Strategies

Introduction

Pine Script® Strategies are specialized scripts that simulate trades across historical and realtime bars, allowing users to backtest and forward test their trading systems. Strategy scripts have many of the same capabilities as indicator scripts, and they provide the ability to place, modify, and cancel hypothetical orders and analyze performance results.

When a script uses the strategy() function as its declaration statement, it gains access to the strategy.* namespace, which features numerous functions and variables for simulating orders and retrieving essential strategy information. It also displays relevant information and simulated performance results in the dedicated Strategy Tester tab.

A simple strategy example

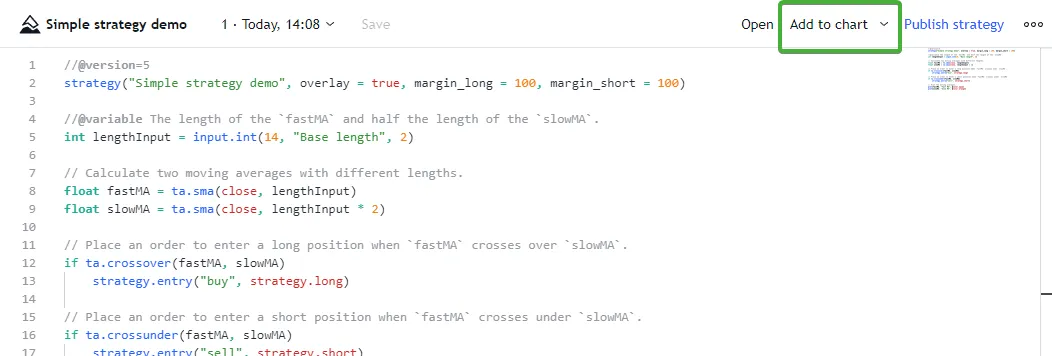

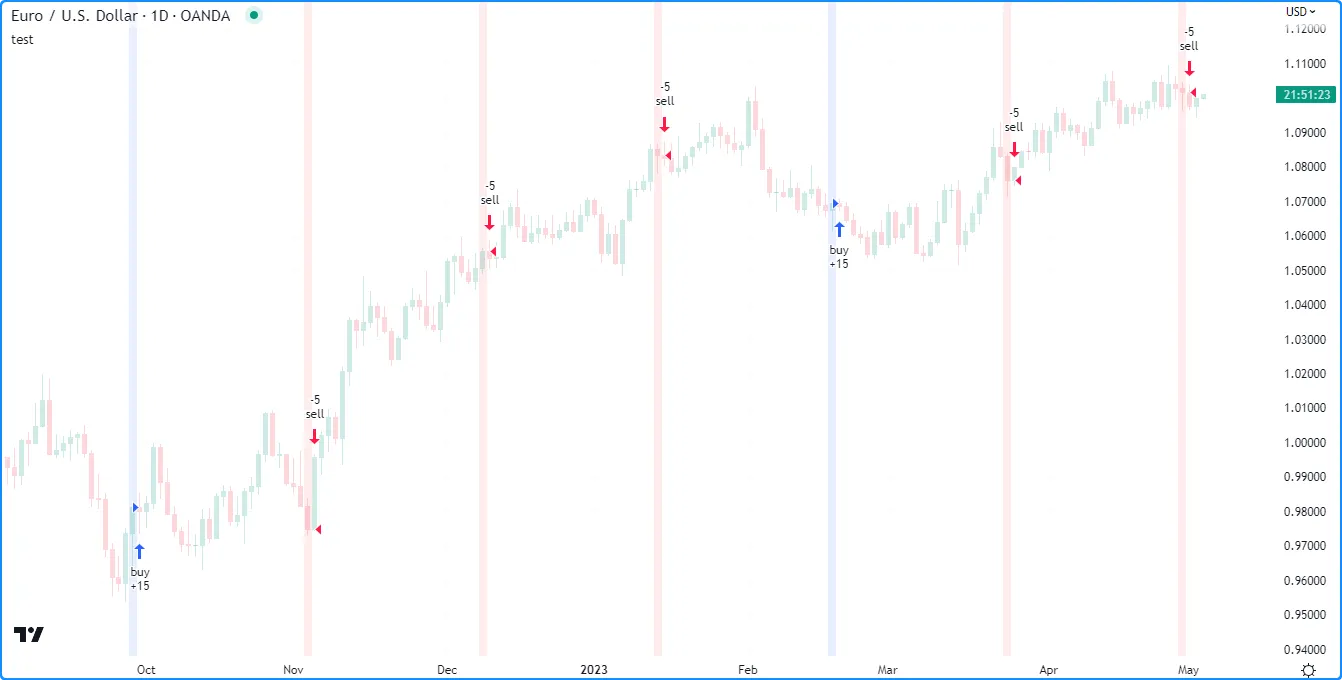

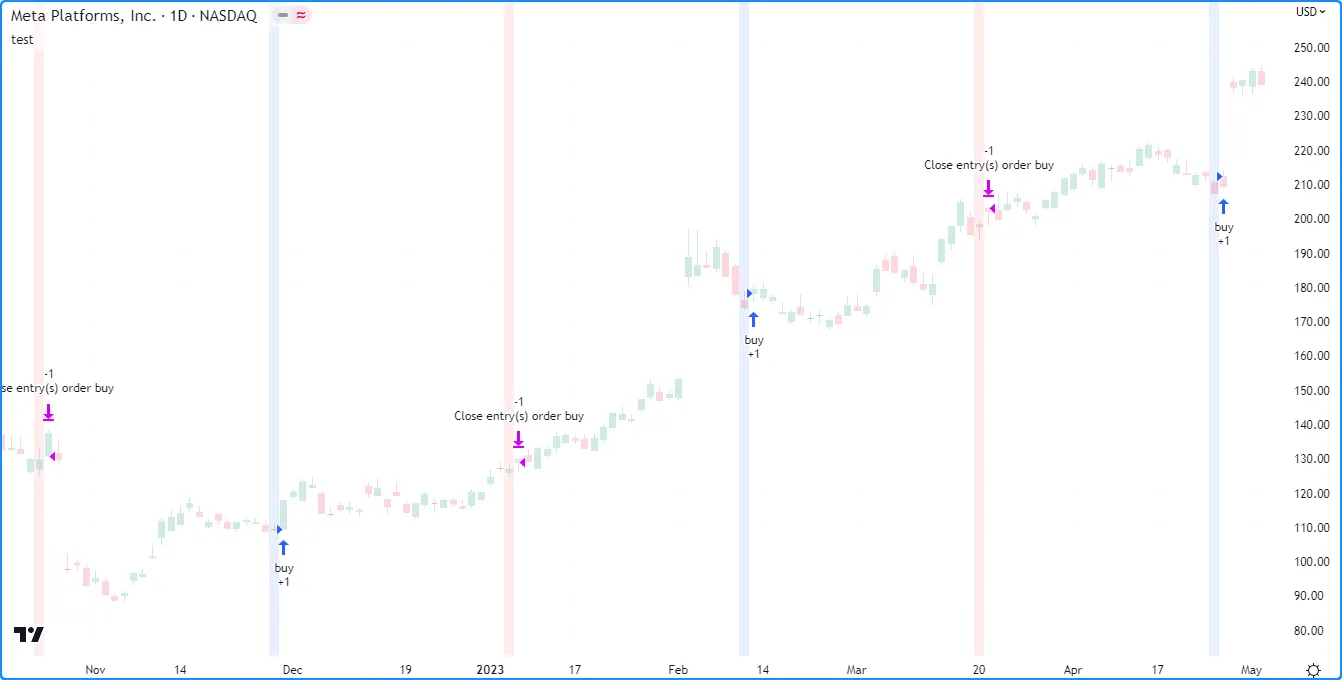

The following script is a simple strategy that simulates entering a long or short position when two moving averages cross. When the fastMA crosses above the slowMA, it places a “buy” market order to enter a long position. When the fastMA crosses below the slowMA, it places a “sell” market order to enter a short position:

//@version=6

strategy("Simple strategy demo", overlay = true, margin_long = 100, margin_short = 100)

//@variable The length of the `fastMA` and half the length of the `slowMA`.

int lengthInput = input.int(14, "Base length", 2)

// Calculate two moving averages with different lengths.

float fastMA = ta.sma(close, lengthInput)

float slowMA = ta.sma(close, lengthInput * 2)

// Place an order to enter a long position when `fastMA` crosses over `slowMA`.

if ta.crossover(fastMA, slowMA)

strategy.entry("buy", strategy.long)

// Place an order to enter a short position when `fastMA` crosses under `slowMA`.

if ta.crossunder(fastMA, slowMA)

strategy.entry("sell", strategy.short)

// Plot the moving averages.

plot(fastMA, "Fast MA", color.aqua)

plot(slowMA, "Slow MA", color.orange)

Note that:

- The strategy() function call declares that the script is a strategy named “Simple strategy demo” that displays visuals on the main chart pane.

- The

margin_longandmargin_shortarguments in the strategy() call specify that the strategy must have 100% of a long or short trade’s amount available to allow the trade. See this section for more information. - The strategy.entry() function is the command that the script uses to create entry orders and reverse positions. The “buy” entry order closes any short position and opens a new long position. The “sell” entry order closes any long position and opens a new short position.

Applying a strategy to a chart

To test a strategy, add it to the chart. Select a built-in or published strategy from the “Indicators, Metrics & Strategies” menu, or write a custom strategy in the Pine Editor and click the “Add to chart” option in the top-right corner:

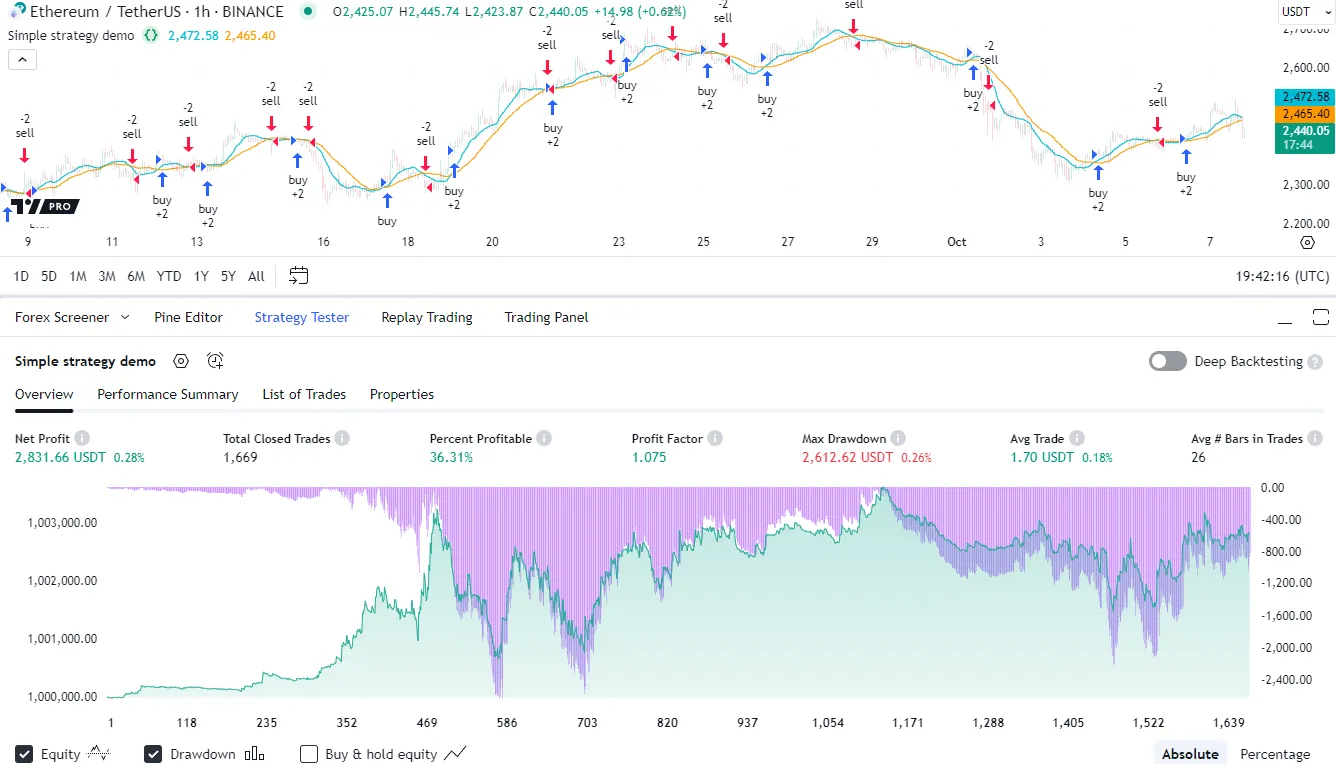

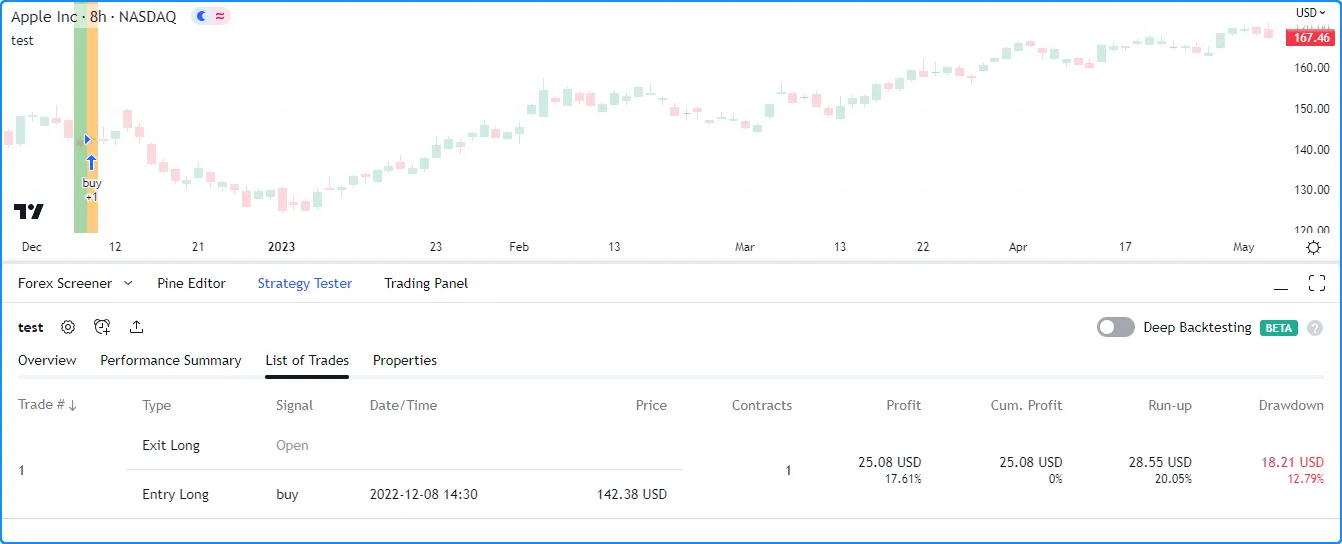

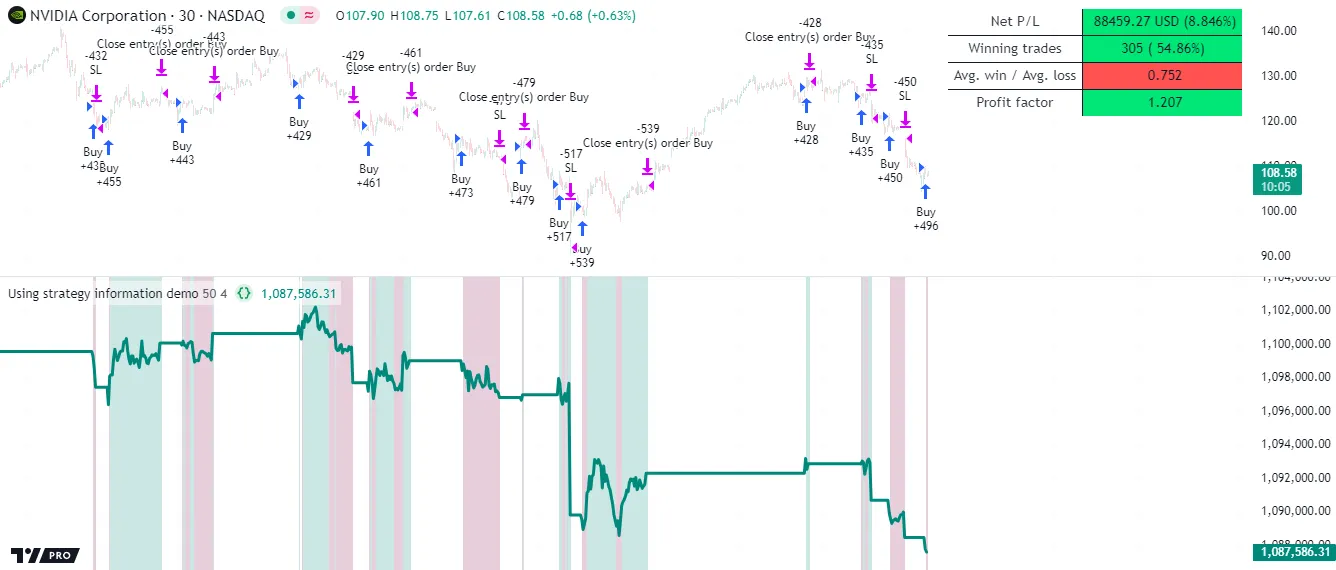

The script plots trade markers on the main chart pane and displays simulated performance results inside the Strategy Tester tab:

Strategy Tester

The Strategy Tester visualizes the hypothetical performance of a strategy script and displays its properties. To use it, add a script declared with the strategy() function to the chart, then open the “Strategy Tester” tab. If two or more strategies are on the chart, specify which one to analyze by selecting its name in the top-left corner.

