Trade ideas

Western Digital.. Reversing Trend after $50? Short of the Year?Ok looking at the monthly where this is sitting at could definitely have some massive gains for the next WHILE. I personally think this may rally to $50, but after that if it can't hold this could completely break under and once it does... oh boy you could see a downtrend for .. well a while.

Let me know your thoughts. This will be a long LASTING trade .. I am not long except for this potential rally. Trade position assuming it does drop out the bottom sooner than expected. IF it doesn't rally a short could be in play extremely soon.

Western Digital Bullish Upgrade By Stifel $wdc Recent upgrade

Stifel analyst Patrick Ho upgraded Western Digital to Buy from Hold with a price target of $73, up from $63. The selloff in the shares due to the concerns related to the coronavirus situation have created an attractive entry point, Ho tells investors in a research note. While the current coronavirus situation could impact near-term estimates, Western Digital's fundamental outlook for 2020 remains intact, contends the analyst. Ho believes structural demand remains intact and near-term issues are supply constraine

Source thefly

Western Digital earnings setup

Has lagged the market considerably, still 60% of its 2018 highs, ?????

Has just topped out at top of channel resistance.

Volume is in decline.

Sentiment within the sector is bullish long term, but has wavered in recent days.

Will wait for earnings, rather miss out on 6% up than catch 10% down.

Longer term this could be a bear flag forming.

WDC for the restest (weekly chart)Liking the indicators here. We have a trigger of all 3 moving averages (circled) with a continuation bar this week. Be looking at a retest in the next couple weeks of the 65 level.

Jan 17 65 call looking to purchase on Monday for a hopeful power move next week with the Santa Rally on the front burner.

Ran too fast to soon WDC All chip makers have been soaring in the past two weeks. I expect to see a pullback soon. Therefore, I choose WDC to be one of my favorite charts to go short. It is possible the stock can run up another $3 or so, but I would be monitoring the chart for any pullback conformation, and I will ride it down into the next Support line at $75.80

$WDC Monday trade setup for Western Digital Entry level $56.70= Traget price $61.00 = Stop loss $55.67

Western Digital upgraded to Positive from Neutral at Susquehanna. Susquehanna analyst Mehdi Hosseini upgraded Western Digital (WDC) to Positive from Neutral with a price target of $90, up from $55. He expects the 5G smartphone build cycle to "start in earnest" late in the March quarter and and combining this with cuts to NAND capital expenditures and wafer starts should lead to a tight NAND supply/demand balance by the June quarter, said Hosseini, Source the fly

WDCGood spot for some mid range longs.

Pink area are targets for the longs.

Green zone good spot for entry. Although, if it reaches here, it may pull back further to teal before pushing to target zone. Orange line is stop loss for green zone entry.

Teal zone should be stronger. Red line is stop loss for teal zone entry.

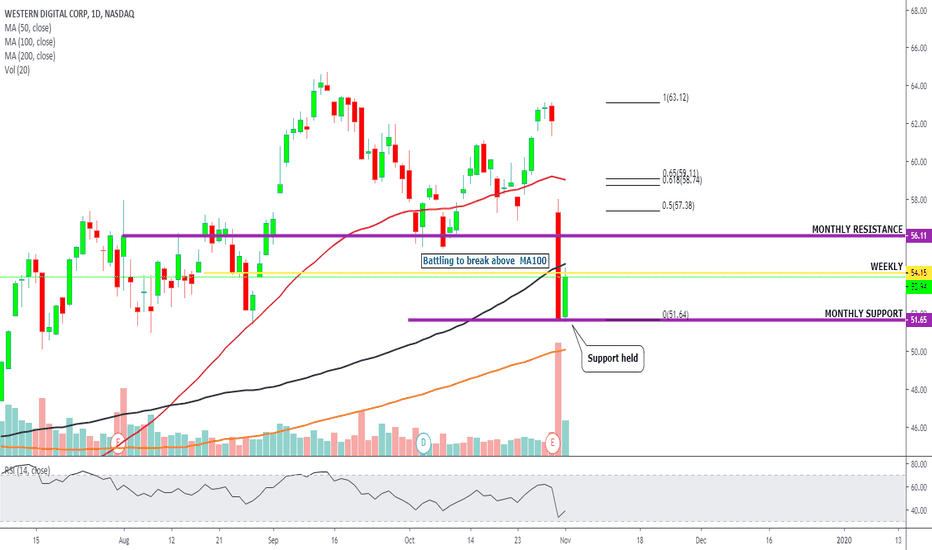

$WDC Western Digital reverses strongly. Buyers have returned today as once again optimism has returned to the market overall.

The massive selloff post earnings was overdone but found support on the monthly support level, today's bounce has found resistance at the weekly and the 100ma.

The average analysts price target remains at $63 with a overweight rating.

Short interest 4.43%

Yield a sizable 3.7%

Company profile

Western Digital Corp. engages in the development, manufacture, market and sale of data storage devices and solutions. It operates through the following product categories: client devices, data center devices and solutions, and client solutions. The client devices category includes mobile, desktop, gaming and digital video hard drives, solid state drives (SSDs), embedded products, and wafers. The data center devices and solutions category covers capacity and performance enterprise hard disk drives (HDDs), enterprise SSDs, data center software, and system solutions. The client solutions category offers removable products, hard drive content solutions, and flash content solutions. The company was founded by Alvin B. Phillips in 1970 and is headquartered in San Jose, CA.

Western Digital Corporation Possible bullish movesAs per the Chart

Abbreviations;

ND=No demand

NS= No supply

DW= Demand Wave

RFSB= Resistance from Supply Bar

SFDB support from Demand Bar

SLK= Stop Loss killer

SLKB= Stop Loss Killer Bottom

DB= Demand Bar

SB= Supply Bar

EVRB= effort vs Result Bottom

My Mentors and Inspiration

Volume Analysis - Oleg Alexandrov

Money and risk Management - Dmitriy Lavrov-