Government bonds

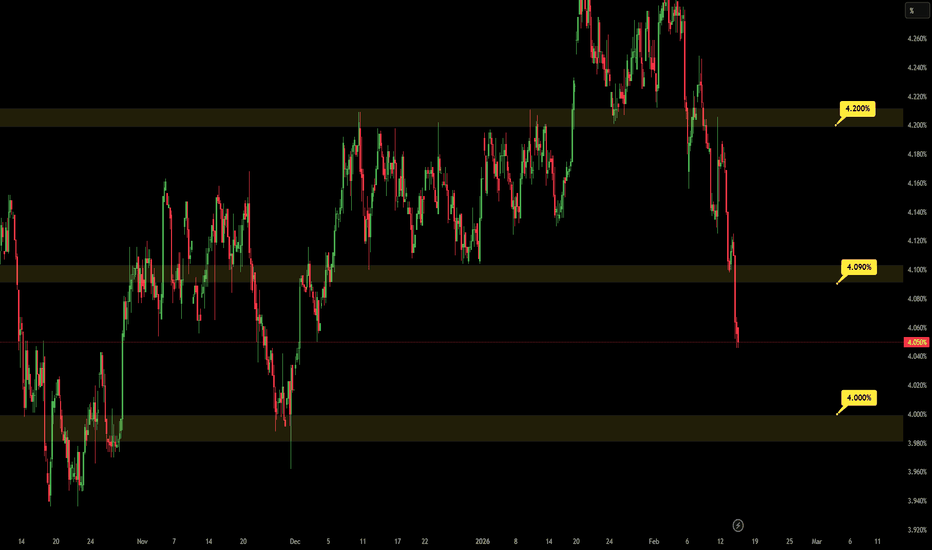

US 10Y TREASURY: False 4,2% breakoutDuring the previous week charts showed that the recent break from the 4,2% for the 10y yields was a false breakout. Actually, the released jobs and inflation data showed better than expected results, which pushed the yields toward the lower grounds. In technical analysis, the false breakouts usually lead to a strong push of price/yields, which also occurred in 10Y yields. Although the 10Y Treasuries started the week around the 4,2%, they are closing it at 4,05%.

The cooler inflation print reinforced expectations that the Federal Reserve may begin cutting interest rates later this year, boosting demand for longer-dated Treasuries and pushing yields down from recent highs. Traders also increased the odds of a June rate cut, pricing in more easing as inflation data undershot forecasts. Broader economic signals, including stronger labor market data earlier in the week, create a backdrop where bond markets are balancing inflation progress against resilient employment figures when setting yields. The drop in the 10-year yield reflects growing optimism about disinflation, even as markets await further key data, the PCE in the week ahead, for guidance on future monetary policy. Although Monday is a holiday in the US when markets will be closed, still some short reversal to the upside could be expected during the week ahead. In this sense, the 4,1% could be tested.

US10Y Daily priceaction and directional bias.US10Y is the yield on the U.S .10-year treasury notes government debt security maturing in 10 years that serves as a global benchmark for interest rates, reflecting investors expectations on growth ,inflation and federal reserve policy.

The US10Y represents the effective return investors demand to lend to united states government for a decade(10years).it moves inversely to bond prices, on technical, when yields are rising which signals stronger growth while falling yields indicates economic caution or safe-haven demand,US10y influences borrowing cost across mortgages, corporate bonds and loans

Coupon rate is the fixed annual interest paid on a bond's face value. For a Treasury note or bond, it's set at issuance and paid semi-annually until maturity.

Key Details

It's calculated as (annual coupon payments / par value) × 100; e.g., a 5% coupon on $1,000 par pays $50 yearly ($25 twice).

Unlike yield, which fluctuates with market price, the coupon remains constant—higher coupons trade at premiums when yields fall.

Bond prices and yields have an inverse relationship. When yields rise, prices fall, and vice versa, due to the fixed coupon payments relative to market rates.

Why Inverse?

Fixed coupons mean higher market yields make existing bonds less attractive, forcing sellers to discount prices for competitive returns.

Lower yields increase demand for higher-coupon bonds, driving prices above par (premium).

US10Y affect DAX40,the DAX40 is the German benchmark index of 40 major stocks, through global yield spillovers and capital flows.