After the selected script executes across the chart’s data, the Strategy Tester populates the following four tabs with relevant strategy information:

Overview

The Overview tab provides a quick look into a strategy’s performance over a sequence of simulated trades. This tab displays essential performance metrics and a chart with three helpful plots:

- The Equity baseline plot visualizes the strategy’s simulated equity across closed trades.

- The Drawdown column plot shows how far the strategy’s equity fell below its peak across trades.

- The Buy & hold equity plot shows the equity growth of a strategy that enters a single long position and holds that position throughout the testing range.

Note that:

- The chart has two separate vertical scales. The “Equity” and “Buy & hold equity” plots use the scale on the left, and the “Drawdown” plot uses the scale on the right. Users can toggle the plots and choose between absolute or percentage scales using the options at the bottom.

- When a user clicks on a point in this chart, the main chart scrolls to the corresponding bar where the trade closed and displays a tooltip containing the closing time.

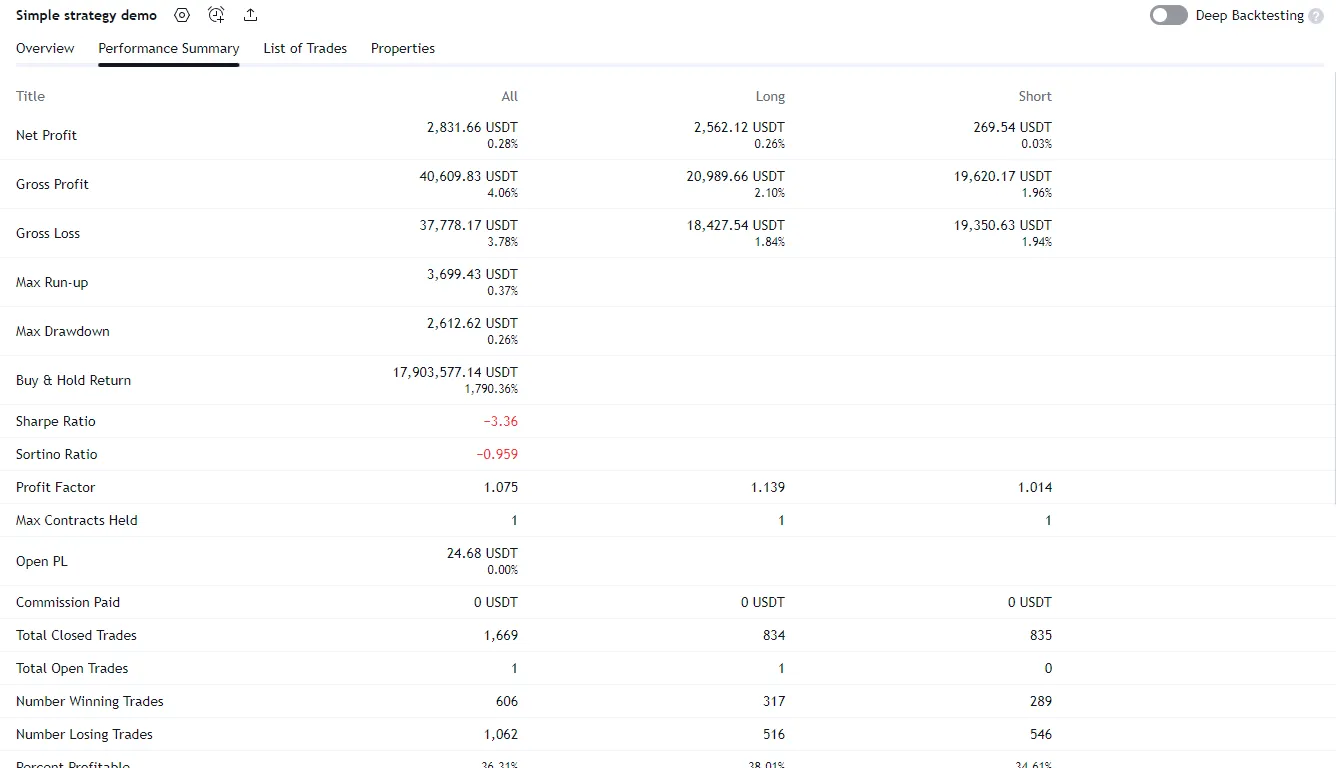

Performance Summary

The Performance Summary tab presents an in-depth summary of a strategy’s key performance metrics, organized into separate columns. The “All” column shows performance information for all simulated trades, and the “Long” and “Short” columns show relevant metrics separately for long and short trades. This view provides more detailed insights into a strategy’s overall and directional trading performance:

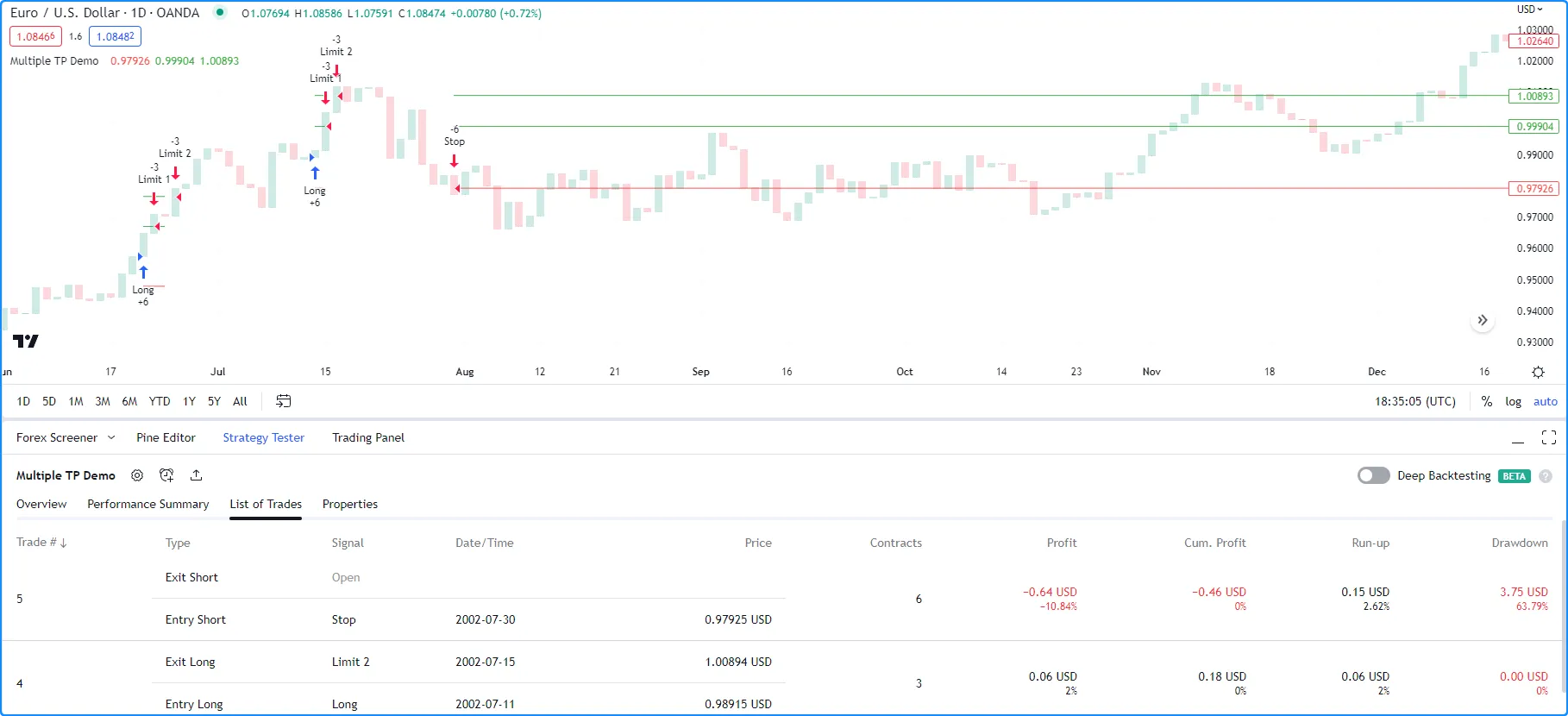

List of Trades

The List of Trades tab chronologically lists a strategy’s simulated trades. Each item in the list displays vital information about a trade, including the dates and times of entry and exit orders, the names of the orders, the order prices, and the number of contracts/shares/lots/units. In addition, each item shows the trade’s profit or loss and the strategy’s cumulative profit, run-up, and drawdown:

Note that:

- Hovering the mouse over a list item’s entry or exit information reveals a “Scroll to bar” button. Clicking that button navigates the main chart to the bar where the entry or exit occurred.

- The list shows each trade in descending order by default, with the latest trade at the top. Users can reverse this order by clicking the “Trade #” button above the list.

Properties

The “Properties” tab provides detailed information about a strategy’s configuration and the dataset that it executes across, organized into four collapsible sections:

- The “Date Range” section shows the range of dates that had simulated trades, and the overall available backtesting range.

- The “Symbol Info” section displays the chart’s symbol, timeframe, type, point value, currency, and tick size. It also includes the chart’s specified precision setting.

- The “Strategy Inputs” section lists the names and values of all the inputs available in the strategy’s “Settings/Inputs” tab. This section only appears if the script includes

input*()calls or specifies a nonzerocalc_bars_countargument in the strategy() declaration statement. - The “Strategy Properties” section provides an overview of the strategy’s properties, including the initial capital, account currency, order size, margin, pyramiding, commission, slippage, and other settings.

Broker emulator

TradingView uses a broker emulator to simulate trades while running a strategy script. Unlike in real-world trading, the emulator fills a strategy’s orders exclusively using available chart data by default. Consequently, it executes orders on historical bars after a bar closes. Similarly, the earliest point that it can fill orders on realtime bars is after a new price tick. For more information about this behavior, see the Execution model page.

Because the broker emulator only uses price data from the chart by default, it makes assumptions about intrabar price movement when filling orders. The emulator analyzes the opening, high, low, and closing prices of chart bars to infer intrabar activity using the following logic:

- If the opening price of a bar is closer to the high than the low, the emulator assumes that the market price moved in this order: open → high → low → close.

- If the opening price of a bar is closer to the low than the high, the emulator assumes that the market price moved in this order: open → low → high → close.

- The emulator assumes no gaps exist between intrabars inside each chart bar, meaning it considers any value within a bar’s high-low range as a valid price for order execution.

- When filling price-based orders (all orders except market orders), the emulator assumes intrabars do not exist within the gap between the previous bar’s close and the current bar’s open. If the market price crosses an order’s price during the gap between two bars, the emulator fills the order at the current bar’s open and not at the specified price.

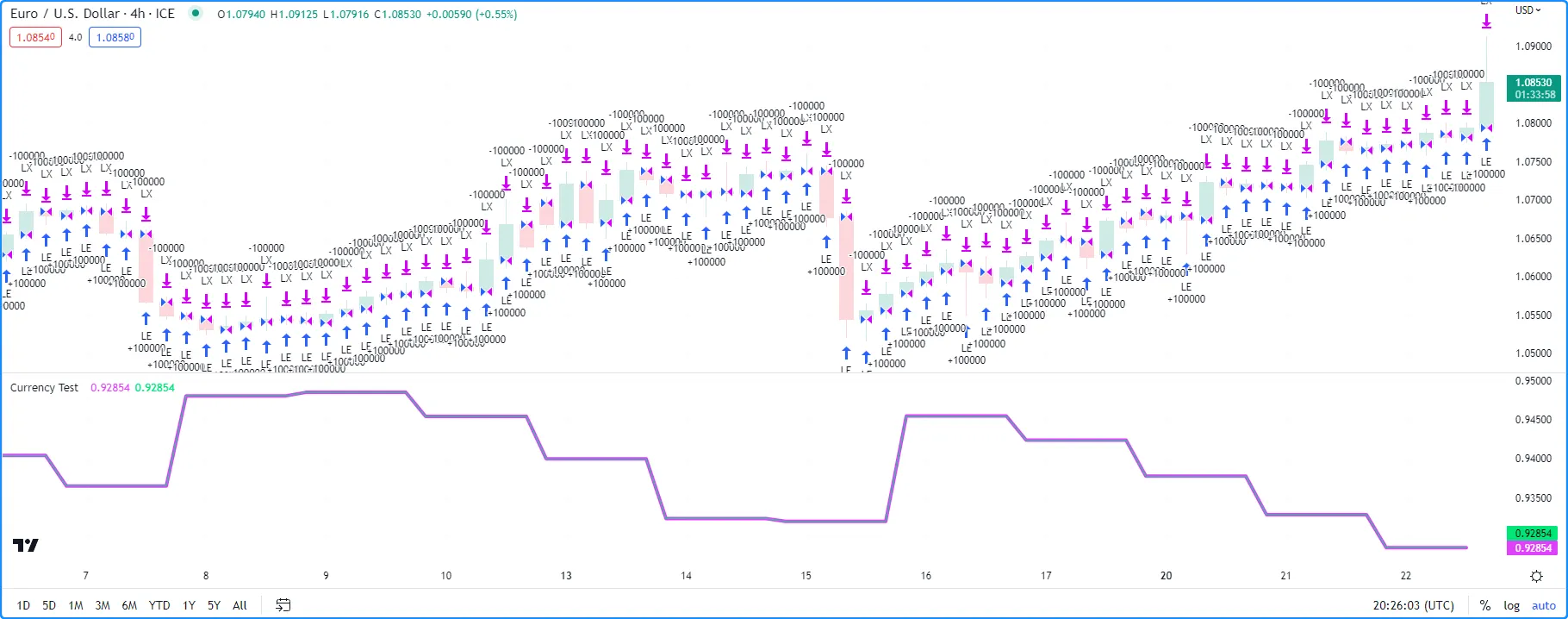

Bar magnifier

Users with Premium and higher-tier plans can override the broker emulator’s default assumptions about intrabar prices by enabling the Bar Magnifier backtesting mode. In this mode, the emulator uses data from lower timeframes to obtain more granular information about price action within bars, allowing more precise order fills in the strategy’s simulation.

To enable the Bar Magnifier mode, include use_bar_magnifier = true in the strategy() declaration statement, or select the “Using bar magnifier” option in the “Fill orders” section of the strategy’s “Settings/Properties” tab.

