Gold May Consolidate and Correct Before Continuing the Uptrend📊 Market Overview:

Gold price is slightly correcting after a strong rally above 5000 USD/oz, facing profit-taking pressure amid low liquidity at the start of the week and a lack of new market-moving news, while the USD is temporarily stabilizing.

📉 Technical Analysis:

• Key Resistance: 5.050 – 5.080 | 5.120 – 5.150

• Nearest Support: 4.980 – 4.950 | 4.900 – 4.880

• EMA: Price remains above EMA 09, indicating the overall trend is still bullish, but showing signs of short-term correction.

• Candlestick / Volume / Momentum: Corrective candles appeared after the peak, volume slightly decreased → indicating weakening buying pressure. RSI shows mild divergence, suggesting consolidation or a pullback before continuing the main trend.

📌 Outlook:

Gold may decline in the short term toward the 4980–4950 support zone before rebounding if buying pressure returns and price holds above 4900.

________________________________________

💡 Trading Strategy Suggestion:

🔻 SELL XAU/USD : 5.078 – 5.081

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 5.085

🔺 BUY XAU/USD : 4.950 – 4.947

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4.943

Goldusd

XAUUSD – 15m Intraday ShortScalp position: SELL

Entry: 5011

Stop Loss: 5036

Targets:

🎯 TP1: 5004

🎯 TP2: 4996

🎯 TP3: 4981

📊 Technical Reasoning

15M chart shows price reacting at the 5010–5015 resistance zone.

5M momentum is weakening (loss of bullish push / smaller candles / failure to make strong higher highs).

Likely short-term liquidity grab before rotation.

Structure suggests potential move back into previous intraday imbalance.

Momentum shift on lower timeframe = early confirmation of rejection from resistance.

🧠 Trade Logic

This is a momentum fade setup, not a blind resistance sell.

We are targeting:

First liquidity pool at 5004

Intraday support at 4996

Deeper pullback toward 4980 liquidity zone

RR profile improves after partials are secured at TP1.

⚠️ Invalidation

Strong bullish 5M impulse candle

Clean break and hold above 5030–5036

Momentum expansion to the upside

📌 Management Plan

Secure partials at TP1

Move SL to breakeven after TP1 hits

Trail aggressively below new 5M lower highs

XAUUSD (Gold) 1H – Support Rejection Toward Range HighMarket Structure

On the 1H timeframe, Gold remains within a broader corrective range after the prior impulsive decline. Price recently swept liquidity below the previous swing low and reacted strongly from the marked support zone (4,880–4,920 area).

The reaction formed a sharp V-shaped recovery, suggesting:

Liquidity grab below support

Strong bullish absorption

Continuation toward range highs

Price is now trading above the short-term ascending trendline and reclaiming minor intraday structure.

Key Technical Levels

Support Zone: 4,880 – 4,920

Immediate Resistance: 5,120 – 5,160

Current Price: ~5,038

Trend Bias (Short-Term): Bullish above 4,920

The resistance zone around 5,150 aligns with:

Prior rejection highs

Descending dynamic resistance

Range upper boundary

Trade Idea (Bullish Scenario)

Entry Zone: Pullbacks toward 4,980 – 5,020

Stop Loss: Below 4,880

Target 1: 5,120

Target 2: 5,150 – 5,170

Rationale:

Higher low formation after liquidity sweep

Momentum shift with strong bullish candles

Risk-to-reward favorable toward range high

Invalidation Scenario

A clean break and close below 4,880 would invalidate the bullish structure and open room for deeper retracement.

Conclusion

Gold shows signs of short-term bullish continuation after defending key support. As long as price holds above 4,920, upside toward 5,150 remains the higher-probability path.

If you want, I can also provide this in German, French, Spanish, Italian, Polish, Turkish, or Russian.

Gold May Continue to Correct Below 5000📊 Market Overview:

Gold price has dropped sharply and broken below the psychological 5000 level due to a stronger USD, improved risk sentiment, and heavy profit-taking after a strong rally, weakening safe-haven demand in the short term.

________________________________________

📉 Technical Analysis:

Key Resistance:

• 4950 – 4980

• 5020 – 5050

Nearest Support:

• 4900 – 4870

• 4820 – 4750

• EMA:

Price is currently below EMA 09 → short-term bearish trend is dominant.

