Apple

AAPL US production lines. Politics or honest long-term strategy?NASDAQ:AAPL is investing into the US. Is it a short-term political move, or an actual genuine intention to "make America great again"?

Let's take a look.

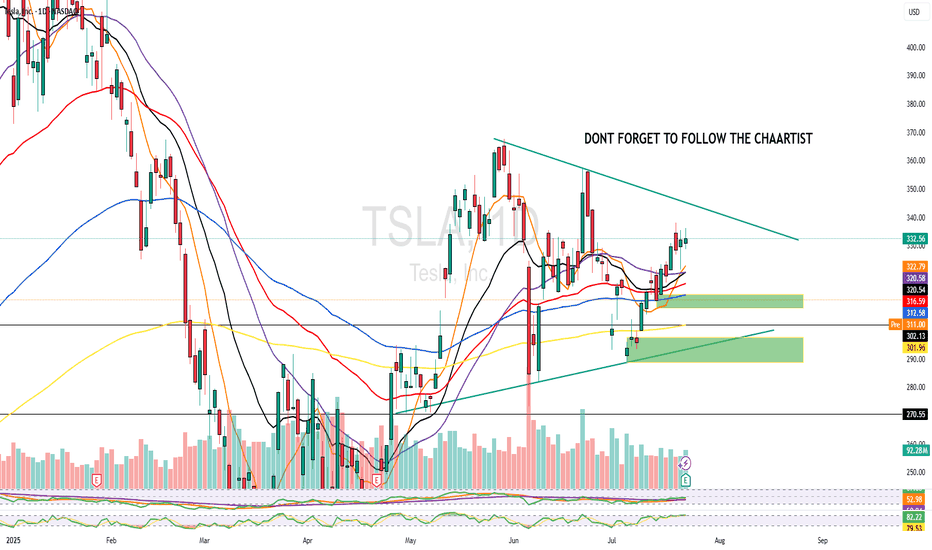

NASDAQ:AAPL

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper risk management and this setup looks very decent.

📝Levels to watch:

$200, $300

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Are The Markets Running Out Of Steam? SPY just cant seemed to hold above the 600 psychological level.

Are big players unloading into this positive market strength?

Are we due for a larger pullback?

There's a lot of mixed price action and we just cant seem to make a true breakout.

Some names are underperforming and other names are outperforming.

We remain tactically bullish while trimming keys positions into strength.

Being nimble in this market us key as were seeing large intra day swings.

Short term there is some risk of lower price so we have hedged in some individual names while still remaining bullish.

Who likes Apple Crumble....WWDC Event FlopSome Key Areas:

Unified Design: Liquid Glass

- Apple unveiled a new design language called Liquid Glass, inspired by visionOS. This aesthetic introduces rounded, translucent elements across iOS 26, iPadOS 26, macOS 26 ("Tahoe"), watchOS 26, tvOS 26, and visionOS 26, aiming for a cohesive and modern look across all devices

Apple Intelligence & AI Enhancements

- Apple expanded its AI capabilities under the Apple Intelligence umbrella:

On-Device AI Models: Developers can now access Apple's on-device large language models to integrate AI features into their apps, ensuring privacy and efficiency.

- Genmoji: A new feature allowing users to create personalized emojis by merging existing ones.

- ChatGPT Integration: Siri can now delegate complex queries to ChatGPT, powered by GPT-4o, with user consent.

- Live Translation: Real-time translation is now available in Messages, FaceTime, and Phone apps, enhancing multilingual communication.

iOS 26 & iPadOS 26: Enhanced User Experience

- Redesigned Apps: Updated Camera, Safari, and Phone apps featuring the new Liquid Glass design.

iPadOS 26 brings

- Advanced Multitasking: Enhanced window management and a Mac-like Preview app.

macOS 26 ("Tahoe"): Productivity Focus

- Personalized Spotlight: Improved search functionality with AI-driven suggestions.

WatchOS 26 & AirPods Enhancements

- AI-Powered "Workout Buddy": Provides real-time insights and encouragement during fitness activities.

Gaming & Developer Tools

- Apple Gaming Hub: A new app aggregating games and challenges, enhancing the gaming experience across devices.

Apple is at a technical inflection point. It needs to hold the wedge or it runs the risk to going lower to the previous lower boundary range.

Bullish Intraday Patterns Everywhere!SPX had a wonderful intraday hourly chart confirmed breakout. This pattern is bullish and likely will continue higher.

The bulls tomorrow would love to confirm the daily chart breakout and will try to push for that.

SPY/SPX is holding more relative strength than the Q's & IWM which is displaying broad participation.

There are many bullish charts showing accumulation, golden crosses and bullish MA crossovers.

The DXY appears to be wanting to break down to around $97.00 which should yield more upside.

We secured profits today on SPY 594 calls & NVDA 144 calls.

We still remain net long and see the S&P 500 over $6000

Apple, XYZ, AI - are bullish setups were continuing to manage.

Apple - Please look at this chart!Apple - NASDAQ:AAPL - is just wonderful:

(click chart above to see the in depth analysis👆🏻)

Last month, Apple created a quite strong bullish rejection wick of about +25%. It was actually no surprise at all, because market structure was perfectly pushing price higher. Following the bullish break and retest pattern, new all time highs will most likely follow.

Levels to watch: $200, $300

Keep your long term vision!

Philip (BasicTrading)

APPLE I Stock Forecast and Price Target Welcome back! Let me know your thoughts in the comments!

** APPLE Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!