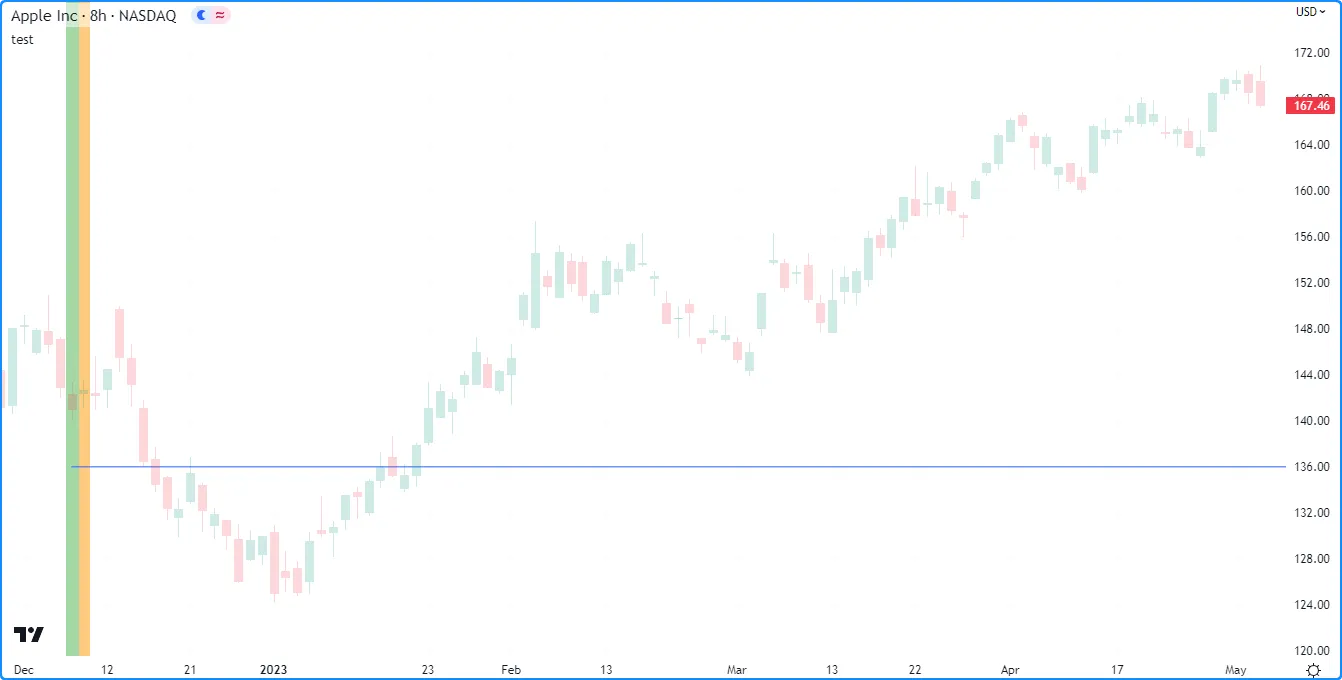

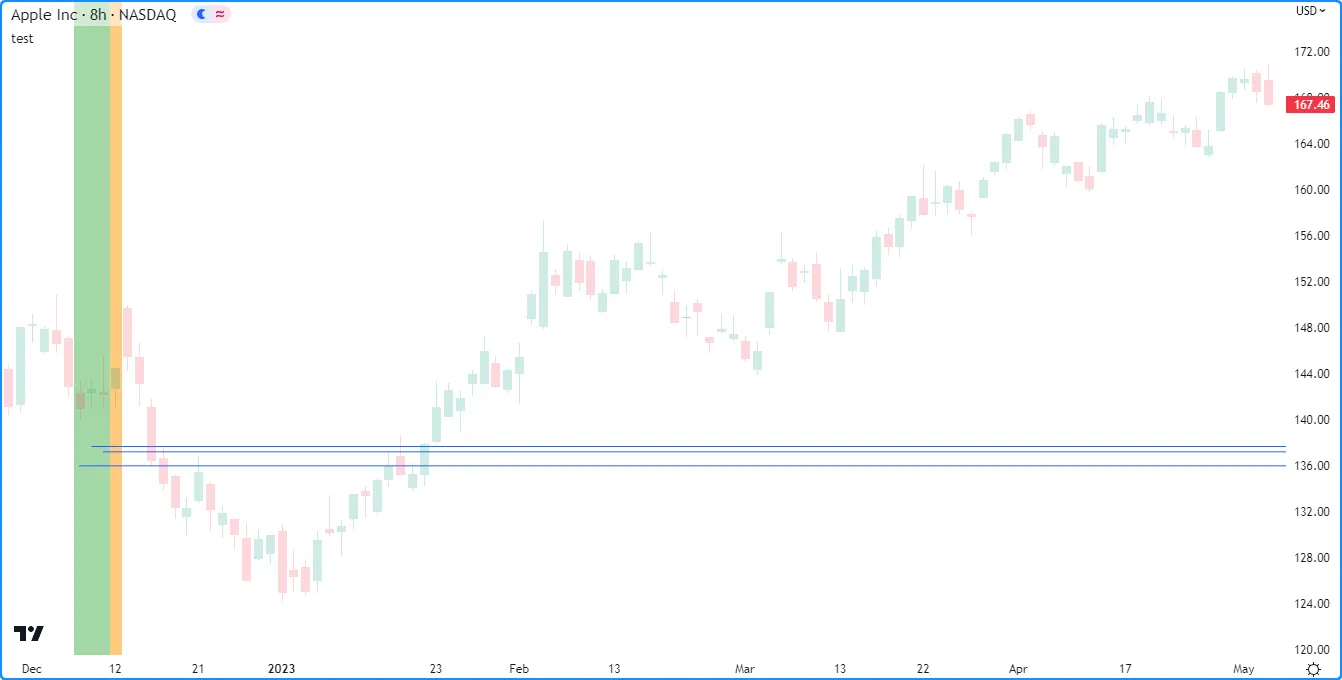

The following example script illustrates how the Bar Magnifier can enhance order-fill behavior. When the time value crosses the defined orderTime, it creates “Buy” and “Exit” limit orders at the calculated entryPrice and exitPrice. For visual reference, the script colors the background orange when it places the orders, and it draws two horizontal lines at the order prices:

//@version=6

strategy("Bar Magnifier Demo", overlay = true, use_bar_magnifier = false)

//@variable The UNIX timestamp to place the order at.

int orderTime = timestamp("UTC", 2023, 3, 22, 18)

//@variable Is `color.orange` when `time` crosses the `orderTime`, false otherwise.

color orderColor = na

// Entry and exit prices.

float entryPrice = hl2 - (high - low)

float exitPrice = entryPrice + (high - low) * 0.25

// Entry and exit lines.

var line entryLine = na

var line exitLine = na

if ta.cross(time, orderTime)

// Draw new entry and exit lines.

entryLine := line.new(bar_index, entryPrice, bar_index + 1, entryPrice, color = color.green, width = 2)

exitLine := line.new(bar_index, exitPrice, bar_index + 1, exitPrice, color = color.red, width = 2)

// Update order highlight color.

orderColor := color.new(color.orange, 80)

// Place limit orders at the `entryPrice` and `exitPrice`.

strategy.entry("Buy", strategy.long, limit = entryPrice)

strategy.exit("Exit", "Buy", limit = exitPrice)

// Update lines while the position is open.

else if strategy.position_size > 0.0

entryLine.set_x2(bar_index + 1)

exitLine.set_x2(bar_index + 1)

bgcolor(orderColor)

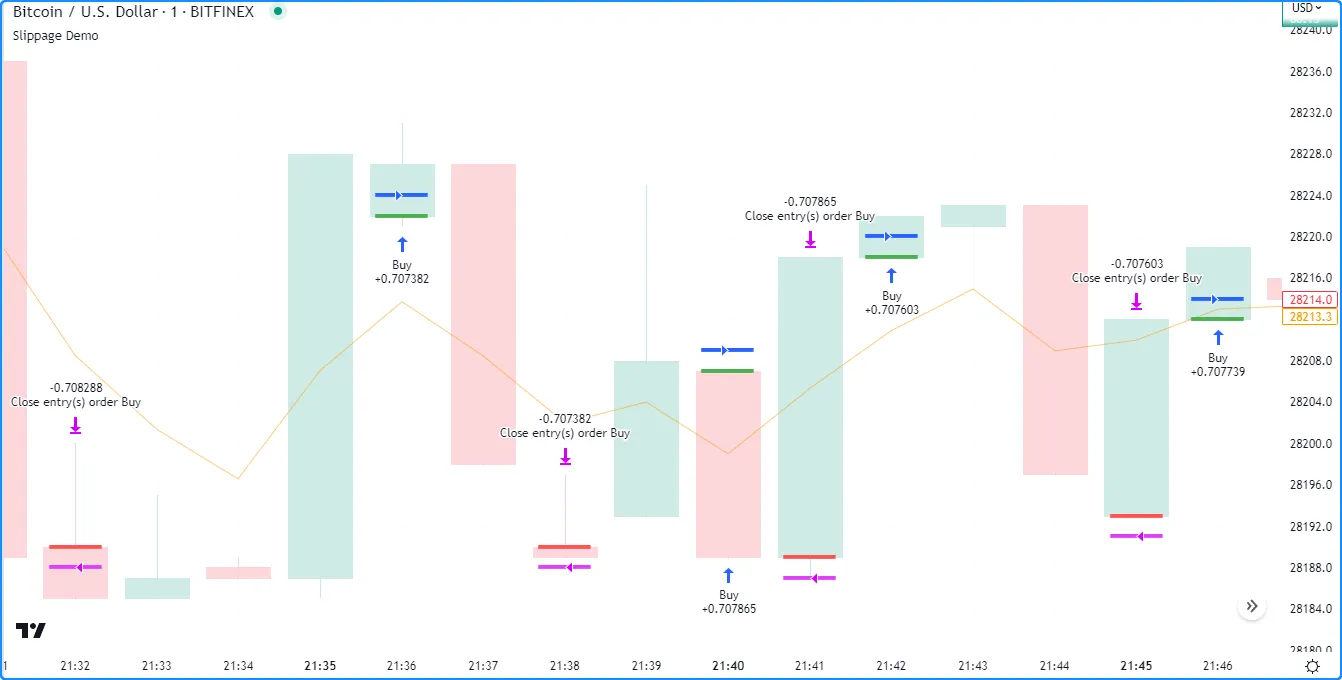

Because the script does not include a use_bar_magnifier argument in the strategy() function, the broker emulator uses the default assumptions when filling the orders: that the bar’s price moved from open to high, high to low, and then low to close. Therefore, after filling the “Buy” order at the price indicated by the green line, the broker emulator inferred that the market price did not go back up to touch the red line and trigger the “Exit” order. In other words, the strategy could not enter and exit the position on the same bar according to the broker emulator’s assumptions.

After we enable the Bar Magnifier mode, the broker emulator can access 10-minute data on the 60-minute chart instead of relying on its assumptions about hourly bars. On this timeframe, the market price did move back up to the “Exit” order’s price after reaching the “Buy” order’s price in the same hour. Therefore, with the Bar Magnifier enabled in this scenario, both orders execute on the same hourly bar:

Orders and trades

Pine Script strategies use orders to make trades and manage positions, similar to real-world trading. In this context, an order is an instruction that a strategy sends to the broker emulator to perform a market action, and a trade is the resulting transaction after the emulator fills an order.

Let’s take a closer look at how strategy orders work and how they become trades. Every 20 bars, the following script creates a long market order with strategy.entry() and draws a label. It calls strategy.close_all() on each bar from the global scope to generate a market order to close any open position:

//@version=6

strategy("Order execution demo", "My strategy", true, margin_long = 100, margin_short = 100)

//@function Displays the specified `txt` in a label at the `high` of the current bar.

debugLabel(string txt) =>

label.new(

bar_index, high, text = txt, color=color.lime, style = label.style_label_lower_right,

textcolor = color.black, size = size.large

)

//@variable Is `true` on every 20th bar, `false` otherwise.

bool longCondition = bar_index % 20 == 0

// Draw a label and place a long market order when `longCondition` occurs.

if longCondition

debugLabel("Long entry order created")

strategy.entry("My Long Entry Id", strategy.long)

// Place a closing market order whenever there is an open position.

strategy.close_all()

Note that:

- Although the script calls strategy.close_all() on every bar, the function only creates a new exit order when the strategy has an open position. If there is no open position, the function call has no effect.

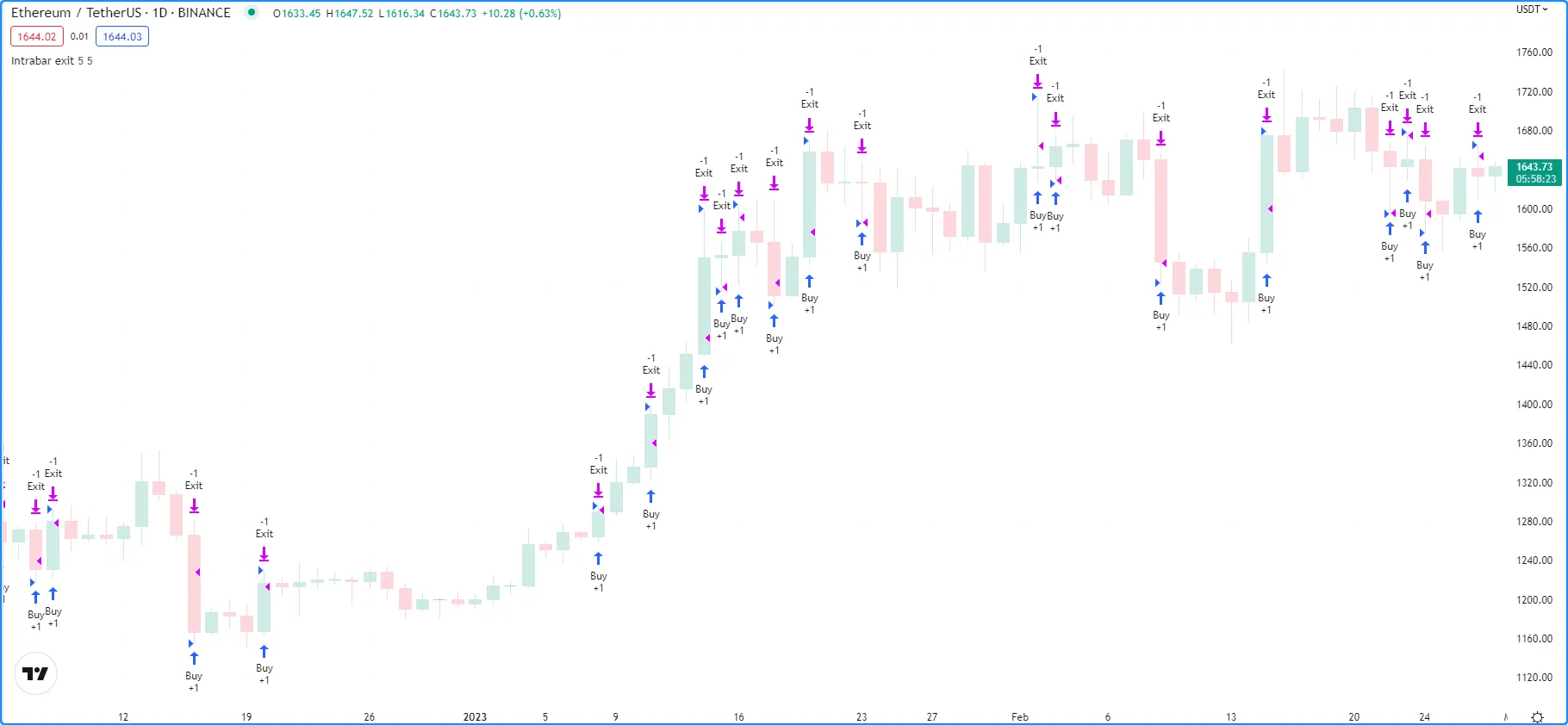

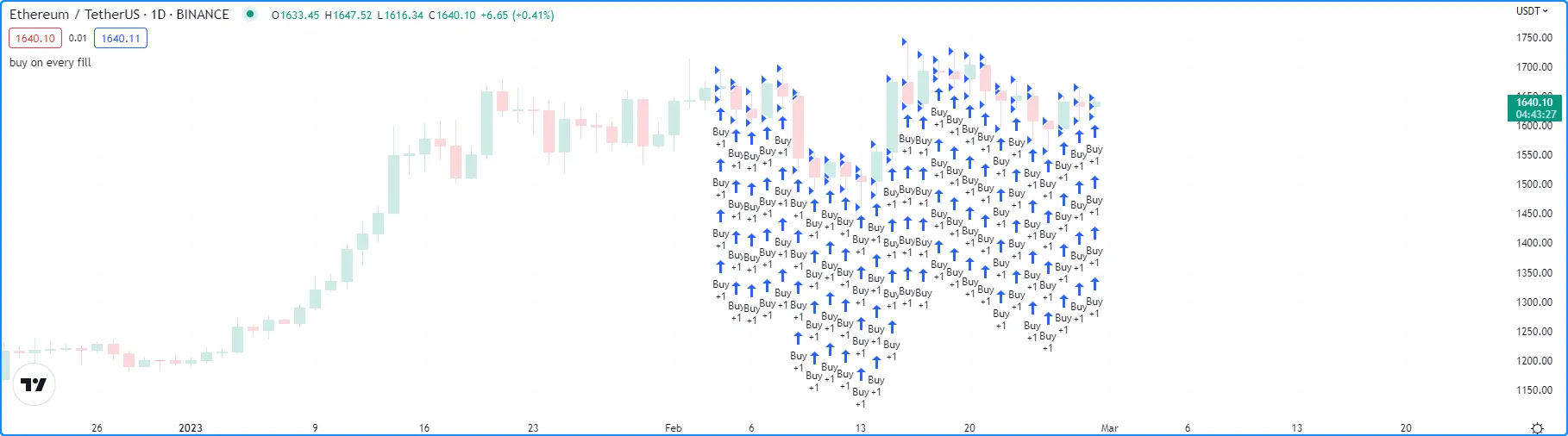

The blue arrows on the above chart show where the strategy entered a long position, and the purple arrows mark the bars where the strategy closed the position. Notice that the label drawings appear one bar before the entry markers, and the entry markers appear one bar before the closing markers. This sequence illustrates order creation and execution in action.