When the US10Y is higher and bullish ,it strengthens the dollar index and pressure Eurozone borrowing, this makes U.S assets more attractive and weighing on European equities like the DAX40.

The US10Y bearish drop can be seen as supporting DAX by easing ECB policy constraints and boosting risk appetite.

So coming week trading US10Y along side DAX40.

the market structure of the US10Y is giving us a sell vibes and it could drop below 4.0% this month .

though we have an ascending trendline on daily that should serve as support to enable us get a retest and sell below 4.0% on possible breakout of trend.

#US10 #US10 #BONDS

100 years!www.tradingview.com

Does this keep you up at night? You might look for this pattern across smaller time frames, but to see it across 100 years is well.. (no words).

3 Scenarios:

1. Yields blast off directly from here.

2. A crisis (real/manufactured) comes in allowing them to pull rates down to the 6M IDM (0-0.36%) and perpetuate the divergence. Then yields spike next cycle.

3. We break the divergence and head into negative rates?

The bond market doesn't lie.

US 10Y TREASURY: back to 4,2%U.S. Treasury yields edged lower this week as investors weighed the health of the economy and softer labor market signals, with the 10-year Treasury yield dipping toward around 4.2%, its lowest in about three weeks. This week only JOLTs Job Openings were posted at a level strongly lower from expectations. The figure of 6.542M was lower from the expected 7,2M. At the same time, NFP and Unemployment rate were postponed, due to a partial US Government “shutdown”. Markets have reacted to weaker economic data and renewed bets on multiple Federal Reserve rate cuts later this year, which has underpinned demand for longer dated government bonds and softened yields. The retracement in the 10-year yield reflects cautious sentiment on growth and inflation outlooks as traders await upcoming employment and macro releases.

The yields reached their highest weekly level at 4,29%, but from Thursday the correction started, ending with Friday's weekly low at 4,16%. Still, yields are closing the week at 4,20%. For the week ahead the correction might continue, but only after the 4,2% is properly tested. This means a potential for another push toward the higher grounds, and return back toward the 4,2% or lower. It should be considered that NFP and Unemployment data were postponed for the week ahead, which might bring back some volatility in yields.

US10Y United states government 10 year bond yieldThe US10Y refers to the yield on the 10-year US Treasury note, a benchmark rate for the return investors demand to lend to the US government over 10 years.

the US10Y is Issued by the US Treasury, these notes pay semi-annual interest and return principal at maturity; yields move inversely to prices based on auction bids and secondary market trading. Seen as virtually risk-free, US10Y signals investor confidence in inflation, growth, and Fed policy.

Economic Effects

Rising US10Y increases borrowing costs ,while strengthening the dollar. Falling yields signal economic worries or flight to safety, spurring growth via cheaper credit but risking bubbles if prolonged. Inverted yield curve (US10Y below short-term rates) often precedes recessions.

US10Y (10-year US Treasury yield) and the Dollar Index (DXY) share a generally positive historical relationship, where rising yields often strengthen the dollar by attracting foreign investment seeking higher returns. However, this correlation has weakened recently, with divergences noted since early 2025 due to factors like global risk sentiment and fiscal policy.

US10Y-DXY Link

Higher US10Y yields boost DXY as investors buy Treasuries, increasing USD demand; falling yields reduce appeal, pressuring the dollar lower. Correlation around 0.55 lately, but it can invert during uncertainty (e.g., 2020 pandemic).

Fed Rate Impact on US10Y

Fed funds rate hikes typically push US10Y yields higher via expectations of sustained tight policy, inflation control, and stronger short-term rates influencing the yield curve. Cuts lower yields by signaling easing and boosting bond prices; US10Y reflects the average expected future fed funds path over 10 years.

#US10Y #DONDS #STOCKS #DOLLAR

US10Y Analysis – 10-Year US Treasury YieldsUS10Y Analysis – 10-Year US Treasury Yields

The US10Y Treasury yield has recently exhibited a clear internal Market Structure Shift (MSS),

reflecting a change in price behavior that favors the bullish scenario.

📈 Technical Bias:

Following the internal MSS, the likely expectation is a continuation of the upward trend.