• Candlestick / Volume / Momentum:

Strong breakdown candle below 5000 with increasing volume → confirms active selling pressure.

• RSI is moving toward lower neutral territory → further downside potential remains.

• Price structure is forming lower highs and lower lows (intraday downtrend).

________________________________________

📌 Outlook:

👉 Gold may continue to decline in the short term if it fails to reclaim 5000 and gets rejected at 4950–4980.

________________________________________

💡 Trading Strategy:

🔻 SELL XAU/USD at: 4940 – 4937

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4944

🔺 BUY XAU/USD at: 4823 – 4820

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4816

Bearish Rejection from Supply Zone, Downside Target in FocusOn the 1-hour timeframe, Gold (XAUUSD) shows a clear rejection from a well-defined supply/resistance zone around 5,070–5,120. Price previously formed a corrective structure after a strong recovery from the 4,720 lows, but bullish momentum weakened as price approached the upper resistance band.

Technical Structure

Supply / Resistance Zone:

The red highlighted area marks a strong distribution zone where sellers previously entered aggressively. Multiple rejections confirm institutional selling interest.

Trendline Confluence:

Price respected the ascending green trendline from the recent swing low near 4,880. However, the recent breakdown below short-term structure suggests weakening bullish control.

Lower High Formation:

The latest push upward failed to break the previous swing high, creating a lower high within the resistance zone — a classic bearish continuation signal.

Support to Resistance Flip:

The marked resistance level (around 4,880–4,920) previously acted as support. After the breakdown, it now serves as a downside magnet (target area).

Trade Idea

Entry Zone: Rejection within 5,040–5,080 supply region

Stop Loss: Above 5,120 (above supply and structure high)

Target: 4,900–4,880 support zone

Bias

Short-term bearish while price remains below the 5,120 resistance. A confirmed breakdown below 4,980 strengthens the probability of continuation toward the green target zone.

Invalidation

A strong 1H close above 5,120 would invalidate the bearish setup and open the path toward 5,150+.

XAUUSD H1 – Resistance Rejection and Pullback Toward Key SupportMarket Overview:

On the H1 timeframe, Gold faced strong rejection near the 5,090–5,100 resistance zone after completing a sharp impulsive move from the 4,680 swing low. The failure to sustain above resistance triggered a bearish retracement toward the 4,900 region.

Technical Structure:

A clear bullish impulse leg formed from 4,680 to approximately 5,120.

Price entered consolidation beneath the 5,100 resistance and failed to break decisively.

A lower high structure developed, followed by strong bearish momentum.

The ALMA (9) has turned downward, confirming short-term bearish pressure.

Key Levels:

Resistance Zone: 5,080–5,100

Immediate Support: 4,900–4,880

Major Support Zone: 4,850 area

Invalidation for Bears: Sustained move back above 5,100

Trade Scenario:

The current structure favors a corrective move toward the marked support zone around 4,880–4,850. If buyers defend this area and bullish confirmation appears, a potential rebound toward the 5,050–5,100 region could follow.

However, a clean H1 close below 4,850 would weaken the broader bullish structure and expose 4,800 as the next downside objective.

Conclusion:

Gold is undergoing a technical pullback after rejection at resistance. The 4,880–4,850 support zone is critical for determining whether this move is a healthy retracement within an uptrend or the beginning of a deeper bearish correction.

Gold May Correct Below the 5000 Level📊 Market Overview:

Gold is under corrective pressure after breaking below the psychological 5000 USD/oz level, as the USD remains strong and US bond yields stay elevated. Market sentiment is cautious ahead of upcoming US economic data and Fed policy expectations, leading to short-term profit-taking in gold.

📉 Technical Analysis:

• Key Resistance: 5005 – 5015 / 5050 – 5060

• Nearest Support: 4920 / 4980

• EMA: Price is trading below EMA 09 → short-term bearish bias.

• Candlestick / Volume / Momentum: Selling pressure increased after the breakdown below 5000. Decreasing volume suggests a potential technical pullback before the main trend continues. RSI is moving down from overbought territory, and bearish momentum still dominates.

📌 Outlook:

Gold may decline in the short term if it fails to reclaim the 5000 level, but a technical rebound toward resistance zones is still possible before a deeper correction.