By default, the earliest point the broker emulator fills an order is on the next available price tick, because creating and filling an order on the same tick is unrealistic. Since strategies recalculate after each bar closes by default, the next available tick where the emulator fills a generated order is at the open of the following bar. For example, when the longCondition occurs on bar 20, the script places an entry order to fill on the next tick, which is at the open of bar 21. When the strategy recalculates its values after bar 21 closes, it places an order to close the current position on the next tick, which is at the open of bar 22.

Order types

Pine Script strategies can simulate different order types to suit specific trading system needs. The main notable order types include market, limit, stop, and stop-limit.

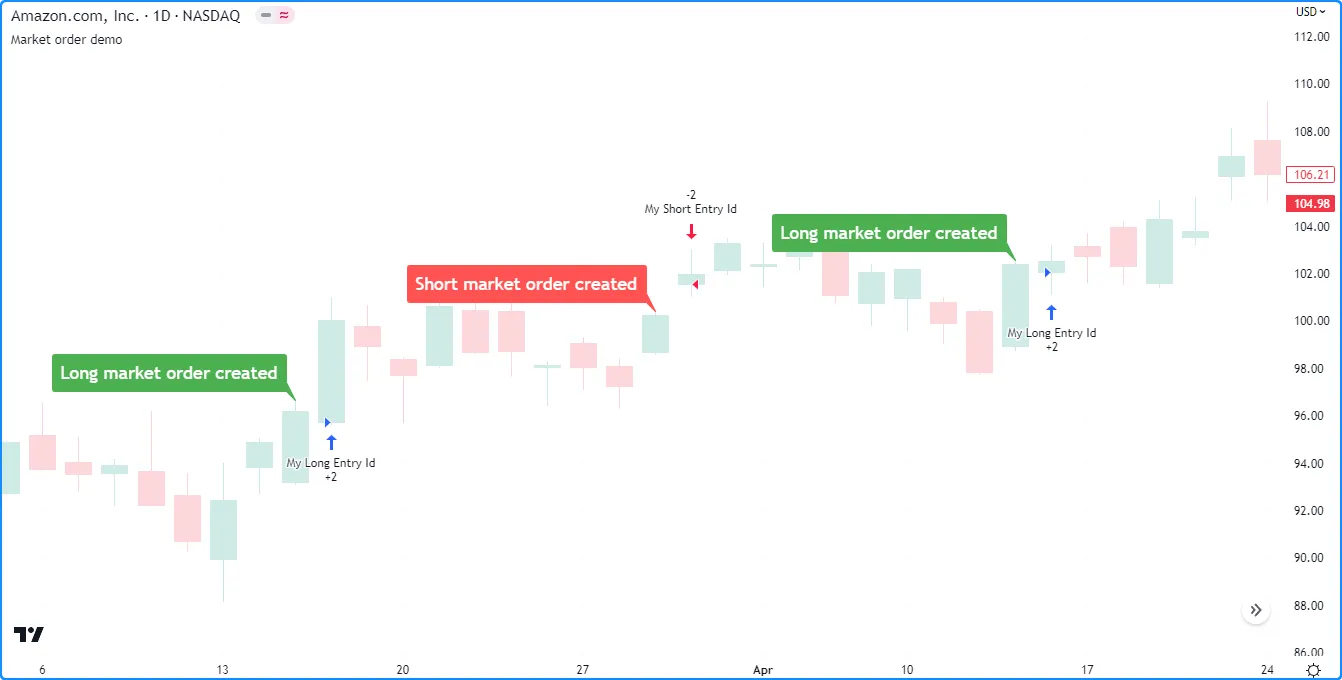

Market orders

A market order is the simplest type of order, which most order placement commands generate by default. A market order is an instruction to buy or sell a security as soon as possible, irrespective of the price. As such, the broker emulator always executes a market order on the next available tick.

The example below alternates between placing a long and short market order once every lengthInput bars. When the bar_index is divisible by 2 * lengthInput, the strategy generates a long market order. Otherwise, it places a short market order when the bar_index is divisible by the lengthInput:

//@version=6

strategy("Market order demo", overlay = true, margin_long = 100, margin_short = 100)

//@variable Number of bars between long and short entries.

int lengthInput = input.int(10, "Cycle length", 1)

//@function Displays the specified `txt` in a label on the current bar.

debugLabel(string txt, color lblColor) => label.new(

bar_index, high, text = txt, color = lblColor, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

//@variable Is `true` every `2 * lengthInput` bars, `false` otherwise.

longCondition = bar_index % (2 * lengthInput) == 0

//@variable Is `true` every `lengthInput` bars, `false` otherwise.

shortCondition = bar_index % lengthInput == 0

// Generate a long market order with a `color.green` label on `longCondition`.

if longCondition

debugLabel("Long market order created", color.green)

strategy.entry("My Long Entry Id", strategy.long)

// Otherwise, generate a short market order with a `color.red` label on `shortCondition`.

else if shortCondition

debugLabel("Short market order created", color.red)

strategy.entry("My Short Entry Id", strategy.short)

Note that:

- The labels indicate the bars where the script generates the market orders. The broker emulator fills each order at the open of the following bar.

- The strategy.entry() command can automatically reverse an open position in the opposite direction. See this section below for more information.

Limit orders

A limit order is an instruction to buy or sell a security at a specific price or better (lower than specified for long orders, and higher than specified for short orders), irrespective of the time. To simulate a limit order in a strategy script, pass a price value to the limit parameter of an applicable order placement command.

When the market price reaches a limit order’s value, or crosses it in the favorable direction, the broker emulator fills the order at that value or a better price. When a strategy generates a limit order at a worse value than the current market price (higher for long orders and lower for short orders), the emulator fills the order without waiting for the market price to reach that value.

For example, the following script generates a long limit order 800 ticks below the close of the bar 100 bars before the last chart bar using the strategy.entry() command. It draws a label to signify the bar where the strategy created the order and a line to visualize the order’s price:

//@version=6

strategy("Limit order demo", overlay = true, margin_long = 100, margin_short = 100)

//@function Displays text passed to `txt` and a horizontal line at `price` when called.

debugLabel(float price, string txt) =>

label.new(

bar_index, price, text = txt, color = color.teal, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

line.new(

bar_index, price, bar_index + 1, price, color = color.teal, extend = extend.right,

style = line.style_dashed

)

// Generate a long limit order with a label and line 100 bars before the `last_bar_index`.

if last_bar_index - bar_index == 100

limitPrice = close - syminfo.mintick * 800

debugLabel(limitPrice, "Long Limit order created")

strategy.entry("Long", strategy.long, limit = limitPrice)

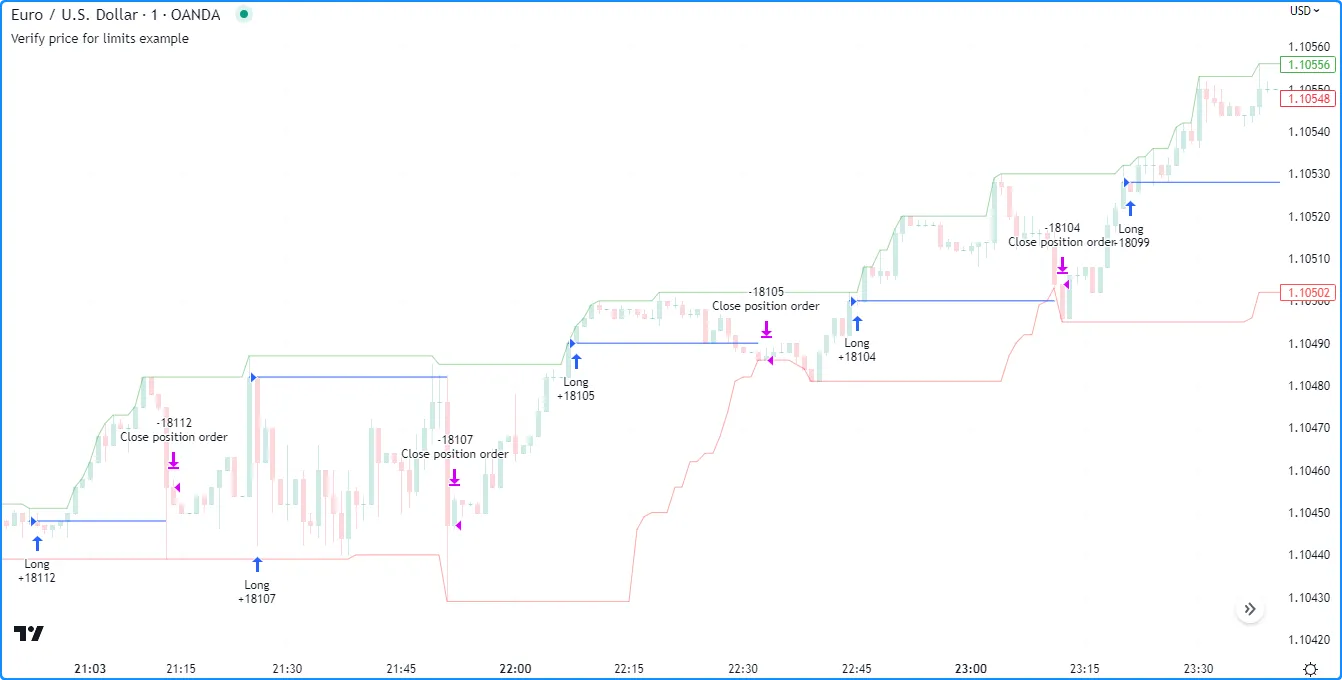

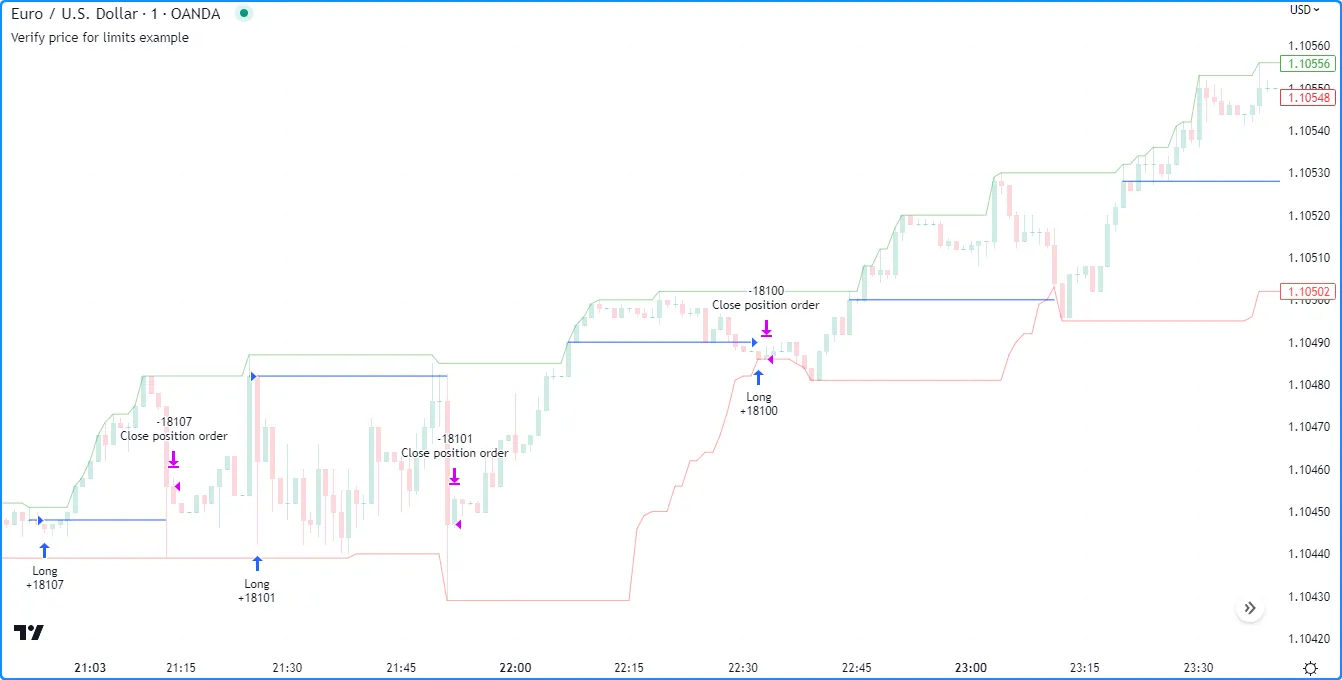

Notice that in the chart above, the label and the start of the line occurred several bars before the “Long” entry marker. The broker emulator could not fill the order while the market price remained above the limitPrice because such a price is a worse value for the long trade. After the price fell and reached the limitPrice, the emulator filled the order mid-bar at that value.

If we set the limitPrice to a value above the bar’s close rather than below, the broker emulator fills the order at the open of the following bar because the closing price is already a more favorable value for the long trade. Here, we set the limitPrice in the script to 800 ticks above the bar’s close to demonstrate this effect:

//@version=6

strategy("Limit order demo", overlay = true, margin_long = 100, margin_short = 100)

//@function Displays text passed to `txt` and a horizontal line at `price` when called.

debugLabel(float price, string txt) =>

label.new(

bar_index, price, text = txt, color = color.teal, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

line.new(

bar_index, price, bar_index + 1, price, color = color.teal, extend = extend.right,

style = line.style_dashed

)

// Generate a long limit order with a label and line 100 bars before the `last_bar_index`.

if last_bar_index - bar_index == 100

limitPrice = close + syminfo.mintick * 800

debugLabel(limitPrice, "Long Limit order created")

strategy.entry("Long", strategy.long, limit = limitPrice)

Stop and stop-limit orders

A stop order is an instruction to activate a new market or limit order when the market price reaches a specific price or a worse value (higher than specified for long orders and lower than specified for short orders). To simulate a stop order, pass a price value to the stop parameter of an applicable order placement command.

When a strategy generates a stop order at a better value than the current market price, it activates the subsequent order without waiting for the market price to reach that value.

The following example calls strategy.entry() to place a stop order 800 ticks above the close 100 bars before the last historical chart bar. It also draws a label on the bar where it created the order and a line to display the stop price. As we see in the chart below, the strategy entered a long position immediately after the price crossed the stop level:

//@version=6

strategy("Stop order demo", overlay = true, margin_long = 100, margin_short = 100)

//@function Displays text passed to `txt` when called and shows the `price` level on the chart.

debugLabel(price, txt) =>

label.new(

bar_index, high, text = txt, color = color.teal, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

line.new(bar_index, high, bar_index, price, style = line.style_dotted, color = color.teal)

line.new(

bar_index, price, bar_index + 1, price, color = color.teal, extend = extend.right,

style = line.style_dashed

)

// Generate a long stop order with a label and lines 100 bars before the last bar.

if last_bar_index - bar_index == 100

stopPrice = close + syminfo.mintick * 800

debugLabel(stopPrice, "Long Stop order created")

strategy.entry("Long", strategy.long, stop = stopPrice)

Note that:

- A basic stop order is essentially the opposite of a limit order in terms of its execution based on the market price. If we use a limit order instead of a stop order in this scenario, the order executes immediately on the next bar. See the previous section for an example.

When a strategy.entry() or strategy.order() call includes a stop and limit argument, it creates a stop-limit order. Unlike a basic stop order, which triggers a market order when the current price is at the stop level or a worse value, a stop-limit order creates a subsequent limit order to fill at the specified limit price.

Below, we modified the previous script to simulate and visualize a stop-limit order. This script version includes the bar’s low as the limit price in the strategy.entry() command. It also includes additional drawings to show where the strategy activated the subsequent limit order and to visualize the limit price.

In this example chart, notice how the market price reached the limit level on the next bar after the stop-limit order was created, but the strategy did not enter a position because the limit order was not yet active. After price later reached the stop level, the strategy placed the limit order, and then the broker emulator filled it after the market price dropped back down to the limit level:

//@version=6

strategy("Stop-Limit order demo", overlay = true, margin_long = 100, margin_short = 100)

//@function Displays text passed to `txt` when called and shows the `price` level on the chart.

debugLabel(price, txt, lblColor, lineWidth = 1) =>

label.new(

bar_index, high, text = txt, color = lblColor, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

line.new(bar_index, close, bar_index, price, style = line.style_dotted, color = lblColor, width = lineWidth)

line.new(

bar_index, price, bar_index + 1, price, color = lblColor, extend = extend.right,

style = line.style_dashed, width = lineWidth

)

var float stopPrice = na

var float limitPrice = na

// Generate a long stop-limit order with a label and lines 100 bars before the last bar.

if last_bar_index - bar_index == 100

stopPrice := close + syminfo.mintick * 800

limitPrice := low

debugLabel(limitPrice, "", color.gray)

debugLabel(stopPrice, "Long Stop-Limit order created", color.teal)

strategy.entry("Long", strategy.long, stop = stopPrice, limit = limitPrice)

// Draw a line and label when the strategy activates the limit order.

if high >= stopPrice

debugLabel(limitPrice, "Limit order activated", color.green, 2)

stopPrice := na

Order placement and cancellation

The strategy.* namespace features the following five functions that simulate the placement of orders, known as order placement commands: strategy.entry(), strategy.order(), strategy.exit(), strategy.close(), and strategy.close_all().