The anticipated movement will follow the same price pattern as the current one.

This upward movement is not random but rather a result of liquidity repositioning within the market.

💵 Strategic Importance:

The US10Y is one of the most important leading indicators for the US dollar.

Any rise in yields supports the strength of the dollar.

Therefore, monitoring this indicator is essential for understanding the movements of:

Dollar Index

Dollar-related currency pairs

Gold and Stocks

⛔ Scenario Invalidation Point:

A break below the 3.960% support level is prohibited.

If a weekly trading candle closes below this level, the bullish scenario is completely invalidated, and the market should be reassessed with a new scenario.

And Allah knows best.

The Truth Behind Rising Rates (US10Y Time Wave Analysis update)Hello. It has been a long time since I last greeted you.

I am now living a new life. I have come to share the truth with you.

First, based on my past experience in market analysis, I would like to briefly review the current U.S. 10-year Treasury yield.

The blue support line at the bottom is a long-term upward trend line. Because this line has been maintained for many years, I define it as a yearly time trend line. Of course, even if this level breaks, if a new line forms over several years, it can again become a strong support for another upward move.

As you can see from my analysis written several years ago, yields already broke out of their long-term downward trend and established a new upward turning point. Interest rates will continue to rise.

At present, yields appear to be consolidating within a smaller time frame, moving back and forth while compressing energy for the next upward move. The current pattern also seems to be forming a leading diagonal. It may easily be mistaken for a corrective pattern, but if price rises after the pattern is completed, that will mark the beginning of a new bullish wave.

From there, yields are likely to move steadily toward at least the 8% level.

However, this also marks the time when the stock market and the real estate economy begin to collapse. I have been warning about a Bitcoin breakdown in many places. The answer to why rising interest rates destroy the economy is not difficult to find.

The economic power and capital markets of the United States have become far too arrogant. They also dominate the world through force and military power. God will surely demand payment for this.

Therefore, I urge you to get out while you still can. Those who pursue money and wealth will certainly pay a price.

I have come to proclaim the truth to you. Those who accept this truth will be blessed. Open your hearts and walk with God.

US 10Y TREASURY: Warsh nomination eased yieldsThere has been two important news for investors during the previous week. The first was related to the FOMC Meeting, where the Fed decided to hold interest rates, which was highly expected. The second important news was related to the nomination of Kevin Warsh as the next Fed Chair in May. Markets generally positively reacted to this news, considering their fears over independence of the Fed from political influence.

At the start of the previous week the 10Y Treasury yields tested 4,2%, however, soon reverted back toward the higher grounds. The highest weekly level was at 4,27%, however, closing level is 4,24%. The rise in rates reflected traders pricing in a potential shift in policy direction. Warsh’s blend of past hawkish criticism of the Fed’s balance sheet and mixed views on rate cuts has contributed to uncertainty, prompting slight upward pressure on 10Y yields even as short-term rate expectations moved differently. For the moment, further relaxation of 10Y yields is quite possible. In this sense, yields could test for one more time the 4,2%. The week ahead brings JOLTs and Unemployment data for December, which might increase volatility a bit.

Where is all the liquidity going?Commodities Crashed

Stock Market Crashed

Crypto Crashed

Heavy sell-off is happening across thr globe. But wait, where does all these money going to?

In the last 30 days (as of Feb 2, 2026), major bond markets like US Treasuries, Japanese JGBs, and Indian government bonds have seen yields rise (e.g., US 10-year from ~4.0% to 4.26%, India 10-year to 6.72% peak)

More liquidity is not good for market! We have seen Inflation in US surged for December, 2025. We are in brick of inflation, may be.

Liquidity Trickle at RiskThis dashboard is built around a simple idea: short-term funding can look calm while liquidity support quietly fades . The top-left panel, FRED:SOFR − FRED:EFFR , is the “plumbing alarm.” When it rises, secured funding is getting more expensive relative to unsecured funding—often a sign that cash is getting scarce in the places that matter. Right now, that spread is muted, which tells us the system isn’t showing acute overnight stress yet.

But the buffers underneath the plumbing are thinner than they look.

