Bullish bounce off?US100 has bounced off the support level, which is an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 25,253.06

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Stop loss: 24.919.12

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Take profit: 25,837.82

Why we like it:

There is a pullback resistance level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Indices

US30 H4 | Falling Towards 50% Fib SupportThe price could fall towards our buy entry level at 48,450.28, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 47,860.43, a multi-swing low support

Our take profit is set at 49,396.96, which aligns with the 161.8% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

[NL25](AEX) - Bullish Trendline Breakout - LONG SetupThe Netherlands 25 (AEX) has finally broken its long-term descending trendline! We are seeing a clear shift in market structure on the 4H timeframe. Is this the start of a New Year rally?

Breakout: Price has decisively closed above the primary descending trendline.

Support Flip: The previous resistance at 952.00 is now acting as a solid support base.

Momentum: Higher highs and higher lows are forming, confirming a bullish transition.

Long Setup

Entry: 951.94

Stop Loss (SL): 938.14 (Below the accumulation zone)

Take Profit 1 (TP1): 968.45

Take Profit 2 (TP2): 977.25

Risk/Reward Ratio: ~1:1.9

⚠️ Disclaimer: Trading financial instruments involves significant risk of loss and is not suitable for every investor. This post is for educational and informational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Always perform your own due diligence and manage your risk strictly.

S&P 500 Daily Chart Analysis For Week of Jan 2, 2026Technical Analysis and Outlook:

During this abbreviated New Year's trading session, the S&P 500 Index is currently continuing to demonstrate an In Force Retracement sentiment. The Index has established a new Mean Support level at 6,833, and it is anticipated that it will persist in its downward trajectory towards the subsequent Mean Support level at 6,877.

It is imperative to recognize that, given the conditions of the market, there exists a considerable probability of a Dead-Cat rebound. This rebound may prompt a retest of the completed Outer Index Rally at 6,945, via the Key Resistance identified at 6,932.

Additionally, it is expected that the prevailing downward sentiment will remain or may even deepen, and intermediate bearish momentum is likely to persist, particularly as the above-named target levels realign with the anticipated market trajectory.

Bearish Supply Zone On NASAQTwo Supply Zones, one in the extreme at the External high, and the other in the Internal High.

Could get a reaction from the internal high and continue to plough through to the extreme zone, or we could get a confirmation signal from that zone and continue with the bearish trend.

GER30 H4 | Bullish Momentum To Extend FurtherBased on the H4 chart analysis, we could see the price fall to our buy entry at 24,474.21, which is a pullback support that 23.6% Fibonacci retracement.

Our stop loss is set at 24,195.24, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 24,786.98, which is a swing high resistance that is slightly below the 161.8% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

US2000 H4 | Falling Towards Key SupportThe price is falling towards our buy entry level at 2,479.37, which is an overlap support that aligns with the 38.2% Fibonacci retracement.

Our Stop loss is set at 2,449.15, which aligns with the 50% Fibonacci retracement.

Our take profit is set at 2,538.48, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

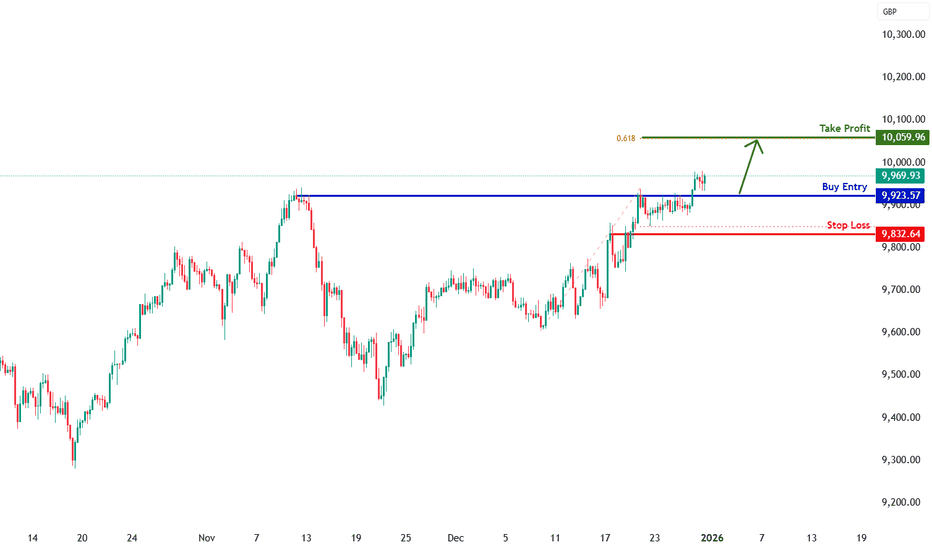

UK100 H4 | Bullish BreakoutThe price is falling towards our buy entry level at 9,923.57, which is an overlap support.