Additionally, the namespace includes the following two functions that cancel pending orders, known as order cancellation commands: strategy.cancel() and strategy.cancel_all().

The segments below explain these commands, their unique characteristics, and how to use them.

strategy.entry()

The strategy.entry() command generates entry orders. Its unique features help simplify opening and managing positions. This order placement command generates market orders by default. It can also create limit, stop, and stop-limit orders with the limit and stop parameters, as explained in the Order types section above.

Reversing positions

One of the strategy.entry() command’s unique features is its ability to reverse an open position automatically. By default, when an order from strategy.entry() executes while there is an open position in the opposite direction, the command automatically adds the position’s size to the new order’s size. The added quantity allows the order to close the current position and open a new position for the specified number of contracts/lots/shares/units in the new direction.

For instance, if a strategy has an open position of 15 shares in the strategy.long direction and calls strategy.entry() to place a new market order in the strategy.short direction, the size of the resulting transaction is the specified entry size plus 15 shares.

The example below demonstrates this behavior in action. When the buyCondition occurs once every 100 bars, the script calls strategy.entry() with qty = 15 to open a long position of 15 shares. Otherwise, when the sellCondition occurs on every 50th bar, the script calls strategy.entry() with qty = 5 to enter a new short position of five shares. The script also highlights the chart’s background on the bars where the buyCondition and sellCondition occurs:

//@version=6

strategy("Reversing positions demo", overlay = true)

//@variable Is `true` on every 100th bar, `false` otherwise.

bool buyCondition = bar_index % 100 == 0

//@variable Is `true` on every 50th bar, `false` otherwise.

bool sellCondition = bar_index % 50 == 0

if buyCondition

// Place a "buy" market order to close the short position and enter a long position of 15 shares.

strategy.entry("buy", strategy.long, qty = 15)

else if sellCondition

// Place a "sell" market order to close the long position and enter a short position of 5 shares.

strategy.entry("sell", strategy.short, qty = 5)

// Highlight the background when the `buyCondition` or `sellCondition` occurs.

bgcolor(buyCondition ? color.new(color.blue, 90) : sellCondition ? color.new(color.red, 90) : na)

The trade markers on the chart show the transaction size, not the size of the resulting position. The markers above show that the transaction size was 20 shares on each order fill rather than 15 for long orders and five for short orders. Since strategy.entry() reverses a position in the opposite direction by default, each call adds the open position’s size (e.g., 15 for long entries) to the new order’s size (e.g., 5 for short entries), resulting in a quantity of 20 shares on each entry after the first. Although each of these transactions is 20 shares in size, the resulting positions are 5 shares for each short entry and 15 for each long entry.

Note that:

- The strategy.risk.allow_entry_in() function overrides the allowed direction for the strategy.entry() command. When a script specifies a trade direction with this risk management command, orders from strategy.entry() in the opposite direction close the open position without allowing a reversal.

Pyramiding

Another unique characteristic of the strategy.entry() command is its connection to a strategy’s pyramiding property. Pyramiding specifies the maximum number of successive entries a strategy allows in the same direction. Users can set this property by including a pyramiding argument in the strategy() declaration statement or by adjusting the “Pyramiding” input in the script’s “Settings/Properties” tab. The default value is 1, meaning the strategy can open new positions but cannot add to them using orders from strategy.entry() calls.

The following example uses strategy.entry() to place a market order when the entryCondition occurs on every 25th bar. The direction of the orders changes once every 100 bars, meaning every 100-bar cycle includes four strategy.entry() calls with the same direction. For visual reference of the conditions, the script highlights the chart’s background based on the current direction each time the entryCondition occurs:

//@version=6

strategy("Pyramiding demo", overlay = true)

//@variable Represents the direction of the entry orders. A value of 1 means long, and -1 means short.

var int direction = 1

//@variable Is `true` once every 25 bars, `false` otherwise.

bool entryCondition = bar_index % 25 == 0

// Change the `direction` on every 100th bar.

if bar_index % 100 == 0

direction *= -1

// Place a market order based on the current `direction` when the `entryCondition` occurs.

if entryCondition

strategy.entry("Entry", direction == 1 ? strategy.long : strategy.short)

//@variable When the `entryCondition` occurs, is a blue color if the `direction` is 1 and a red color otherwise.

color bgColor = entryCondition ? (direction == 1 ? color.new(color.blue, 80) : color.new(color.red, 80)) : na

// Highlight the chart's background using the `bgColor`.

bgcolor(bgColor, title = "Background highlight")

Notice that although the script calls strategy.entry() with the same direction four times within each 100-bar cycle, the strategy does not execute an order after every call. It cannot open more than one trade per position with strategy.entry() because it uses the default pyramiding value of 1.

Below, we modified the script by including pyramiding = 4 in the strategy() declaration statement to allow up to four successive trades in the same direction. Now, an order fill occurs after every strategy.entry() call:

//@version=6

strategy("Pyramiding demo", overlay = true, pyramiding = 4)

//@variable Represents the direction of the entry orders. A value of 1 means long, and -1 means short.

var int direction = 1

//@variable Is `true` once every 25 bars, `false` otherwise.

bool entryCondition = bar_index % 25 == 0

// Change the `direction` on every 100th bar.

if bar_index % 100 == 0

direction *= -1

// Place a market order based on the current `direction` when the `entryCondition` occurs.

if entryCondition

strategy.entry("Entry", direction == 1 ? strategy.long : strategy.short)

//@variable When the `entryCondition` occurs, is a blue color if the `direction` is 1 and a red color otherwise.

color bgColor = entryCondition ? (direction == 1 ? color.new(color.blue, 80) : color.new(color.red, 80)) : na

// Highlight the chart's background using the `bgColor`.

bgcolor(bgColor, title = "Background highlight")

strategy.order()

The strategy.order() command generates a basic order. Unlike other order placement commands, which can behave differently based on a strategy’s properties and open trades, this command ignores most properties, such as pyramiding, and simply creates orders with the specified parameters. This command generates market orders by default. It can also create limit, stop, and stop-limit orders with the limit and stop parameters. Orders from strategy.order() can open new positions and modify or close existing ones. When a strategy executes an order from this command, the resulting market position is the net sum of the open position and the filled order quantity.

The following script uses strategy.order() calls to enter and exit positions. The strategy places a long market order for 15 units once every 100 bars. On every 25th bar that is not a multiple of 100, it places a short market order for five units. The script highlights the background to signify where the strategy places a “buy” or “sell” order:

//@version=6

strategy("`strategy.order()` demo", overlay = true)

//@variable Is `true` on every 100th bar, `false` otherwise.

bool buyCondition = bar_index % 100 == 0

//@variable Is `true` on every 25th bar, `false` otherwise.

bool sellCondition = bar_index % 25 == 0

if buyCondition

// Place a "buy" market order to trade 15 units in the long direction.

strategy.order("buy", strategy.long, qty = 15)

else if sellCondition

// Place a "sell" market order to trade 5 units in the short direction.

strategy.order("sell", strategy.short, qty = 5)

// Highlight the background when the `buyCondition` or `sellCondition` occurs.

bgcolor(buyCondition ? color.new(color.blue, 90) : sellCondition ? color.new(color.red, 90) : na)

This particular strategy never simulates a short position. Unlike the strategy.entry() command, strategy.order() does not automatically reverse open positions. After filling a “buy” order, the strategy has an open long position of 15 units. The three subsequent “sell” orders reduce the position by five units each, and 15 - 5 * 3 = 0. In other words, the strategy opens a long position on every 100th bar and gradually reduces the size to 0 using three successive short orders. If we used strategy.entry() instead of the strategy.order() command in this example, the strategy would alternate between entering long and short positions of 15 and five units, respectively.

strategy.exit()

The strategy.exit() command generates exit orders. It features several unique behaviors that link to open trades, helping to simplify closing market positions and creating multi-level exits with take-profit, stop-loss, and trailing stop orders.

Unlike other order placement commands, which can generate a single order per call, each call to strategy.exit() can produce more than one type of exit order, depending on its arguments. Additionally, a single call to this command can generate exit orders for multiple entries, depending on the specified from_entry value and the strategy’s open trades.

Take-profit and stop-loss

The most basic use of the strategy.exit() command is the placement of limit orders to trigger exits after earning enough money (take-profit), stop orders to trigger exits after losing too much money (stop-loss), or both (bracket).

Four parameters determine the prices of the command’s take-profit and stop-loss orders:

- The

profitandlossparameters accept relative values representing the number of ticks the market price must move away from the entry price to trigger an exit. - The

limitandstopparameters accept absolute values representing the specific prices that trigger an exit when the market price reaches them.

When a strategy.exit() call includes arguments for the relative and absolute parameters defining take-profit or stop-loss levels (profit and limit or loss and stop), it creates orders only at the levels expected to trigger exits first.

For instance, if the profit distance is 19 ticks and the limit level is 20 ticks past the entry price in the favorable direction, the strategy.exit() command places a take-profit order profit ticks past the entry price because the market price will move that distance before reaching the limit value. In contrast, if the profit distance is 20 ticks and the limit level is 19 ticks past the entry price in the favorable direction, the command places a take-profit order at the limit level because the price will reach that value first.

The following example creates exit bracket (take-profit and stop-loss) orders with the strategy.exit() command. When the buyCondition occurs, the script calls strategy.entry() to place a “buy” market order. It also calls strategy.exit() with limit and stop arguments to create a take-profit order at the limitPrice and a stop-loss order at the stopPrice. The script plots the limitPrice and stopPrice values on the chart to visualize the exit order prices:

//@version=6

strategy("Take-profit and stop-loss demo", overlay = true)

//@variable Is `true` on every 100th bar.

bool buyCondition = bar_index % 100 == 0

//@variable The current take-profit order price.

var float takeProfit = na

//@variable The current stop-loss order price.

var float stopLoss = na

if buyCondition

// Update the `takeProfit` and `stopLoss` values.

if strategy.opentrades == 0

takeProfit := close * 1.01

stopLoss := close * 0.99

// Place a long market order.

strategy.entry("buy", strategy.long)

// Place a take-profit order at the `takeProfit` price and a stop-loss order at the `stopLoss` price.

strategy.exit("exit", "buy", limit = takeProfit, stop = stopLoss)

// Set `takeProfit` and `stopLoss` to `na` when the position closes.

if ta.change(strategy.closedtrades) > 0

takeProfit := na

stopLoss := na

// Plot the `takeProfit` and `stopLoss` values.

plot(takeProfit, "TP", color.green, style = plot.style_circles)

plot(stopLoss, "SL", color.red, style = plot.style_circles)

Note that:

- We did not specify a

qtyorqty_percentargument in the strategy.exit() call, meaning it creates orders to exit 100% of the “buy” order’s size. - The strategy.exit() command’s exit orders do not necessarily execute at the specified prices. Strategies can fill limit orders at better prices and stop orders at worse prices, depending on the range of values available to the broker emulator.

When a strategy.exit() call includes a from_entry argument, the resulting exit orders only apply to existing entry orders that have a matching ID. If the specified from_entry value does not match the ID of any entry in the current position, the command does not create any exit orders.

Below, we changed the from_entry argument of the strategy.exit() call in our previous script to “buy2”, which means it creates exit orders only for open trades with the “buy2” entry ID. This version does not place any exit orders because it does not create any entry orders with the “buy2” ID:

//@version=6

strategy("Invalid `from_entry` ID demo", overlay = true)

//@variable Is `true` on every 100th bar.

bool buyCondition = bar_index % 100 == 0

//@variable The current take-profit order price.

var float takeProfit = na

//@variable The current stop-loss order price.

var float stopLoss = na

if buyCondition

// Update the `takeProfit` and `stopLoss` values before entering the trade.

if strategy.opentrades == 0

takeProfit := close * 1.01

stopLoss := close * 0.99

// Place a long market order.

strategy.entry("buy", strategy.long)

// Attempt to place an exit bracket for "buy2" entries.

// This call has no effect because the strategy does not create entry orders with the "buy2" ID.

strategy.exit("exit", "buy2", limit = takeProfit, stop = stopLoss)

// Set `takeProfit` and `stopLoss` to `na` when the position closes.

if ta.change(strategy.closedtrades) > 0

takeProfit := na

stopLoss := na

// Plot the `takeProfit` and `stopLoss` values.

plot(takeProfit, "TP", color.green, style = plot.style_circles)

plot(stopLoss, "SL", color.red, style = plot.style_circles)

Note that:

- When a strategy.exit() call does not include a

from_entryargument, it creates exit orders for all the position’s open trades, regardless of their entry IDs. See the Exits for multiple entries section below to learn more.

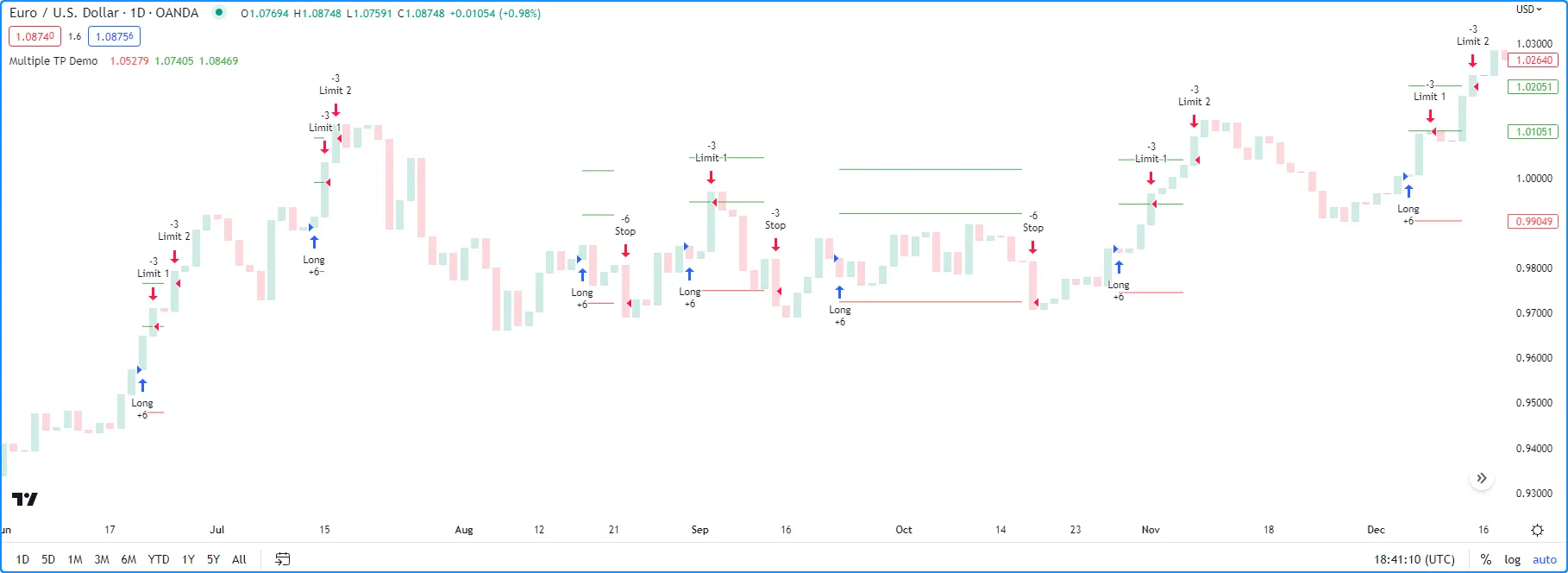

Partial and multi-level exits

Strategies can use more than one call to strategy.exit() to create successive partial exit orders for the same entry ID, helping to simplify the formation of multi-level exit strategies. To use multiple strategy.exit() calls to exit from an open trade, include a qty or qty_percent argument in each call to specify how much of the traded quantity to close. If the sum of the exit order sizes exceeds the open position, the strategy automatically reduces their sizes to match the position.

Note that:

- When a strategy.exit() call includes both

qtyandqty_percentarguments, the command uses theqtyvalue to size the order and ignores theqty_percentvalue.

