Hybrid Leading Indicators use all 3 data sets from each transaction that occurs in the stock market. Today this lesson talks about Chaikin Oscillator and Chaikin MFI. Both are used on the same chart as the volume oscillator reveals the volume and price correlation to what the Dark Pool Buy Side institutions are buying or selling for long term holds. The...

There are two primary Order Types that the Professional Side of the market use. 1. Time Weighted at Average Price, aka TWAP , is used extensively by the Dark Pool Buy Side, Derivative Developers, and Sell Side Banks of record for Buybacks for corporations. The TWAP can be set at a penny to few pennies spread and pings and transacts on a specific TIME to PRICE....

VWAP orders are used by Independent Small Funds Managers. IF a Small Fund or Small Asset company has 3 billion or less assets under management, the SEC classifies them as NOT a professional side entity. This is because most independent Small Funds Managers have no Financial Degree, no professional certification aka CMT, CFA etc. These managers often know less...

High Frequency Trading Firms provide liquidity to the public stock exchanges and have been around for more than 20 years. HFTs are called "maker/takers" as the make liquidity by selling shares of stock when there is a high number of buyers but fewer sellers. They take the market and sell short to provide the buy to cover to fill the orders during a panic selling...

XAUUSD is a Futures Spot contract. it trades similarly to a stock or ETF or any stock market derivative. When the stock market is stressed as it is right now, then this futures spot offers potential swing to platform position trading opportunities. Trade Wars are creating a very stress stock, bond, ETF, and commodities markets situation at this time. Gold is...

A downtrend starts with Dark Pool Buy Side Institutions slow rotation to lower inventory of a stock or ETF. The rotation bends the trend into a rounding pattern that is visible on the stock or ETF chart. The goal of the Dark Pool rotation is not to disturb the uptrend while they are slowly selling shares of stock over several months time. The bending of the price...

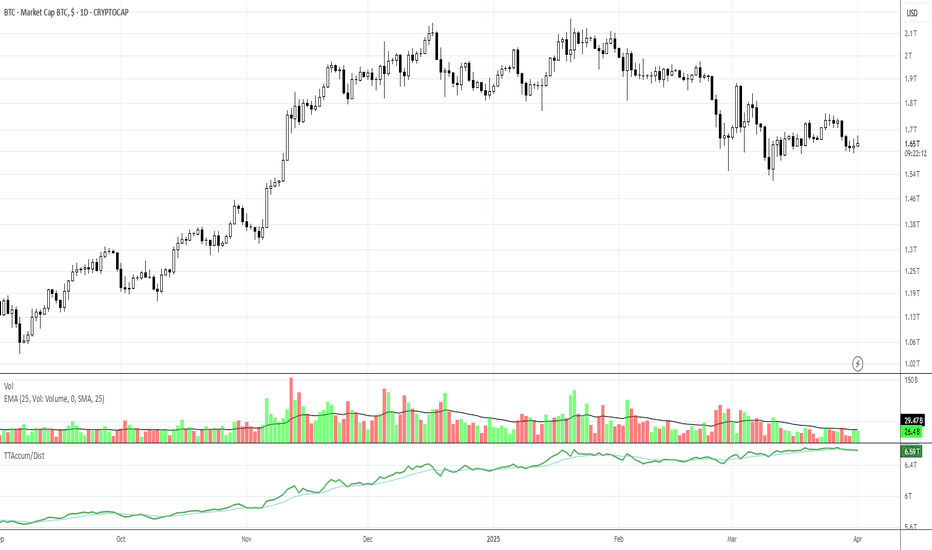

There are now over 40 Bitcoin ETFs that you can use for long term investing, trading for monthly income, to diversify, to mitigate risk, or for safe-haven investments. BTCs are a Stock Market Derivative. There are numerous derivatives that are available in the stock market. Every other financial market has derivatives that have been developed by Dark Pool Buy Side...

Yes, you can see fundamental levels using your technical analysis in your charts. Dark Pool Buy Side institutions buy a stock incrementally ahead of its earnings season often weeks ahead. The fundamentals are right in your charts and are easy to see and recognize once you understand the dynamics of the Dark Pool Buy Zones and how and why these form in most...

Most Traders use the indexes to try to understand whether they should buy long or sell short. However, the ETFs impact the index components prices not the other way around. Most traders do not realize that they should be studying the ETF of an index rather than the index to determine how to trade the next day. Also ETF trading can be highly lucrative. Using the...

Often times when the market is in a panic selling mode or trending down in a correction, stocks fall below their fundamental values. When that happens traders need to quickly close their sell short positions with buy to cover orders and prepare to start swing trading the velocity or momentum runs that will move price up quickly over a 3-6 day average run up to net...

Learn the important aspects of how to sell short with consistent success and higher profits. There are many myths about selling short that this video training will explain. Selling Short is something all traders need to learn to do. However, it requires an understanding of the downside price action that is totally different than buying long whether you swing...

Sell Side Institutions are a major market participant. They are often called "Wall Street" These giant banks and financial services companies do a variety of trading activities. They move price in an entirely different way than the Buy Side Institutions. Sell Side Institutions have specific services they provide to the stock market including Market Making when...

This lesson is about TWAP vs VWAP order types, Indicators that reveal reversals before price moves. You will learn about Dark Pool candle patterns, Professional traders setups and how to determine with a high degree of probability what direction the stock price will take in the near term. Learning about why certain candlesticks and indicator patterns reveal who...

Futures are only reliable for how the US Stock Market will open. With the modern market structure whipsaw action after the market opens can cause huge losses or disappointing profits for retail day or swing traders. You will learn how volume oscillators can warn of a whipsaw or reversal day. Void of buyers is a crucial aspect of whipsaw to down trending stocks...

Sideways trends are more common in the past several years than they were in the past. This is due to the dominance of Dark Pools and how they use TWAPs to ping a penny spread while in accumulation mode. Once Dark Pools have all the shares of stock they have determined to buy based on Quantitative Analysis using some AI, then the Professional Independent Traders...

Most traders rely upon an indicator signal or a strategy and when these fail they are often baffled by their loss. Losses erode capital but more importantly your self confidence. Learn to READ stock charts. Be observant in seeing patterns developing before a stock has a huge gap up or down. NVDA had several patterns that warned early that the stock was at risk of...

Banks are Sell Side Institutions. They do buybacks for the corporations where they are the Bank of Record. Banks and Sell Side Institutions also buyback their own shares of stock to boost price. Runs up are typical of Sell Side short term trading. Sell Side Institutions also have their favorite industries that they frequently have their floor traders trade for...

Platform Position Style Trading is a trading style that is ideal for those of you who have a career and can only trade once a week to a few times a week. It is also great for retirees who do not want to sit all day monitoring your stocks. It is a very low-risk trading style with higher profit potential, as the hold time is a week to a few weeks. The platform is...