in tech companies and the S&P are extremely stretched.

S&P 500 - Options Trading Volume Reveal Exuberant SentimentThe CBOE 10D Put/Call sentiment shows very upbeat sentiment among market participants. They fear on missing out a year-end rally. Unfortunately, current readings coincided with those near tops during the past 42 months. Larger corrections unfolded shortly after the reading and further upside was lim

See all ideas