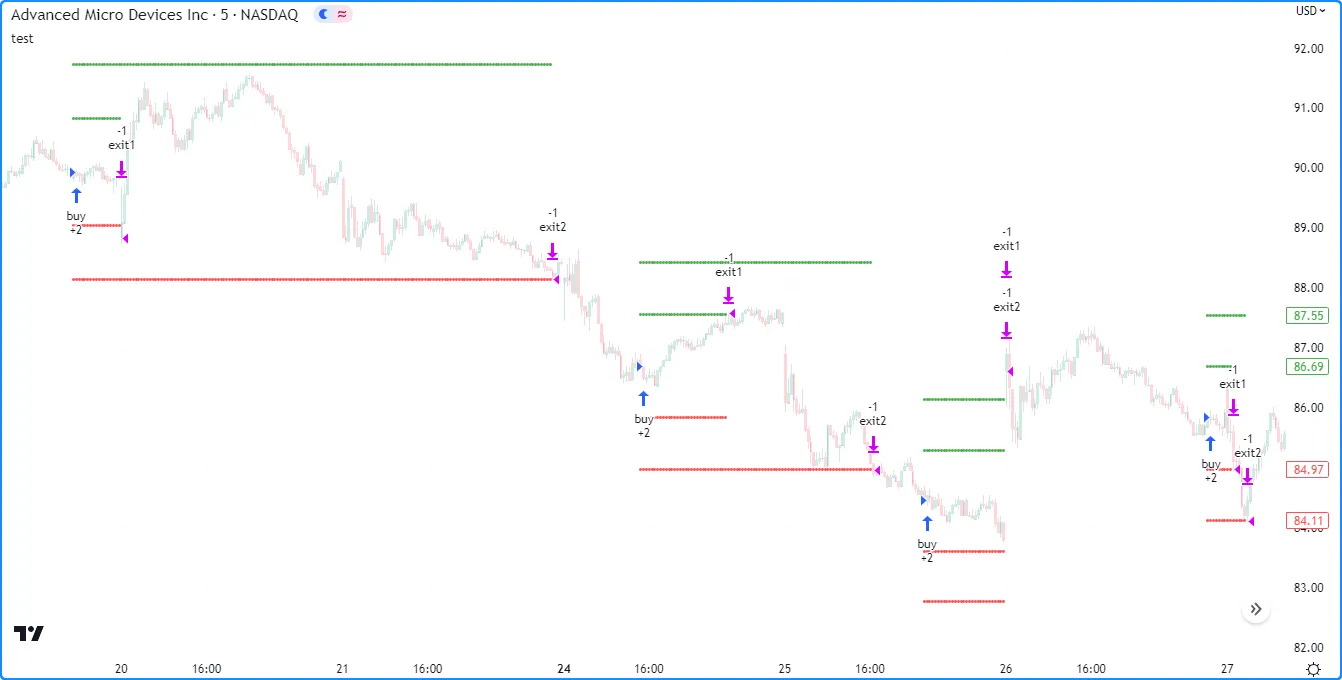

This example demonstrates a simple strategy that creates two partial exit order brackets for an entry ID. When the buyCondition occurs, the script places a “buy” market order for two shares with strategy.entry(), and it creates “exit1” and “exit2” brackets using two calls to strategy.exit(). The first call uses a qty of 1, and the second uses a qty of 3:

//@version=6

strategy("Multi-level exit demo", "test", overlay = true)

//@variable Is `true` on every 100th bar.

bool buyCondition = bar_index % 100 == 0

//@variable The take-profit price for "exit1" orders.

var float takeProfit1 = na

//@variable The take-profit price for "exit2" orders.

var float takeProfit2 = na

//@variable The stop-loss price for "exit1" orders.

var float stopLoss1 = na

//@variable The stop-loss price for "exit2" orders.

var float stopLoss2 = na

if buyCondition

// Update the `takeProfit*` and `stopLoss*` values before entering the trade.

if strategy.opentrades == 0

takeProfit1 := close * 1.01

takeProfit2 := close * 1.02

stopLoss1 := close * 0.99

stopLoss2 := close * 0.98

// Place a long market order with a `qty` of 2.

strategy.entry("buy", strategy.long, qty = 2)

// Place an "exit1" bracket with a `qty` of 1 at the `takeProfit1` and `stopLoss1` prices.

strategy.exit("exit1", "buy", limit = takeProfit1, stop = stopLoss1, qty = 1)

// Place an "exit2" bracket with a `qty` of 3 at the `takeProfit1` and `stopLoss1` prices.

// The size of the resulting orders decreases to match the open position.

strategy.exit("exit2", "buy", limit = takeProfit2, stop = stopLoss2, qty = 3)

// Set `takeProfit1` and `stopLoss1` to `na` when the price touches either value.

if high >= takeProfit1 or low <= stopLoss1

takeProfit1 := na

stopLoss1 := na

// Set `takeProfit2` and `stopLoss2` to `na` when the price touches either value.

if high >= takeProfit2 or low <= stopLoss2

takeProfit2 := na

stopLoss2 := na

// Plot the `takeProfit*` and `stopLoss*` values.

plot(takeProfit1, "TP1", color.green, style = plot.style_circles)

plot(takeProfit2, "TP2", color.green, style = plot.style_circles)

plot(stopLoss1, "SL1", color.red, style = plot.style_circles)

plot(stopLoss2, "SL2", color.red, style = plot.style_circles)

As we can see from the trade markers on the chart above, the strategy first executes the “exit1” take-profit or stop-loss order to reduce the open position by one share, leaving one remaining share in the position. However, we specified a size of three shares for the “exit2” order bracket, which exceeds the remaining position. Rather than using this specified quantity, the strategy automatically reduces the “exit2” orders to one share, allowing it to close the position successfully.

Note that:

- This strategy only fills one exit order from the “exit1” bracket, not both. When a strategy.exit() call generates more than one exit order type for an entry ID, the strategy fills the only the first triggered one and automatically cancels the others.

- The strategy reduced the “exit2” orders because all orders from the strategy.exit() calls automatically belong to the same strategy.oca.reduce group by default. Learn more about OCA groups below.

When creating multiple exit orders with different strategy.exit() calls, it’s crucial to note that the orders from each call reserve a portion of the open position. The orders from one strategy.exit() call cannot exit the portion of a position that a previous call already reserved.

For example, this script generates a “buy” entry order for 20 shares with a strategy.entry() call and “limit” and “stop” exit orders with two separate calls to strategy.exit() 100 bars before the last chart bar. We specified a quantity of 19 shares for the “limit” order and 20 for the “stop” order:

//@version=6

strategy("Reserved exit demo", "test", overlay = true)

//@variable The price of the "limit" exit order.

var float limitPrice = na

//@variable The price of the "stop" exit order.

var float stopPrice = na

//@variable Is `true` 100 bars before the last chart bar.

bool longCondition = last_bar_index - bar_index == 100

if longCondition

// Update the `limitPrice` and `stopPrice`.

limitPrice := close * 1.01

stopPrice := close * 0.99

// Place a long market order for 20 shares.

strategy.entry("buy", strategy.long, 20)

// Create a take-profit order for 19 shares at the `limitPrice`.

strategy.exit("limit", limit = limitPrice, qty = 19)

// Create a stop-loss order at the `stopPrice`. Although this call specifies a `qty` of 20, the previous

// `strategy.exit()` call reserved 19, meaning this call creates an exit order for only 1 share.

strategy.exit("stop", stop = stopPrice, qty = 20)

//@variable Is `true` when the strategy has an open position, `false` otherwise.

bool showPlot = strategy.opentrades == 1

// Plot the `limitPrice` and `stopPrice` when `showPlot` is `true`.

plot(showPlot ? limitPrice : na, "Limit (take-profit) price", color.green, 2, plot.style_linebr)

plot(showPlot ? stopPrice : na, "Stop (stop-loss) price", color.red, 2, plot.style_linebr)

Users unfamiliar with the strategy.exit() command’s unique behaviors might expect this strategy to close the entire market position if it fills the “stop” order before the “limit” order. However, the trade markers in the chart below show that the “stop” order only reduces the position by one share. The strategy.exit() call for the “limit” order executes first in the code, reserving 19 shares of the open position for closure with that order. This reservation leaves only one share available for the “stop” order to close, regardless of when the strategy fills it:

Trailing stops

One of the strategy.exit() command’s key features is its ability to create trailing stops, i.e., stop-loss orders that trail behind the market price by a specified amount whenever it moves to a better value in the favorable direction (upward for long positions and downward for short positions).

This type of exit order has two components: an activation level and a trail offset. The activation level is the value the market price must cross to activate the trailing stop calculation, and the trail offset is the distance the activated stop follows behind the price as it reaches successively better values.

Three strategy.exit() parameters determine the activation level and trail offset of a trailing stop order:

- The

trail_priceparameter accepts an absolute price value for the trailing stop’s activation level. - The

trail_pointsparameter is an alternative way to specify the activation level. Its value represents the tick distance from the entry price required to activate the trailing stop. - The

trail_offsetparameter accepts a value representing the order’s trail offset as a specified number of ticks.

To create and activate a trailing stop order, a strategy.exit() call must specify a trail_offset argument and either a trail_price or trail_points argument. If the call contains both trail_price and trail_points arguments, the command uses the level expected to activate the stop first. For instance, if the trail_points distance is 50 ticks and the trail_price value is 51 ticks past the entry price in the favorable direction, the strategy.exit() command uses the trail_points value to set the activation level because the market price will move that distance before reaching the trail_price level.

The example below demonstrates how a trailing stop order works in detail. The strategy places a “Long” market order with the strategy.entry() command 100 bars before the last chart bar, and it calls strategy.exit() with trail_price and trail_offset arguments on the following bar to create a trailing stop. The script uses lines, labels, and a plot to visualize the trailing stop’s behavior.

The green line on the chart shows the level the market price must reach to activate the trailing stop order. After the price reaches this level from below, the script uses a blue plot to display the trailing stop’s price. Each time the market price reaches a new high after activating the trailing stop, the stop’s price increases to maintain a distance of trailOffsetInput ticks from the best value. The exit order does not change its price level when the price decreases or does not reach a new high. Eventually, the market price crosses below the trailing stop, triggering an exit:

//@version=6

strategy("Trailing stop order demo", overlay = true, margin_long = 100, margin_short = 100)

//@variable The distance from the entry price required to activate the trailing stop.

int activationOffsetInput = input.int(1000, "Activation level offset (in ticks)", 0)

//@variable The distance the stop follows behind the highest `high` after activation.

int trailOffsetInput = input.int(2000, "Trailing stop offset (in ticks)", 0)

//@variable Draws a label and an optional line at the specified `price`.

debugDrawings(float price, string txt, color drawingColor, bool drawLine = false) =>

// Draw a label showing the `txt` at the `price` on the current bar.

label.new(

bar_index, price, text = txt, color = drawingColor, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

// Draw a horizontal line at the `price` starting from the current bar when `drawLine` is `true`.

line.new(

bar_index, price, bar_index + 1, price, color = drawingColor, extend = extend.right,

style = line.style_dashed

)

//@variable The level required to activate the trailing stop.

var float activationLevel = na

//@variable The price of the trailing stop.

var float trailingStop = na

//@variable The value that the trailing stop would have if it was currently active.

float theoreticalStopPrice = high - trailOffsetInput * syminfo.mintick

// Place a long market order 100 bars before the last historical bar.

if last_bar_index - bar_index == 100

strategy.entry("Long", strategy.long)

// Create and visualize the exit order on the next bar.

if last_bar_index - bar_index == 99

// Update the `activationLevel`.

activationLevel := open + syminfo.mintick * activationOffsetInput

// Create the trailing stop order that activates at the `activationLevel` and trails behind the `high` by

// `trailOffsetInput` ticks.

strategy.exit(

"Trailing Stop", from_entry = "Long", trail_price = activationLevel,

trail_offset = trailOffsetInput

)

// Create drawings to signify the activation level.

debugDrawings(activationLevel, "Trailing Stop Activation Level", color.green, true)

// Visualize the trailing stop's levels while the position is open.

if strategy.opentrades == 1

// Create drawings when the `high` is above the `activationLevel` for the first time to show when the

// stop activates.

if na(trailingStop) and high >= activationLevel

debugDrawings(activationLevel, "Activation level crossed", color.green)

trailingStop := theoreticalStopPrice

debugDrawings(trailingStop, "Trailing Stop Activated", color.blue)

// Otherwise, update the `trailingStop` value when the `theoreticalStopPrice` reaches a new high.

else if theoreticalStopPrice > trailingStop

trailingStop := theoreticalStopPrice

// Plot the `trailingStop` value to visualize the trailing price movement.

plot(trailingStop, "Trailing Stop")

Exits for multiple entries

A single call to the strategy.exit() command can generate exit orders for more than one entry in an open position, depending on the call’s from_entry value.

If an open position consists of two or more entries with the same ID, a single call to strategy.exit() with that ID as the from_entry argument places exit orders for each corresponding entry created before or on the bar where the call occurs.

For example, this script periodically calls strategy.entry() on two consecutive bars to enter and add to a long position. Both calls use “buy” as the id argument. After creating the second entry, the script calls strategy.exit() once with “buy” as its from_entry argument to generate separate exit orders for each entry with that ID. When the market price reaches the takeProfit or stopLoss value, the broker emulator fills two exit orders and closes the position:

//@version=6

strategy("Exits for entries with the same ID demo", overlay = true, pyramiding = 2)

//@variable Take-profit price for exit commands.

var float takeProfit = na

//@variable Stop-loss price for exit commands.

var float stopLoss = na

//@variable Is `true` on two consecutive bars in 100-bar cycles.

bool buyCondition = math.min(bar_index % 100, math.max(bar_index - 1, 0) % 100) == 0

if buyCondition

// Place a "buy" market order to enter a trade.

strategy.entry("buy", strategy.long)

// Calculate exits on the second order.

if strategy.opentrades == 1

// Update the `takeProfit` and `stopLoss`.

takeProfit := close * 1.01

stopLoss := close * 0.99

// Place exit orders for both "buy" entries.

strategy.exit("exit", "buy", limit = takeProfit, stop = stopLoss)

// Set `takeProfit` and `stopLoss` to `na` when both trades close.

if ta.change(strategy.closedtrades) == 2

takeProfit := na

stopLoss := na

// Plot the `takeProfit` and `stopLoss` values.

plot(takeProfit, "TP", color.green, style = plot.style_circles)

plot(stopLoss, "SL", color.red, style = plot.style_circles)

A single strategy.exit() call can also generate exit orders for all entries in an open position, irrespective of entry ID, when it does not include a from_entry argument.

Here, we changed the strategy.entry() instance in the above script to create an entry order with a distinct ID on each call, and we removed the from_entry argument from the strategy.exit() call. Since this version does not specify which entries the exit orders apply to, the strategy.exit() call creates orders for every entry in the position:

//@version=6

strategy("Exits for entries with different IDs demo", overlay = true, pyramiding = 2)

//@variable Take-profit price for exit commands.

var float takeProfit = na

//@variable Stop-loss price for exit commands.

var float stopLoss = na

//@variable Is `true` on two consecutive bars in 100-bar cycles.

bool buyCondition = math.min(bar_index % 100, math.max(bar_index - 1, 0) % 100) == 0

if buyCondition

// Place a long market order with a unique ID.

strategy.entry("buy" + str.tostring(strategy.opentrades + strategy.closedtrades), strategy.long)

// Calculate exits on the second order.

if strategy.opentrades == 1

// Update the `takeProfit` and `stopLoss`.

takeProfit := close * 1.01

stopLoss := close * 0.99

// Place exit orders for ALL entries in the position, irrespective of ID.

strategy.exit("exit", limit = takeProfit, stop = stopLoss)

// Set `takeProfit` and `stopLoss` to `na` when both trades close.

if ta.change(strategy.closedtrades) == 2

takeProfit := na

stopLoss := na

// Plot the `takeProfit` and `stopLoss` values.

plot(takeProfit, "TP", color.green, style = plot.style_circles)

plot(stopLoss, "SL", color.red, style = plot.style_circles)

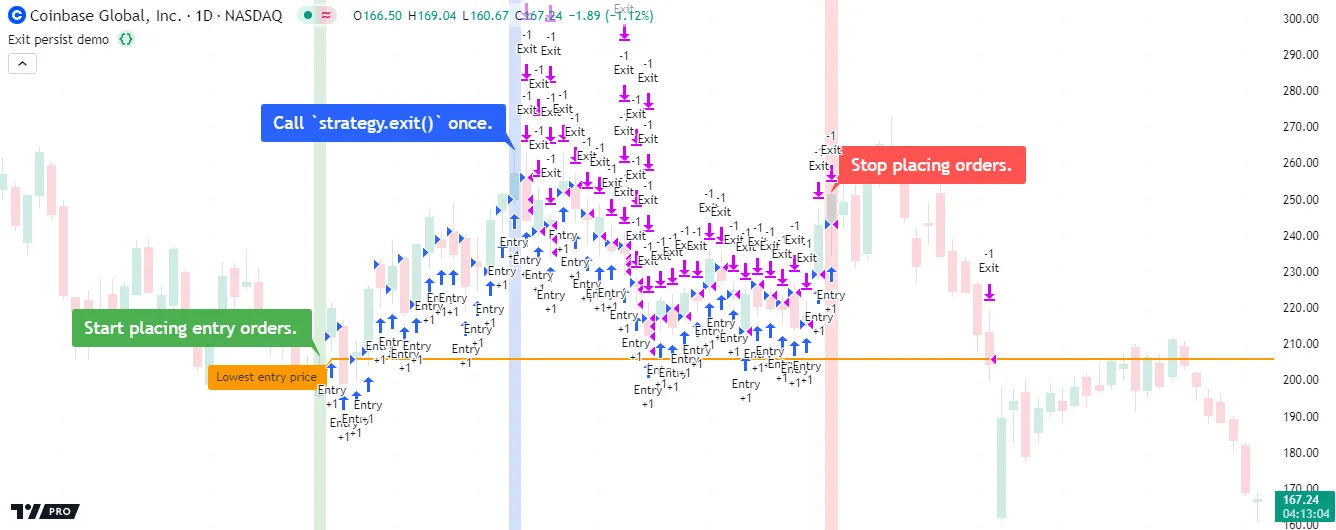

It’s crucial to note that a call to strategy.exit() without a from_entry argument persists and creates exit orders for all open trades in a position, regardless of when the entries occur. This behavior can affect strategies that manage positions with multiple entries or exits. When a strategy has an open position and calls strategy.exit() on any bar without specifying a from_entry ID, it generates exit orders for each entry created before or on that bar, and it continues to generate exit orders for subsequent entries after that bar until the position closes.

