A break down would call for 30k again. However the RSI divergence could hint at a double bottom forming. Always wait for confirmation.

Notice the declining volume as well as the patterning.

Chart for forecast on GJOpen.com.

If the DAX regains the trendline in 2020, I will eat my hat!

Gold has bumped its head on a historically strong resistance level at ~1560. USDJPY has not confirmed gold's move since Dec '19. USDJPY breaking out higher itself (bearish gold) so we should expect gold to readjust itself. DXY in general has regained an important historical level + 61.8 fib of most recent trend which points the dollar higher (bearish...

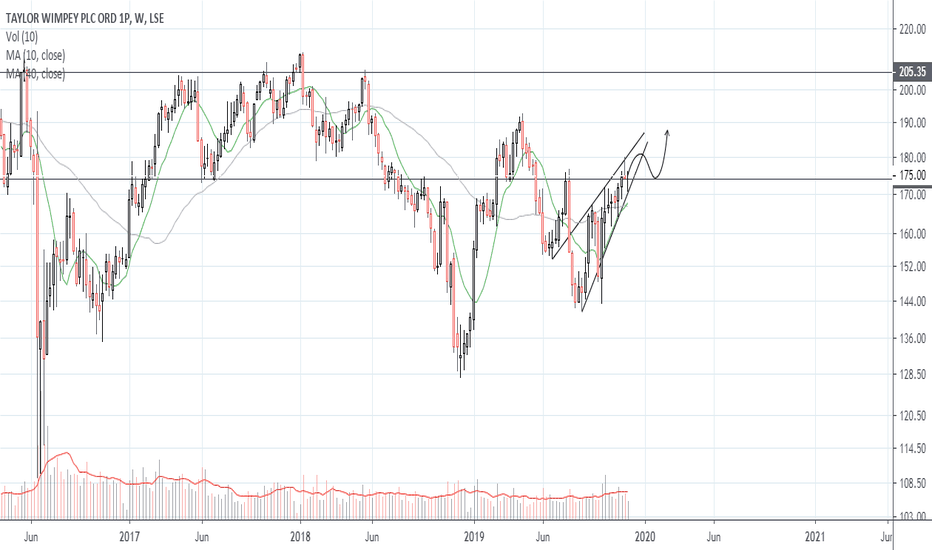

Rising wedge suggests a possibility of a breakdown in the coming year..

A lot of Fib levels hanging around underneath the psychological $300. I'll be playing it short with PUTs inside that red box.

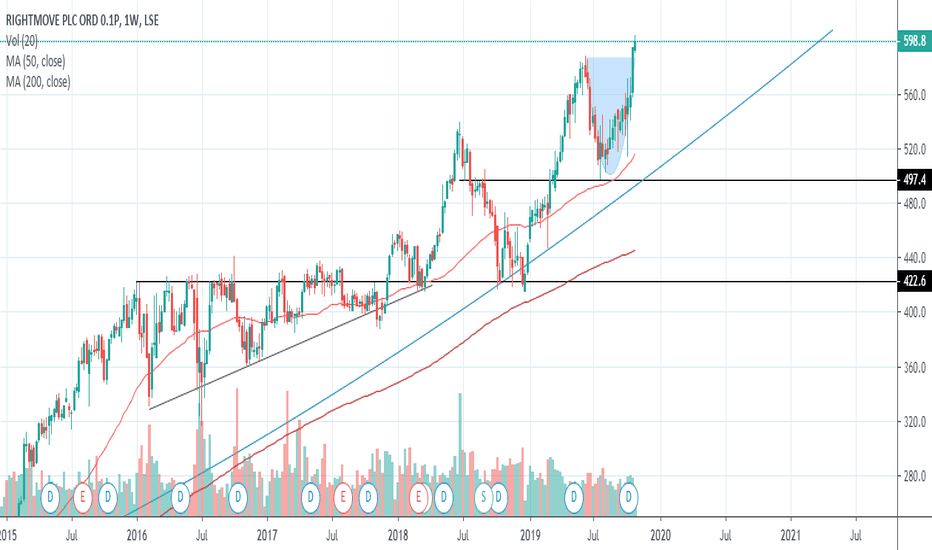

History of large 'buy' volume weeks. Created a couple of firm bases on the weekly, the latest of which it is breaking out from with good volume.

Burford has broken out from its post-Woodford drop. Clean air up to the resistance and fib area, around 1050-1100p. I'd expect a few early opportunists to sell out here though, and have it retest the breakout area.

Might be a struggle with wider market conditions but it has shown relative strength on every timeframe this year

Looks like the consolidation from the crash is coming to an end in the next year or so. Coiling down at 200p and will probably want to retest previous highs around 250p

Pound strengthening, breaking the 0.382% retrace. An hour left in the monthly candle but it's finishing strong which usually indicates a continuation into the next month. Target 0.500%. (...just in time for booking a driving and safari holiday!)