________________________________________

💡 Trading Strategy:

🔻 SELL XAU/USD at: 5057 – 5060

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 5064

🔺 BUY XAU/USD at: 4920 – 4917

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4913

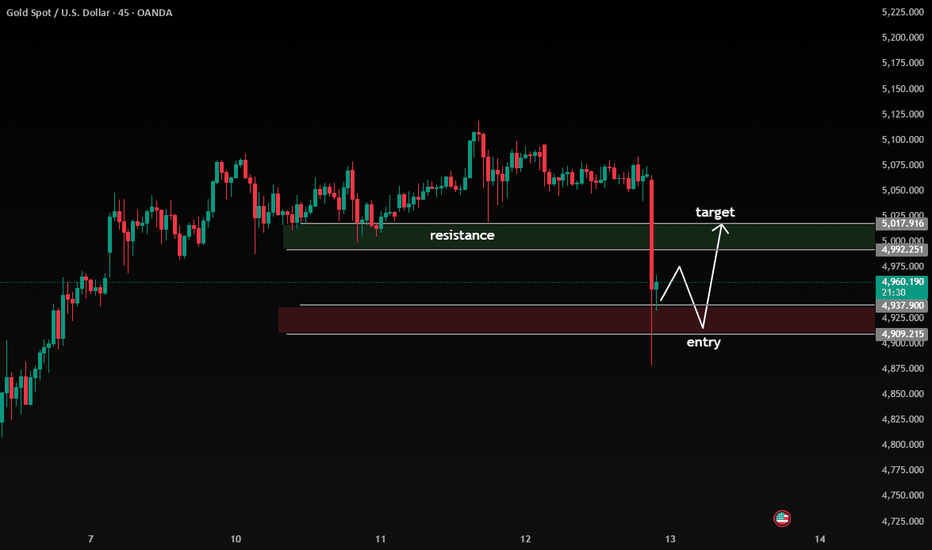

Bearish Breakout Below Range, Pullback Into Resistance

Current Structure:

Price was ranging under a clear resistance zone (≈ 4,992 – 5,018) before printing a strong bearish impulse candle that decisively broke structure to the downside. This move invalidated short-term bullish momentum and shifted bias intraday to bearish.

🔎 Key Observations

1. Market Structure Shift

The large bearish candle confirms a break of minor support and signals momentum expansion.

This looks like a liquidity sweep + displacement move, often followed by a corrective pullback.

2. Entry Zone (Demand) – 4,909 – 4,937

Price tapped into a marked demand/support area.

Reaction here suggests potential for a short-term retracement rather than immediate continuation.

This zone is likely where buyers attempt a bounce.

3. Resistance / Target Zone – 4,992 – 5,018

Previous consolidation + supply area.

If price retraces, this zone becomes:

A sell-on-rally area

A potential lower high formation zone

📈 Probable Scenario (Based on Structure)

Most likely flow:

Short-term bounce from demand

Retracement toward ~4,975–5,000

Rejection at resistance

Continuation lower if bearish structure holds

This would form a lower high, confirming bearish continuation.

⚠️ Alternative Scenario

If price:

Reclaims and closes strongly above 5,018

Holds above resistance

Then the bearish impulse becomes a fake breakdown and buyers regain control.

📊 Bias Summary

Intraday Bias: Bearish

Short-term Expectation: Pullback → rejection → continuation lower

Invalidation: Sustained move above resistance zone

XAU/USD (Gold) – 1H Chart Technical Analysis

🟢 Market Structure

The chart shows bullish recovery after a strong downtrend.

Price formed higher lows and higher highs, indicating buyers are gaining control.

Currently, price is moving in a consolidation range just above a demand zone.

🔵 Key Zones

✅ Demand Zone / Buy Entry

Around 5000 – 5030

Price has reacted multiple times here → strong buyer interest.

This area is marked as a potential BUY entry.

🔴 Stop Loss Zone

Around 4970 – 4990

If price breaks and closes below this zone, bullish setup becomes weak.

🟩 Resistance / Target Zone

Around 5140 – 5170

Previous rejection area.

Likely profit-taking zone if price continues upward.

📍 Current Price Behavior

Price is consolidating above demand → bullish sign.

ALMA moving average is supporting price → trend strength confirmation.