Let’s explore this behavior and how it works. The script below creates a long entry order with strategy.entry() on each bar within a user-specified time range, and it calls strategy.exit() without a from_entry argument on one bar within that range to generate exit orders for every entry in the open position. The exit command uses a loss value of 0, which means an exit order fills each time the market price is not above an entry order’s price.

The script prompts users to select three points before it starts its calculations. The first point specifies when order creation begins, the second determines when the single strategy.exit() call occurs, and the third specifies when order creation stops:

//@version=6

strategy("Exit persist demo", overlay = true, margin_long = 100, margin_short = 100, pyramiding = 100)

//@variable The time when order creation starts.

int entryStartTime = input.time(0, "Start time for entries", confirm = true)

//@variable The time when the `strategy.exit()` call occurs.

int exitCallTime = input.time(0, "Exit call time", confirm = true)

//@variable The time when order creation stops.

int entryEndTime = input.time(0, "End time for entries", confirm = true)

// Raise a runtime error if incorrect timestamps are chosen.

if exitCallTime <= entryStartTime or entryEndTime <= exitCallTime or entryEndTime <= entryStartTime

runtime.error("The input timestamps must follow this condition: entryStartTime < exitCallTime < entryEndTime.")

// Create variables to track entry and exit conditions.

bool entriesStart = time == entryStartTime

bool callExit = time == exitCallTime

bool entriesEnd = time == entryEndTime

bool callEntry = time >= entryStartTime and time < entryEndTime

// Place a long entry order when `callEntry` is `true`.

if callEntry

strategy.entry("Entry", strategy.long)

// Call `strategy.exit()` when `callExit` is `true`, which occurs only once.

// This single call persists and creates exit orders for EVERY entry in the position because it does not

// specify a `from_entry` ID.

if callExit

strategy.exit("Exit", loss = 0)

// Draw labels to signify when entries start, when the `strategy.exit()` call occurs, and when order placement stops.

switch

entriesStart => label.new(

bar_index, high, "Start placing entry orders.", color = color.green, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

callExit => label.new(

bar_index, high, "Call `strategy.exit()` once.", color = color.blue, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

entriesEnd => label.new(

bar_index, high, "Stop placing orders.", color = color.red, textcolor = color.white,

style = label.style_label_lower_left, size = size.large

)

// Create a line and label to visualize the lowest entry price, i.e., the price required to close the position.

var line lowestLine = line.new(

entryStartTime + 1000, na, entryEndTime, na, xloc.bar_time, extend.right, color.orange, width = 2

)

var lowestLabel = label.new(

entryStartTime + 1000, na, "Lowest entry price", color = color.orange,

style = label.style_label_upper_right, xloc = xloc.bar_time

)

// Update the price values of the `lowestLine` and `lowestLabel` after each new entry.

if callEntry[1]

var float lowestPrice = strategy.opentrades.entry_price(0)

float entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if not na(entryPrice)

lowestPrice := math.min(lowestPrice, entryPrice)

lowestLine.set_y1(lowestPrice)

lowestLine.set_y2(lowestPrice)

lowestLabel.set_y(lowestPrice)

// Highlight the background when `entriesStart`, `callExit`, and `entriesEnd` occurs.

bgcolor(entriesStart ? color.new(color.green, 80) : na, title = "Entries start highlight")

bgcolor(callExit ? color.new(color.blue, 80) : na, title = "Exit call highlight")

bgcolor(entriesEnd ? color.new(color.red, 80) : na, title = "Entries end highlight")

Note that:

- We included

pyramiding = 100in the strategy() declaration statement, which allows the position to have up to 100 open entries from strategy.entry(). - The script uses labels and bgcolor() to signify when order placement starts and stops and when the strategy.exit() call occurs.

- The script draws a line and a label at the lowest entry price to show the value the market price must reach to close the position.

We can observe the unique strategy.exit() behavior in this example by comparing the code itself with the script’s chart outputs. The script calls strategy.exit() one time, only on the bar with the blue label. However, this single call placed exit orders for every entry before or on that bar and continued placing exit orders for all entries after that bar. This behavior occurs because strategy.exit() has no way to determine when to stop placing orders if it does not link to entries with a specific ID. In this case, the command only ceases to create new exit orders after the position fully closes.

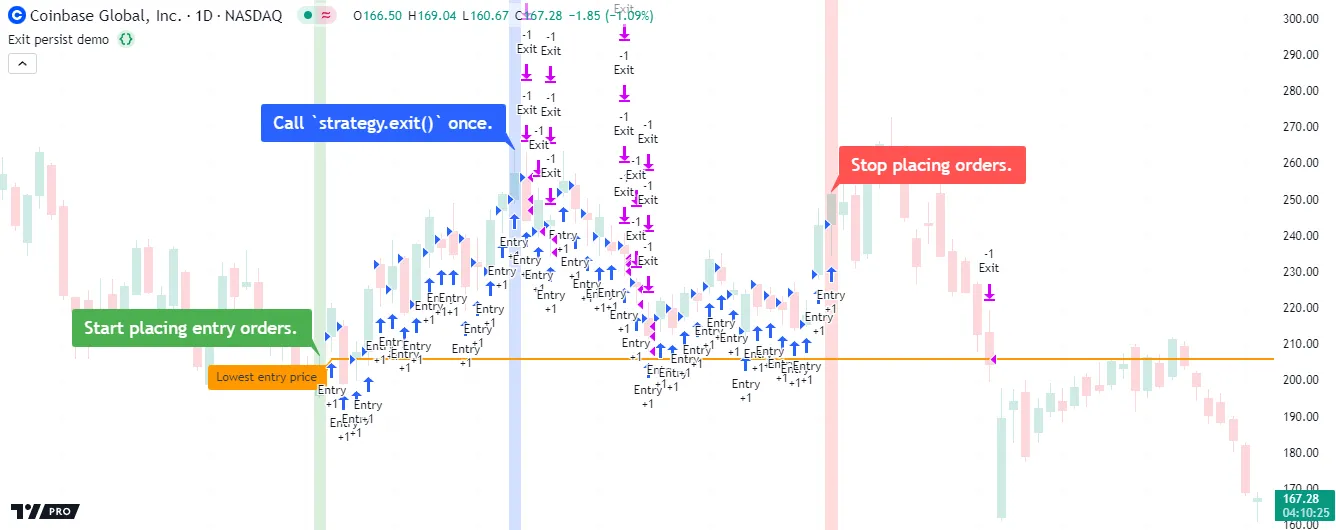

The above script would exhibit different behavior if we included a from_entry argument in the strategy.exit() call. When a call to this command specifies a from_entry ID, it only applies to entries with that ID which the strategy created before or on the bar of the call. The command does not place exit orders for subsequent entries created after that bar in that case, even ones with the same ID.

Here, we added from_entry = "Entry" to our script’s strategy.exit() call, meaning it only produces exit orders for entries with the “Entry” ID. Only 17 exits occur this time, each corresponding to an entry order created before or on the bar with the blue label. The call does not affect any entries that the strategy creates after that bar:

//@version=6

strategy("Exit persist demo", overlay = true, margin_long = 100, margin_short = 100, pyramiding = 100)

//@variable The time when order creation starts.

int entryStartTime = input.time(0, "Start time for entries", confirm = true)

//@variable The time when the `strategy.exit()` call occurs.

int exitCallTime = input.time(0, "Exit call time", confirm = true)

//@variable The time when order creation stops.

int entryEndTime = input.time(0, "End time for entries", confirm = true)

// Raise a runtime error if incorrect timestamps are chosen.

if exitCallTime <= entryStartTime or entryEndTime <= exitCallTime or entryEndTime <= entryStartTime

runtime.error("The input timestamps must follow this condition: entryStartTime < exitCallTime < entryEndTime.")

// Create variables to track entry and exit conditions.

bool entriesStart = time == entryStartTime

bool callExit = time == exitCallTime

bool entriesEnd = time == entryEndTime

bool callEntry = time >= entryStartTime and time < entryEndTime

// Place a long entry order when `callEntry` is `true`.

if callEntry

strategy.entry("Entry", strategy.long)

// Call `strategy.exit()` when `callExit` is `true`, which occurs only once.

// This single call only places exit orders for all entries with the "Entry" ID created before or on the bar where

// `callExit` occurs. It DOES NOT affect any subsequent entries created after that bar.

if callExit

strategy.exit("Exit", from_entry = "Entry", loss = 0)

// Draw labels to signify when entries start, when the `strategy.exit()` call occurs, and when order placement stops.

switch

entriesStart => label.new(

bar_index, high, "Start placing entry orders.", color = color.green, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

callExit => label.new(

bar_index, high, "Call `strategy.exit()` once.", color = color.blue, textcolor = color.white,

style = label.style_label_lower_right, size = size.large

)

entriesEnd => label.new(

bar_index, high, "Stop placing orders.", color = color.red, textcolor = color.white,

style = label.style_label_lower_left, size = size.large

)

// Create a line and label to visualize the lowest entry price, i.e., the price required to close the position.

var line lowestLine = line.new(

entryStartTime + 1000, na, entryEndTime, na, xloc.bar_time, extend.right, color.orange, width = 2

)

var lowestLabel = label.new(

entryStartTime + 1000, na, "Lowest entry price", color = color.orange,

style = label.style_label_upper_right, xloc = xloc.bar_time

)

// Update the price values of the `lowestLine` and `lowestLabel` after each new entry.

if callEntry[1]

var float lowestPrice = strategy.opentrades.entry_price(0)

float entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if not na(entryPrice)

lowestPrice := math.min(lowestPrice, entryPrice)

lowestLine.set_y1(lowestPrice)

lowestLine.set_y2(lowestPrice)

lowestLabel.set_y(lowestPrice)

// Highlight the background when `entriesStart`, `callExit`, and `entriesEnd` occurs.

bgcolor(entriesStart ? color.new(color.green, 80) : na, title = "Entries start highlight")

bgcolor(callExit ? color.new(color.blue, 80) : na, title = "Exit call highlight")

bgcolor(entriesEnd ? color.new(color.red, 80) : na, title = "Entries end highlight")

strategy.close() and strategy.close_all()

The strategy.close() and strategy.close_all() commands generate orders to exit from an open position. Unlike strategy.exit(), which creates price-based exit orders (e.g., stop-loss), these commands generate market orders that the broker emulator fills on the next available tick, irrespective of the price.

The example below demonstrates a simple strategy that places a “buy” entry order with strategy.entry() once every 50 bars and a market order to close the long position with strategy.close() 25 bars afterward:

//@version=6

strategy("Close demo", "test", overlay = true)

//@variable Is `true` on every 50th bar.

buyCond = bar_index % 50 == 0

//@variable Is `true` on every 25th bar except for those that are divisible by 50.

sellCond = bar_index % 25 == 0 and not buyCond

if buyCond

strategy.entry("buy", strategy.long)

if sellCond

strategy.close("buy")

bgcolor(buyCond ? color.new(color.blue, 90) : na)

bgcolor(sellCond ? color.new(color.red, 90) : na)

Notice that the strategy.close() call in this script uses “buy” as its required id argument. Unlike strategy.exit(), this command’s id parameter specifies the entry ID of an open trade. It does not represent the ID of the resulting exit order. If a market position consists of multiple open trades with the same entry ID, a single strategy.close() call with that ID as its id argument generates a single market order to exit from all of them.

The following script creates a “buy” order with strategy.entry() once every 25 bars, and it calls strategy.close() with “buy” as its id argument to close all open trades with that entry ID once every 100 bars. The market order from strategy.close() closes the entire position in this case because every open trade has the same “buy” entry ID:

//@version=6

strategy("Multiple close demo", "test", overlay = true, pyramiding = 3)

//@variable Is `true` on every 100th bar.

sellCond = bar_index % 100 == 0

//@variable Is `true` on every 25th bar except for those that are divisible by 100.

buyCond = bar_index % 25 == 0 and not sellCond

if buyCond

strategy.entry("buy", strategy.long)

if sellCond

strategy.close("buy")

bgcolor(buyCond ? color.new(color.blue, 90) : na)

bgcolor(sellCond ? color.new(color.red, 90) : na)

Note that:

- We included

pyramiding = 3in the strategy() declaration statement, allowing the script to generate up to three entries per position with strategy.entry() calls.

The strategy.close_all() command generates a market order to exit from the open position that does not link to any specific entry ID. This command is helpful when a strategy needs to exit as soon as possible from a position consisting of multiple open trades with different entry IDs.

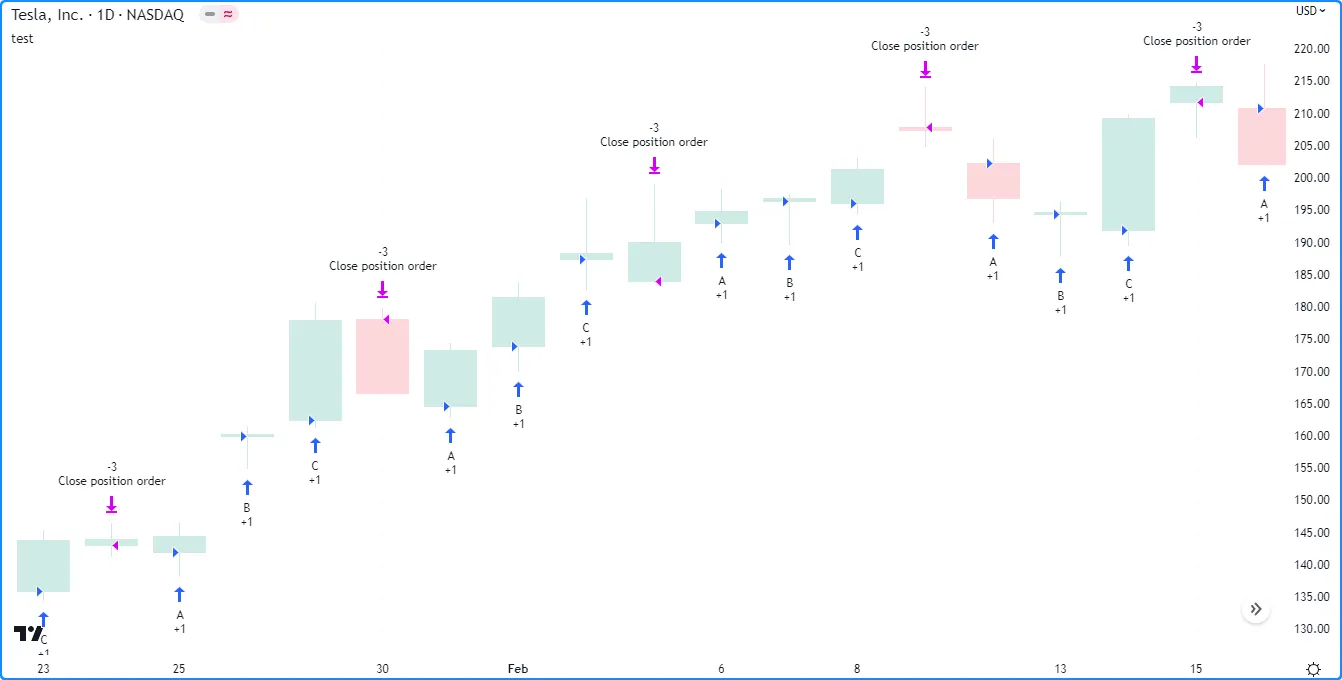

The script below places “A”, “B”, and “C” entry orders sequentially based on the number of open trades as tracked by the strategy.opentrades variable, and then it calls strategy.close_all() to create a single order that closes the entire position on the following bar:

//@version=6

strategy("Close multiple ID demo", "test", overlay = true, pyramiding = 3)

switch strategy.opentrades

0 => strategy.entry("A", strategy.long)

1 => strategy.entry("B", strategy.long)

2 => strategy.entry("C", strategy.long)

3 => strategy.close_all()

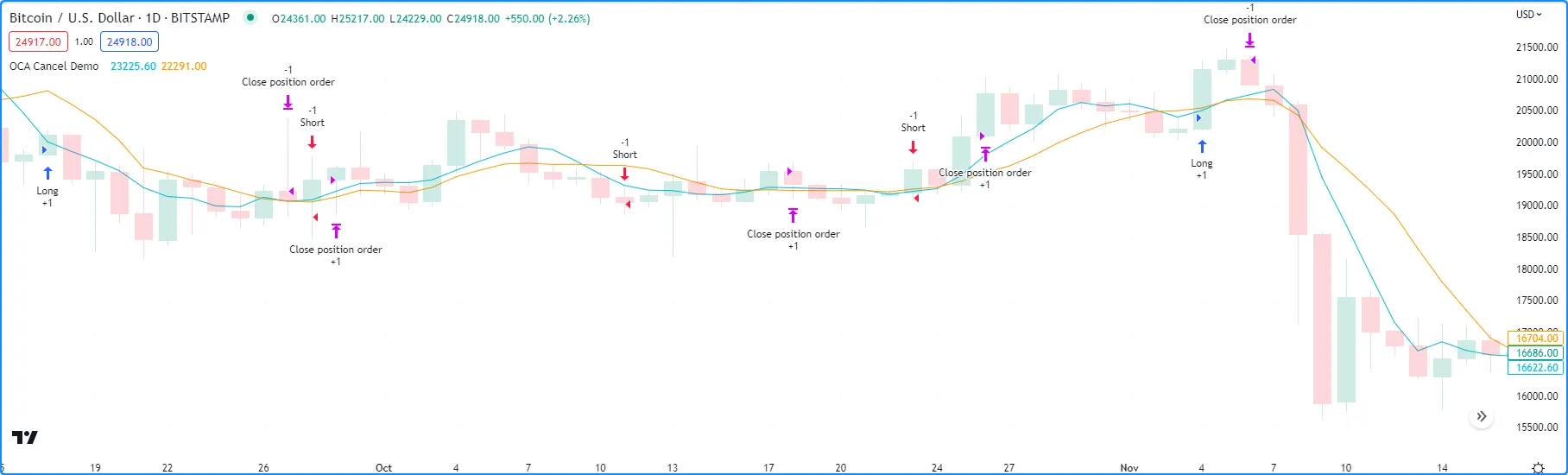

strategy.cancel() and strategy.cancel_all()

The strategy.cancel() and strategy.cancel_all() commands allow strategies to cancel unfilled orders before the broker emulator processes them. These order cancellation commands are most helpful when working with price-based orders, including all orders from strategy.exit() calls and the orders from strategy.entry() and strategy.order() calls that use limit or stop arguments.

