normaescobarca

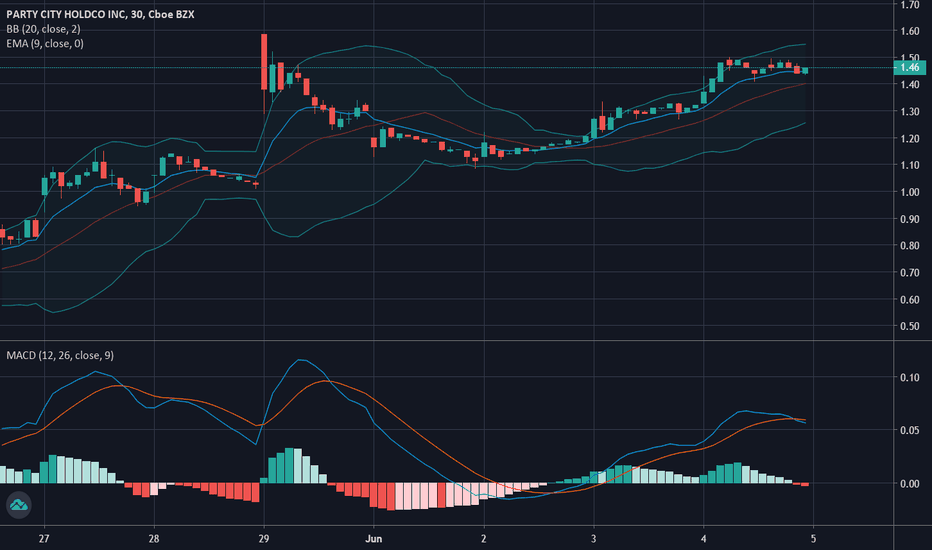

Day 1 - This stock was found using the following rules 1) price under 15 2) volume over 200k 3) price above 50 sma 4) price above 200 sma 5) float under 50M 6) relative volume over 3 * Testing out if those inputs equate to favourable outputs Holding period - not determined in the set of rules, testing how the rules react first

This is my hypothesis to find the optimal entry point, based on algorithmic patters observed following this stock: The optimal entry point is when all the following events occurs: 1) Price closed below the lower Bollinger band (20 day period) 2) The (support) is relatively close to the lower Bollinger band. In this case, lower Bollinger band is at 12.11 and...

This week I have been following American Airlines closely. My past self would’ve been absolutely horrified with what’s being going on in the airline industry, but now that my mindset has switched towards a technical approach, I couldn’t be any happier. The airline industry has both, the volatility and volume, desired to enter a trade. Here are some of my...

This week I started working on my first filter algorithm. The sole purpose of the program is to filter stocks who's trading price closes below the lower Bollinger band (80 day period) in the TSX, TSXV AND CSE. We use algorithms when the inefficiency targeted is persistent. Meaning that the trading opportunities occur over and over in a similar manner. EXAMPLE -...

This week I am going bullish on Walmart. I usually don’t trade stocks this expensive but my algo picked it up. Current price trading below lower bollinger and EMA. This is my first trial blindly trusting my algo which is simply coded to mirror Matthew Kratter´s rubberband strategy. However, I decided to also toss in the EMA to shorten my holding period to a...

Currently working on small coding project. An algorithm that filters stocks from the TSX, TSX Ventures and CSE who’s price closes below the lower Bollinger band (80). I’ve been reading some of the work from Matt at Trader University and he calls it the rubber band stocks. Even though the purpose of this project is merely recreational, it got me thinking of a few...

I’ve been following Matt’s work from Trader University. In his book he goes into detail about this simple, yet interesting strategy. The strategy consists of buying when the price closes below the lower Bollinger band (80) and selling once it closes at the middle band. He usually holds for a few days or weeks, so this trade will be oriented towards swing trading....

Following this stock for today. I'm hoping to enter my position later today before the market closes. Anyone else trading this one? The reason why I am waiting to enter is that the current price is trading really close to resistance levels (1.64$). I'm interested in finding out whether the price will break through its resistance level or if the price will dip...

Excited for the market to open. Current position: 500 shares at $1.46. Short term support and resistance levels at $0.54 and $2.79 Exit target - 1.75, already trading at 1.60 pre-market hours, if things go south, exiting at 1.40. The valuable lesson I learned: The most important times for buying and selling shares are market open and market close. Market open...

I entered GNC last night before the market closed at 0.81. I think I entered at the highest price of that trading day (my bad) however this is the going to be my play: Entry Price - 0.81 Exit Target - 1.00 Current price - 0.80 Based on Level II, both, the bid and ask, are lower than the current price. I am expecting a price drop as soon as the market opens of...

Current Position - 100 shares at 9.9$ (holding since Friday, May 29) Exit Target - 11.5$ Bullish on this one. Indicators and trading volume indicating a rise in price. I've been following this stock since Friday and if I don't get to sell today at my target price, I will hold for one more day. If things go south, exiting at 9.25$ assuming a small loss. Very...

This morning I decided to add HBI to my watchlist. The current price is $10.21. Support levels at 9.30 and resistance at 14.85. Had a pretty big dip in price yesterday of over a $1 per share (about 10% loss). I've read a variety of opinions on this one. Group chats seem to be equally divided among bears and bulls. Personally, I'm going bullish on this one. I do...

There's an incredible amount of investors I've followed that are very pleased with VZ stock's performance during the past years. Fundamentally speaking, yes, indeed Verizon has a cleaner balance sheet, way less debt, and it has done a really good job at being a decent rival for AT&T within America. However, I have strong reasons to believe that AT&T is not a...

Pompeo announced this evening that Hong Kong is no longer an independent part from China. Chinese investors and business people are buying as much influence and shareholder stake in HK. Who benefits? China. Anyways, on top of the announcement, the CFO of Huawei was denied extradition proceedings. So far, U.S can’t prosecute yet. Quite unfortunate given the...

Yesterday, I carefully watched HTZ due to its bankruptcy announcement on Friday night. The price had opened at $2.84 and after careful observation, it literally did not move throughout the day. There was absolutely no information on Level II, trading volume, etc. Somehow, after literally not moving during market hours, the price dropped to $0.55 right before...

Hertz just filed for everyone’s favourite chapter in the book. I’m posting this idea 12 hours before the market opens because I am beyond curious how industrial algorithms will react to the announcement, plus the fearful trading sentiment around the stock. This is the first time where I get to closely watch the price of a stock pre market hours after the...

Current time - 10:09 NST - I've been working on getting serious about day trading. Spoken with a few about strategies and indicators. I've learned a lot throughout this short period, however one of the best ways I learn is through asking. Following my first penny stock $MREY. Initial Observations: -Level II indicating strong demand from the bid size -Spread...

I am 21 and besides trading , I have set aside a designated portfolio for long term holdings. Stocks to hold up to 30 years. This is why I believe Air Canada is a suitable stock for any retirement portfolio. 1) Current market price is lower than IPO price from 14 years ago. 2) Given the current market price, there’s a return opportunity of 158% or $30 gain per...