Our stop loss is set at 9,832.64, which is an overlap support.

Our take profit is set at 10,059.96, which aligns with the 61.8% Fibonacci projection.

High Risk Investment Warning

Stratos Markets Limited (

JPN225 H4 | Bullish Bounce OffThe price has bounced off our buy entry level at 50,261.74, which is an overlap support.

Our stop loss is set at 49,846.21, which is an overlap support.

Our take profit is set at 51,425.25, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

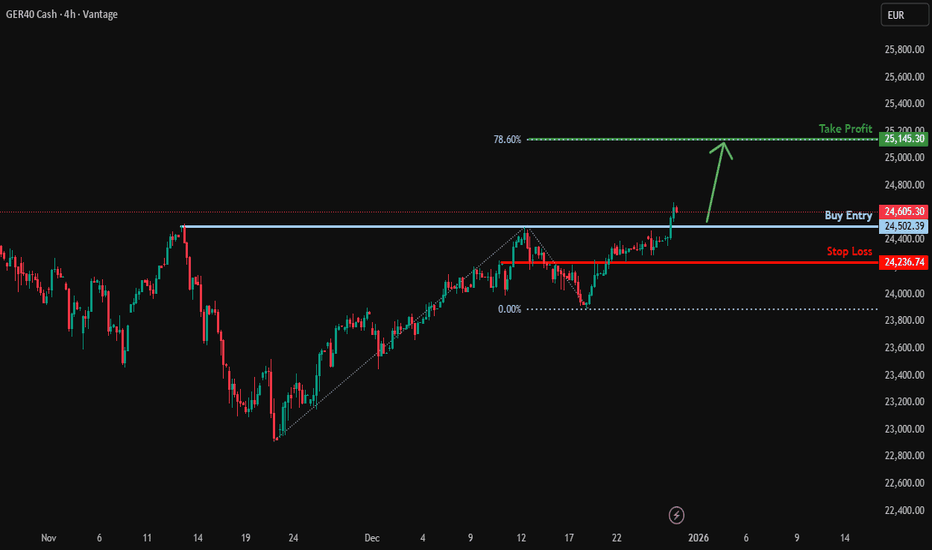

Bullish breakout?GER40 is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 24,502.39

Why we like it:

There is a pullback support level.

Stop loss: 24,236.74

Why we like it:

There is a pullback support level.

Take profit: 25,145.30

Why we like it:

There is a resistance level at the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GE40 (DAX): Structural Breakout — Bulls Targeting 25,000

Macro Environment: Investors are currently digesting a "Santa Rally" while eyeing the upcoming Fed Minutes for clues on 2026 monetary policy. Despite thin year-end liquidity, the technical structure remains exceptionally bullish as fiscal reform optimism offsets manufacturing weakness.

Technical Analysis

The H4 chart reveals a decisive shift in market regime:

The Breakout: Price has cleared a multi-month descending trendline and a major horizontal ceiling at 24,400.

Base Formation: A clean accumulation zone (grey box) acted as a launchpad, confirming strong institutional demand at lower levels.

Momentum: The successful flip of previous resistance into support suggests a "Buy the Dip" environment.

Order Swing Set-up: LONG

Entry: 24,476 (Ideally on a retest of the breakout level)

Take Profit: 25,006 (Key psychological level & measured move target)

Stop Loss: 24,195 (Protected below the recent consolidation base)

Risk/Reward Ratio: ~ 1:1.8

⚠️ DISCLAIMER: This post is for educational purposes and personal opinion only; it is not financial advice. Trading indices involves significant risk, especially during low-liquidity holiday periods. Please Do Your Own Research (DYOR) and manage your risk strictly.