RRP usage is near depleted , meaning the money-market “shock absorber” that used to soak up Treasury issuance is largely gone. With that buffer drained, a TGA rebuild ( FRED:WDTGAL rising) is more likely to show up as a direct drain on bank reserves rather than being offset by cash rotating out of RRP. That’s why FRED:WRESBAL matters: it’s the remaining cushion.

So why have we seen risk assets wobble even without a repo-spread flare-up?

Because the market is trading the marginal impulse—and that’s increasingly about the Fed’s balance sheet .

The second chart is the focal point: after the post-COVID QT downtrend, the recent action looks like milder QT / a small balance-sheet “trickle” rather than an aggressive, continuous drain. Even a small easing in the slope can matter at the margin for the most liquidity-sensitive corners of the market.

That’s where expectations around leadership and posture enter. Kevin Warsh is widely perceived as hawkish on the balance sheet —more inclined toward discipline, faster normalization, and less tolerance for “stealth easing.” If markets start pricing a higher probability of that kind of balance-sheet stance, the implication is straightforward:

the recent trickle of liquidity support could stop—or reverse.

That expectation alone can drive what you’re seeing: a selloff concentrated in speculative silver, crypto, and high-beta equities , because those assets tend to be the first to reprice when the perceived liquidity impulse turns down. You don’t need SOFR − EFFR to spike for that to happen; often the speculative complex moves first, and the plumbing follows only if conditions truly tighten.

How to read the dashboard from here:

If FRED:WDTGAL rises while RRP stays pinned, watch FRED:WRESBAL for drawdown.

If reserves slide and funding tightens, FRED:SOFR − FRED:EFFR is your alarm.

If the balance-sheet “trickle” fades and real yields remain firm, the path of least resistance stays pressure on the speculative complex.

Wild TimesThe charts are saying up we go.

6% and even 7.5% are potential targets.

Equities better watch out, especially those with bad debt.

Over the last 30-40 years, the U.S. economy has escaped severe drawdowns and crisis mainly due to cyclical refinancing periods.

Most companies survived prior recession by refinancing their debt and expanding, but this time those companies may just go bust, and have their values decline to such a ridiculous level that other companies that survive will buy for a fire-sale.

If this holds and we do go toward 6-7%, this is very bad news long term. This would mean the refinancing cycle has ended and we are indeed in a long term bullish trend for the next 3-5 years at least.

A daily close above 4.30 will confirm the continuation of the bull trend.

A daily close below 4.10 would confirm a downtrend, but there is currently no evidence for this.

T bonds crashing Since the Fed began easing policy and trimming the federal funds rate, short-term borrowing costs have indeed drifted lower as expected. However, long-term Treasury yields — like the 10- and 30-year — have stubbornly stayed high or even climbed, pushing bond prices down. That’s the opposite of what “textbook” rate cuts usually do, but markets aren’t textbook right now.

The disconnect comes from the fact that Fed rate cuts only directly influence short-term rates, not the entire yield curve. Longer maturities reflect market expectations about inflation, growth, fiscal policy, government debt issuance and global demand for U.S. debt over decades — all of which can outweigh the effect of near-term Fed action.

Investors remain concerned about persistent inflation above target, heavy Treasury supply, fiscal deficits and weaker foreign demand, so they’re demanding higher yields for long-dated bonds to compensate for those risks. A higher yield means a lower bond price, i.e., a crash in long bonds even as benchmark policy rates fall.

In short: the Fed may be cutting the short-end to support growth, but the market is pricing the long-end based on inflation and risk premia farther out in time — and that’s keeping yields elevated and long bonds under pressure.

