kentcortanakyl

hello traders, with gold making a significant correction from friday's run.....today potential formation of a drop base drop is currently forming also small AO divergent is visibly leadly to a likely bias for drop back to 1970 zone good luck on the trade guys . safe trading and always ensure RISK MANAGEMENT

hello traders, Gold maintains a significant increase of 8% for the month, and, more importantly, for the quarter, it has had $160 gain that translated to a near 9% win. There is potential bearish break for the metal as shown in the chart and zones 1949.16-1934.73 with regards to supply.currently we are on uptrend awaiting for confirmation of the break....thats the...

hello traders, last week was interesting with gold making a significant 3% increasing on closing. despite many financial analysists and articles authoring potential rise in iterest rates from the fed allowing market manupulation for most traders to hold sell options out of fear. ( which they do often lol! ) Howerver, The collapse of Silicon Valley Bank and...

Hello traders, With gold breaking through the falling channel at the start of the week, we were able to gain a new higher high rallying up to 1856.06. Gold is bringing an end to a run of four successive weekly declines, rising around 2% over the last five days after running into significant support at around $1,800. This followed a near-8% decline from the highs...

Hello traders✋🏽, last week gold finally broke through the triangle structure around the 1940 area as we expected. this week looks more promising with expectaion of a further bullish rally to 1960 area. key point: with this breakout new structural movement is expected with both small bull and bear rallies accompanied by a massive potential pullback back to the...

Hello traders ✋🏽, Following last week consolidation Gold seems to be slow and uncertain. The price is currently stuck within a wide intraday trading range. Daily chart indicates fairly strong sell to buy ratio as we near weekly curve. Possible opportunity on gold next week: .Either trade the market within the range, buying from support and selling from...

Hello traders✋🏽, With last week's closing aiding the formation of a flag pattern, we atleast expect its continuation around midweek. Possible in trade day scalping opportunities are likely through buying the support and selling the resistance. On daily time frame strong sell formation is already building up Potential 1st tp1804 2nd tp1797.73. ...

Hello traders, we are back. Happy new year 🎉 This week gold present good opportunity for both in-day traders and weekly traders to capitalize. Gold has been on a horizontal trading range on daily time frame(1782.0 -1832.0). Possibility of pullback around 1803.93-1795.73 is open with entry point for short position 1820. This should only be green light after...

Following last weeks consolidation and a bullish rally on friday, Gold was able to reach a daily high(1830.33) The pair has maintained structure on the rising horizontal channel. with that we look for a confirmation to sell the (PULLBACK) Be on look out for double top formation as a key signal for drop Alternatively, a bullish breakout signify a further...

With gold reaching a new monthly high (1834), it has shown a steady but bumpy growth and on friday had a small pullback around 1811. with the retest i expect potential entry point for daily trades. on monday we should see strong buy to sell ratio. E.P=1811.04 TP1=1828.87 TP2=1838.72 TP3=1840s REMINDER: Look for proper confirmation (reversal pattern formation...

The medium-term bullish uptrend was broken with ease 10 days ago and gold now finds itself close to an important support level that needs to hold if the precious metal is to move higher. The 50% Fibonacci retracement of the mid-March/early-August 2020 rally comes in around . a level that held its first real test last Friday. gold seems to be consolidating around...

Gold was able to pump up 1755 a major support zone previous from August 2020. with these week's supply it has been able to form horizontal structure and a resistance line of a rising parallel channel . daily selling opportunity may thus present itself following a bearish break out possible entry zone around 1867.75 with a TP1 and 2 of around 1755.55 and...

we recently saw bitcoin breakthrough its falling channel within the 4h chart and spiking to around 38062.92 and the followed by a massive pullback to the retracement level around 33755.96....the price has followed a triangle structure and we may see a bullish trend form if demand zone 33678.00 doesnt see the pair drop...........entry position for long 32271.2...

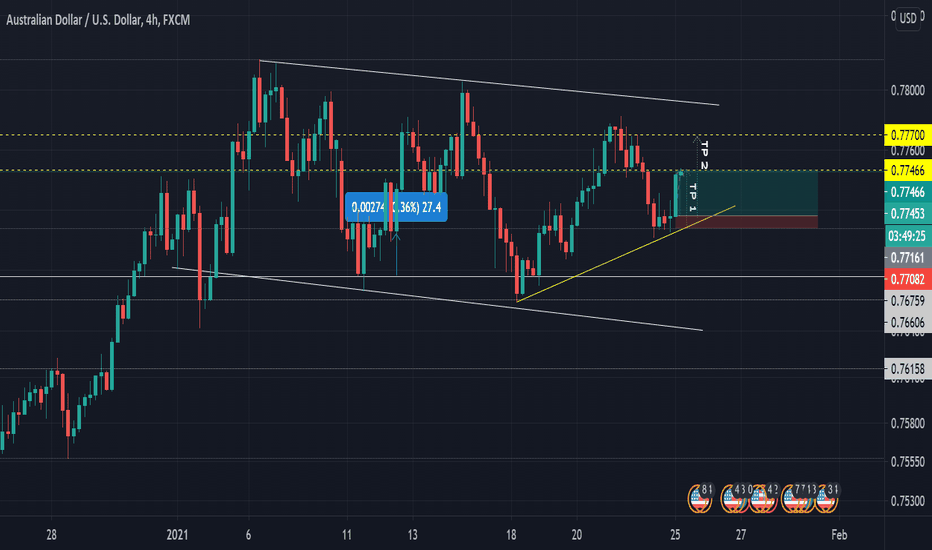

the pair recently broke structure forming reversal on 4H DAILY....expected drop after inital retests

the pair has developed a consistent bullish flag pattern on the 4H daily chart.....position for short term buy may present itself

what to expect from the pairs on 4H moving into the weekend

short pull back on the cad?chf short entry may presents themselves

so far into this week the pair has maintained a progressive dip and is still following thetrend structure....small short scalping entries still present themselves as it heads for its S.P(1.16999)