Spirit AeroSystems Holdings, Inc. designs, engineers, manufactures, and markets commercial aerostructures worldwide. It operates through three segments: Commercial, Defense & Space, and Aftermarket. The Commercial segment offers forward, mid, and rear fuselage sections and systems, struts/pylons, nacelles, and related engine structural components; and wings and...

Sleep Number Corporation, together with its subsidiaries, offers sleep solutions and services in the United States. The company designs, manufactures, markets, retails, and services beds, pillows, sheets, and other bedding products under the Sleep Number name. It also provides adjustable bases under the FlextFit, and smart beds under the Sleep Number 360 brands....

Tilray Brands Inc. engages in the research, cultivation, production, marketing, and distribution of medical cannabis products. It operates through five segments: Cannabis Business, Distribution Business, Beverage Alcohol Business, Wellness Business, and Business Under Development. The company provides medical and adult-use cannabis products; pharmaceutical and...

Nikola Corporation operates as a technology innovator and integrator that works to develop energy and transportation solutions in the United States. The company assembles, integrates, and commissions its vehicles in collaboration with its business partners and suppliers. It operates in two business units, Truck and Energy. The Truck business unit develops and...

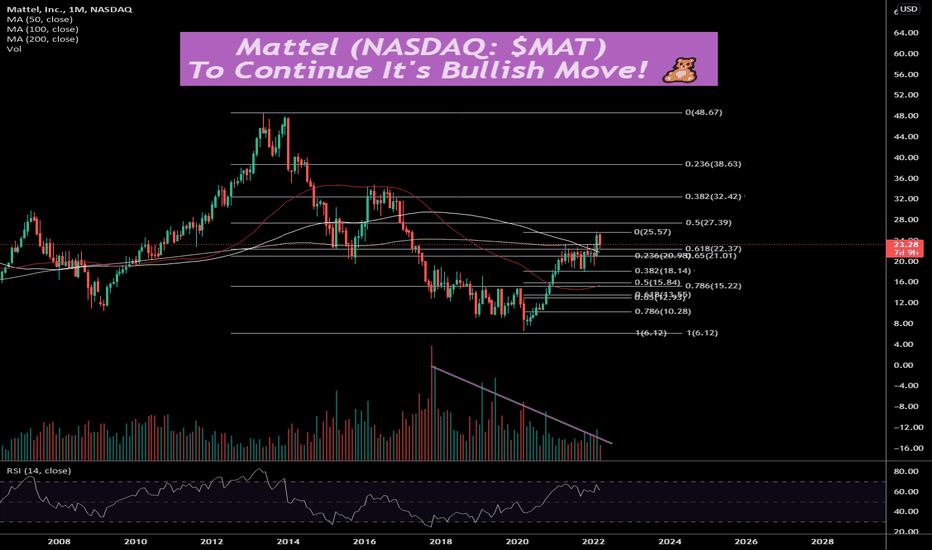

Mattel, Inc., a children's entertainment company, designs and produces toys and consumer products worldwide. The company operates through North America, International, and American Girl segments. It offers dolls and accessories, as well as content, gaming, and lifestyle products for children under the Barbie, Monster High, American Girl, Polly Pocket, Spirit, and...

GoHealth, Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: MedicareÂInternal; MedicareÂExternal; Individual and Family Plans (IFP) and OtherÂInternal; and IFP and OtherÂExternal. The company operates a technology platform that leverages machine-learning...

Hycroft Mining Holding Corporation, together with its subsidiaries, operates as a gold and silver producer in the United States. The company holds interests in the Hycroft mine covering an area of approximately 70,671 acres located in the state of Nevada. As of December 31, 2020, its Hycroft mine had proven and probable mineral reserves of 11.9 million ounces of...

NIKE, Inc., together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories worldwide. The company offers NIKE brand products in six categories, including running, NIKE basketball, the Jordan brand, football, training, and sportswear. It also markets products designed for kids, as well as for other...

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sales, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through four segments: Commercial Airplanes; Defense, Space & Security; Global Services; and...

BP p.l.c. engages in the energy business worldwide. It operates through Gas & Low Carbon Energy, Oil Production & Operations, Customers & Products, and Rosneft segments. It produces and trades in natural gas; offers biofuels; operates onshore and offshore wind power, and solar power generating facilities; and provides de-carbonization solutions and services, such...

JD.com, Inc. operates as an e-commerce company and retail infrastructure service provider in the People's Republic of China. It operates in two segments, JD Retail and New Businesses. The company offers home appliances; mobile handsets and other digital products; desktop, laptop, and other computers, as well as printers and other office equipment; furniture and...

DiDi Global Inc., a mobility technology platform, provides ride hailing and other services in the People's Republic of China, Brazil, Mexico, and internationally. It offers ride hailing, taxi hailing, chauffeur, hitch, and other forms of shared mobility services, as well as enterprise business ride solutions; auto solutions comprising leasing, refueling, and...

Roblox Corporation develops and operates an online entertainment platform. The company offers Roblox Studio, a free toolset that allows developers and creators to build, publish, and operate 3D experiences, and other content; Roblox Client, an application that allows users to explore 3D digital world; Roblox Education for learning experiences; and Roblox Cloud,...

Harley-Davidson, Inc. manufactures and sells motorcycles. The company operates in two segments, Motorcycles and Related Products and Financial Services. The Motorcycles and Related Products segment designs, manufactures, and sells Harley-Davidson motorcycles, including cruiser, touring, standard, sportbike, and dual models, as well as motorcycle parts,...

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. It operates through four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment, and...

Wheaton Precious Metals Corp., a mining company, primarily sells precious metals in Canada and internationally. The company sells gold, silver, palladium, and cobalt deposits. It has agreements for 24 operating mining assets and 7 development stage projects. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals...

Mirati Therapeutics, Inc., a clinical-stage oncology company, develops product candidates to address the genetic and immunological promoters of cancer in the United States. The company develops MRTX849, a KRAS G12C inhibitor, which is in Phase I/II clinical trial for treating non-small cell lung (NSCL), colorectal, pancreatic, and other cancers; and Sitravatinib,...

Teladoc Health, Inc. provides virtual healthcare services on a business-to-business basis in the United States and internationally. It covers various clinical conditions, including non-critical, episodic care, chronic, and complicated cases like cancer and congestive heart failure, as well as offers telehealth solutions, chronic condition management, expert...