At the time of writing it is crucial for buyers to hold the 5.5 level, if not, I see a possibility for the price to move inside 4.2-5,2 range and consolidate there. I don't think it will be a long process in terms of time. Fundamentally though I have a bullish view and started to slowly accumulate position with an investment time horizon at least 1 year I...

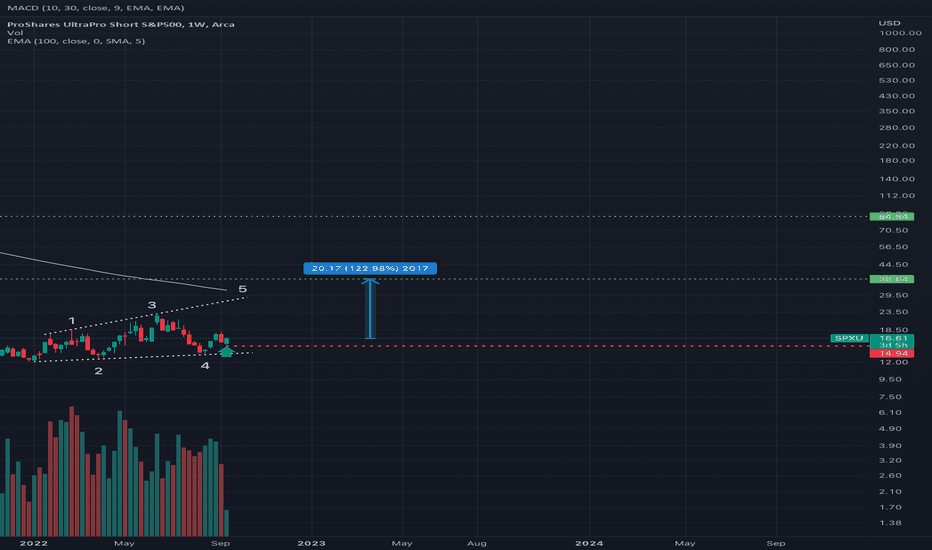

$SPXU - bears are in control after CPI release Shorting the US market is not an easy business, but this is the trend since the beginning of 2022 and there is no sign of it changing. In addition to my previous post... On Friday I have been stopped out from both $SPXU and $SQQQ, locking in roughly 1,5% and 2% profit accordingly. I have also been stoped out from...

Really straightforward close of the week in tech… From current levels I see another 10-15% downside possibility in Nasdaq, where strong bullish support would probably step in seriously. From macro point of view I agree with those specialists who say that J. Powell was pretty straightforward in his views on battling the inflation, which is the number one problem...

‘’If it walks like a duck and quacks like a duck, then it's probably not a chicken...’’ The boss is telling me to sell. I sold. Investors – especially growth oriented – have been hit quite hard this year. I am no exception. ARK funds are no exception. It’s hard to be an investor this year. We have to trade and manage the portfolio more actively....

Waiting end of the day close, we'll see whether buyers can defend this zone of interest around 10-11... Or sellers going to win and take control?

Interesting bullish potential for swing price action traders in my opinion

Globally we can also see a decline and a possible C Wave extending to 162% fibo level and even lower. My T/P target is 15k$ S/L at 19900$. Entry point at 18992$. Potential return in terms of capital is around 0,4%. Potential loss 0,15%. R:R is 2,65

SP500 has shown some weakness in the beginning of 2022... All of us know that one of the most important reason behind such a 12% drawdown is Fed hawkishness... At the time of writing smart money traders are pricing at least 5 interest rate hikes by the end of 2022, which is obviously putting pressure on the US stock market. ''Money today worth more than money...

Quarterly report: Very impressive in my opinion. It was beating analyst estimations both in terms of revenue and earnings as well as future guidance and outlook. Investors are happy and on pre-market the stock is gaining more than 8% at the time of writing. Fundamental analysis: 1. Valuation: I could say that historically $MU had better valuation than it...

The major US index is ''suffering'' a healthy correction from around 4750 ATH set in November roughly 2 weeks ago! The volatility is quite high, thus the risk has increased in addition to potential return. You know how it works... ...higher risk - higher return. At the moment my total stock market exposure is around $50k and from current level I am planning to...

Fundamental analysis 1. Valuation: The company is expensive based on almost all valuation metrics such as PE or PS, however the guru focus model estimates that the company is ‘’fairly valued’’, while the 2 stage free cash flow model estimates that the fair value of AMZN share price should be around $5,500. 2. Growth: $AMZN remains a solid growth story....

30k is a psychological resistance for BTC in my opinion... ...as mentioned earlier, we might go higher from around 22-24k level proved to be true and now it should be difficult for BTC to break above 30k zone. As per now, the price stopped below 28400 price, but we will see how it closes EOD. Bulls are still in control, shorting from here is more like a gamble,...

EURUSD is close to an important resistance zone last seen in 2018... In my opinion, it will be difficult for euro to continue it's strengthening and break above 1.23000-1.25500 price zone. I am not trying to predict where the price will be, however at the above mentioned zone I would at least expect some profit realization. Entering the market now doesn't...

Where to buy bitcoin? Obviously the price can go higher from this level, but I wouldn't chase the market here... …the first support zone can be found somewhere between 17.5k and 19.5k, where bulls might step in once again. If we get such a pullback (at least 15%) - in my opinion, only in this case you should enter the market and hope for another move higher (at...

On the chart you can see a technical picture of AUDUSD, which in near-term may experience a pullback. For outside the market Aussie bulls the first entry level - in my opinion - can be somewhere around 0.74520, the second around 0.73790, etc. Don't forget, that proper risk management and volume calculations before getting an exposure in a certain asset is...

Hello Traders! On the chart you can see my analysis of USDCAD pair... …in my opinion 1.29930-1.31460 price zone should be considered as an opportunity to open long position, as this is the zone where buyers might show some demand interest. Fundamentally speaking, yesterdays GDP numbers from China were worse than expected, risk-off on the equity markets and...

Hello Traders! 3300 - 3410 price zone is the first, where bulls might step in and show some buying interest. If this is the case, the first take profit target is around 3500 level. Follow your personal risk-management rules before opening position. ^^ Make sure you follow me for more upcoming ideas and feel free to share your opinion via comment. If you agree...