Coforge: Weekly B/O above 8000 Expected TGT 16% (approx 9300+ levels) A nice reversal from 61.80% retracement.

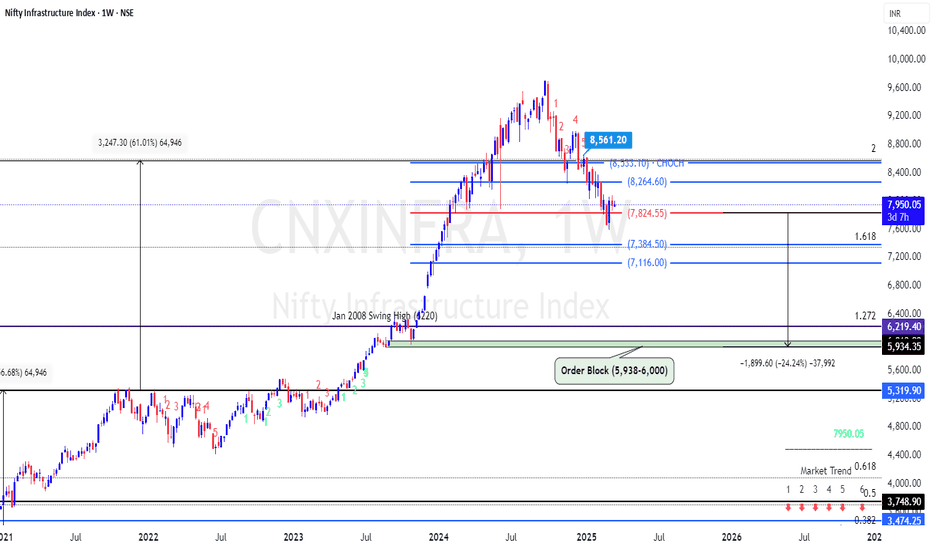

NIFTY INFRASTRUCTURE : POISED FOR ANOTHER 25% CORRECTION 1. Sustaining Below 8,500 for over 2 months, this level will act as an immediate resistance. 2. We may expect approx. 25% downside from the current levels 3. Most likely it may retest JAN 2008 Swing top (Around 6,000) that confluences with the Weekly Order Block 4. We may find levels around these levels on...

NIFTY (Reality) - Weekly Chart 1. After CHOCH the best place to initiate buying in this sector lies 30-35% below the current Levels. 2. Sectorial churn makes this indice less attractive at current levels. 3. It may retest the OB at around 550-580 levels (The Green strip) on the chart

ITDC BULLISH ON M/D/W Time frames Previous Swing High is taken out on a Daily TF All good to go up (SL - 3-5%) for at least 20-25% TGTs are depicted on the Chart

IRB Infra showing Bullishness. On All Higher TF the stock is Bullish. We can expect a TGT of 80 in Medium Term

Bank Of India 1. Stock Fallen around 38% from Highs and showing reversal. 2. A very nice R:R near the Order Block. 3. Target is to tap the previous swing high on a Daily Chart. (i.e. 20%) 4. If move further the trade can be carried forward as a multi-gainer.

LAURUSLABS Bullish on Daily/Weekly/Monthly TF Risk 4-5% Reward: 20%+ Targets are Estimated based on FIB Extensions Best buy around 578

SBI Cards : A good Short term (15%) to Long Term (50%) play on cards from current levels. 720 SL Here’s a summary of the key points : 1. Rating Upgrade: Stock rating for SBI Cards (SBICARD) upgraded to 'Buy' from 'Sell'. 2. Target Price Raised: Target price increased to 913 rupees from 652 rupees. 3. Profit Outlook: Pre-provision operating profit for SBIC is...

Bajaj Finserve Key Points: Consolidation of nearly 30 days before the up-move provides a reliable cushion. 1745 works as a support reflecting a confluence of Fib Extension and a short term previous swing high. Check out depicted levels for re-entry/profit booking/ Stop Loss.

Bajaj Finserve Key Points: Consolidation of nearly 30 days before the up-move provides a reliable cushion. 1745 works as a support reflecting a confluence of Fib Extension and a short term previous swing high. Check out depicted levels for re-entry/profit booking/ Stop Loss.

Asian Paints: Paint Sector generally shows strength during May - Sep every year. Asian paints has not performed since 2021 Very predictable price behavior - 2600-2700 (Buy) 3600 (Sell)

SBI Key points: 1. Goldman Sachs downgrades SBI to "Sell" 2. Healthy red candle with volume on the daily chart appeared after 24 day's of consolidation. Means bears have accumulated energy during that phase 3. Institutional selling on this counter (Reason unknown, so far) 4. 2 order blocks are pending to be re-visited by the price )around 700 and 600 levels. 5....

Orient Cements: Monthly Chart Observation Each up-move clocks186 points. Considering (204) as a monthly open and a pocket friendly Stop Loss longs can be initiated A FVG exists on the Daily Chart (288-291). This also can be a good Long Entry point. Use your reasoning (Wave Theory included) and trade decisions around these levels. Targets are depicted on...

KEC Given multi time frame B/O If gets retested around 960 and goes up, BUY SL 5% from entry

ADF Foods shown multi TF B/O at 262 B/O got retested to provide reference for Stop Loss Supported by Volume Best Buy around 266-267 SL 252 (Closing Basis) TGT 345/359

Gujarat State Petro offering a safe and a promising technical play for 50% gains with almost zero SL.

Merger of HDFC (Finance) with HDFC Bank paved the way for other Housing Finance Companies like LIC Housing Finance and PNB Housing Finance and other peer group companies. Performance of these companies is a function of Interest Rates, Real Estate Inventory in Metros and B Grade Towns. That is why these are subject to volatility and unpredictable Price...

Dalmia Bharat Best buy level 1850 SL 1800 (Daily Closing Basis) TGTs - Each previous Swing Highs (Lowe Highs) Play all Fractals within these levels