The circled region suggests a pullback and continuation pattern.

📈 Trade Idea (Based on Chart)

Buy Entry: Demand zone (≈ 5000 – 5030)

Stop Loss: Below 4970

Target: 5140 – 5170 resistance zone

⚠️ Risk Notes

If price breaks below demand zone → possible bearish continuation.

Watch for false breakouts near resistance

Gold may consolidate short-term before a breakout.📊 Market Overview:

Gold (XAU/USD) is currently trading around the 5030–5050 USD/oz zone as the market awaits inflation data and policy signals from the Fed. The USD has weakened slightly, but US bond yields remain elevated, preventing gold from breaking out strongly and keeping the market in a consolidation phase.

📉 Technical Analysis:

• Key Resistance: 5055 – 5065 | 5100 – 5120

• Nearest Support: 5010 – 5000 | 4975 – 4960

• EMA: Price is trading above the EMA 09 on H1 but below the EMA on H4, indicating a short-term bullish bias while the medium-term trend remains mixed.

• Candlestick / Volume / Momentum: H1 candles show small bodies with decreasing volume → consolidation signal. RSI is around 55–60, not in overbought territory, suggesting room for upside but lacking strong breakout momentum.

📌 Outlook:

Gold may rise slightly or continue to move sideways in the short term if the USD does not strengthen and inflation data does not exceed expectations. However, a break below 5000 could trigger stronger downside pressure.

________________________________________

💡 Trading Strategy:

SELL XAU/USD: 5100 – 5103

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5107

BUY XAU/USD: 5000 – 4997

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4993

Gold - ImpulseContinuing the outlook on gold:

Following the recent high, price has started to move lower.

The main question now is the type of correction unfolding.

The primary scenario is to treat this decline as an impulse. Since the move up was strong and even showed signs of mania, an impulsive move down in Wave A appears to be the most likely outcome.

The impulse scenario would be invalidated by a move above 5100 , as that would overlap the first wave.

Additional confirmation comes from the internal structure.

Wave 2 formed a zigzag, while Wave 4 developed as a flat, a classic alternation pattern.

A move above 5100 , even a retest of the highs, would not cancel the downside targets.

It would only change the type of correction.

So far, the market has retraced only about 50% of the fifth wave.

The expectation, however, is for a correction of the entire advance, not just the final leg.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

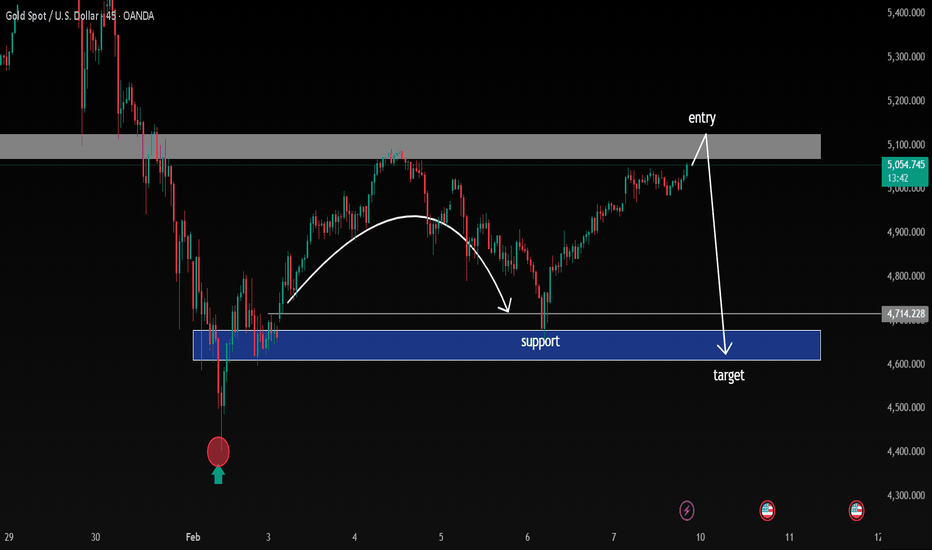

45-Minute Chart Analysis: Support Hold → Range Break Attempt

Market Structure

Price previously sold off hard into the major demand/support zone (~4,650–4,720).

