Julien_Eche

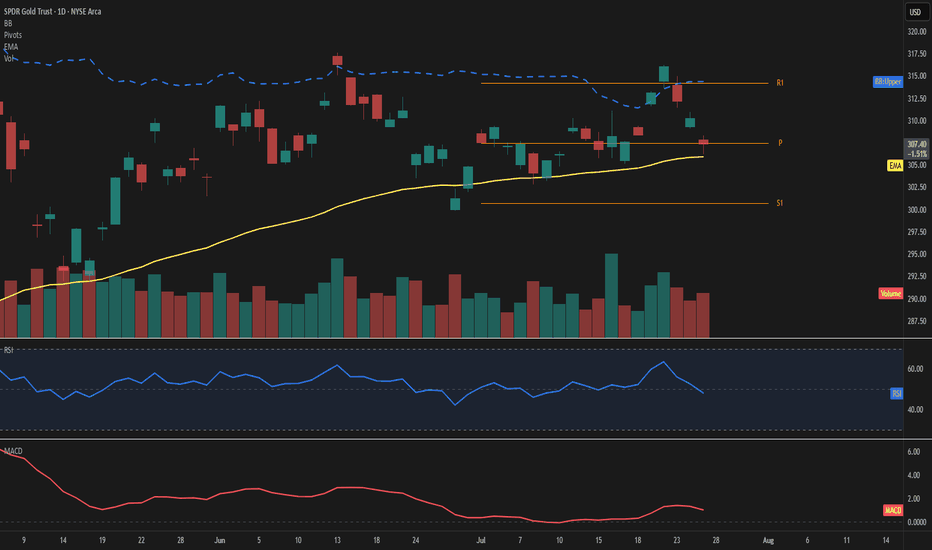

ModPrice is hovering just above the 50-day EMA at 307, showing signs of short-term hesitation near the Fibonacci pivot. The upper Bollinger Band sits at 314, leaving moderate room for expansion if momentum picks up. The RSI reads 48, reflecting a balanced setup without clear directional bias. MACD remains slightly positive, suggesting a still-constructive but soft...

Price extends well above the 50-day EMA and pierces through the upper Bollinger Band, highlighting strong bullish momentum. RSI stands at 76, confirming overbought conditions, while MACD remains firmly positive. The ongoing move leaves the EMA50 at 608 and the Fibonacci pivot at 607—both now acting as key support levels. With R1 at 620 already surpassed, the next...

BTC is trading around 117,800 USD, well above both the EMA 50 (111,800) and the pivot level (105,300), confirming bullish dominance. Price remains below the upper Bollinger Band (123,400), leaving potential room for continuation. Momentum stays constructive, with RSI at 60 and MACD in a strong positive zone, reflecting sustained upward pressure. As long as price...

The current mix of geopolitical tensions, policy uncertainty, and fragile market sentiment brings to mind the setup ahead of October '87. Without stabilizing signal, especially from the U.S. administration this weekend, the risk of a sharp correction is not negligible.

Revealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the...

The SPY (ETF tracking the S&P 500) has just broken upward from a clearly defined short-term descending channel identified by the Adaptive Trend Finder (ATF) indicator. This indicator automatically detects the current dominant trend (here at 150 periods) with high relevance, as evidenced by the strong correlation highlighted by the indicator. Prices are currently...

Current Market Situation Bitcoin's technical analysis currently reveals intriguing signals that warrant investor attention. Price patterns and technical indicators suggest a potential consolidation phase following the recent bullish performance. Key Technical Levels Chart analysis highlights a crucial technical level for Bitcoin at approximately $66,203. This...

Is Tesla Set for a Bullish Ride? 🚀 With Tesla's stock showing signs of a potential uptrend, investors are wondering if this could mean big gains ahead, maybe even a doubling in value. Here's the rundown: 👍 Tesla fans are excited about: • Cool Innovations: Tesla's new Cybertruck production line is getting attention for its smart design, making manufacturing...

A pivotal moment as the stock breaks through the channel with a bullish surge, hinting at a potential shift in market sentiment. Here's a closer look: Positive Indicators: • Financial Resilience: There are signs that GameStop is gaining control over cash burn and losses, suggesting a possible turnaround in its financial stability. • Margin Expansion Potential:...

Liquidity drives risk assets, especially growth assets, crypto, and tech. #Bitcoin closely tracks US net liquidity.

Join me as I delve into the intricacies of trend analysis using the Adaptive Trend Finder (log) on TradingView, focusing on the S&P 500 Index (SPX). This powerful tool is my go-to for identifying both short-term and long-term trends, leveraging the robust Pearson correlation method. Displayed prominently in the lower center (in gray) is the strength of the...

Hello fellow traders, Today, I want to discuss one of my favorite tools for identifying robust short-term and long-term trends on the CAC40 using TradingView—the Adaptive Trend Finder (log). This tool employs a highly effective method based on Pearson correlation, allowing for a nuanced analysis of market trends. Located in the middle of the chart in gray,...

Hello fellow traders! Today, I'd like to share my insights on the USDCAD pair using one of my favorite tools on TradingView: the Adaptive Trend Finder (log). This tool is exceptional for identifying both short-term and long-term trends with great accuracy, employing the powerful method of Pearson correlation. In the chart, you'll notice the Adaptive Trend Finder...

Hello traders! Today, I'm excited to share insights on the AUDUSD pair using my favorite tool, the Adaptive Trend Finder (log) available on TradingView. This tool is exceptionally effective for identifying both short-term and long-term trend strengths, employing the powerful Pearson correlation method. In the chart, focus on the middle section highlighted in...

Discovering strong short-term and long-term trends in GBPUSD has become effortless with the Adaptive Trend Finder (log), my favored tool on TradingView. This tool harnesses a remarkably effective method known as Pearson correlation. At the core of the chart, in a subdued gray shade, lies the representation of long-term trend strength. To the right, highlighted in...

Hello traders! Today I want to share insights on USDJPY using one of my favorite tools on TradingView—the Adaptive Trend Finder (log). This tool excels in identifying both short-term and long-term trend strengths using an effective method based on Pearson correlation. In the chart, focus on the lower middle section highlighted in gray for the long-term trend...

Hello traders, Today, I want to share insights on my preferred tool for identifying strong short-term and long-term trends in EURUSD—The Adaptive Trend Finder (log). This tool employs a highly effective method utilizing Pearson correlation. At the bottom center of the chart (in gray), you can observe the trend strength for the long-term channel, while on the...

Hello traders! Today I want to share insights on BTCUSD using my favorite tool, the Adaptive Trend Finder (log), available on TradingView. This tool is exceptional for identifying both short-term and long-term trends with high accuracy, leveraging the powerful Pearson correlation method. When you look at the chart, focus on the bottom middle section highlighted...