goldenBear88

PremiumTechnical analysis: Interesting turn of events regarding the Short-term as Gold crossed the second Resistance (and is Trading #2 points above it currently) on the Hourly 4 chart and crossed aswell #6-session High’s, which may result as an traditional Buying back every dip (as I advice Traders to Buy every local Low’s recently / what I am doing personally),...

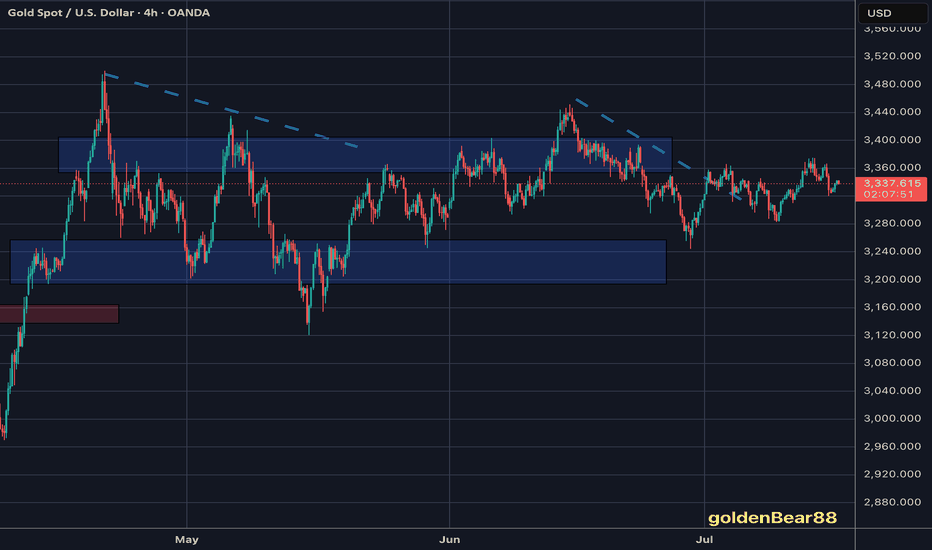

Technical analysis: Interesting turn of events regarding the Short-term as Gold crossed the second Resistance (and is Trading #2 points above it currently) on the Hourly 4 chart and crossed aswell #6-session High’s, which may result as an traditional Buying back every dip (as I advice Traders to Buy every local Low’s recently / what I am doing personally),...

As discussed throughout my yesterday's session commentary: "My position: My strategy remains the same, Buying every dip on Gold on my calculated key entry points which Gold respects and ultimately, anticipating #3,377.80 Resistance break-out to the upside." I have broken my personal record throughout yesterday's session (#200.000 EUR Profit) using #25 and #50...

As discussed throughout my yesterday's session commentary: "My position: My strategy remains the same, Buying every dip on Gold on my calculated key entry points which Gold respects and ultimately, anticipating #3,377.80 Resistance break-out to the upside." I have broken my personal record throughout yesterday's session (#200.000 EUR Profit) using #25 and #50...

As discussed throughout my yesterday's session commentary: "My position: I have Bought Gold throughout Friday's session within #3,330's however closed earlier below #3,348.80 (missed #3,352.80 benchmark break-out) however my Profits were already great so I don't mind. Keep Buying every dip on Gold (aggressive Scalps)." I have re-Bought Gold firstly on #3,357.80,...

As discussed throughout my yesterday's session commentary: "My position: I have Bought Gold throughout Friday's session within #3,330's however closed earlier below #3,348.80 (missed #3,352.80 benchmark break-out) however my Profits were already great so I don't mind. Keep Buying every dip on Gold (aggressive Scalps)." I have re-Bought Gold firstly on #3,357.80,...

Gold is about to test #3,400.80 benchmark, strong possibility which I announced many times lately that Gold will deliver Bullish accumulation below #3,300.80 then #3,400.80 test (if you read my previous analysis, you would be in excellent Profits). Technical analysis: Gold eventually honored the Fundamental side and is Trading on a Bullish pattern on the...

Gold is about to test #3,400.80 benchmark, strong possibility which I announced many times lately that Gold will deliver Bullish accumulation below #3,300.80 then #3,400.80 test (if you read my previous analysis, you would be in excellent Profits). Technical analysis: Gold eventually honored the Fundamental side and is Trading on a Bullish pattern on the...

Gold has tested #3,330.80 Resistance and got rejected many times as I firstly Bought Gold from #3,322.80 towards #3,330.80 Resistance zone in extension. Later on, I have added Selling order on #3,327.80 to the downside and closed it on #3,320.80. I have engaged Buying order on #3,318.80 Support once again and added more Buying orders on #3,321.80 / closed all...

Gold has tested #3,330.80 Resistance and got rejected many times as I firstly Bought Gold from #3,322.80 towards #3,330.80 Resistance zone in extension. Later on, I have added Selling order on #3,327.80 to the downside and closed it on #3,320.80. I have engaged Buying order on #3,318.80 Support once again and added more Buying orders on #3,321.80 / closed all...

Technical analysis: Gold has made an important Bullish step towards full scale Hourly 4 chart’s reversal as it almost recovered the #3,330.80 pressure point. That makes Hourly 4 chart practically Neutral but leaning on the Bullish side, however well Supported within #3,300’s belt now, which has held on multiple occasions so far. As mentioned throughout my...

Technical analysis: Gold has made an important Bullish step towards full scale Hourly 4 chart’s reversal as it almost recovered the #3,330.80 pressure point. That makes Hourly 4 chart practically Neutral but leaning on the Bullish side, however well Supported within #3,300’s belt now, which has held on multiple occasions so far. As mentioned throughout my...

As discussed throughout my yesterday's session commentary: "My position: I will keep Buying and Selling Gold only with my aggressive Scalp orders from my key entry and reversal points." Firstly I have engaged multiple re-Buy orders on #3,320.890 towards #3,327.80 (Scalp of course) delivering decent Profit however when #3,322.80 got invalidated, personally I...

As discussed throughout my yesterday's session commentary: "My position: I will keep Buying and Selling Gold only with my aggressive Scalp orders from my key entry and reversal points." Firstly I have engaged multiple re-Buy orders on #3,320.890 towards #3,327.80 (Scalp of course) delivering decent Profit however when #3,322.80 got invalidated, personally I...

As discussed throughout my yesterday's session commentary: "My position: In my opinion I need to stay on Hourly 4 time-frame for us and the potential break-out to the downside since Hourly 4 chart remains Bearish (never Swing Buy while #H4 is Bearish) on logarithmic scale, hence on limited upside. My expectation is that we still have one (minor) rebound left which...

As discussed throughout my yesterday's session commentary: "My position: In my opinion I need to stay on Hourly 4 time-frame for us and the potential break-out to the downside since Hourly 4 chart remains Bearish (never Swing Buy while #H4 is Bearish) on logarithmic scale, hence on limited upside. My expectation is that we still have one (minor) rebound left which...

Technical analysis: As expected last week has started off inside my Neutral Rectangle and despite the pullback from the Daily High’s, the (#1W) Weekly chart’s candle was finishing the week at (# +1.79%). As mentioned throughout the week, the last time we had two straight green (#1W), third will follow so expect Bull week (this one) if cycle is replicated. The...

Technical analysis: As expected last week has started off inside my Neutral Rectangle and despite the pullback from the Daily High’s, the (#1W) Weekly chart’s candle was finishing the week at (# +1.79%). As mentioned throughout the week, the last time we had two straight green (#1W), third will follow so expect Bull week (this one) if cycle is replicated. The...