That support held cleanly (strong rejection + momentum shift), kicking off a rounded recovery / corrective arc.

Since Feb 7–10, price has been consolidating above a minor demand zone (~5,000–5,020) — classic base-building behavior.

Key Levels

Major Support (blue zone below): ~4,650–4,720

→ Strong institutional demand, validated by multiple reactions.

Current Entry Zone (blue box): ~5,000–5,020

→ Prior resistance turned support + consolidation range.

Major Resistance (gray zone): ~5,180–5,220

→ Supply zone / previous distribution area.

Trade Idea Logic

The chart is showing a higher low + compression under resistance.

If price holds above the entry zone and prints bullish continuation (strong close, volume expansion), the probability favors a push into resistance.

The drawn arrow reflects a range expansion move, not a breakout confirmation yet.

Bias

Bullish continuation (conditional) while price holds above ~5,000.

A clean rejection below the entry zone would invalidate the setup and shift bias back to range or pullback.

Summary

This is a support-hold → consolidation → resistance-target structure.

Patience matters here: confirmation above the range is the green light 🚦, while losing the blue entry zone is the warning sign.

Gold May Consolidate Short-Term Before Breakout📊 Market Overview:

Gold is trading around 5025 USD/oz as markets await new signals from US economic data and expectations that the Fed will ease monetary policy. A slightly weaker USD and ongoing safe-haven demand continue to support gold above the psychological 5000 level.

📉 Technical Analysis:

• Key Resistance: 5055 – 5100

• Nearest Support: 5000 – 4970

• EMA: Price remains above EMA 09, indicating a short-term bullish bias.

• Candlestick / Volume / Momentum: Gold is forming a range consolidation pattern with declining volume, suggesting a potential breakout. Momentum remains positive but slightly weakening.

📌 Outlook:

Gold may continue to rise if it holds above 5000 and breaks 5055; otherwise, a pullback is likely if 5000 is broken.

________________________________________

💡 Trading Strategy Suggestion:

🔻 SELL XAU/USD at: 5057 – 5060

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5063

🔺 BUY XAU/USD at: 4975 – 4972

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4969

XAUUSD – Rejection From Major Supply, Bearish Continuation Setup

Chart Analysis:

This XAUUSD chart is telling a pretty clean story of range-to-distribution behavior.

Grey zone (top) → Clear supply / resistance area. Price has tapped this zone multiple times historically and is now reacting to it again.

The recent push up into this zone looks corrective, not impulsive — higher lows, but weakening momentum as it approaches resistance.

The curved white arrow highlights a previous drop from the same area, showing this level already caused a strong sell-off before. That adds confidence to the zone.

Current Structure:

Market is making a lower high relative to the major swing high.

Price is stalling right under supply → classic sign of sellers absorbing buys.

No strong bullish breakout candles above the grey zone.

Trade Idea Shown:

Entry: Short from the grey supply zone

Target: Blue support zone below (prior demand + liquidity pool)

Support zone: Strong base where price previously accumulated and bounced hard — logical take-profit area.

Bias:

Bearish while below the grey zone

Expectation: rejection → rotation down → liquidity grab into support

What Would Invalidate This Setup?

Strong bullish close and acceptance above the grey zone

Follow-through volume confirming breakout (not just a wick)

Summary:

This is a textbook sell-from-supply → target-demand setup. The market already showed respect for these levels in the past, and current price action suggests sellers are defending aggressively again.

Gold May Continue Rising as the USD Weakens📊 Market Overview:

Gold surged strongly and remains above the 5000 USD/oz level as the US dollar weakened and expectations of Fed rate cuts increased, boosting safe-haven demand. Market sentiment remains risk-off amid ongoing macroeconomic uncertainties.

________________________________________

📉 Technical Analysis:

Key Resistance:

• 5035 – 5040

• 5065 – 5070

Nearest Support:

• 5000 – 4995

• 4970 – 4965

EMA:

• Price is trading above EMA 09 → short-term trend remains bullish.

Candlestick / Volume / Momentum:

• H1 candles show bullish bodies with short lower wicks → buyers are in control.

• Volume increased during the breakout above 5000 → confirming a valid breakout.

• RSI and momentum remain bullish but not overbought → further upside potential remains.