S&P500 H4 | Bullish Bounce Off Pullback SupportThe price is falling towards our buy entry level at 6,860.35, which is a pullback suport that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 6,791.64, which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Our take profit is set at 6,945.99, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

AUS200 H4 | Bullish BounceThe price is falling towards our buy entry at 8,670.62, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is at 8.605.17, which is a pullback suport that aligns with the 78.6% Fibonacci retracement.

Our take profit is at 8,803.69, which acts as a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Falling towards 50% Fib support?US100 is falling towards the support levle which has been identified as an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 25,253.06

Why we like it:

There is an overlap support that aligns with the 50% Fibonacci retracement.

Stop loss: 24,919.12

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Take profit: 25,723.79

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

QQQ (NQ-US100) Weekly Prediction – Outlook (21 DEC)QQQ (NQ-US100) Weekly Prediction – Outlook (21 DEC)

📊 Market Sentiment

Market sentiment turned fully bullish after the CPI data came in significantly lower than expected on Thursday. While the consensus expectation was 3.1%, the actual CPI print came at 2.7%, representing a meaningful downside surprise.

This data does not directly determine the outcome of the January FED meeting, as another CPI report will be released on January 13, 2026, which will be far more critical for the FED’s decision making process. However, the current soft inflation trend increased the probability of another lower CPI reading in January, which positively impacted risk sentiment across markets.

📈 Technical Analysis

Last week’s QQQ analysis played out perfectly. I hope you were able to capitalize on it. Price reversed precisely from the levels we anticipated following the CPI release. I am linking last week’s QQQ weekly analysis below for reference.

After the CPI data, price transitioned back into a clean bullish structure on both the daily and weekly timeframes. On Friday, QQQ rallied impulsively and closed the week with strong bullish momentum.

Overall, I think the market structure supports bullish continuation.

📌 Game Plan

I think QQQ may directly test 618.5 (Target 1) early in the week, followed by a move toward 625.75. These are the two bullish targets I expect to be reached within this week.

Price may also move toward these targets without any meaningful retracement. I plan to close one third of my call options at 618.5 and the remaining portion at 625.75 from the positions I am holding since Thursday.

If price pulls back to 611.75 or 607 before reaching 625.75 and prints strong 1H or 4H bullish candle closes, I will look to add new call option positions targeting 625.75.

In the event of a developing bearish structure, I will provide updates. However, at this stage, I do not see any clear bearish signals.

💬 For deeper sentiment and strategy insights, subscribe to my Substack free access available.

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research before trading or investing.

S&P 500 Daily Chart Analysis For Week of Dec 26, 2025Technical Analysis and Outlook:

During this shortened holiday trading session, the S&P 500 Index achieved a significant milestone by completing the highly anticipated Outer Index Rally target of 6,945, surpassing the Key Resistance level of 6,905, which had been forecasted over a considerable period.

At this time, upon the above-mentioned target completion, the index market experienced an admirable pullback; the downside target is currently set at Mean Support 6.877.

It is, however, essential to acknowledge that, given the market's recent gains, there is a substantial likelihood that prices may exhibit an upward fluctuation near this completed target. Additionally, there remains the potential for further upward movement before the anticipated alignment with the projected downward trajectory.

US30 Approaches Key Support at 48,400!Hey Traders,

In the coming week, we are monitoring US30 (Dow Jones) for a potential buying opportunity around the 48,400 zone.

The index remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback. Price is now approaching a key trend support and support/resistance confluence near 48,400, an area that has previously attracted buyers.

If bullish structure remains intact, this zone could act as a base for trend continuation higher. Watching closely for price reaction and confirmation before engaging.

Trade safe,

Joe

Bullish rise?US30 has bounced off the support level, which is an overlap support and could rise from this level to our take profit.

Entry: 25,425.09

Why we like it:

There is an overlap support level.

Stop loss: 25,270.20

Why we like it:

There is a pullback support level.

Take profit: 25,855.87

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NASDAQ Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring NAS100 fora buying opportunity around 25,450 zone, NASDAQ was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 25,450 support and resistance area.

Trade safe, Joe.