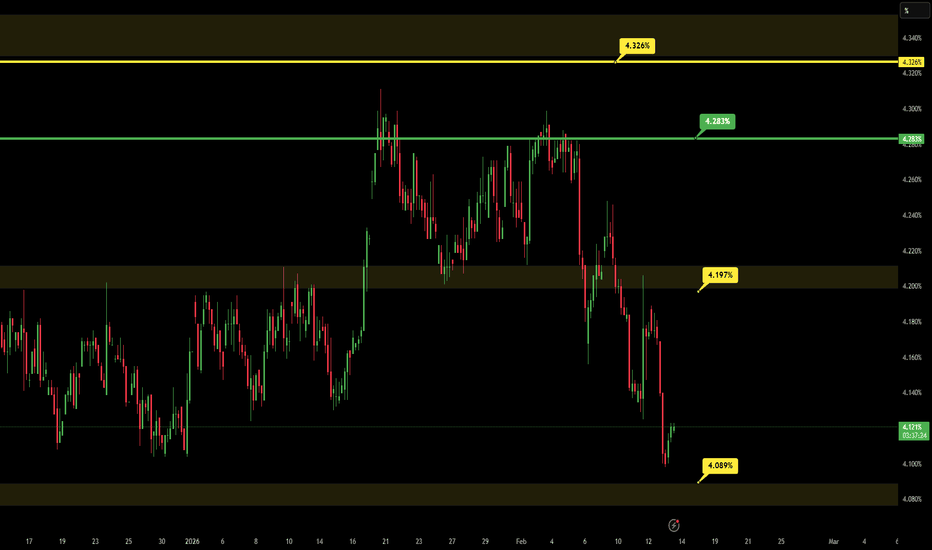

10Y Bond - Expectation 1-2 weekBOND has down trend and it can continue, 4.197 point can work, as short term support level, but under this point it can increase the chance to reach 4.089 point, one more retest on 4.283 point is dangerous, and it can increase more. QE actions are important for the Bond direction.

US 10Y TREASURY: Fed will hold rates? The previous week was full of news, both political and economical, bringing higher volatility to US Treasury yields. As the 4,2% was clearly broken, yields continued their path toward the higher grounds, reaching the peak weekly level at 4,31%. Still, some easing during the second half of the week brought yields slightly back, closing the week at 4,23%. Investors are still weighting the broader state of the U.S. economy and potential impact of current both political and geopolitical developments. In any case, economic signals currently remain mixed, increasing the probability of further higher volatility.

As for weekly macro data posted, the GDP Growth rate final for Q3 was standing at 4,4%, which was positive for the U.S. economy. Fed's favorite inflation gauge, the PCE Price Index in November was at the level of 0,2% for the month and 2,8% on a yearly basis, and was generally in line with market expectations. The next FOMC meeting is scheduled for the week ahead, where on Wednesday, its members will decide on interest rates. As per CME Fed WatchTool, current odds are 95% that the Fed will hold interest rates at this meeting. As for potential yield levels in a week ahead, there is some probability that the 4,2% support might be shortly tested, but generally, now that the 4,2% is definitely broken, the yields will seek higher grounds. Current levels that are in the spot line are between 4,30% and 4,35%.

Macro Structure Snapshot – Rates, Dollar & Yield Curve Alignment1) Short-Term Rates (2Y)

Short-term yields remain flat and stalled, reflecting continued compression and equilibrium. Momentum is muted, signaling ongoing digestion rather than directional intent. This reinforces a neutral short-term rate regime, keeping near-term liquidity pressure contained.

2) U.S. Dollar Index (DXY)

The dollar continues to unwind lower, now trading near 97.45, with the 20 EMA showing clear downward curvature. Momentum remains negative, confirming continued cooling rather than stabilization. Structurally, this maintains a risk-supportive macro backdrop, as dollar weakness typically alleviates pressure across broader asset classes.

3) Long-Term Rates (10Y)

Long-term yields remain constructive, holding higher with the 20 EMA maintaining smooth upward momentum. This reflects improving structural participation and supports a gradual re-expansion in macro trend energy, particularly relative to the continued stalling in short-term rates.

4) Macro Alignment

Macro structure continues to reflect a controlled regime transition:

Short-term rates compressed

Dollar trending lower

Long-term yields stabilizing and advancing

This alignment supports a constructive macro backdrop, where volatility remains restrained while broader structure slowly rebuilds.

5) What I’m Monitoring

I’m watching for:

Continued 2Y compression vs 10Y expansion, and

Whether DXY downside momentum persists,

as this combination often precedes broader directional clarity across equities, commodities, and crypto risk cycles.

⭐️Final Clarity Note⭐️:

This remains a structure-driven environment, where macro alignment favors stability, gradual risk expansion, and regime transition, rather than abrupt directional shifts. Compression continues to be the dominant force, with energy slowly rebuilding beneath the surface.