________________________________________

📌 Outlook:

Gold may continue rising in the short term if price holds above 5000 and no hawkish signals from the Fed or strong US economic data emerge.

________________________________________

💡 Trading Strategy:

🔻 SELL XAU/USD: 5039 – 5042

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5045

🔺 BUY XAU/USD: 4999 – 4996

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4993

Gold May Continue Short-Term Correction Amid High Volatility📊 Market Overview:

Earlier today, spot gold (XAU/USD) experienced a sharp sell-off toward the 4,655 USD/oz area before rebounding. This move highlights elevated market volatility, driven by a firm US dollar and cautious investor sentiment following the previous strong rally. Dip-buying emerged near lower levels, but short-term selling pressure remains evident.

📉 Technical Analysis:

Key Resistances:

• 4,900 – 4,950 USD

• 5,020 – 5,080 USD

Immediate Supports:

• 4,700 – 4,750 USD

• 4,600 – 4,650 USD

EMA:

• Price is hovering around the EMA 09, indicating an unclear short-term trend and a consolidating market.

Candlestick / Volume / Momentum:

• Large-range candles with long wicks show strong buying and selling pressure. Volume remains elevated, confirming active market participation, but bullish momentum is not yet strong enough to confirm a sustainable uptrend.

📌 Outlook:

Gold may continue to correct in the short term if price fails to hold above the 4,700 USD/oz support, while rallies may continue to face profit-taking pressure.

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD: 4,947 – 4,950

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4,957

🔺 BUY XAU/USD: 4,703 – 4,700

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4,693

Gold Rebounds, Volatility Risk Persists📊 Market Overview:

Gold recently experienced a strong sell-off driven by profit-taking pressure and rising risk-off sentiment, pushing prices quickly down to the 4789 area. However, strong dip-buying demand emerged at this deep support zone, helping prices rebound to around 4890. This indicates that the market remains highly volatile and sensitive.

📉 Technical Analysis:

Key Resistance:

• 4920 – 4930

• 4980 – 5000

Nearest Support:

• 4850 – 4840

• 4790 – 4780

EMA:

Price is still trading below the EMA 09, suggesting the short-term trend has not fully reversed to bullish. The current rebound is more of a technical pullback.

Candlestick / Volume / Momentum:

On the short-term timeframe, a long lower-wick candle formed from the 4789 low, with increased volume at lower levels, confirming real dip-buying interest. However, rebound momentum remains weak, and selling pressure is re-emerging near the 4920 area → risks of consolidation or another pullback remain.

📌 Outlook:

Gold may continue to range or correct in the short term if price fails to decisively break above 4920–4930. A clearer bullish scenario would require holding firmly above 4850.

💡 Suggested Trading Strategy:

SELL XAU/USD at: 4997 – 5000

TP: 40 / 80 / 200 / 300 pips

SL: 5007

BUY XAU/USD at: 4842 – 4839

TP: 40 / 80 / 200 / 300 pips

SL: 4832

Gold Shows Short-Term Recovery Signs After a Sharp Decline📊 Market Overview:

Gold prices are surging today as safe-haven demand increases amid rising geopolitical tensions between the U.S. and Iran. Ongoing conflict concerns continue to boost demand for safe assets, pushing gold prices up more than 2% during the session and lifting spot gold above ~5,070 USD/oz. Fundamental forecasts also support a bullish outlook if rate-cut expectations persist and economic data comes in weaker than expected.

________________________________________

📉 Technical Analysis:

• Key Resistance Levels:

1. ~ 5,100–5,120 USD/oz – strong psychological resistance and current session high zone.

2. ~ 5,250–5,300 USD/oz – extended target area if price breaks above current highs.

• Nearest Support Levels:

1. ~ 4,900–4,950 USD/oz – short-term support in case of a pullback.

2. ~ 4,800–4,850 USD/oz – momentum support if a deeper correction occurs.

• EMA / Trend:

EMA 09: If price remains above EMA 09, it confirms a short-term bullish trend.

• Candlestick / Volume / Momentum:

Strong bullish candles with wide ranges reflect aggressive buying driven by geopolitical risk. Short-term momentum shows buying pressure dominating selling, with volume supporting the breakout above key psychological levels.

