Trade Scenario 1: Bullish - For us to go long we want to see price break above our edge of value 130.100. We will then wait for a retrace and for 130.100 to act as support. Enter on strong bullish setups, first targeting our edge of value 130.400. Trade Scenario 2: Bearish - For us to go short we want to see price break below 130.100. We will then wait for a...

Trade Scenario 1: Bullish - For us to go long we need to see price retrace to our edge of value at 1.2040. We will then wait for price to find support and enter on strong bullish setups, first targeting previous highs around 1.2075 Trade Scenario 2: Bearish - For us to go short we want to see price break below 1.2040. We will then wait for a retrace and for...

Trade Scenario 1: Bullish - For us to go long we want to see price break above our edge of value at 1.3980. We will then wait for 1.3980 to act as support. Enter on strong bullish setups, first targeting our edge of value around 1.4040. Trade Scenario 2: Bearish - For us to go short we want to see price reject off 1.3980. We will then enter on strong bearish...

Trade Scenario 1: Bullish - For us to go long we want to see price break above 1.2540. We will then wait fo a retrace and for 1.2540 to act as support. Enter on strong bullish setups, first targeting our edge of value at 1.2570 Trade Scenario 2: Bearish - For us to go short we want to see price reject off 1.2530. We will wait for a quick retrace and then enter on...

Trade Scenario 1: Bearish - For us to go short we want to see price reject off 108.250. We will then enter on strong bearish setups, first targeting 107.850. Trade Scenario 2: Bullish - For us to go long we want to see price break above 108.250. We will then wait for a retrace and for 108.250 to act as support. Enter on strong bullish setups, first targeting our...

Trade Scenario 1: Bullish - For us to go long we want to see price retrace back to our edge of value 130.100. We will then wait for price to find support and enter on strong bullish setups, first targeting our edge of value 130.400. Trade Scenario 2: Bearish - For us to go short we want to see price break below 130.100. We will then wait for a retrace and for...

Trade Scenario 1: Bullish - For us to go long we want to see price retrace back to 151.200. We will then wait for price to find support and enter on strong bullish setups, first targeting our edge of value around 151.600. Trade Scenario 2: Bearish - For us to go short we want to see price break below 151.200. We will then wait for a retrace and for 151.200 to act...

Trade Scenario 1: Bullish - For us to go long we need to see price retrace to our point of control at 1.2027. We will then wait for price to find support and enter on strong bullish setups, first targeting previous highs around 1.2043 Trade Scenario 2: Bearish - For us to go short we want to see price reject off 1.2043. We will then enter on strong bearish...

Trade Scenario 1: Bullish - For us to go long we want to see price retrace to our edge of value at 1.3900. We will then wait for 1.3900 to act as support. Enter on strong bullish setups, first targeting our point of control around 1.3960. Trade Scenario 2: Bearish - For us to go short we want to see price break below 1.3900. We will then wait for 1.3900 to act as...

Trade Scenario 1: Bullish - For us to go long we want to see price break above 1.2490. We will then wait fo a retrace and for 1.2490 to act as support. Enter on strong bullish setups, first targeting our edge of value at 1.2530 Trade Scenario 2: Bearish - For us to go short we want to see price reject off 1.2490. We will then enter on strong bearish setups, first...

Trade Scenario 1: Bearish - For us to go short we want to see price reject off 84.350. We will then enter on strong bearish setups, first targeting our point of control 84.150. Trade Scenario 2: Bullish - For us to go long we want to see price break above our edge of value at 84.350. We will then wait for a retrace and for 84.350 to act as support. Enter on...

Trade Scenario 1: Bearish - For us to go short we want to see price break below 108.650. We will then wait for a retrace and for 108.650 to act as resistance. Enter on strong bearish setups, first targeting 108.500. Trade Scenario 2: Bullish - For us to go long we want to see price break above 108.750. We will then wait for a retrace and for 108.750 to act as...

Trade Scenario 1: Bullish - For us to go long we want to see price break above 150.100. We will then wait for a retrace and for 150.100 to act as support. Enter on strong bullish setups, first targeting previous highs around 150.300. Trade Scenario 2: Bearish - For us to go short we want to see price break below 149.800. We will then wait for a retrace and for...

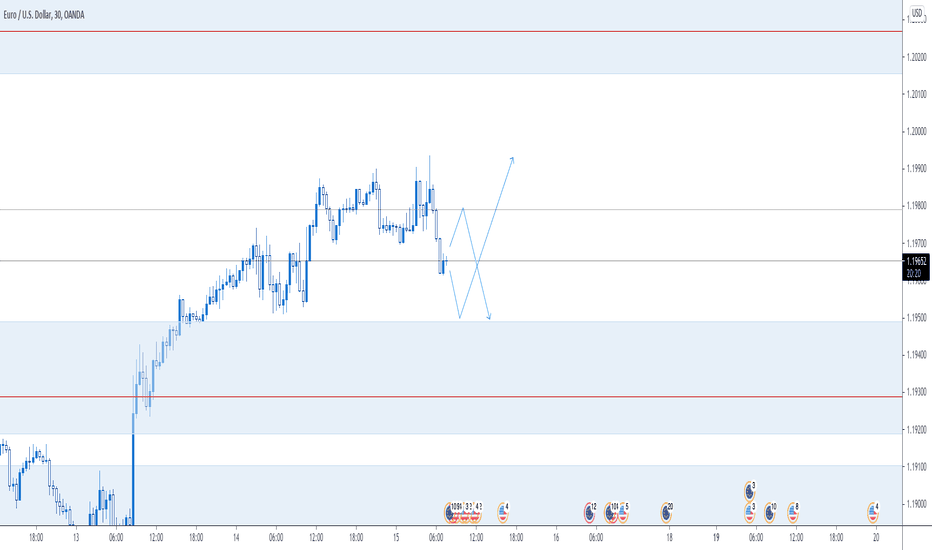

Trade Scenario 1: Bullish - For us to go long we need to see price retrace to our edge of value at 1.1950. We will then wait for price to find support and enter on strong bullish setups, first targeting previous highs around 1.1990 Trade Scenario 2: Bearish - For us to go short we want to see price retrace to 1.1980. We will then wait for 1.1980 to act as...

Trade Scenario 1: Bullish - For us to go long we want to see price retrace to our edge of value at 1.3760. We will then wait for 1.3760 to act as support. Enter on strong bullish setups, first targeting previous highs around 1.3800. Trade Scenario 2: Bearish - For us to go short we want to see price reject off 1.3800. We will then wait for 1.3800 to act as...

Trade Scenario 1: Bullish - For us to go long we want to see price break above 1.2500. We will then wait fo a retrace and for 1.2500 to act as support. Enter on strong bullish setups, first targeting our edge of value at 1.2530 Trade Scenario 2: Bearish - For us to go short we want to see price retrace back to 1.2510. We will then wait for 1.2510 to act as...

Trade Scenario 1: Bearish - For us to go short we want to see price reject off 108.950. We will then wait for a retrace and for 108.950 to act as resistance. Enter on strong bearish setups, first targeting 108.700. Trade Scenario 2: Bullish - For us to go long we want to see price break above our edge of value at 109.000. We will then wait for a retrace and for...

Trade Scenario 1: Bullish - For us to go long we want to see price break above 130.600. We will then wait for a retrace and for 130.600 to act as support. Enter on strong bullish setups, first targeting 130.900 Trade Scenario 2: Bearish - For us to go short we need to see price break below 130.400. We will then wait for a retrace and for 130.400 to act as...