SPY (ES-US500-SPX) Weekly Prediction – Outlook (21 DEC)SPY (ES-US500-SPX) Weekly Prediction – Outlook (21 DEC)

📊 Market Sentiment

Market sentiment turned fully bullish after the CPI data came in significantly lower than expected on Thursday. While the expectation was 3.1%, the actual CPI print came at 2.7%, which was a meaningful downside surprise.

This data does not directly determine the outcome of the January FED meeting, as another CPI report will be released on January 13, 2026, which will be far more critical for the FED’s decision making process. However, the current soft inflation trend increased the probability of another lower CPI reading in January, which positively impacted risk sentiment across markets.

📈 Technical Analysis

In my previous SPY analysis last week, I clearly outlined the expectation of an early week pullback followed by a precise reversal level. That scenario played out exactly as anticipated.

Following the CPI release, price completed its reversal and closed the week with very strong bullish price action on Friday. In my opinion, this behavior suggests that the corrective phase has likely ended and price is now preparing for continuation to the upside.

📌 Game Plan

I think price may target the 683.5 level early in the week.

For call options and long positions, the key lower timeframe reaction zones I will be monitoring are 678.25 and 675.25.

If price rallies directly toward 683.5, I plan to sell the majority of my existing call positions around that level. However, if price first tests 678.25 or 675.25 before reaching 683.5, I am considering adding additional call exposure from those zones.

That said, my decision to enter will strongly depend on 1H and 4H candle closes. I will not enter positions in a market that simply breaks through these levels. If price tests these zones and prints strong bullish 1H or 4H closes, that is when I will begin executing call option entries.

💬 For deeper sentiment and strategy insights, subscribe to my Substack free access available.

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research before trading or investing.

Bullish momentum to continue?S&P500 (US500) is falling towards the pivot, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 6,882.83

1st Support: 6,861.98

1st Resistance: 6,918.56

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

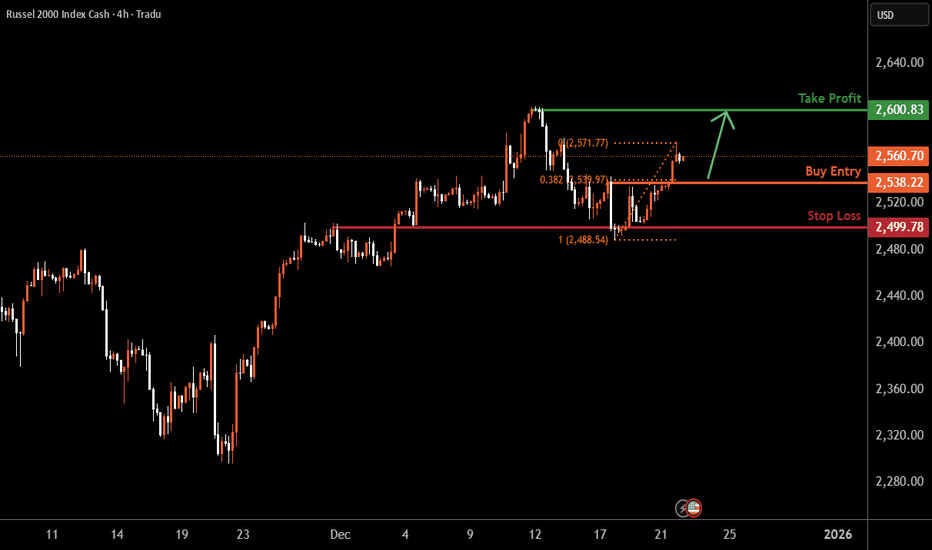

US2000 H4 | Falling Towards Pullback SupportMomentum: Bullish

The price is falling towards the buy entry, which aligns with the 38.2% Fibonacci retracement and also trading above the Ichimoku cloud, a good sign of bullish momentum.

Buy entry: 2,538.22

Pullback support

38.2% Fibonacci retracement

Stop loss: 2,499.78

Overlap support

Take profit: 2,600.83

Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

GER30 H4 | Bullish Momentum To ExtendMomentum: Bullish

The price has bounced off the buy entry, which aligns with the 38.2% Fibonacci retracement.

Buy entry: 24,207.41

Pullback support

38.2% Fibonacci retracement

Stop loss: 24,088.31

Pullback support

61.8% Fibonacci retracement

Take profit: 24,476.05

Multi swing high resistance

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.