The strategy.cancel() command has a required id parameter, which specifies the ID of the entry or exit orders to cancel. The strategy.cancel_all() command does not have such a parameter because it cancels all unfilled orders, regardless of ID.

The following strategy places a “buy” limit order 500 ticks below the closing price 100 bars before the last chart bar with strategy.entry(), and it cancels the order on the next bar with strategy.cancel(). The script highlights the chart’s background to signify when it places and cancels the “buy” order, and it draws a horizontal line at the order’s price. As we see below, our example chart shows no entry marker when the market price crosses the horizontal line because the strategy already cancels the order (when the chart’s background is orange) before it reaches that level:

//@version=6

strategy("Cancel demo", "test", overlay = true)

//@variable Draws a horizontal line at the `limit` price of the "buy" order.

var line limitLine = na

//@variable Is `color.green` when the strategy places the "buy" order, `color.orange` when it cancels the order.

color bgColor = na

if last_bar_index - bar_index == 100

float limitPrice = close - syminfo.mintick * 500

strategy.entry("buy", strategy.long, limit = limitPrice)

limitLine := line.new(bar_index, limitPrice, bar_index + 1, limitPrice, extend = extend.right)

bgColor := color.new(color.green, 50)

if last_bar_index - bar_index == 99

strategy.cancel("buy")

bgColor := color.new(color.orange, 50)

bgcolor(bgColor)

The strategy.cancel() command affects all unfilled orders with a specified ID. It does nothing if the specified id represents the ID of an order that does not exist. When there is more than one unfilled order with the specified ID, the command cancels all of them at once.

Below, we’ve modified the previous script to place a “buy” limit order on three consecutive bars, starting 100 bars before the last chart bar. After placing all three orders, the strategy cancels them using strategy.cancel() with “buy” as the id argument, resulting in nothing happening when the market price reaches any of the order prices (horizontal lines):

//@version=6

strategy("Multiple cancel demo", "test", overlay = true, pyramiding = 3)

//@variable Draws a horizontal line at the `limit` price of the "buy" order.

var line limitLine = na

//@variable Is `color.green` when the strategy places the "buy" order, `color.orange` when it cancels the order.

color bgColor = na

if last_bar_index - bar_index <= 100 and last_bar_index - bar_index >= 98

float limitPrice = close - syminfo.mintick * 500

strategy.entry("buy", strategy.long, limit = limitPrice)

limitLine := line.new(bar_index, limitPrice, bar_index + 1, limitPrice, extend = extend.right)

bgColor := color.new(color.green, 50)

if last_bar_index - bar_index == 97

strategy.cancel("buy")

bgColor := color.new(color.orange, 50)

bgcolor(bgColor)

Note that:

- We included

pyramiding = 3in the strategy() declaration statement, allowing three successive entries from strategy.entry() per position. The script would also achieve the same result without this setting if it called strategy.order() instead because pyramiding does not affect orders from that command.

The strategy.cancel() and strategy.cancel_all() commands can cancel orders of any type, including market orders. However, it is important to note that either command can cancel a market order only if its call occurs on the same script execution as the order placement command. If the call happens after that point, it has no effect because the broker emulator fills market orders on the next available tick.

This example places a “buy” market order 100 bars before the last chart bar with strategy.entry(), then it attempts to cancel the order on the next bar with strategy.cancel_all(). The cancellation command does not affect the “buy” order because the broker emulator fills the order on the next bar’s opening tick, which occurs before the script evaluates the strategy.cancel_all() call:

//@version=6

strategy("Cancel market demo", "test", overlay = true)

//@variable Is `color.green` when the strategy places the "buy" order, `color.orange` when it tries to cancel the order.

color bgColor = na

if last_bar_index - bar_index == 100

strategy.entry("buy", strategy.long)

bgColor := color.new(color.green, 50)

if last_bar_index - bar_index == 99

strategy.cancel_all()

bgColor := color.new(color.orange, 50)

bgcolor(bgColor)

Position sizing

Pine Script strategies feature two ways to control the sizes of the orders that open and manage positions:

- Set a default fixed quantity type and value for the orders. Programmers can specify defaults for these properties by including

default_qty_typeanddefault_qty_valuearguments in the strategy() declaration statement. Script users can adjust these values with the “Order size” inputs in the “Settings/Properties” tab. - Include a non-na

qtyargument in the strategy.entry() or strategy.order() call. When a call to either of these commands specifies a non-naqtyvalue, that call ignores the strategy’s default quantity type and value and places an order forqtycontracts/shares/lots/units instead.

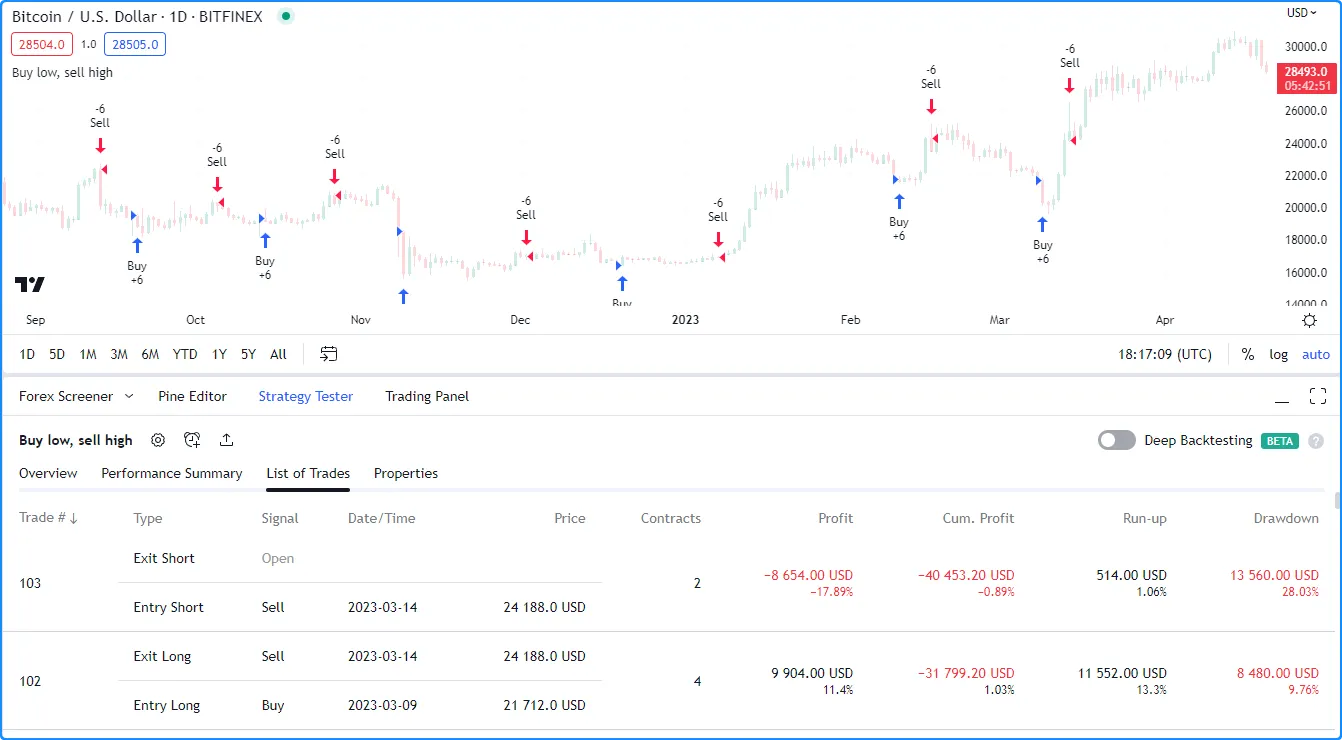

The following example uses strategy.entry() calls with different qty values for long and short trades. When the current bar’s low equals the lowest value, the script places a “Buy” order to enter a long position of longAmount units. Otherwise, when the high equals the highest value, it places a “Sell” order to enter a short position of shortAmount units:

//@version=6

strategy("Buy low, sell high", overlay = true, default_qty_type = strategy.cash, default_qty_value = 5000)

int length = input.int(20, "Length", 1)

float longAmount = input.float(4.0, "Long Amount", 0.0)

float shortAmount = input.float(2.0, "Short Amount", 0.0)

float highest = ta.highest(length)

float lowest = ta.lowest(length)

switch

low == lowest => strategy.entry("Buy", strategy.long, longAmount)

high == highest => strategy.entry("Sell", strategy.short, shortAmount)

Notice that although we’ve included default_qty_type and default_qty_value arguments in the strategy() declaration statement, the strategy does not use this default setting to size its orders because the specified qty in the entry commands takes precedence. If we want to use the default size, we must remove the qty arguments from the strategy.entry() calls or set their values to na.

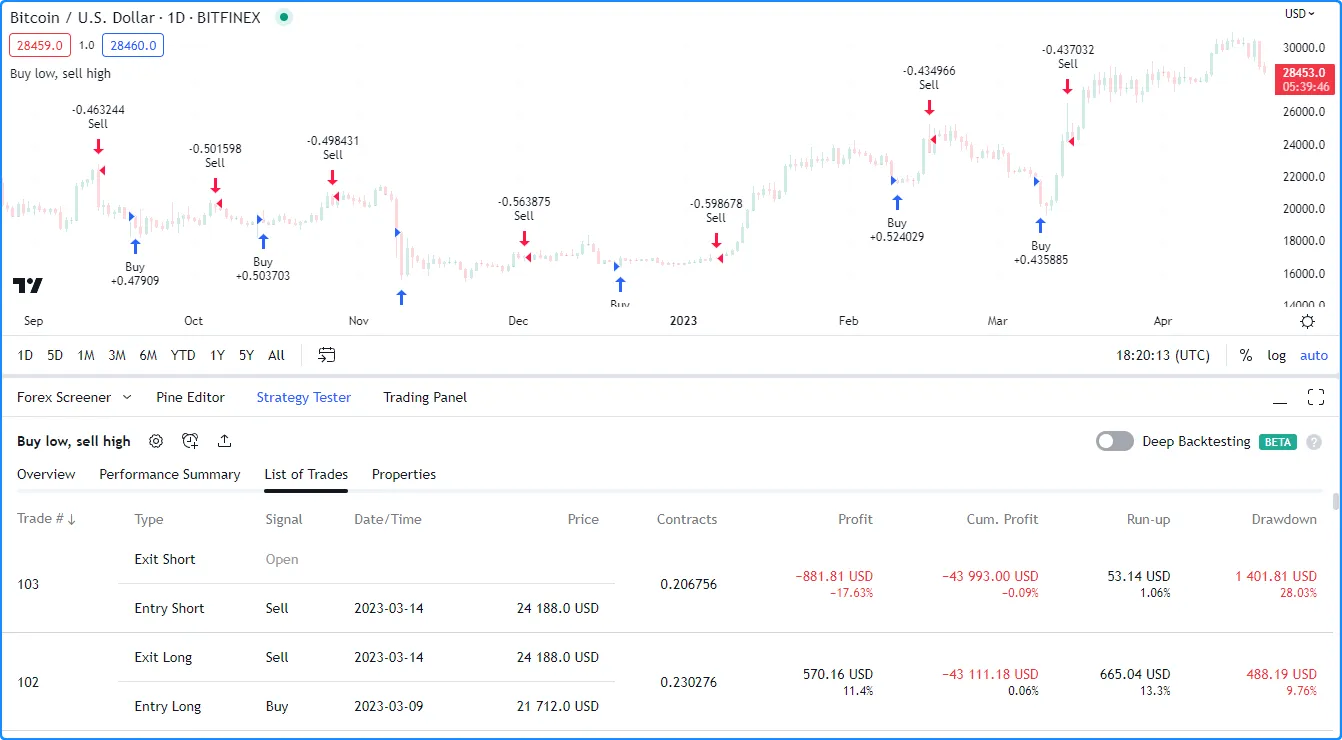

Here, we edited the previous script by including ternary expressions for the qty arguments in both strategy.entry() calls that replace input values of 0 with na. If the specified longAmount or shortAmount is 0, which is what we set as the new default, the corresponding entry orders use the strategy’s default order size instead, as we see below:

//@version=6

strategy("Buy low, sell high", overlay = true, default_qty_type = strategy.cash, default_qty_value = 5000)

int length = input.int(20, "Length", 1)

float longAmount = input.float(0.0, "Long Amount", 0.0)

float shortAmount = input.float(0.0, "Short Amount", 0.0)

float highest = ta.highest(length)

float lowest = ta.lowest(length)

switch

low == lowest => strategy.entry("Buy", strategy.long, longAmount == 0.0 ? na : longAmount)

high == highest => strategy.entry("Sell", strategy.short, shortAmount == 0.0 ? na : shortAmount)

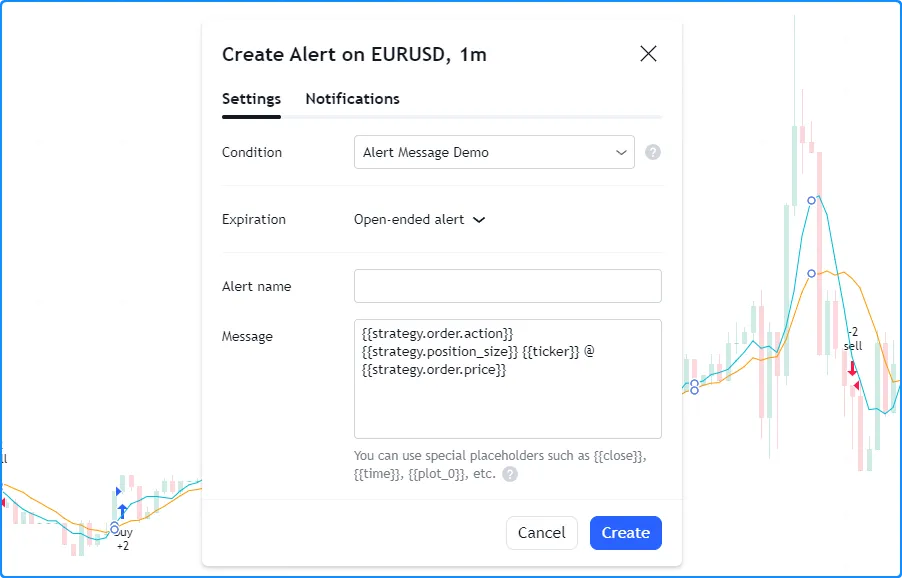

Closing a market position