________________________________________

📌 Outlook:

Gold may continue to rise in the short term if:

• Geopolitical tensions persist

• The U.S. dollar weakens further

• Markets continue to price in additional Fed rate cuts

However, unexpectedly strong economic data or a more hawkish Fed stance could trigger a short-term correction before the main trend resumes.

________________________________________

💡 Trading Strategy:

🔻 SELL XAU/USD: 5,117 – 5,120

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~ 5,127

🔺 BUY XAU/USD: 4,950 – 4,947

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~ 4,940

Gold Remains Volatile – Correction Pressure May Rise📊 Market Overview

Gold prices are currently trading around ~4,750–4,850 USD/oz during the session on February 3, 2026, declining from recent highs after a sharp correction from previous record levels. Strength in global equity markets, combined with selling pressure following Fed leadership developments and expectations of a stronger USD, continues to weigh on gold as a traditional safe-haven asset. However, capital inflows are showing signs of returning as deeply discounted prices attract technical buying interest.

📉 Technical Analysis

• Key resistance levels:

– 4,900–4,950 USD/oz

– ~5,050–5,150 USD/oz (psychological / technical zone)

• Nearest support levels:

– ~4,650–4,700 USD/oz

– ~4,500–4,550 USD/oz

• EMA (09): Price is trading below the EMA 09 on the 4H/D1 timeframes, indicating that the short-term bearish trend remains dominant.

• Candlestick / Volume / Momentum: Declining volume during rebounds suggests technical buying is present but not strong. RSI on several timeframes is approaching oversold territory, which may cause volatility before the next directional move.

📌 Outlook

Gold may continue its short-term decline if it fails to break above the 4,900–4,950 USD/oz resistance zone and selling pressure resumes due to stable or rising USD interest rate expectations. However, if the 4,650–4,700 USD/oz support zone holds, a technical rebound toward higher resistance levels remains possible.

💡 Suggested Trading Strategy

SELL XAU/USD: 4,953–4,956

🎯 TP: 50 / 100 / 150 / 300 pips

❌ SL: ~4,963

BUY XAU/USD at: 4,650–4,647

🎯 TP: 50 / 100 / 150 / 300 pips

❌ SL: ~4,640

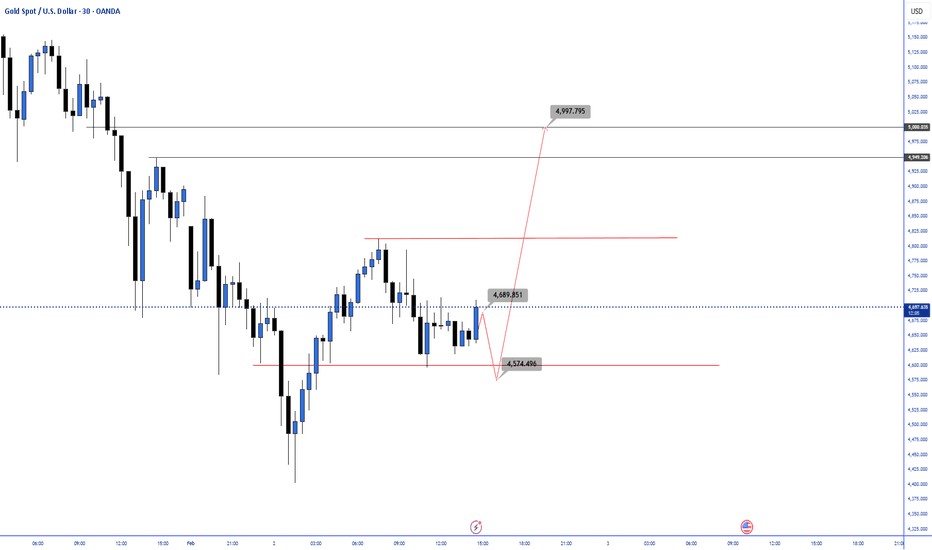

XAUUSD GOLD🔍 XAUUSD (30M) – Market Structure & Liquidity Explanation

Market Context:

Gold is currently in a range-bound accumulation phase after a strong impulsive sell-off. Price is no longer trending aggressively — it is compressing and building liquidity.

This is NOT a random zone. This is institutional positioning.

