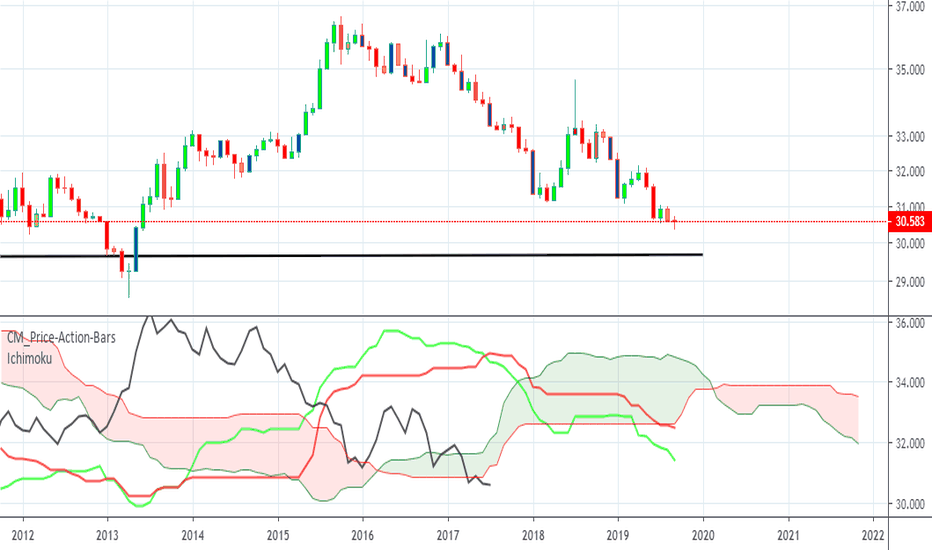

USDTHB analysisUSDTHB analysis ( THB continues to strengthen ) and have come up to test the resistance

USDTHB

Thai Baht May Outperform as Tourism Slowly Boosts EconomyThe Thai Baht has been cautiously gaining ground against the US Dollar since December despite recent volatility in stock markets.

In fact, USD/THB recently broke under a key rising trendline from early 2021, confirming the breakout. Key support below appears to be the 200-day Simple Moving Average.

Tourism is a key component of Thailand's economy, which has been hampered due to the global pandemic. But, as countries around the world gradually move forward with vaccinations and natural immunity, a gradual comeback in local tourism may boost the economy, perhaps setting the Thai Baht on course to outperform in the medium to long term.

In the event of a turn higher, critical resistance seems to be the 33.861 - 34.000 resistance zone, where breaking above may open the door to resuming the dominant uptrend. Further Covid-19 variants also risk derailing domestic growth expectations.

Clearing the 200-day SMA exposes the November and August lows. In the long run, key below seems to be the 29.718 - 29.842 range.

USDTHB top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDTHB Long Term (Double opportunities Read Description)USDTHB reached a monthly resistance in where price has rejected multiple times. At the same time, it is important to notice how it broke a daily downtrend that it had going on for weeks. Buying opportunities can't be taken at the current level, however, possible shorts opportunities could be taken as soon as price starts shifting market structure on lower timeframes. When price reaches the support area, short positions must be closed and we can start to look for long opportunities in order to trade with the higher timeframe structure.

I do like this pair a lot because of its long constant trends and minimal consolidation, which provides plenty of opportunities and a more relaxed trading experience for swing traders.

RESUMED Idea: Currently looking for shorts as long as a long term pullback it is highly likely to occur. Shorts cannot be opened until smaller timeframe changes structure to bearish. Looking to close shorts and open longs when price reaches the support area as overall higher timeframe (Weekly and Monthly) are bullish. This is a long term/ swing trade.

ENJOY and Good Luck on your trading.

RidetheMacro| USDTHB Market Commentary 2020.09.21As the drivers of exports and tourism continue to be missing in action, the negative GDP growth trend is here to stay for the rest of the year, and perhaps beyond. Rising political uncertainty is another reason why we expect the Thai baht to remain one of Asia's weakest currencies over the remainder of the year.

🦠 Thailand has been one of Asia’s Covid-19 success stories. It was the first Asian country outside China to report infections but also the first one to have the outbreak under control.

⚡ However, the economy hasn't been spared from the fallout of this global Covid-19 pandemic. A 12% GDP plunge in 2Q was the steepest since the Asian crisis in 1998. Without vigorous exports and a recovery in tourism, a couple more quarters of negative growth remains our baseline.

📌 High unemployment and weak demand have pushed inflation into negative territory. Inflation should continue to be a non-issue for the economy and for policy throughout 2021-2021.