📐 Key Levels on the Chart

Range Low (Major Support): 4574.496

Mid-Range Reaction High: 4689.851

Range High / Supply Zone: ~4800 area

Major Liquidity Target Above: 4997.795

🧠 What Smart Money Is Doing

Sell-side liquidity is still resting below

Price may sweep below 4574.496

This move is designed to trap retail shorts and stop out weak longs

After liquidity grab → displacement up

Once sell-side is cleared, institutions can push price aggressively higher

First reaction toward 4689.851

Then continuation toward range highs

Final objective = buy-side liquidity

Above all recent highs

Targeting 4997.795

This is where late buyers will get trapped

❗ Important Correction (Read This Carefully)

🚫 Mistake most traders make:

They try to buy immediately inside the range.

✅ Correct approach:

Wait for liquidity sweep below 4574

Look for strong bullish displacement

Enter after confirmation, not before

Patience here = survival.

🎯 Trading Plan Logic (High-Level)

Bearish move first → liquidity grab

Bullish expansion next → smart money entry

Final push up → distribution & profit-taking

This is a classic accumulation → manipulation → expansion model.

🧘 Final Note for Traders

This is NOT the time to overtrade.

Let the market show its hand.

“The market doesn’t move to reward you.

It moves to take liquidity.”

Stay disciplined.

Updates will be shared only after confirmation. 🔒📈

Gold Dumps After Technical Rebound, Selling Pressure Dominates📊 Market Overview:

Gold staged a sharp technical rebound from 4500 to 4582, but the rally lacked follow-through buying. Sellers aggressively re-entered at higher levels, confirming distribution near 4580. This rejection triggered another strong sell-off, pushing price back down to around 4400.

📉 Technical Analysis:

Key Resistance Levels:

• 4480 – 4500

• 4560 – 4580

Nearest Support Levels:

• 4400 – 4385

• 4350 – 4320

•EMA:

Price is trading far below EMA 09 on M5, M15, and H1 → strong bearish trend with no bottoming signal yet.

•Candlestick / Volume / Momentum:

The rebound from 4500 to 4582 was a technical pullback with weak buying volume. Strong bearish candles with rising volume afterward confirm a bull trap. Bearish momentum is accelerating again.

📌 Outlook:

Gold may continue to decline in the short term if 4400 fails to hold, opening the way for a deeper move toward the 4350 – 4320 zone before any meaningful rebound occurs.

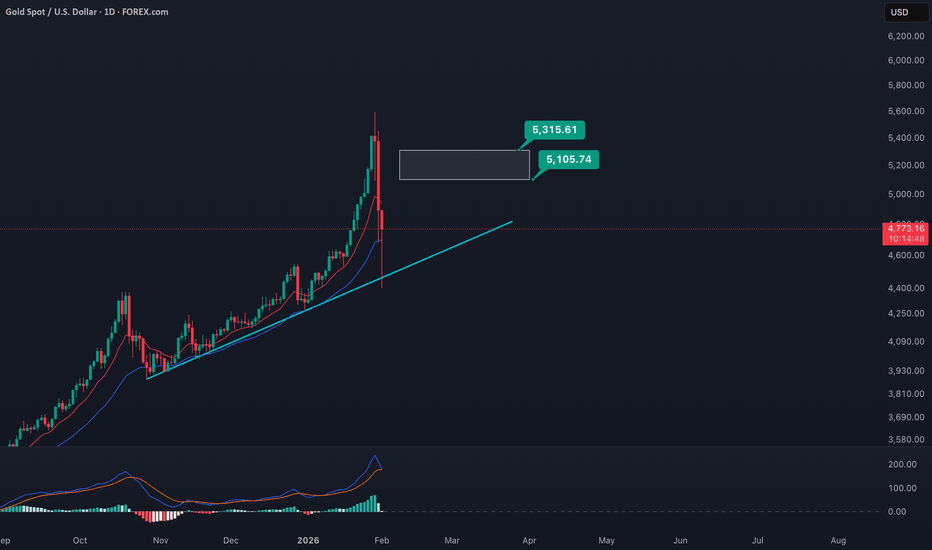

GOLD USDI expect the Gold reach to those prices as shown on the chart to complete its wave 2, and then fall down from that PRZ to make an impulse wave 3. So be careful when opening long position.

Also please bear in mind this is my analysis, and it can be failed at any point, as market can do whatever he wants.