📍 Covid-19 stimulus worth a total of 14.5% of GDP places Thailand in the ranks of the big spenders throughout in this cOVID-19 crisis. A little over half of this comprises a genuine boost.📉

🔑 The economy is sinking into a recession. The recovery is going to be even slower than the most recent crisis.

Thanks for keeping the feedback coming 👍 or 👎

Ridethemacro

USDTHB structure replayFirst time I forecast this exotic I believe. Instantly noticed this diagonal trend and the bearish candles for August and September '18 lookalikes. Based on this and more possibly current bullish candle to turn bearish up to 30.6, 30.2 or even all the way down to 29.7. Then a bullish candle for October and another two bearish for November and December targeting 28.55.

Thailand may see lesser US tourists already ongoing from October '15. Wasn't that when FED started printing?

Note the volumes of late '08 and '09 and now at higher levels than previous years from March '18 till date. If volume spikes like March '09 repeat this pair might hit new record lows. Even more as the diagonal downtrend may be recognised as part of a descending triangle and signal a accelerated breakdown.

UJ Seasonality agrees as USD devaluation has broken pre-covid lows back July and momentum has not signalled to reverse imho.

USDTHB Potential Bullish MovementUSDTHB Potential Bullish Movement

we are waiting for a momentum candle close above 32.870 to buy this one

Reason:

1- Divergence on MACD (in red)

2- Objective Wedge (in blue)

3- Double Bottom (in purple)

Three confluences are enough to consider Buying USDTHB, after a break below 32.870 (in gray)

*unless price broke below our double bottom pattern (purple zone), then this one may resume its bearish trend.

Daily flag, wedge can breakThailands tourism is in the gutter as Chinese tour groups stopped. China is a large cut of tourism.

Baht had its run, part IS OVER. Time for this MASSIVE BULL WEDGE TO BREAK UPWARD, AND THE BAHT DECEND TO ITS REAL VALUE.... which matches the countries LOW productivity levels.

High baht times are over for now.

36 baht per USD target. Long prediction. This is a descending wedge which are bullish. In the long run, monthly I see a target of 36 in the years to come. World trade and spending are slowing in the macro economic picture and EMs will not hold up! If you have baht, time to sell and reverse positions as 29 or 30 baht per dollar will NO WAY hold much longer. This kind of rate is totally ridiculous in the grand scheme of world economics. These FX currency flows into Thailand (despite huge tourism numbers decreasing) is a suckers market. Its mostly Chinese construction companies laundering money to get money out of china to build more Bangkok condos which nobody is buying! (Huge numbers of unsold condos in Bangkok in 2018, apprx 650,000 unsold units, should be higher in 19" and 20's!). To think Thailands economy is strong is misleading, its a house of cards. I have been living in Thailand on and off since 2010 so know things from feet on the ground. 30/USD is just way overvalued.

Watch for the break out from the wedge and indicators that go along with it.

USDTHB: Short signal on the 1D EMA50.The pair is trading on a multi month 1M Channel Down (RSI = 35.185, MACD = -0.898, Highs/Lows = -0.7368). The price is now on the 1D MA50 (blue line) which since May 2019 has always initiated a new bearish leg. Since the 1D RSI is also approaching the usual 65.60 Sell Level, we are expecting a decline. Our Target is 30.000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

usd/thb back to 29.70000 supportUSD/THB is going back to his support around the area of 29.70000

Good reasons that could happen:

1.: europe holidays are done and people are start working=less money circulation for their tourists

2.: fed has pumped money into their monetary system to prevent recessions

3.: price action bars tell you more than just the price.

Have a nice and risk management week

Hola

USD/THB Short Trade BiasPretty self explanatory trade. We've been in a long term down trend for awhile now and recently broke the support level and closed below it on the daily chart. At this stage I'm just waiting for a pullback and some signs of entry to get short on this. I'll be looking for a long term trade on this heading towards 29.77820 level

USDTHB fomred bullish butterfly | Upto 4.5% bull move.Priceline of US Dollar / Thai Baht forex pair has formed a bullish butterfly pattern and entered in potential reversal zone to hit the sell target soon insha Allah.

This PRZ area is also a stop loss point, in case of complete candle stick closes below this area.

MACD is turning bullish, it was strong bearish now turned weak bearish.

RSI is oversold.

Stochastic is oversold.

Volume profile of complete pattern is showing less interest of traders at this area.

I have used Fibonacci sequence to set the targets:

Buy between: 30.772 to 30.397

Sell between: 31.064 to 31.770

Enjoy your profits and regards,

Atif Akbar (moon333)